Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

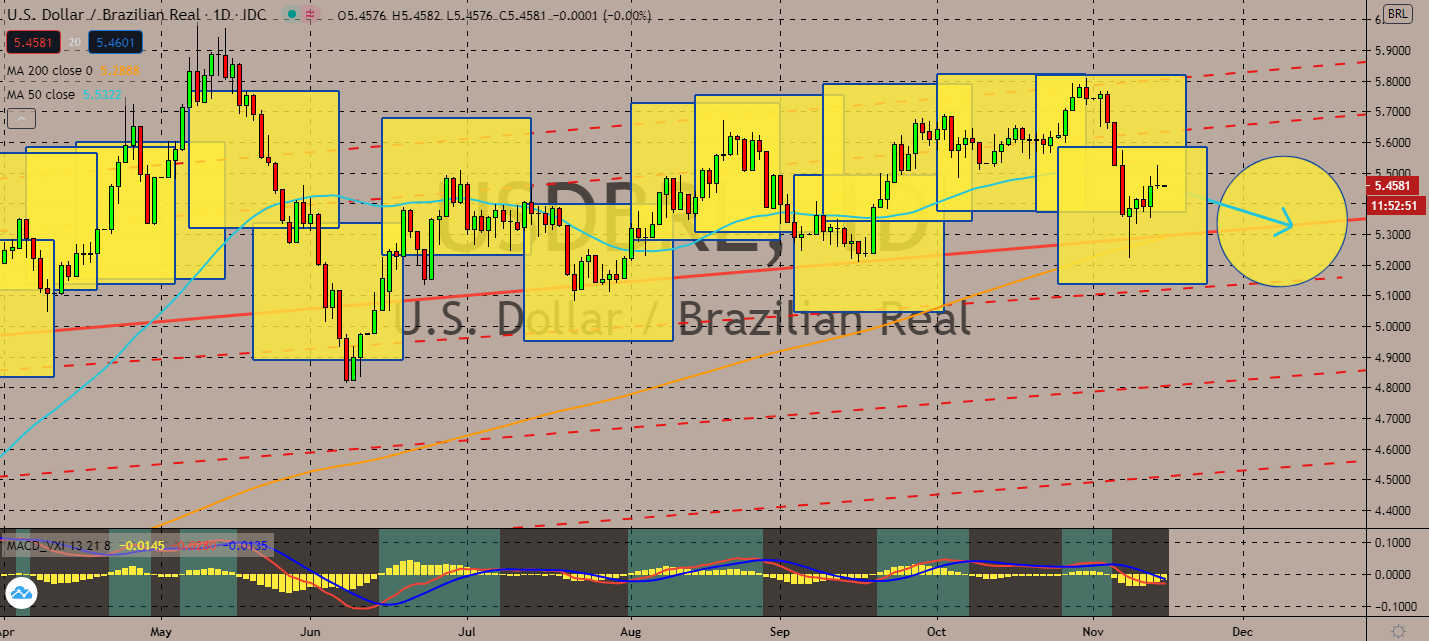

USDBRL

Economic activity in Brazil rose for the fifth month in September, according to its central bank’s announcement last Friday. The South American country is projected to continue its solid recovery from the third quarter this year, which was the worst impacted quarter by the coronavirus in the year. A seasonally adjusted 1.3 percent increase in September, which was above the average 1.0 percent estimated growth, will push optimism towards its improving economy in the near-term as the United States continues its spiral limbo in between Trump’s current presidential term and Biden’s inauguration next year. The pair’s 50-day moving average is still moving above its 200-day moving average, but the market is more likely to pay attention to the latter going upward rapidly toward its counterpart. As a result, the pair could be meeting with the bears soon with anticipation for the moving averages to cross pessimistically by the end of the year.

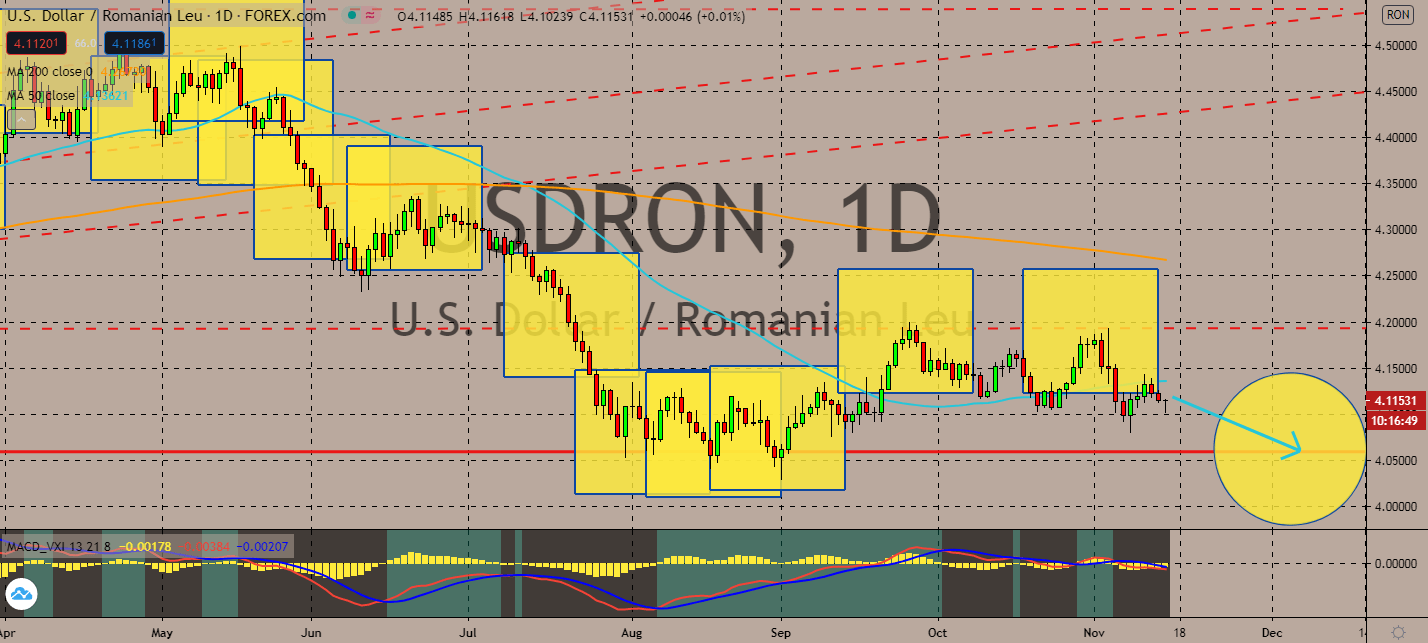

USDRON

The series of pessimistic news in Romania is projected to deliver more pressing results for the pair in the near-term. Finance Minister Florin Citu announced that Romania’s National Bank is in discussion to reduce its monetary policy interest rate, slashing gains for its currency in the near-term. The central bank revised its end-year inflation prediction a few days ago by 6.0 percent to 2.2 percent. The next day, the National Statistics Institute announced that its gross domestic product results for the third quarter disappointed its early projection, as well. In fact, after claiming that its economic decline was the shallowest in Europe, the country announced a slower-than-expected recovery from its 12.2 percent contraction recorded in Q2 vs Q1. The pair’s 50-day moving average may continue its trend below its 200-day moving average, but the descending longer-term average is likely to be the focus of near-term trading.

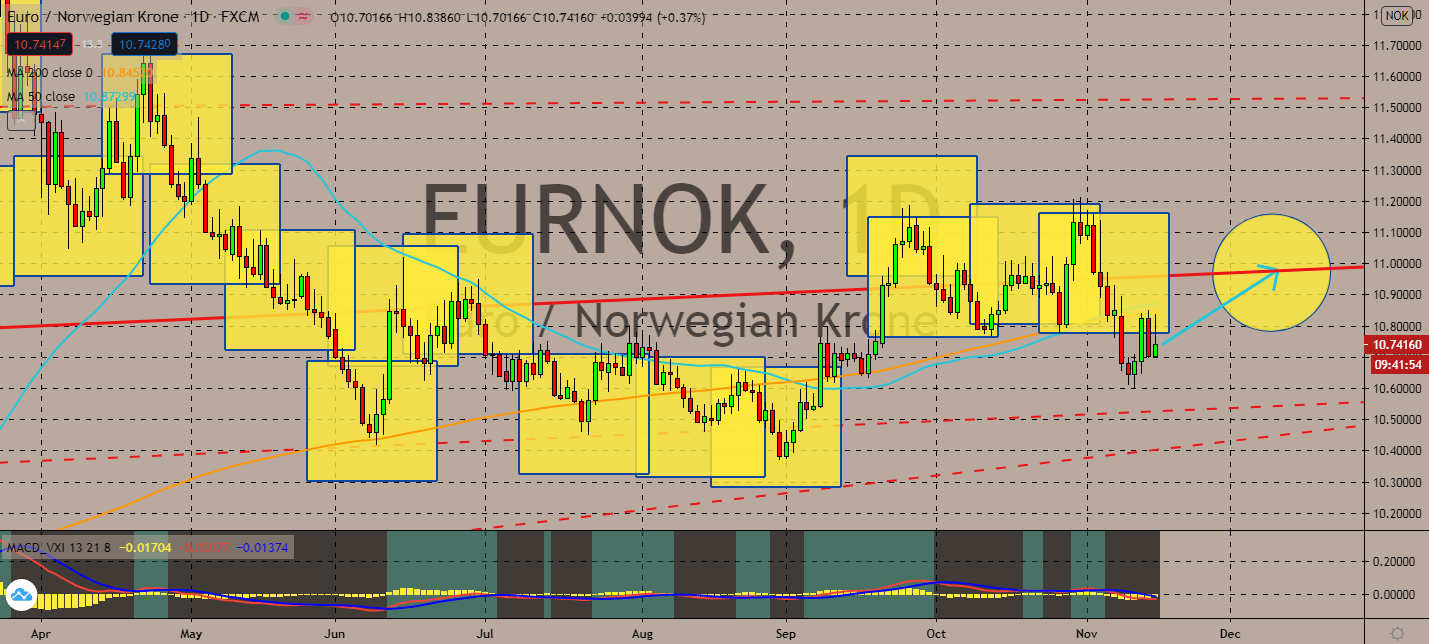

EURNOK

Norway’s overall rate of unemployment disappointed for the first time in seven months. The move emphasized the effects of the coronavirus on its economy. Last week’s announcement of an increase to 6.7 percent in October in comparison to 6.6 percent seen in September was the first time it had jumped since April. The familiar month, which was around the time when the pandemic was at its peak, had seen a record 15.4 percent in early April at a time when the economy was shut down to result in mass layoffs. For reference, unemployment stood at 3.7 percent in February, or way before the pandemic spread. Despite the pressing concern in the eurozone regarding its deal with the Unitde Kingdom, the euro currency should witness an uptick in the near-term at least until Brexit continues its departure without a trade agreement with the bloc. The pair’s 50-day moving average could therefore keep its increase up its 200-day moving average counterpart.

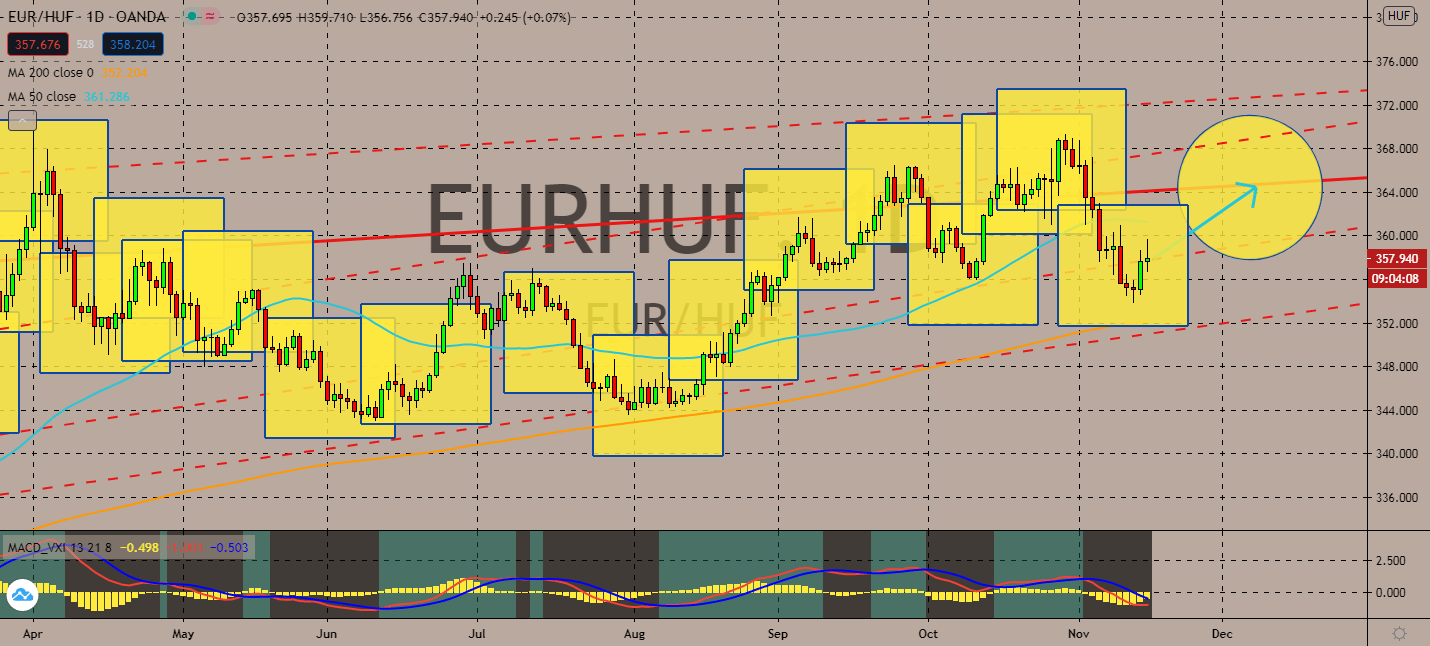

EURHUF

Hungary allegedly violated the rule of law conditions for the European Union’s long-term budget for 2021-2027, as well as its post-pandemic economic revival plan that was crafted to help its own harmed economy. Now, Hungarian Prime Minister Viktor Orban is urging to use a veto that could take away the said rule of law. This would result to a halt in what could be a 1.3 trillion-euro bidget and the 50 billion-euro Own Resources Decision to stop unless the rule of law was altered. To make matters worse, other emerging markets in the eurozone are following behind it. As the pair’s 50-day moving average remains way above its 200-day moving average counterpart, the euro is projected to maintain its bullish ascent in the near-term. The increase will happen despite the uncertainty on whether or not it could reach a concrete trade agreement with the United Kingdom before it reaches the deadline for Brexit at the end of the year.

COMMENTS