Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

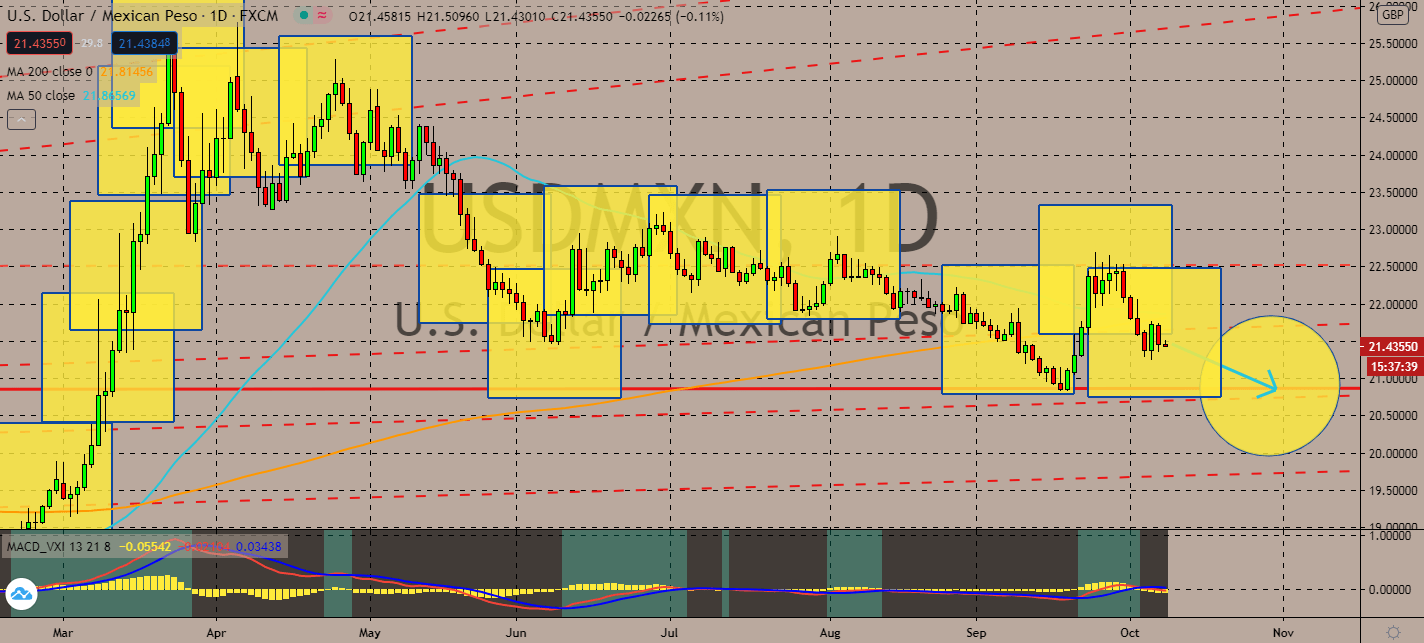

USDMXN

Investors are projected to lift the Mexican peso. The government announced its plan to invest worth more than $14 billion for local businesses, equivalent to 297 billion pesos. The package will be the first move to invest under President Andres Manuel Obrador. Forex analysts are looking forward to how the project would go as the Mexican government plans to prevent prior mistakes to cope with the pandemic and keep its currency up against its peers. The peso’s strength has relatively been doing well against the greenback for months now, especially after its 50-day moving average dropped in mid-May. Now it looks like the pair is bound to fall further down as its 200-day moving average skirts upwards. This also follows the announcement from US President Donald Trump that the US congress won’t continue its talks for another stimulus package until the presidential elections on November.

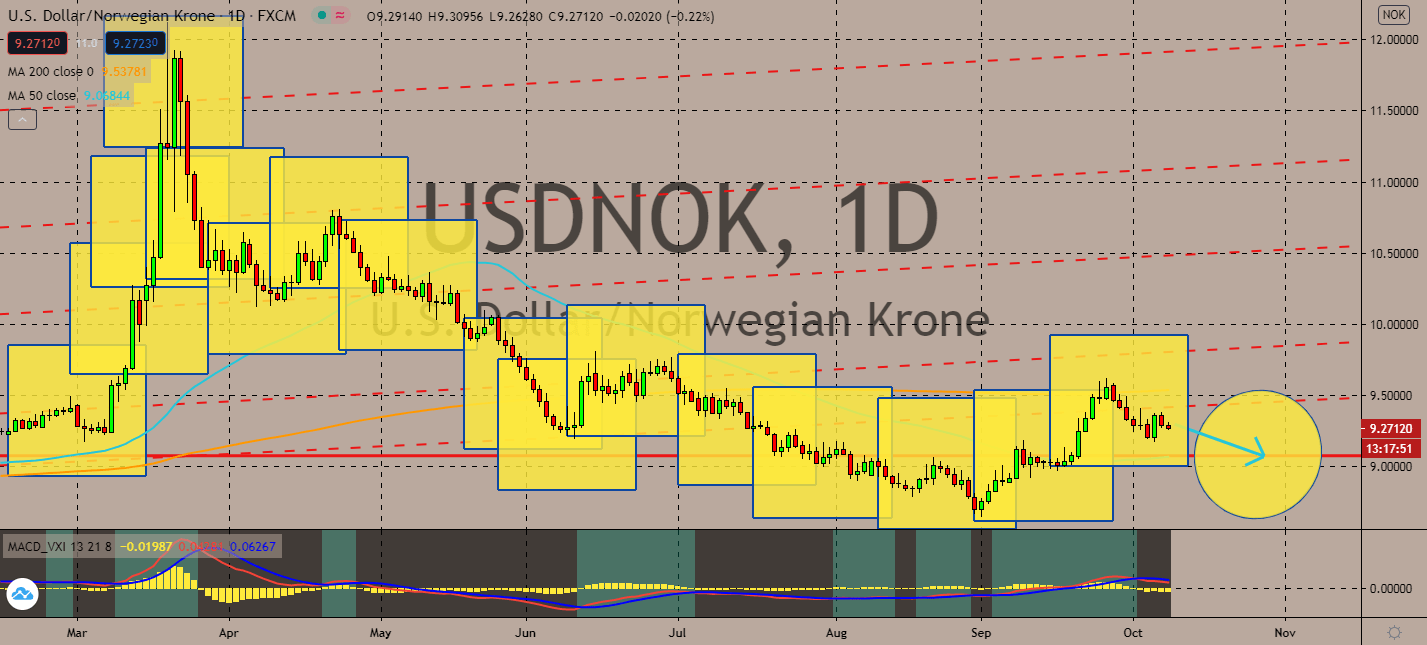

USDNOK

As tension between the European Union and Britain rise, Brexit officials are vouching for Norway’s model for a post-Brexit deal on shared stocks. The claim should up the Norwegian crown against stronger currencies such as the US dollar, considering that its 50-day moving average has been struggling to move up to the higher 200-day moving average. Several factors are projected to pull the dollar down today, such as the recent meeting in the Federal Reserve when its chairman Jerome Powell faced oppositions toward what the central bank plans to do with interest rates, employment figures, and inflation for the rest of the year. According to the FOMC meeting minutes released earlier, inflation is moderately on track to exceed the 2% target for some time. However, any positivity from the meeting will be offset by tensions between the Democratic party and the current US President Trump, which halted any stimulus packages until the election in November.

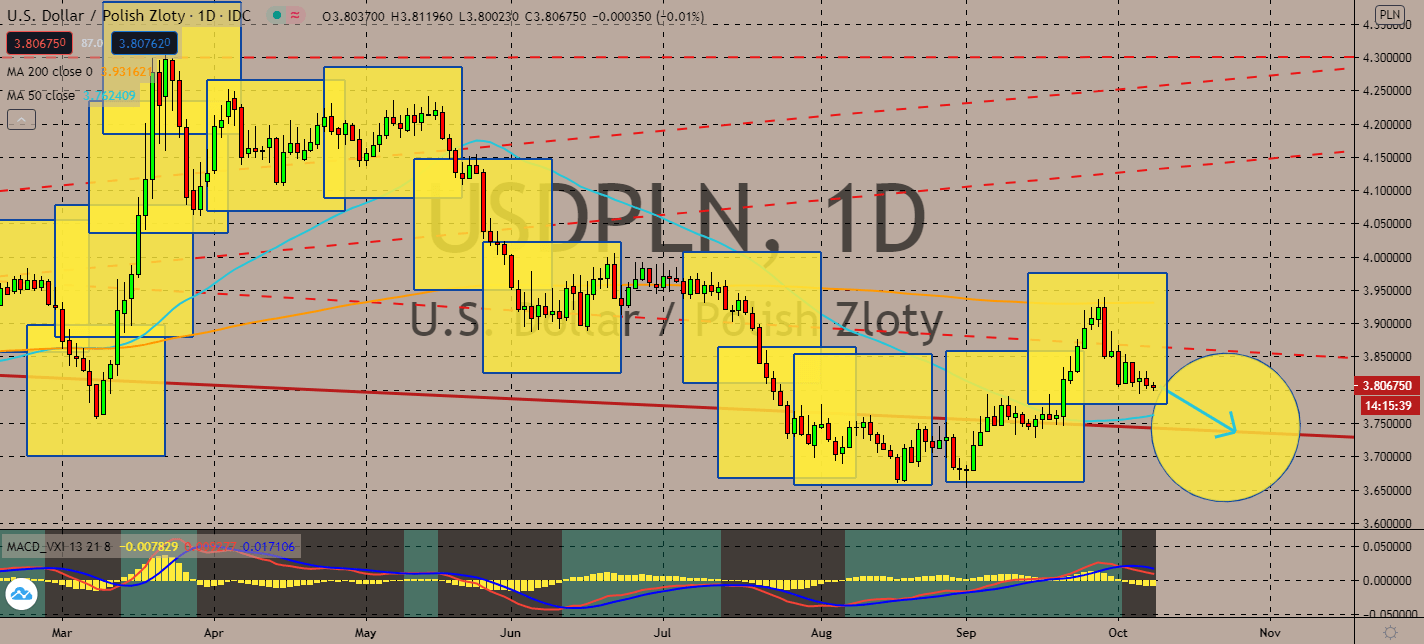

USDPLN

US President Donald Trump shocked the US market when he rejected the Democrats’ stimulus offers, haling talks over a major stimulus package for its economy. Millions remain out of work, small businesses are struggling, and states are still struggling to get by with limited budgets. It turns out that he effectively halted all negotiations. The pair has been falling as early as May, but it looks like it could only go down now that the Polish central bank decided to keep its benchmark interest rates as it is at 0.1% thanks to its strong V-shaped recovery in the third quarter. The National Bank of Poland also called to keep its asset purchase program while CPI inches up. The pair’s 50-day moving average is still moving far below its 200-day moving average, and it’s going to continue falling until the election takes place. As the election approaches, markets should keep their eyes on how Poland will improve despite the pandemic.

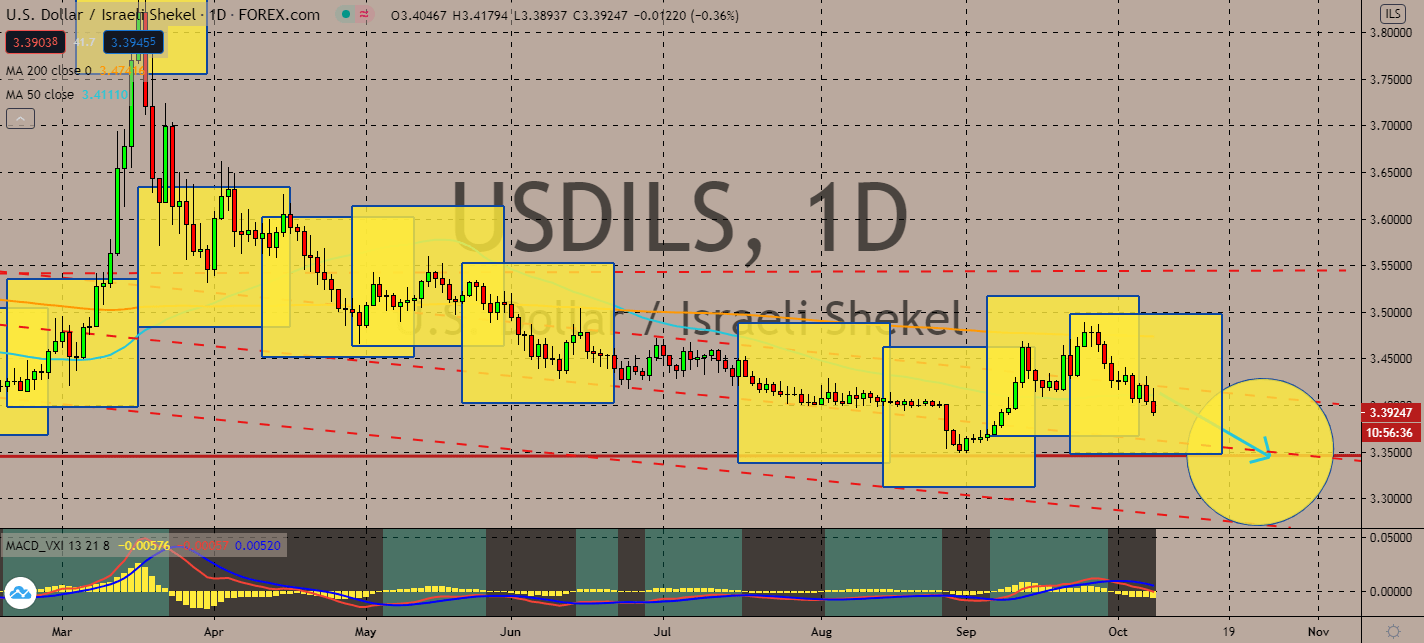

USDILS

Tensions are rising in the Israeli economy as more protest flourish against its Prime Minister Benjamin Netanyahu’s leadership. Fortunately for the shekel, the markets are driving away from the US dollar near-term. Overall near-term dollar weakness is proejcted to help emerging markets like Israel’s as the US presidential elections near. This is further proven by the pair’s 50-day moving average, which is moving below the 200-day moving average after both touched recent levels. Markets are getting more interested in buying the shekel until the presidential elections, or at least when Israel’s coronavirus numbers continue to decline after it reported its lowest level on Tuesday or when employment figures in the US worsen despite the Federal Reserve’s efforts to reach inflation targets of 2% by the end of the year.

COMMENTS