Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

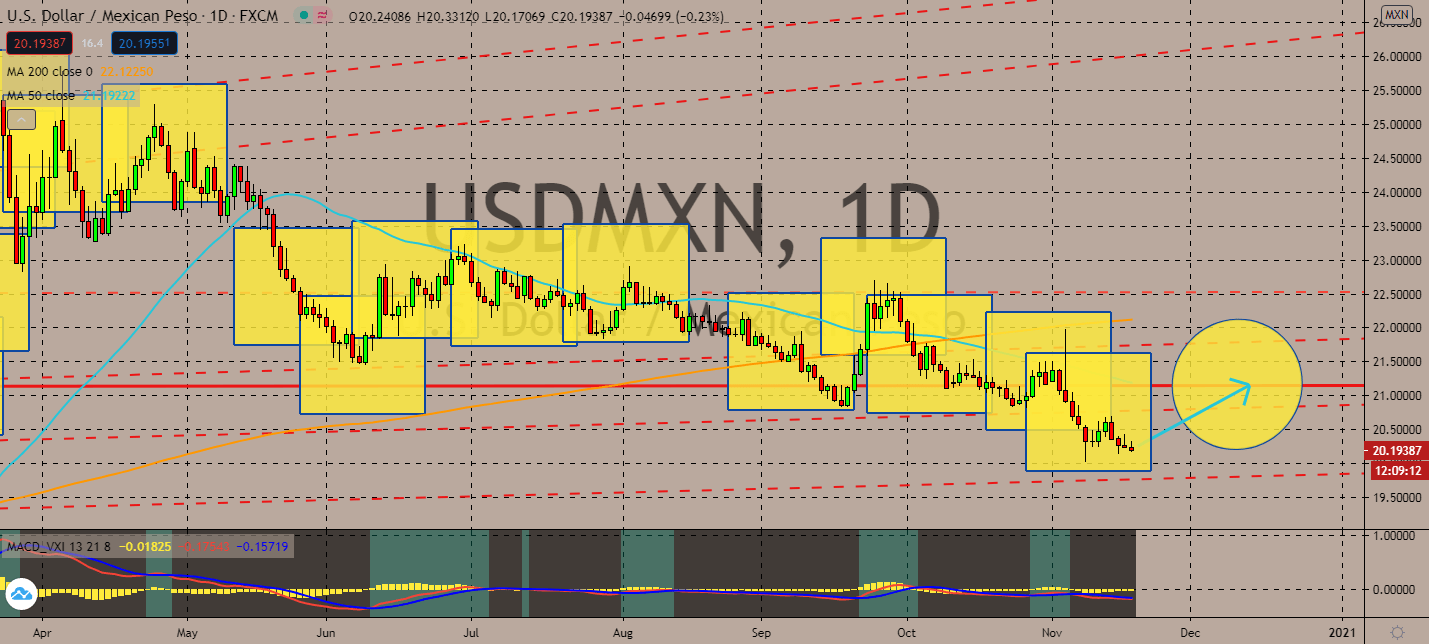

USDMXN

More than a million cases of the coronavirus have now been reported in Mexico, driven mostly by the Mexican president’s consistent downplaying of the threat of the virus to keep its economy open. The panic is projected to be the main driver of the Mexican peso’s downfall in the near-term. Although the pair’s 50-day moving average remains way below its 200-day moving average counterpart, it could meet a volatile path upwards over worries that the pandemic might take over more than any investors could have anticipated. As a matter of fact, that Dr. Julio Frenk, a former Mexican health minister, claimed that President Andres Manuel Lopez Obrador’s move was one of the biggest public health failures in the history of Mexico. Now that it has the fourth-highest death toll in the world, its economy is projected to fall. As long as President Lopez Obrador keeps the country’s doors open, uncertainty shall keep its course.

USDNOK

The overall rate of unemployment in Norway jumped from a week prior as the more restrictive economic measures lead to more furloughed workers in the country. The rate is expected to continue after it began to rise in early November after having fallen consistently since April, showing signs that its economy could meet a deeper contraction than initially projected. Its Labor and Welfare Agency confirmed that in this case, one additional person has registered as unemployed with every minute for the past week. The overall number, which includes people who now work in reduced hours while seeking full employment. Although the figure was down from the record jump to 15.4 percent seen in April, the figure is expected to grow back up in upcoming months. The pair’s 50-day moving average may remain below its 200-day moving average, but risk aversion is projected to prevail in the near-term.

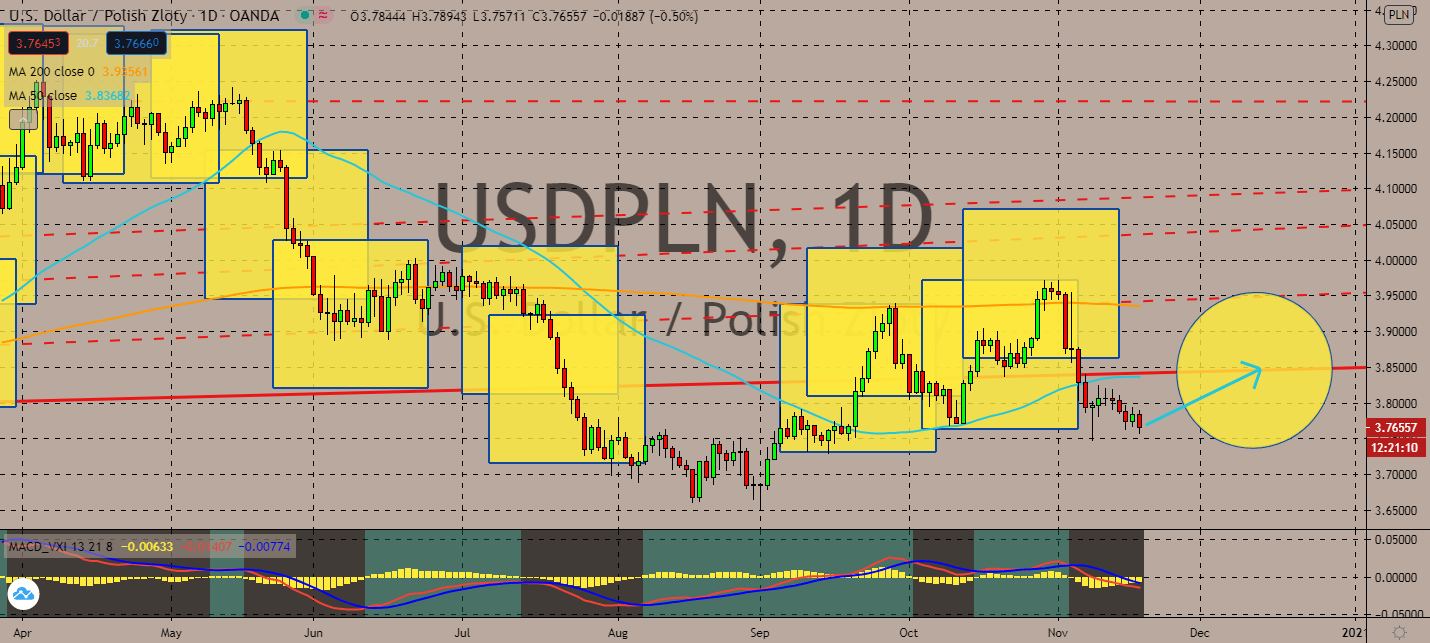

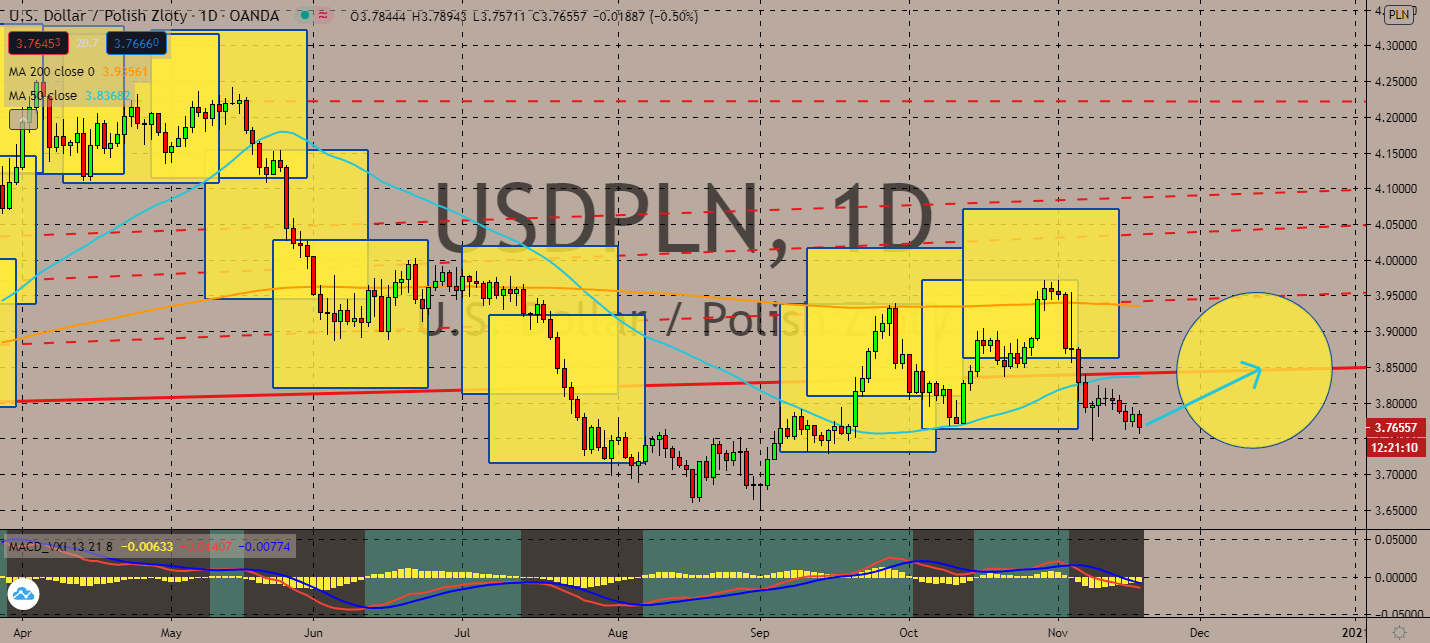

USDPLN

Months after the European Union unanimously agreed to a 750 billion-euro budget for suffering participants to recover from the coronavirus pandemic, Hungary and Poland backed out of the deal. While the Hungarian Prime Minister insisted to create room for political abuses, Poland followed suit after months-long protests from a potential total abortion ban in the country. Although both countries are those that fell under the needed category, the budget still requires unanimity. Therefore, both Hungary and Poland’s governments will have to make up for their own losses without the help of the total 1.1 trillion-euro budget. Now that Poland has locked in on its economic fate, the pair’s 50-day moving average will begin stagnating below its 200-day moving average as the latter begins to descend. Risk aversion could continue to prevail in the near-term despite anticipated volatility for the exchange.

COMMENTS