Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

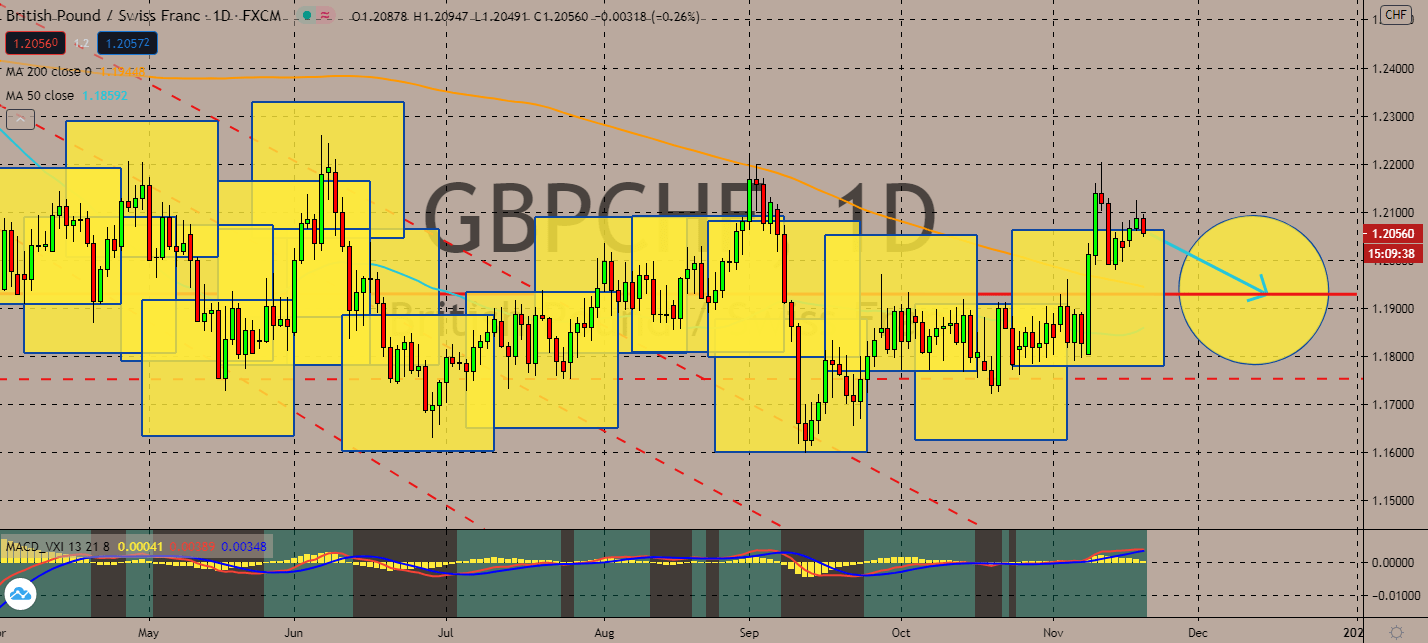

GBPCHF

Overall weakness in British fundamentals will be its major driver. The United Kingdom is projected to suffer over the recent veto from Hungary and Poland, affecting the deal on trade talks as the Brexit transition deadline on December 31 draws near. With the end about only six weeks away, agreements on key talks such as fishing, level of state aid for British companies, and arbitration for its own government, the two-way trade could be altered to be harmful to both economies. Moreover, Prime Minister Boris Johnson is also having to self-isolate until the next month after meeting with an MP who later tested positive for the coronavirus, a feat that might delay talks at its most crucial period. The pair’s 50-day moving average is projected to remain below its 200-day moving average, which has been rapidly declining as of late.

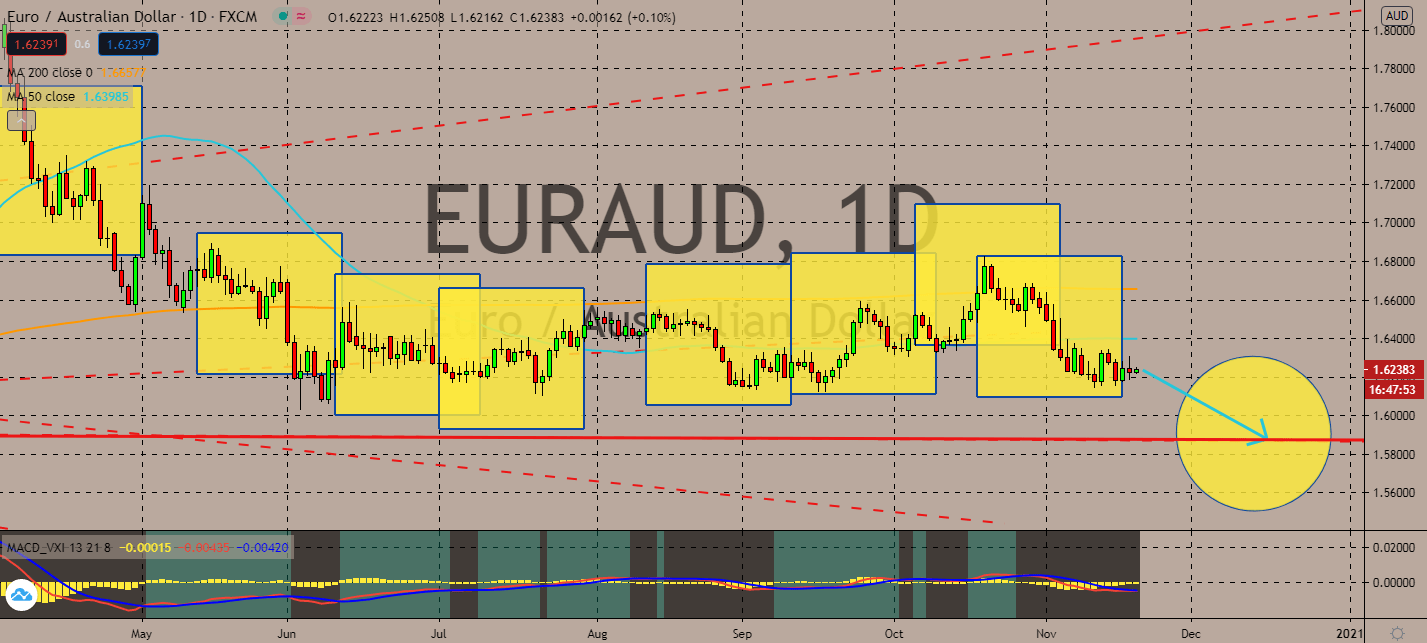

EURAUD

Australia’s efforts on focusing on its employment records are paying off, now that it reported its employment change record seen in October. From far negative around -29.5 thousand seen in the month prior, its result also rose way above the expected fall to -30.0 thousand. The Aussie dollar is expected to pump out a pleasant surprise after records have shown an increase to 178 thousand. The increase was a result of the lifted lockdowns in Victoria. Meanwhile, Europe is now the home of half the coronavirus cases around the world. The United Nations health agency reported that its 54-nation region still has most of the cases than any other region worldwide, indicating that its case decline is almost as fast at its increase with more than 29,000 new deaths just last week. The pair’s 50-day moving average is still under its 200-day moving average, showing signs that it should keep its bearish trend in the near-term with little signs of stopping.

EURAUD

Australia’s efforts on focusing on its employment records are paying off, now that it reported its employment change record seen in October. From far negative around -29.5 thousand seen in the month prior, its result also rose way above the expected fall to -30.0 thousand. The Aussie dollar is expected to pump out a pleasant surprise after records have shown an increase to 178 thousand. The increase was a result of the lifted lockdowns in Victoria. Meanwhile, Europe is now the home of half the coronavirus cases around the world. The United Nations health agency reported that its 54-nation region still has most of the cases than any other region worldwide, indicating that its case decline is almost as fast at its increase with more than 29,000 new deaths just last week. The pair’s 50-day moving average is still under its 200-day moving average, showing signs that it should keep its bearish trend in the near-term with little signs of stopping.

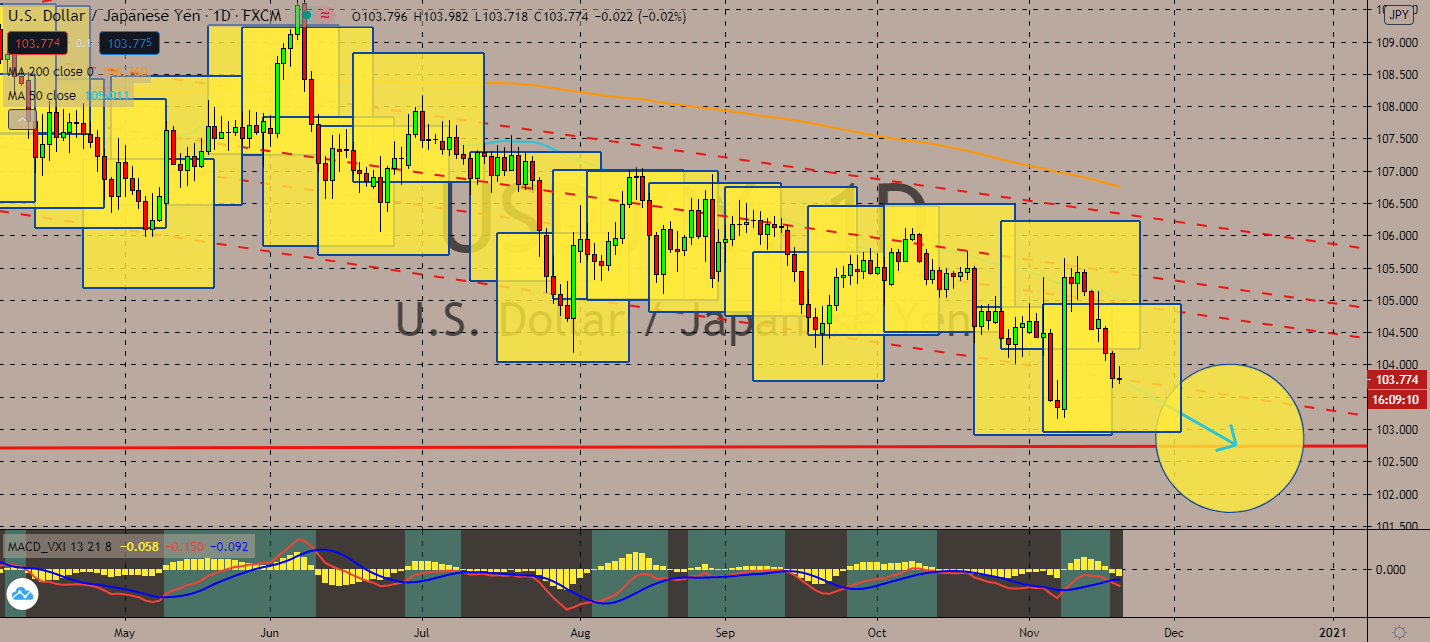

USDJPY

A quarter after Japan experienced an economic contraction of 28 percent in the April to June period, its gross domestic product reaches back to growth. The world’s third-largest economy had previously recorded three consecutive declines in its quarterly reports, but it had returned to growth in the July-September quarter with share prices going higher for its stock market, as well. Its quarterly increase reached 5 percent, thanks to improvements in exports in sectors including vehicles and auto parts, as well as those in private consumption, which is its main contributor to growth. The expected improvement is expected to benefit the Japanese yen near-term, considering that the pair’s 50-day moving average is still well under its 200-day moving average. The troubling rapid increase in coronavirus deaths in the United States is projected to keep the greenback low, now that at least one American reportedly dies every minute across the nation.

COMMENTS