Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

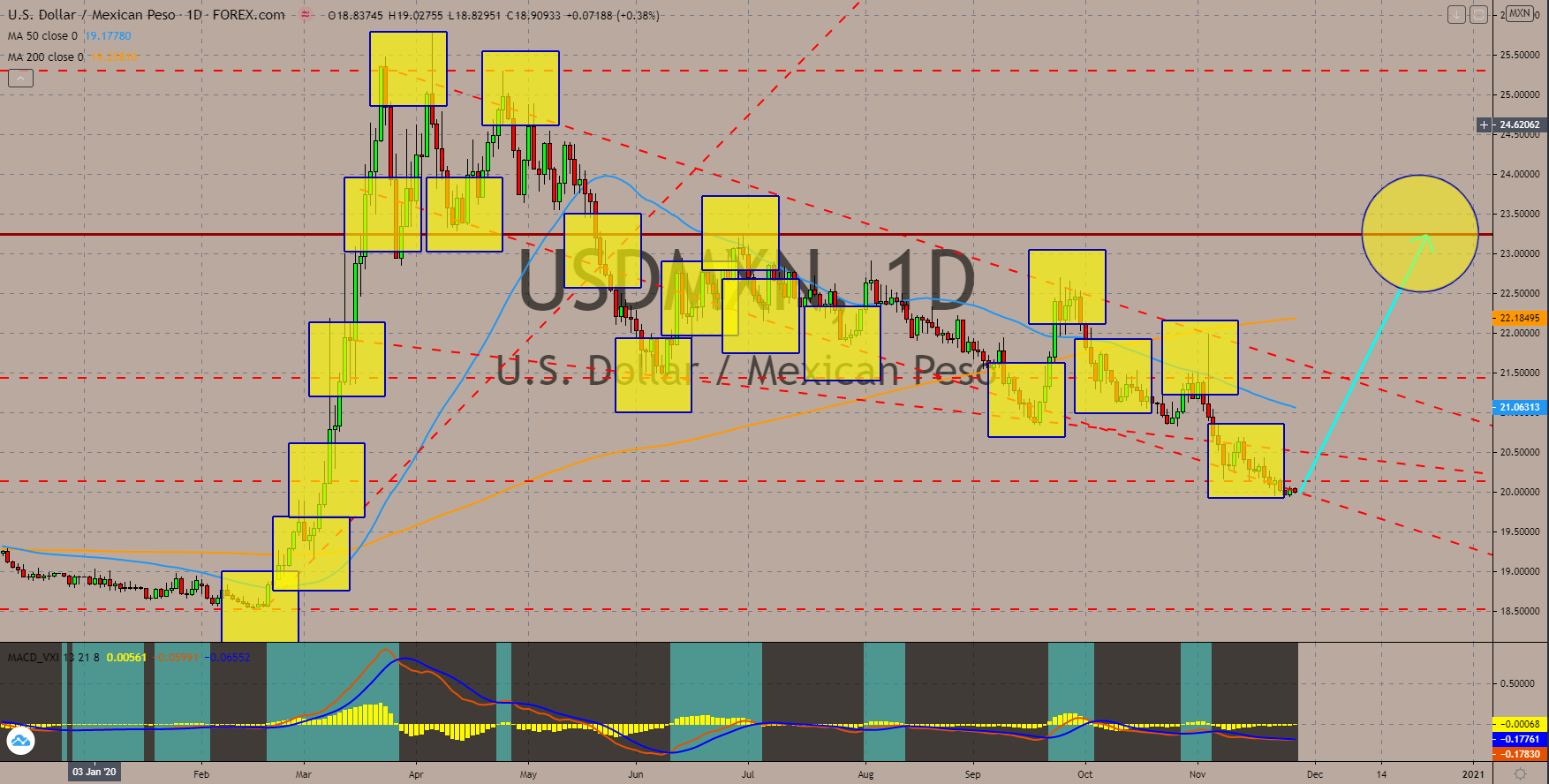

USDMXN

Mexico’s economic outlook turned bleak amid the rising cases of coronavirus in the country. On November 24, Mexico reached its highest daily cases at 10,794. The increase is still small when compared to the US which has now 13 million total cases. Despite this, the Mexican peso will underperform against the US dollar in the coming session amid the recent report that shows a budget surplus of only $17.50 million for the third quarter. In Q2, the deficit reached -$116 million. Also, Mexico’s economy is expected to expand by 12.1% in Q3, the biggest quarterly growth in a decade. However, the annual GDP expectation of -9.3% in fiscal 2020 is still high despite the revised forecast by the central bank from -12.8%. Analysts expect some of the positive results to sustain in the coming weeks. USDMXN pair is expected to breach the 50-day and 200-day moving average in December. Meanwhile, the MACD is showing a bullish crossover.

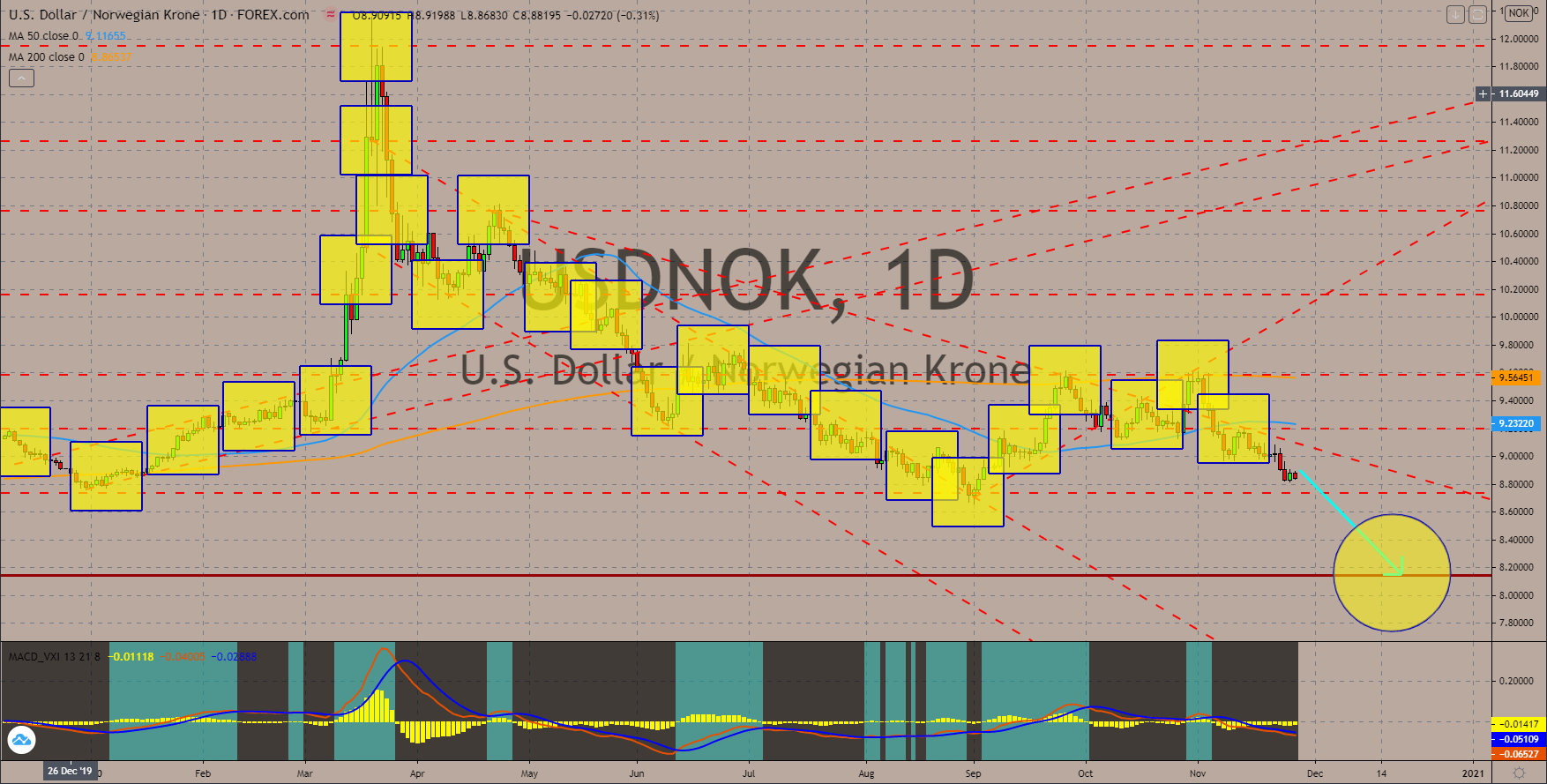

USDNOK

Norway’s unemployment rate declined to 5.2% from 5.3%. This was despite the rising coronavirus cases in the region. Meanwhile, the prime minister gave a deadline for the country’s lockdown until mid-December, which is earlier compared to Germany. German Chancellor Angela Merkel extended the country’s second lockdown until the end of December, which is expected to have a substantial effect on corporate profits. On the other hand, the US dollar continues to decline amid the high unemployment seen in the past two (2) weeks. Analysts are expecting the US House of Representative and the Federal Reserves to pass a stimulus budget more than the $2.2 trillion pending on the senate. As a result, investors would see a further decline in the US dollar against the Norwegian kroner while US equities will advance, which is beneficial for the Norwegian currency. The USDNOK is trading below the 50 and 200 moving average.

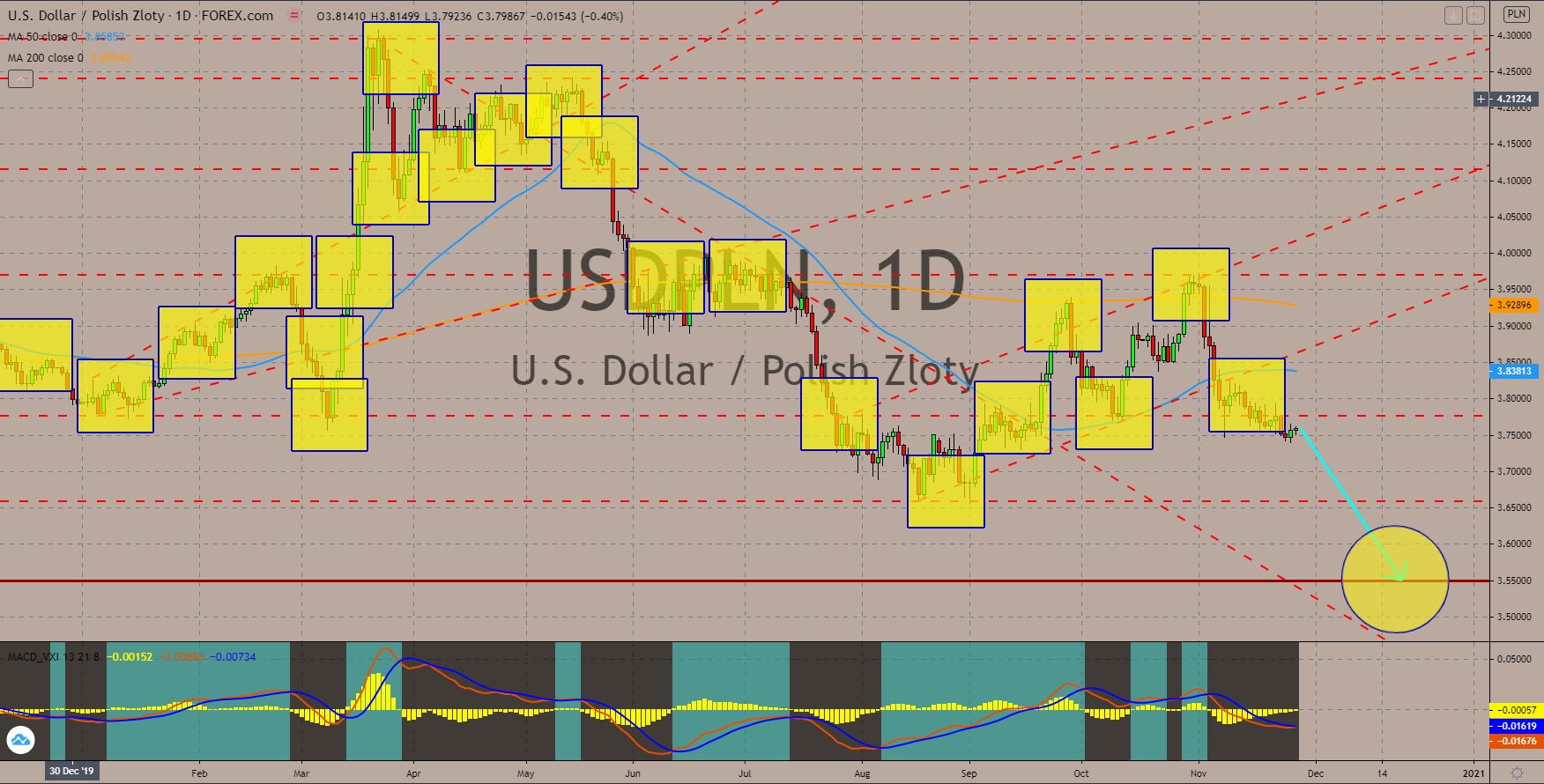

USDPLN

The tension between the European Union and the eastern countries of Hungary and Poland will benefit the Polish zloty in the coming weeks. Poland and Hungary were the only countries inside the bloc which vetoed the $2.15 trillion economic aid for the next seven (7) years. The decision to block the budget was due to the condition attached in the budget wherein the EU could cut the budget of countries it found were violating the EU rule of law. However, Poland and Hungary’s economy are going better compared to their western counterparts, Germany and France. Thus, the conflict between these parties will hurt the Eurozone the most. On the other hand, the US is also proposing a $2.2 trillion additional stimulus, which will negatively affect the value of the US dollar. The 50 and 200 moving averages showed a skewed movement to the downside. Meanwhile, the crossover in the MACD is expected to be temporary with the bearish “Death Cross”.

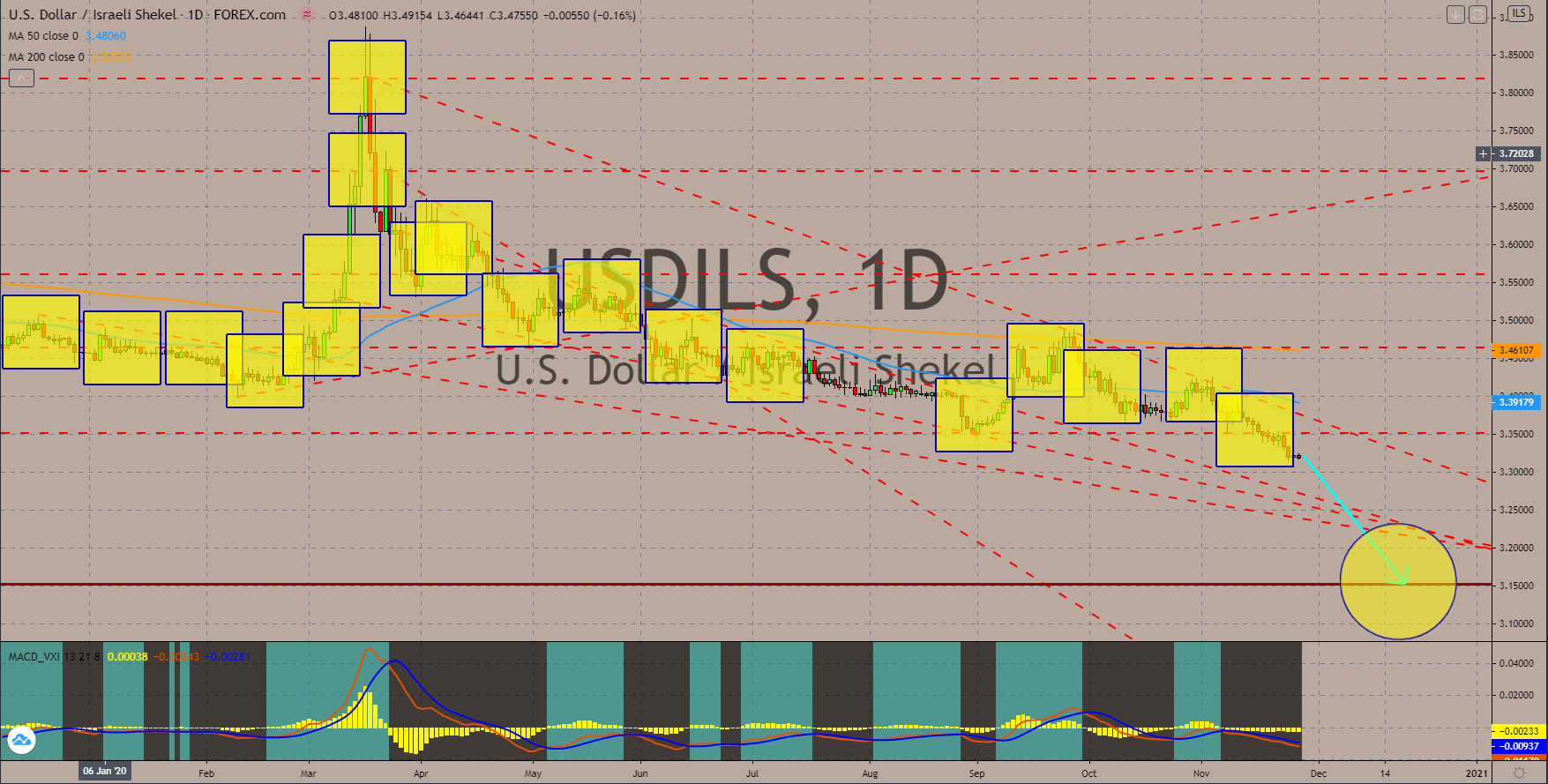

USDILS

The US initial jobless claims report hit its five (5) week high on Wednesday’s report, November 25. Last week, there were 778,000 individuals who filed for unemployment benefits. This number is higher than the estimate of 730,000 and from the previous report’s 748,000 result. In relation to this, personal income and personal spending have dropped dramatically. The growth has slowed down to -0.7% and 0.5%, respectively. The US hasn’t provided any expectations for the upcoming initial jobless claims report next week. This suggests that investors will see higher numbers for the report, which could force the US government to pass an immediate stimulus package. In other news, the Palestinian Authority (PA) has restored its economic and political ties with Israel. The USDILS pair will continue to trade lower below the 50 and 200 moving averages. Meanwhile, the MACD shows no sign of continued downward movement.

COMMENTS