Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

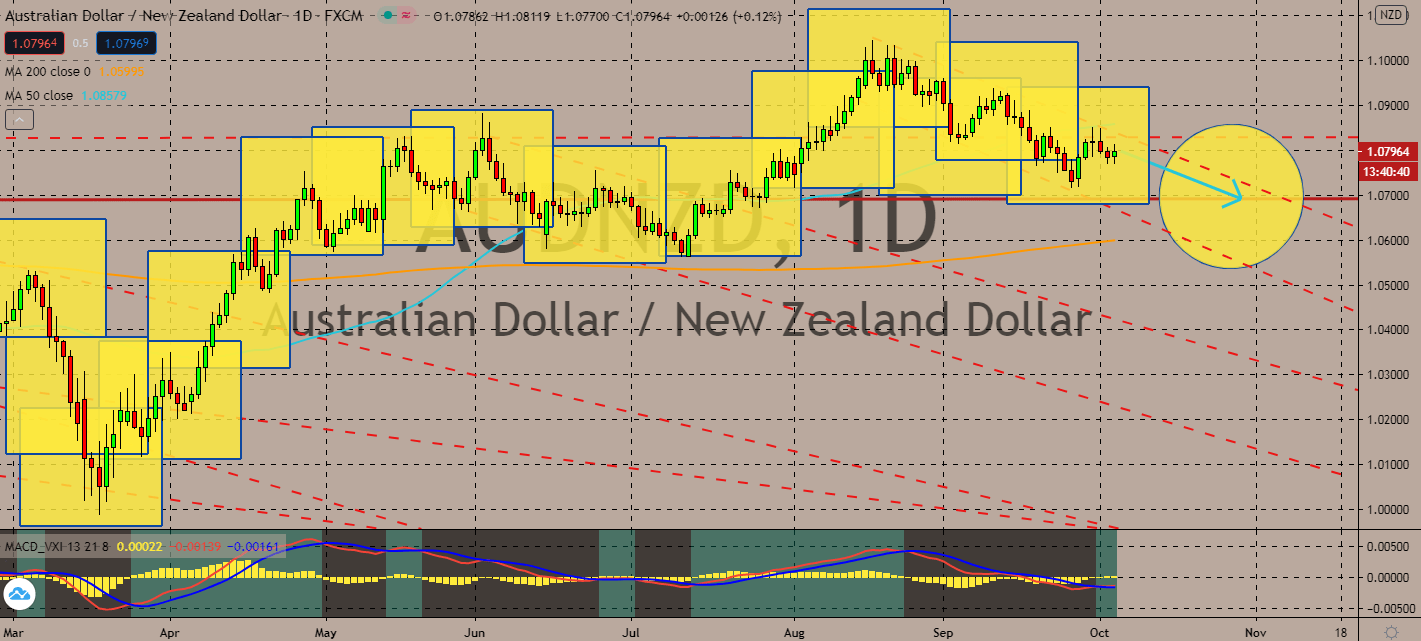

AUDNZD

The Reserve Bank of Australia is projected to retain October’s interest rates at 0.25%, but debt burden is still projected to report a jump to A$712.1 billion or 38% of its gross domestic product. Economists claim budget deficits could swell to A$220 billion to June 2021. These predictions are projected to pull the Aussie dollar down near-term. The pair’s 50-day average is looking to go up, but it looks like its 200-day average is moving to catch up as the pair struggles to break out of its resistance levels. New Zealand is now healing from its second coronavirus wave in the region, having loosened its restrictions to level 1. Prime Minister Jacinda Ardern was proud to say the country had “beat the virus again,” which ignited confidence for the kiwi dollar in the near-term. Despite risk appetite across the market, the kiwi should pull the pair down soon.

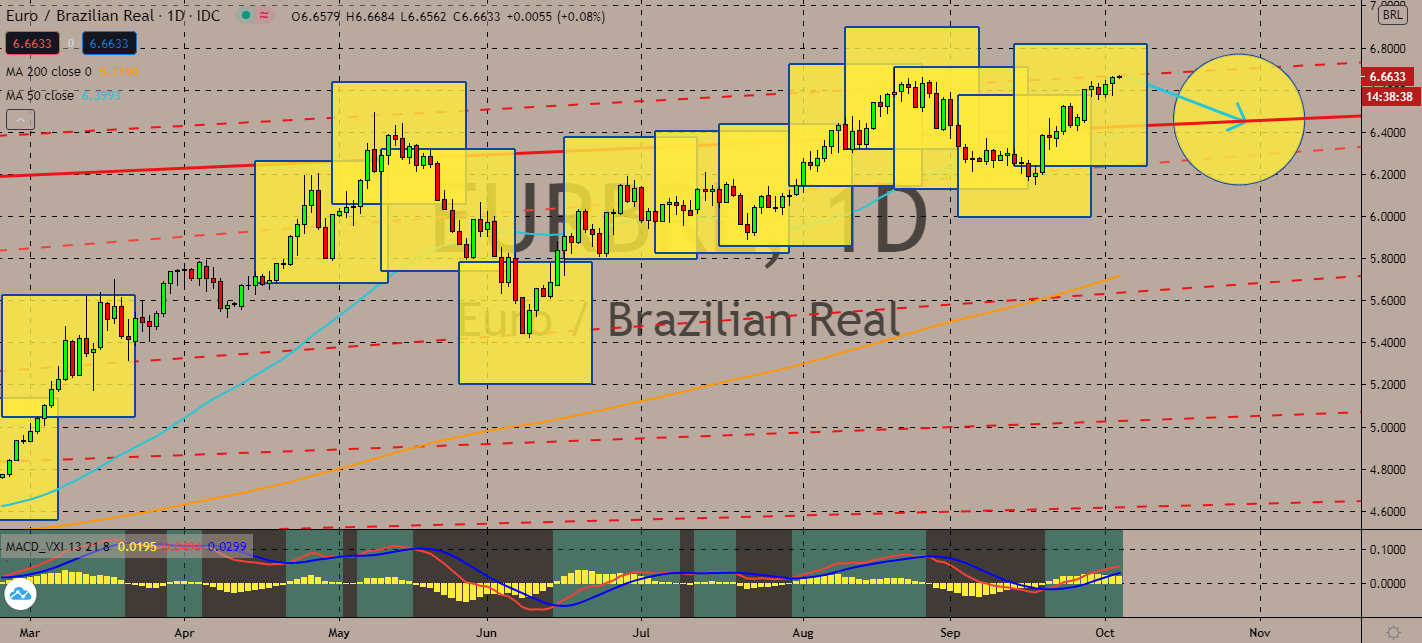

EURBRL

Days after the European Union announced that it launched legal action against the United Kingdom, British Prime Minister Boris Johnson said that the City would prosper even without a trade deal with the EU. The statement is projected to pull both currencies down against emerging markets like the Brazilian real. In fact, the pair’s 50-day average has been stagnant in recent sessions while its 200-day moving average starts to peak from June’s support levels. Despite being much higher, the nearer-term average will most likely be at a disadvantage near-term due to risk appetite. Rising consumer prices are projected to keep Brazil’s interest rate stagnant in coming months, which is projected to help its economy as the eurozone’s equivalent struggles to encourage consumer spending for several participating countries in the bloc, which is projected to pull its overall purchasing managers index to a standstill at 50.1.

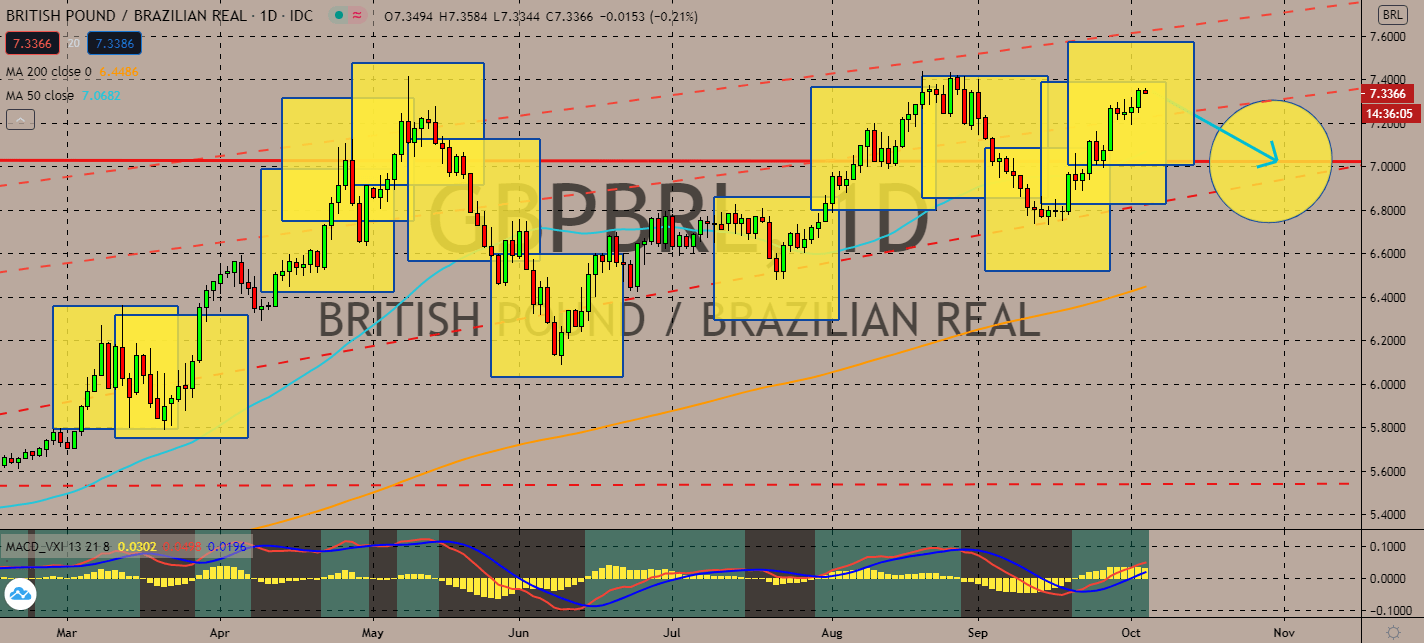

GBPBRL

Both composite and services PMI in the UK are projected to report declines in September brought by lockdowns implemented to muffle the effects of the coronavirus resurgence in the City. Finance chancellor Rishi Sunak warned that further lockdowns will have to take a toll on both economic and social terms in the long run. Sunak had already forewarned that the UK might not be able to recover every business lost in last month’s new jobs scheme. Not only that, Britain’s rising tension against the European Union will push investors’ appetite away from the Pound, as well. The pair is on a volatile streak, but it looks like it’s ready to pull back from resistance levels last seen in August despite having its 50-day moving average move above its 200-day moving average. Improving consumer spending in Brazil will also help lift its currency against its bigger counterparts as economic confidence reaches back to pre-pandemic levels.

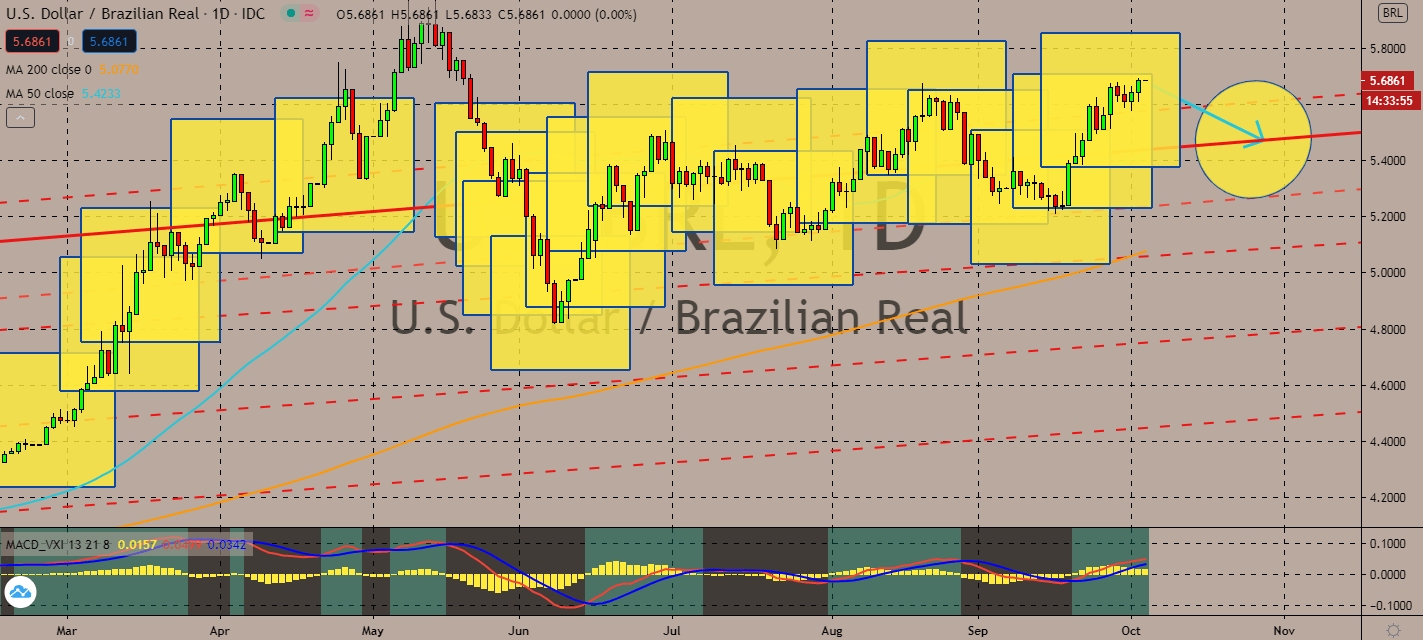

USDBRL

United States President Donald Trump is influencing risk appetite in the forex market after his doctors confirmed that he can go back to the White House only days after he was diagnosed with the coronavirus. Any news regarding his health will determine the pair’s trend until before the presidential elections in November. For now, easing concerns will help the pair drive down with risk appetite. Despite having increased in recent trading, the 50-day moving average won’t be in the spotlight. Instead, the peaking 200-day moving average is projected to help pull the dollar lower near-trade. As economic confidence for Brazil grows, the opposite is the case for the US – a panel of 52 economists agreed that the October-December season will grow by 4.9 percent instead of 6.8 percent estimated prior, while 2021 forecasts are calling for a 3.6 percent growth instead of the 4.8 percent rate estimated in a survey held in June.

COMMENTS