Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

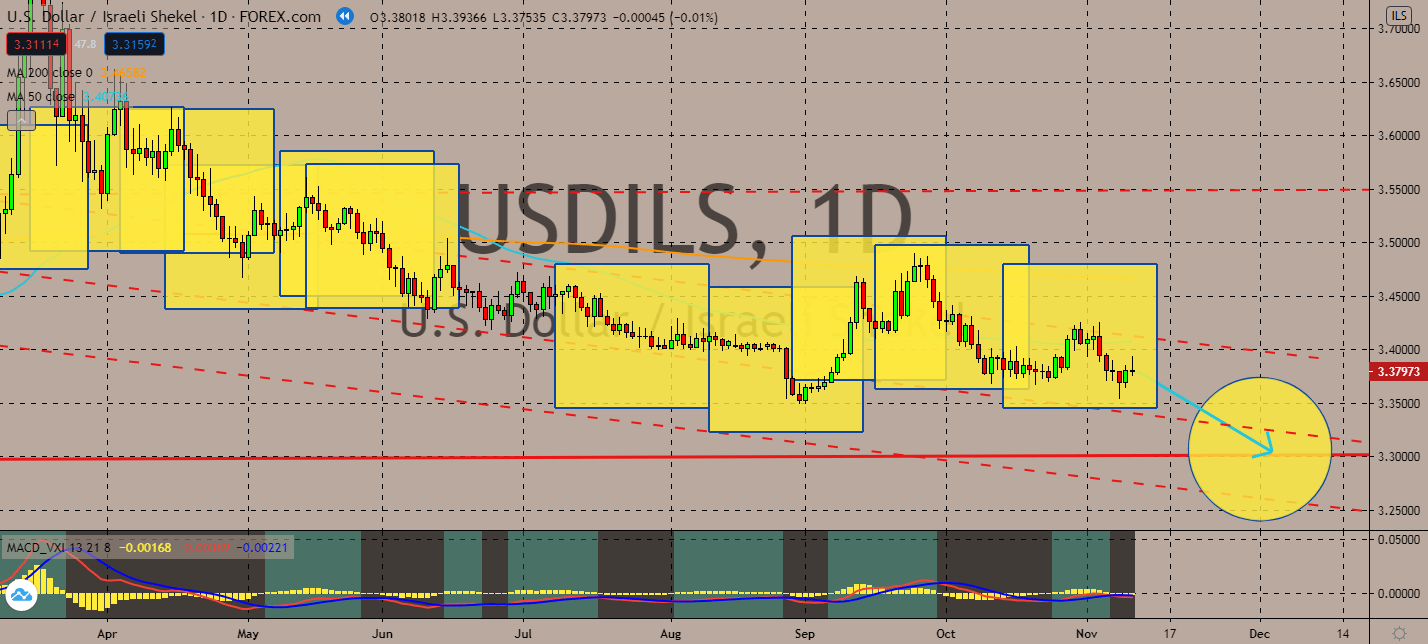

USDILS

Joe Biden’s victory in the presidential elections will lift risk-oriented currencies such as the Israeli shekel in the near-term. The US economic calendar will be quiet in today’s trading to make way for analyses regarding his plans. Notably, investors are more worried about the likelihood of implementing another stimulus package for its economy before he gets inaugurated in January. He is projected to pass on another round of coronavirus stimulus on top of the one that could be on its way. The pair’s 50-day moving average is projected to remain below its 200-day moving average in the near-term because of this. Meanwhile, Asia-Pacific shares are projected to boost thanks to the announcement of the most effective coronavirus vaccine by Pfizer and BioNtech, which both claimed that their entry is about 90 percent effective in preventing infection of the coronavirus vaccine of those without evidence of infection prior to its third-phase tests.

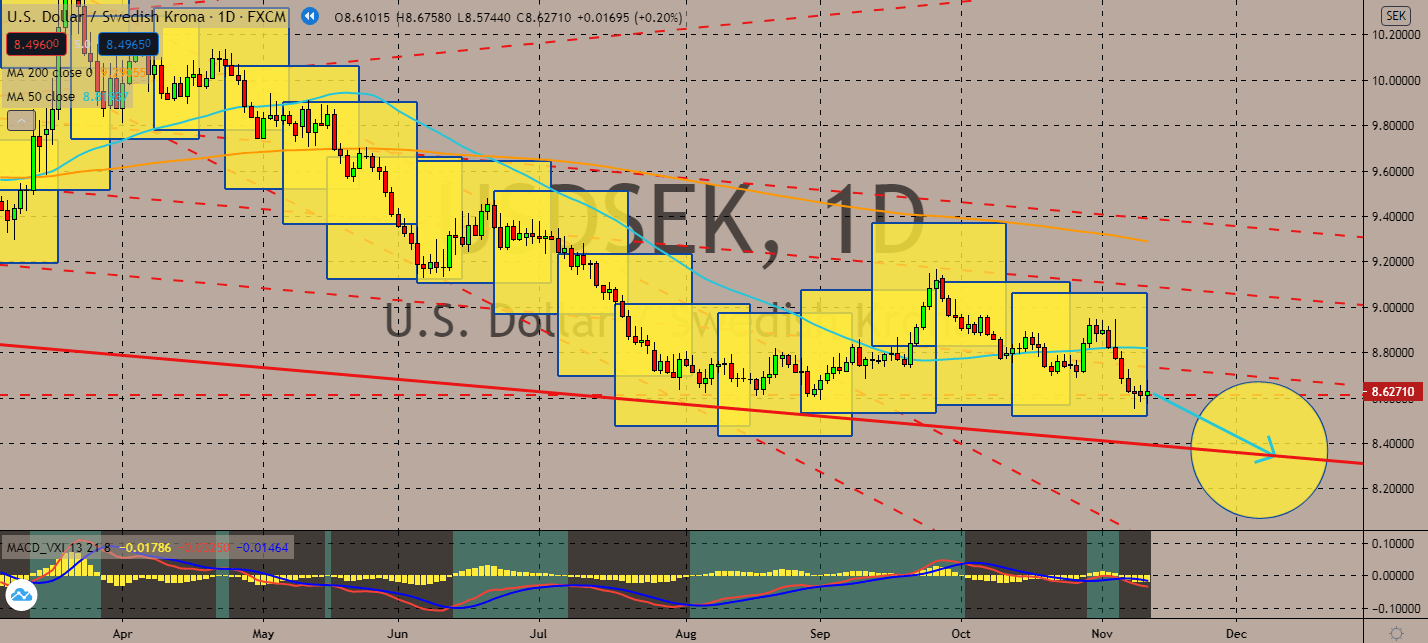

USDSEK

Pfizer and BioNTech’s coronavirus vaccine candidate will help boost assets outside the United States. Now that Joe Biden has officially won the president’s seat, investors are looking forward to better global trade relationships, including the crown. Scandinavian currencies are expected to experience a high trajectory that could continue the greenback’s 10-week low in near-term trading. The pair’s 50-day moving average is still under its 200-day moving average, indicating that USDSEK investors are unlikely to root for the US dollar, anyway. As Sweden continues its lax lockdown strategy with no signs of stopping within the year, optimism towards the vaccine’s global distribution by December is projected to keep benefitting the Swedish krone. Investors could see Sweden endure the pandemic through the year without a total lockdown, increasing sentiment for its currency more than for its greenback counterpart.

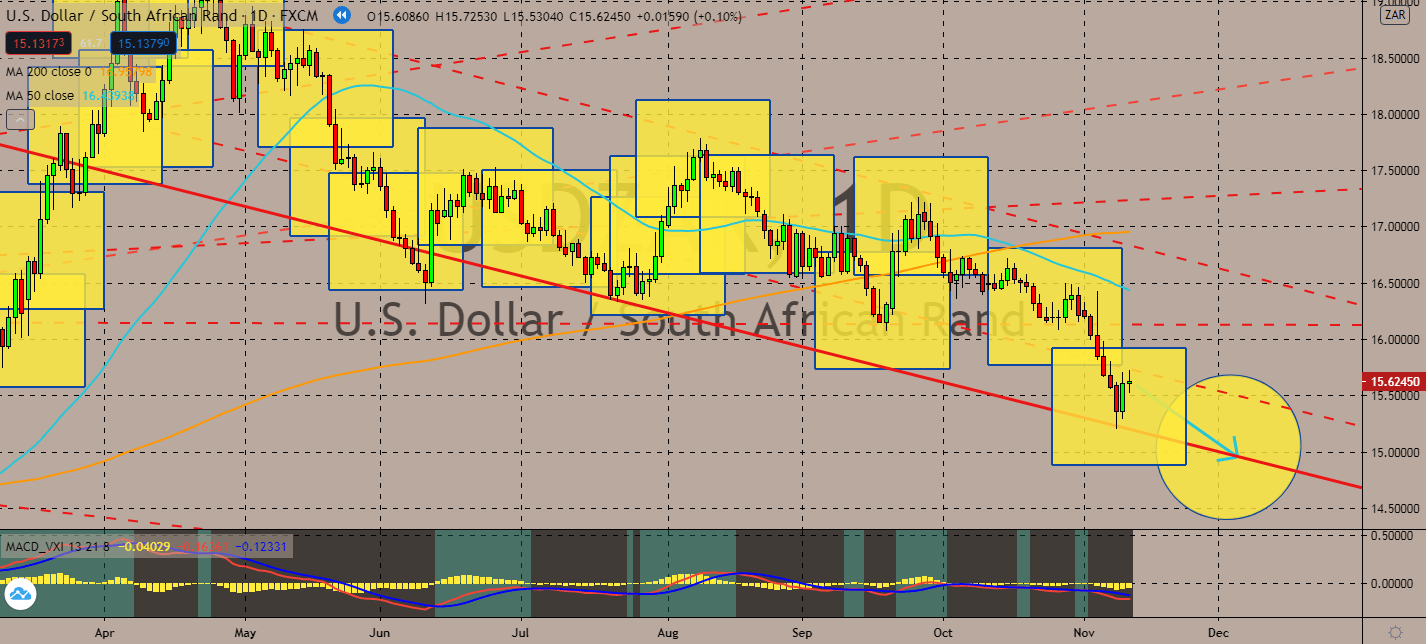

USDZAR

The strictest and longest lockdown in the world will be devastating for South Africa as economists expect the devastating fiscal and economic effects to come into fruition throughout the end of the year. The gross domestic product for South Africa will most likely fall by 10 percent below its baseline level with its hospitality and tourism industry projected to suffer the most. Transportation, services, beverages, and overall tobacco exports will also be harmed, while its manufacturing sector is projected to struggle with its recovery to 2027. Risk sentiment won’t pull the greenback down from its rand counterpart as the pair’s 50-day moving average even as its 50-day moving average remains above its 200-day moving average counterpart. The South African economy is still struggling to recover even after receiving 4.3 billion US dollars in emergency funding from the International Monetary fund with only about a 30 percent chance of another package.

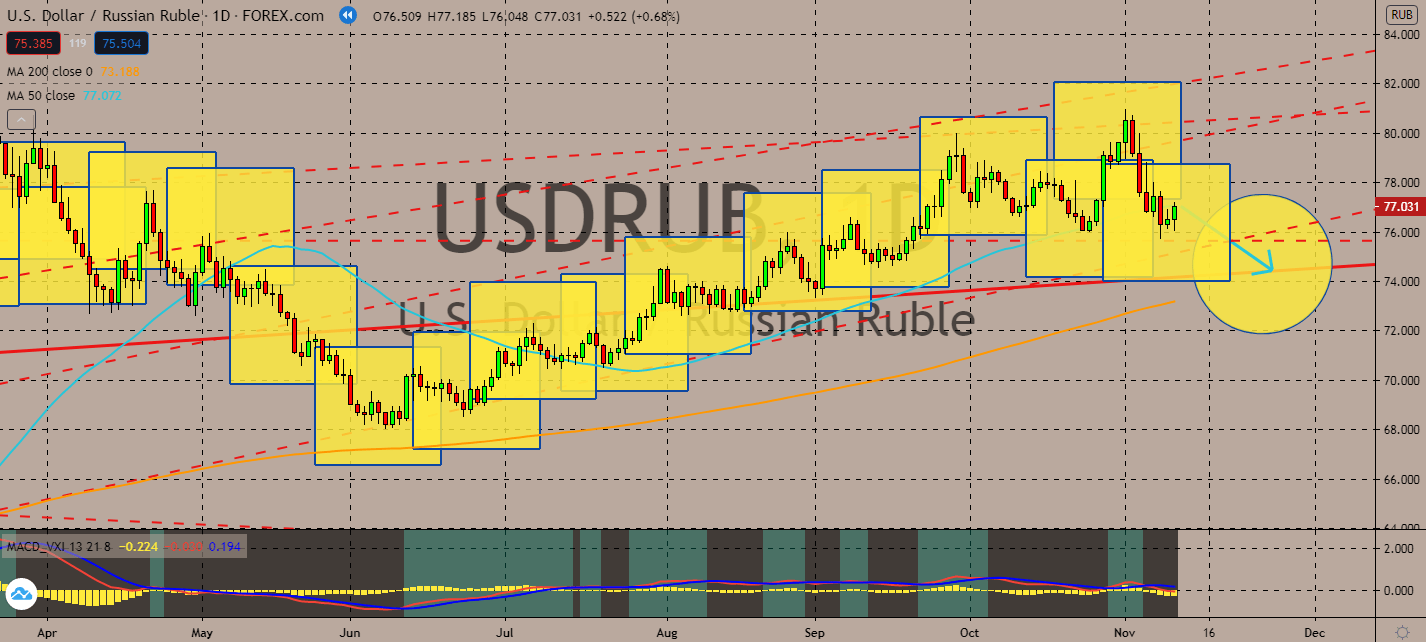

USDRUB

Many households are projected to skyrocket debt in the United States as general declines in business revenues continue to pull economic activity away, weakening the ability of businesses to continue. The US stock market and Asia-Pacific shares are projected to benefit from this, which is also thanks to a possible coronavirus vaccine that could be distributed by December. The greenback will suffer over risk sentiment after the Federal Reserve warned that the US government’s failure to keep up with grant programs, which were implemented to help businesses and households cope with the pandemic, will raise the risk of another economic plummet despite the jump in gross domestic product announced a few weeks ago. The pair’s 200-day moving average is fast approaching its 50-day moving average, as well, which indicates that bearish traders will take advantage of the progress in the near-term.

COMMENTS