Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

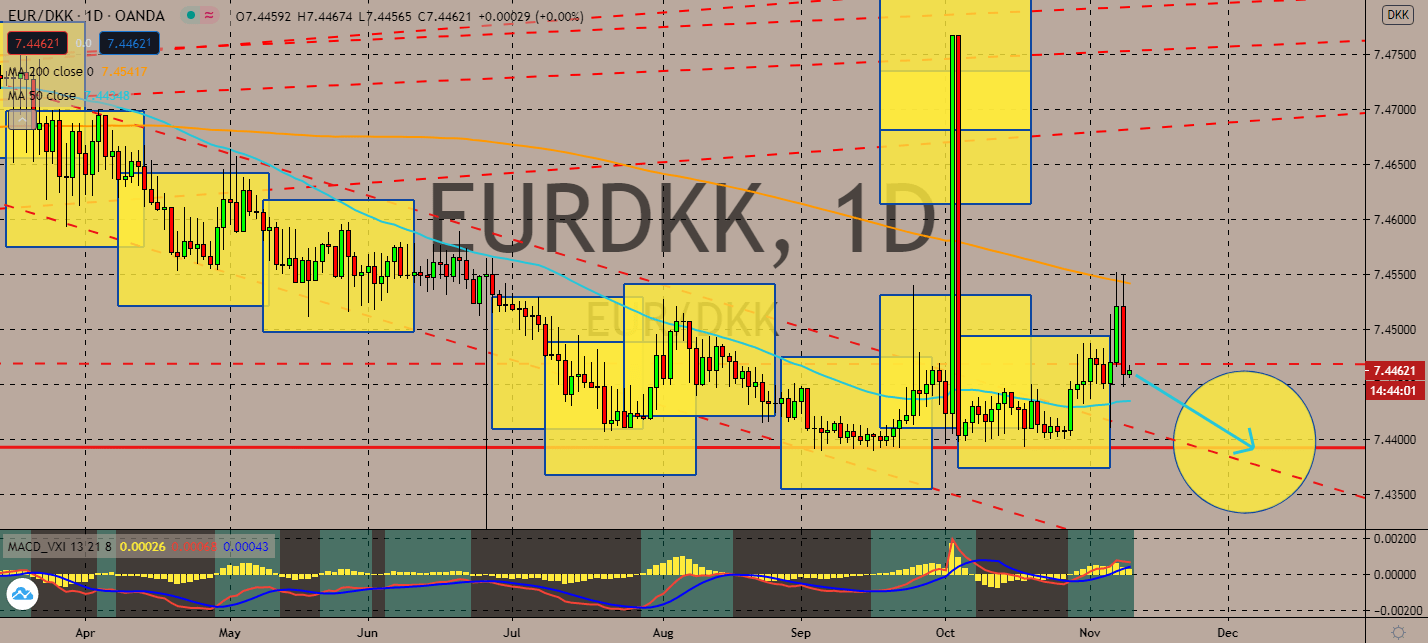

EURDKK

The market will pay more attention to the eurozone’s economic calendar today. After all, the ZEW Economic Sentiment figures for Germany and the overall eurozone area are due for announcements. Despite Biden’s victory, which promises better geopolitical relationships, the market is projected to keep its focus on Europe’s growth – or lack thereof. Now that the ZEW Economic Sentiment is projected to plummet below the 50-point territory toward 41.7 in Germany, markets are expected to pull the euro low against its relatively risky counterparts, even if it was the Danish crown. The pair’s 50-day moving average is expected to remain lower than its 200-day moving average if the bloc’s activity continues slowing down from the lockdown seen across its largest countries within the year. However, investors should still keep a close eye on vaccine progress from the United States for a longer-term track.

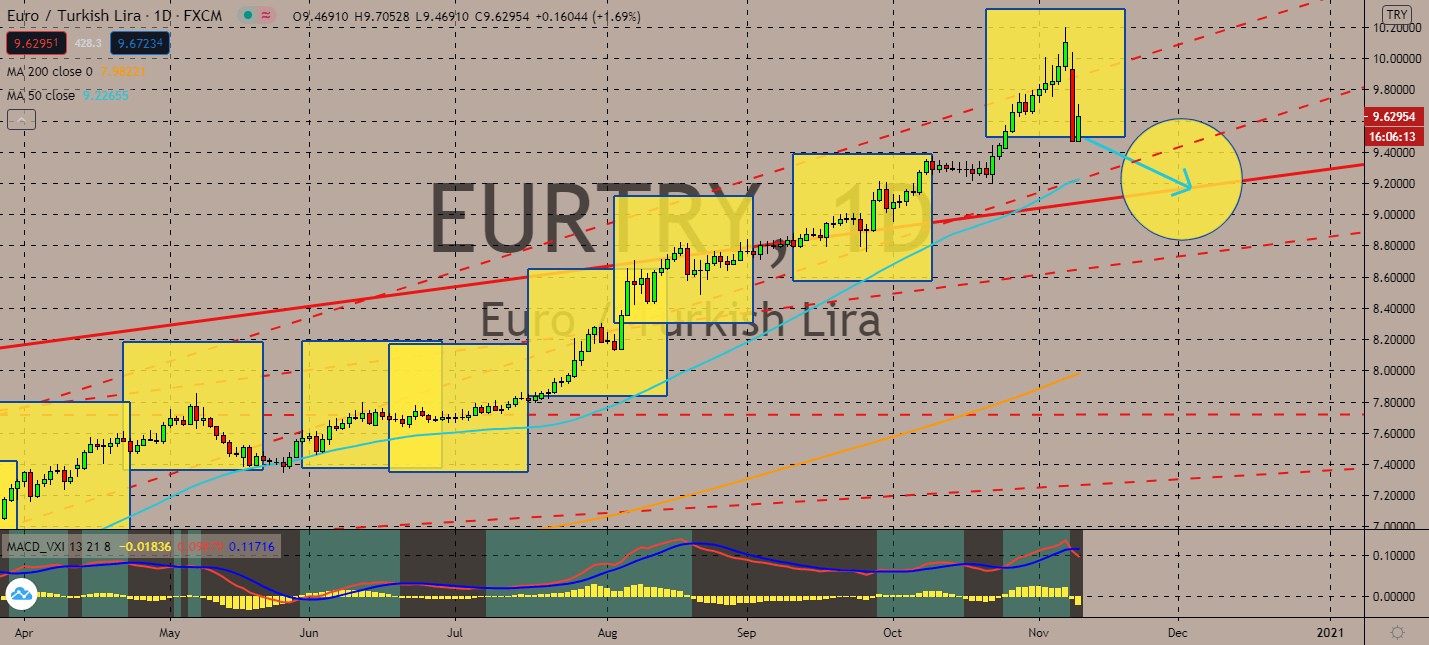

EURTRY

Turkey’s finance minister, the son in law of President Recep Tayyip: Erdogan Berat Albayrak announced his resignation from his position on Sunday evening for “health reasons” amid the plummeting economy brought by the coronavirus. A potential turnout in the country’s response to the health crisis is projected to lift the lira against its bigger counterparts, such as the euro currency amid risk sentiment. The pair’s 50-day moving average remains well above its 200-day moving average, but it looks like the lira will likely benefit from the change in the near-term. Bearish traders are expected to take advantage of the euro’s recent lockdown brought by the coronavirus, which could pull confidence down for its largest economies, especially Germany. In fact, ZEW Economic Sentiment on both Germany and the overall eurozone is projected to fall in the month of November over fears that a possible coronavirus vaccine won’t get distributed in time this year.

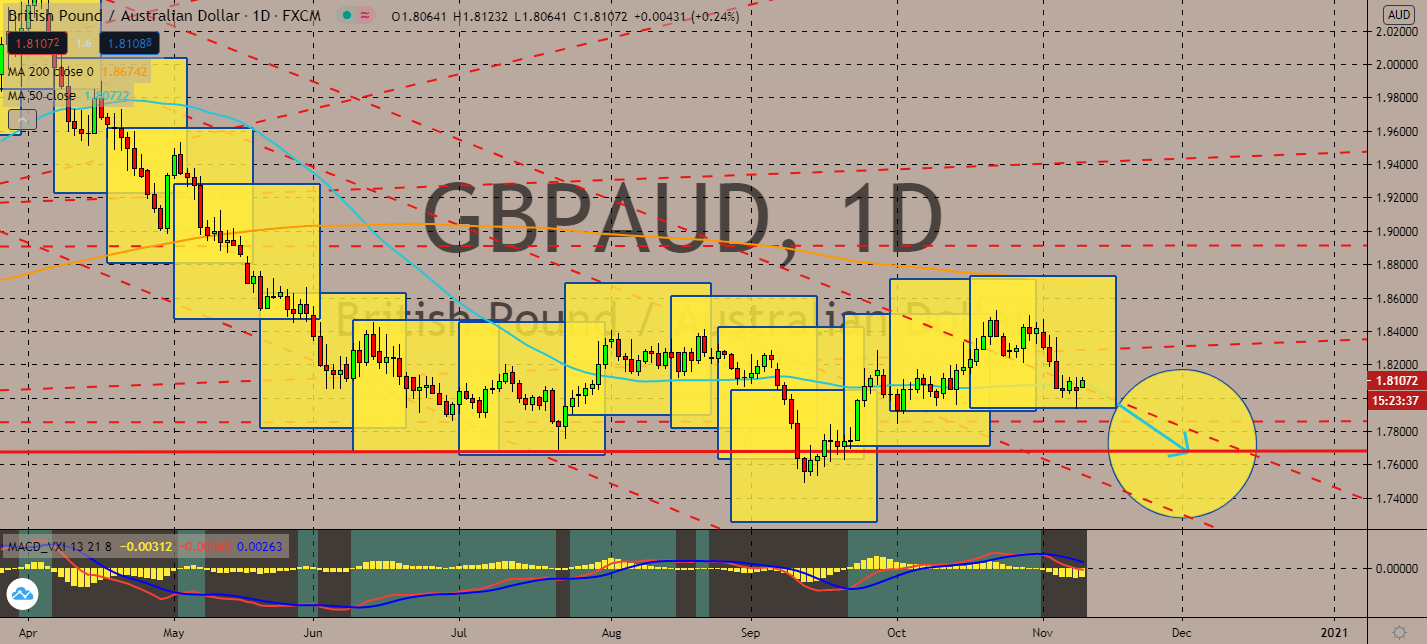

GBPAUD

The National Australia Bank’s Business Confidence Index recovered its losses in October from -4 to +5. The figure marked its second monthly increase from September, which had seen an increase from -8 to -4. Business confidence also rose to its highest levels since mid-2019 through its employment index, suggesting that any monetary policies will remain as it is in Australia in the near-term. The bank claimed that the economy managed to rebound from its earlier lockdown, although the growth remains fragile. The pair’s 50-day moving average will keep its downward track below its 200-day moving average, considering that the market is currently questioning the United Kingdom’s ability to stay afloat throughout the rest of the year. The Bank of England announced a 150 billion-pound quantitative easing program for November with a possible agreement for Brexit as its only hope, pulling down its currency near-term.

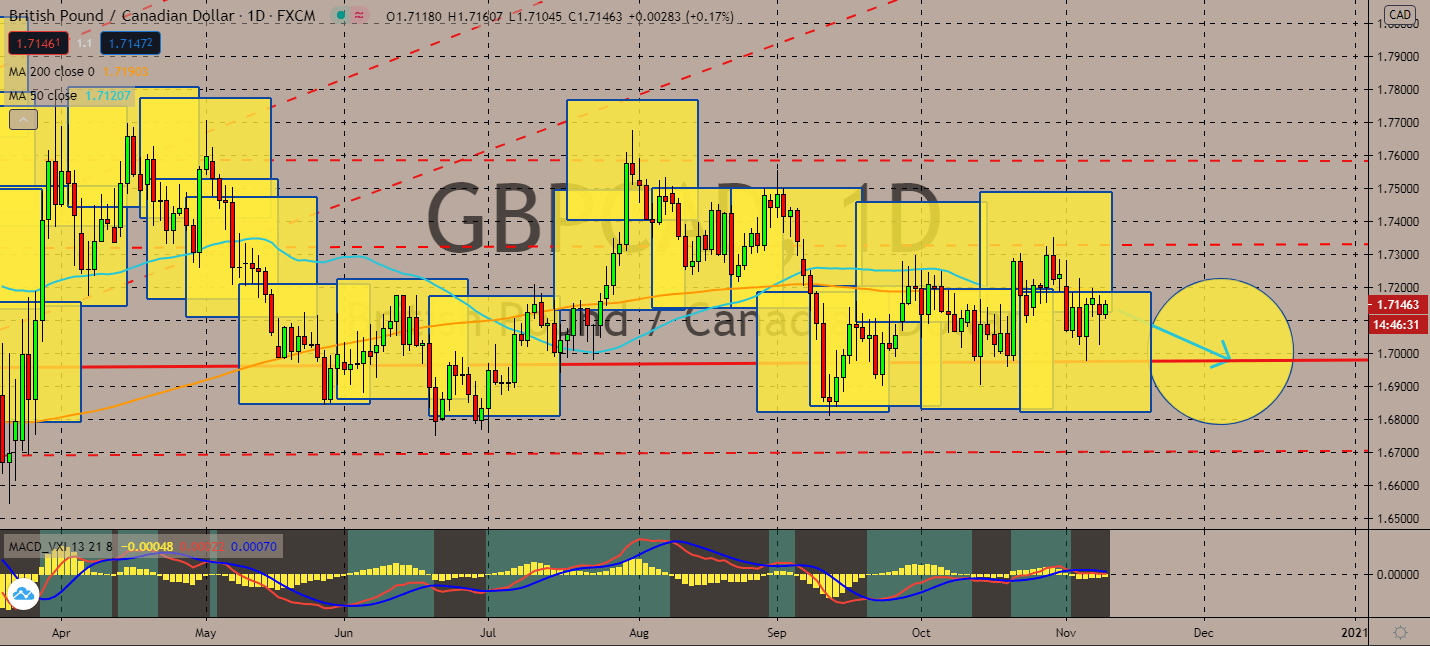

GBPCAD

Despite his urges to create better efforts toward consuming more sustainable energy, Joe Biden’s term as president is projected to assist the Canadian economy’s recovery. The Conference Board of Canada claims that the president-elect Biden’s promise to kill the Keystone XL pipeline wouldn’t hinder its growth on Canadian resource and energy exports as ongoing trade disputes wither away under his administration. National policy director for Pembina Institute also claimed that Biden will be an interactive partner at the federal level in the transition to a decarbonized economy. The pair’s 50-day moving average is therefore projected to fall deeper down below its 200-day moving average, showing that the bearish market will likely dominate the pair sooner than later. As the Brexit deal remains on a stalemate despite the looming deadline at the end of the year, the sterling will now fall against most of its counterparts.

COMMENTS