Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

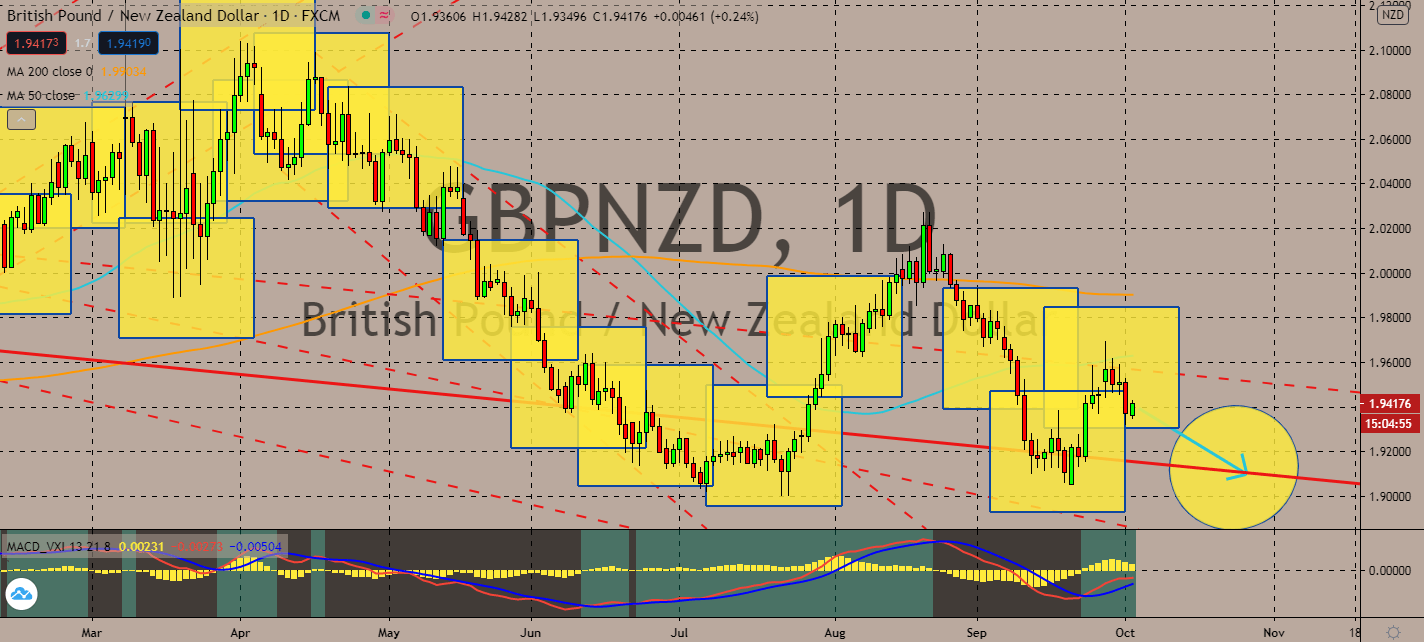

GBPNZD

The United Kingdom failed to withdraw legislation that would breach both sides of the Brexit deal. The European Union launched legal action to counter it, announced weeks after the City confirmed that it plans to override a specific part of the Withdrawal Agreement. Although both sides claim that they’d still want an end-goal agreement, the news is still projected to pull the British pound lower against the safe haven New Zealand dollar. The pair’s 50-day moving average also just touched the pair’s current level, showing signs that it could be preparing to fall beyond its current support levels as its 200-day moving average remains above it. Meanwhile, New Zealand is looking forward to a safer economic output: it confirmed that it had 0 cases of new daily coronavirus cases yesterday, a tell-tale sign that the kiwi could look forward to a better post-lockdown response for its economy for the rest of the year.

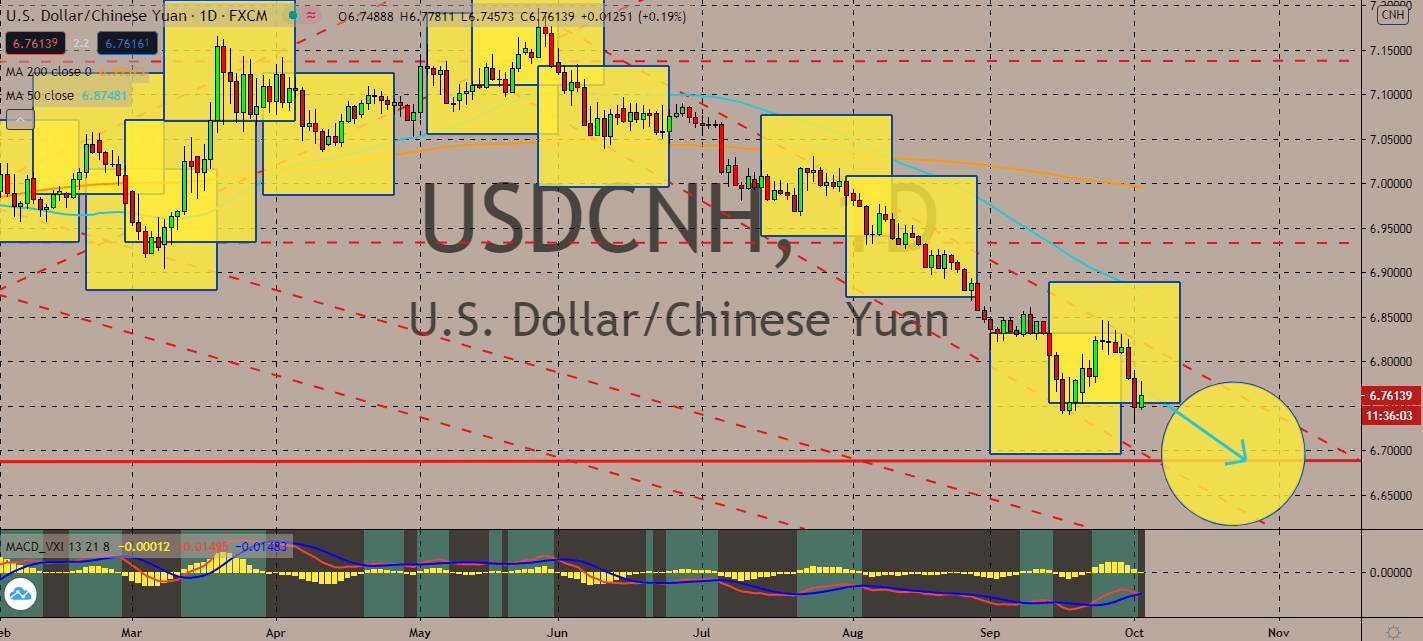

USDCNH

Amid the market keeping focus on the upcoming presidential elections in the United States, current president Donald Trump announced that he tested positive for the coronavirus in early trade. Counterparts are projected to rise in the greenback’s place. The pair’s 50-day moving average has been stooping low and lagging behind its 200-day moving average, showing signs that the pair might not go back up anytime soon. American assets are projected to fall near-term as the market tentatively waits for several economic indicators in the United States, such as its wage growth, finalized consumer sentiment, and factory orders, which will all be announced later today. China is also still celebrating its Golden Week, helping the yuan rise as tourism begins to boom in its busiest holiday week. The industry is looking forward to making a big impact on its economy as it continues to recover from its coronavirus slump.

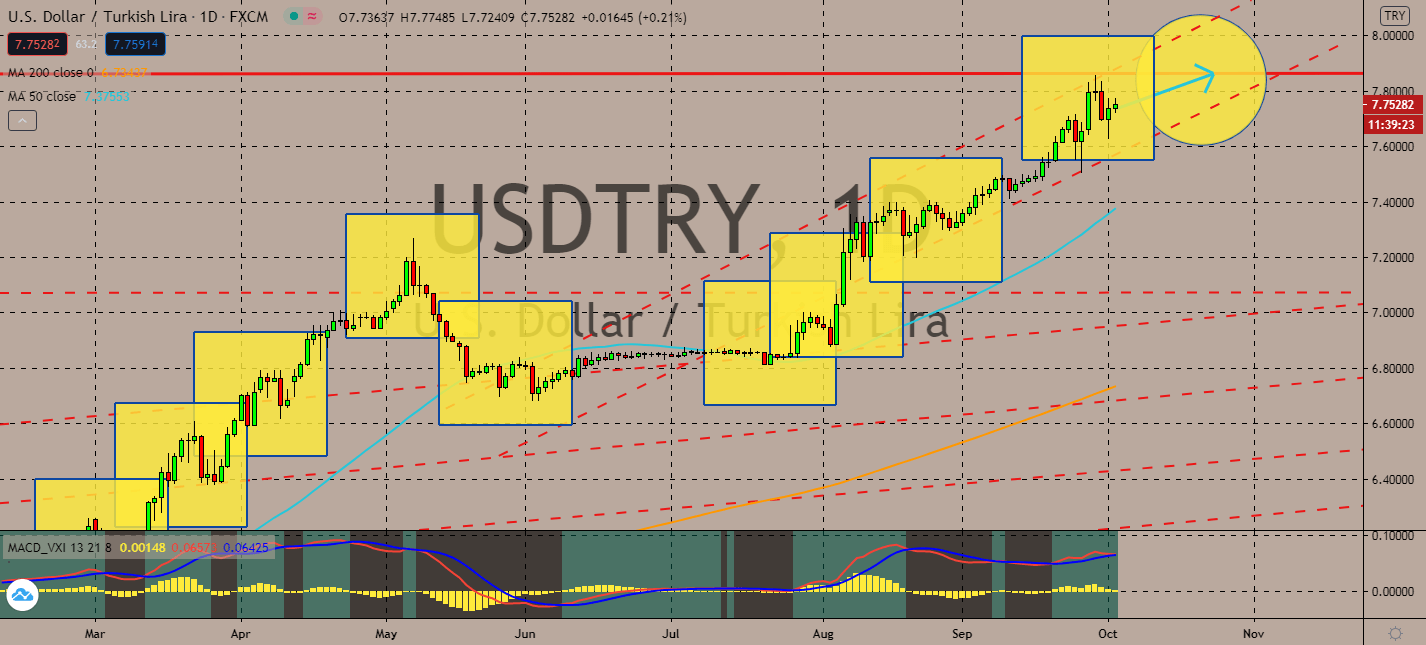

USDTRY

Turkish President Recep Tayyip Erdogan fueled the fire between Azerbaijan and Armenia when he declared all-out support for the former party, accusing Armenia of refusing to cooperate in negotiations for a resolution amid their long-simmering conflict. After four days into the all-out war, the harmful attack killed dozens of people for the past week. His proclamation is projected to push the pair upwards as its 50-day moving average continues to peak way above its 200-day moving average. Even as the greenback approaches overbought territory, the greenback would still go up thanks to better conditions in the US employment system, as well as its status as a safe haven currency in the market. Unemployment in the US is expected to drop from 8.4 percent to 8.2 percent, an equivalent of an additional 850,000 employees in the month of September. Retail sales, payroll gains, and consumer spending should all improve near-term.

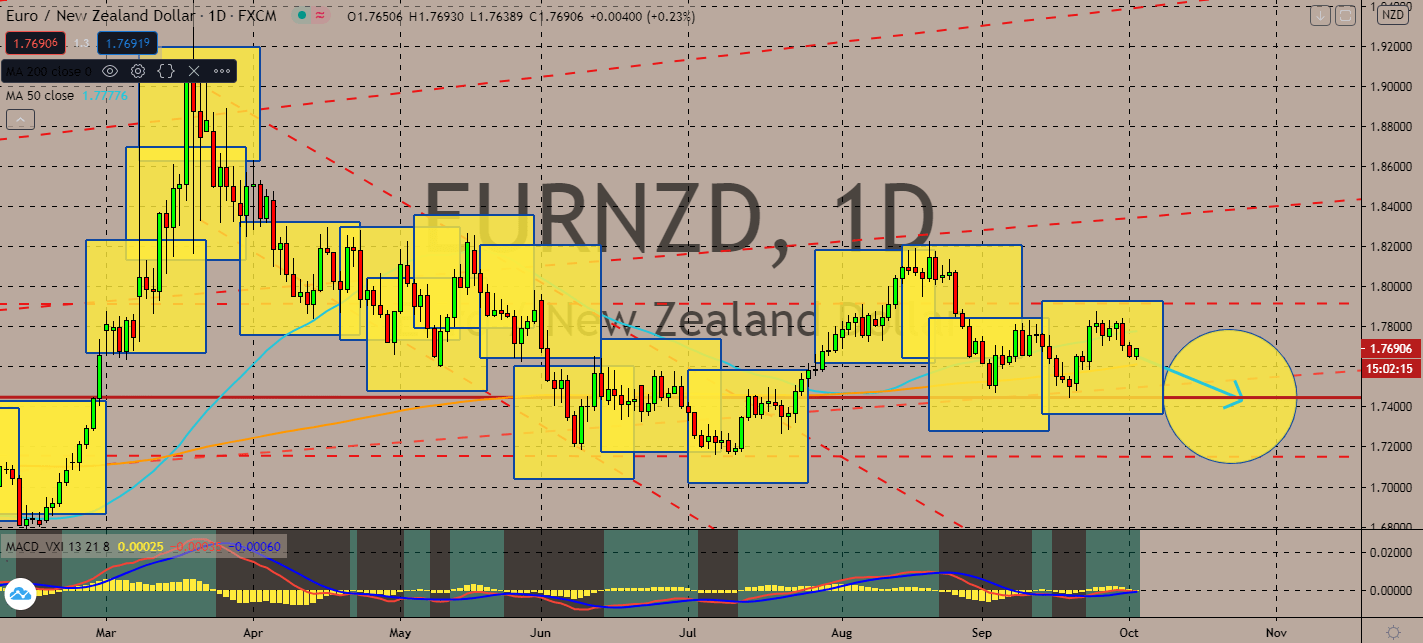

EURNZD

The intense conflict between the European Union and the United Kingdom is projected to inject worries for euro investors, contrary to the safety in the New Zealand dollar. The pair’s trend fell when its 50-day moving average touched its recent levels, indicating that the pair could go down towards its 200-day moving average soon. The move will come after the European Union announced that it launched legal action against the United Kingdom for disrupting international laws and legislation on both parties in the Brexit deal. The Northern Island Protocol, which called to eradicate border checking requirements between the borders between the two economies in Ireland. Meanwhile, New Zealand is seeking to reopen its tourism bubble with Australia, which could better tourism as one of its economic drivers in the country.

COMMENTS