Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

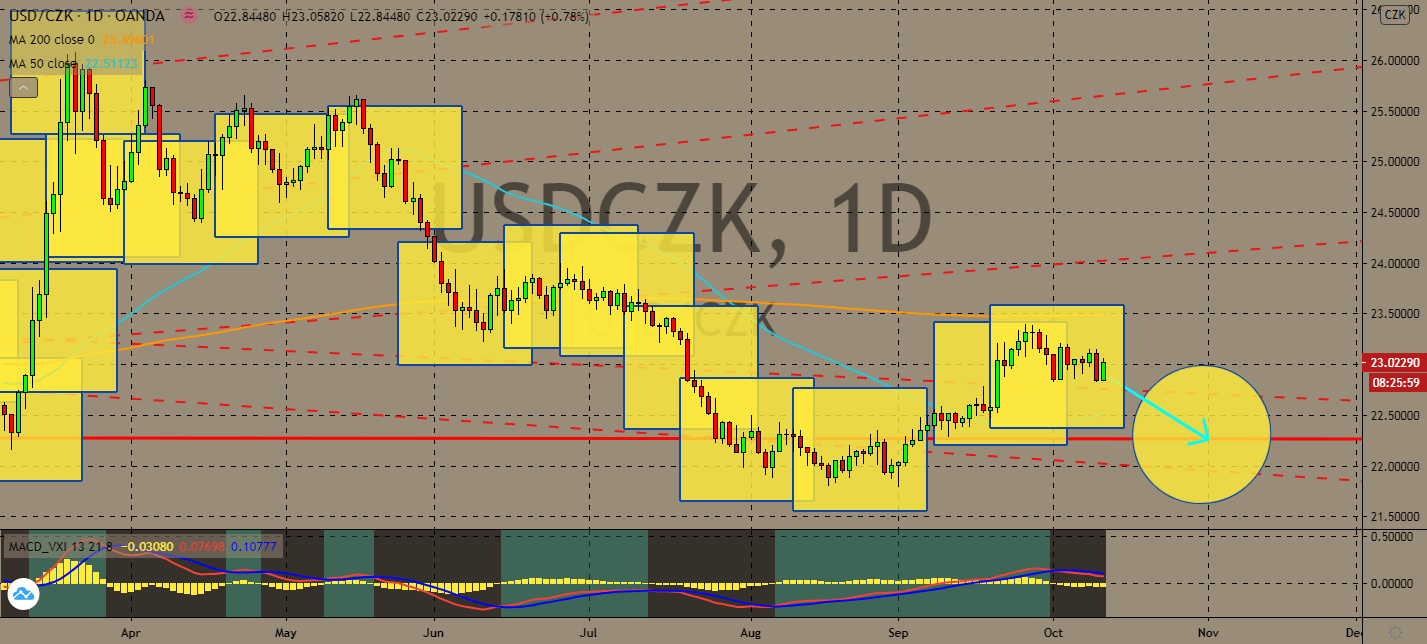

USDCZK

The US dollar is experiencing an overall weakness in the forex market due to the uncertainty of a near-term stimulus package, despite increasing optimism of a possible launch in a new administration next year. President Trump had participated in talks with House Democrats over the weekend, but it had been declined by the White House Representative Nancy Pelosi. The pair’s 50-day moving average is still below its 200-day moving average, which means that the pair is likely to move upward only after the presidential elections in November. Investors should be cautious of the crown’s future for this year, especially after it just announced a surge in coronavirus cases today that brought it to the brink of another nationwide lockdown. The 8 thousand added infections was the fourth record tally in a row, months after it had been a model for coronavirus responses. As a result, the greenback will fall near-term while the crown could fall by winter.

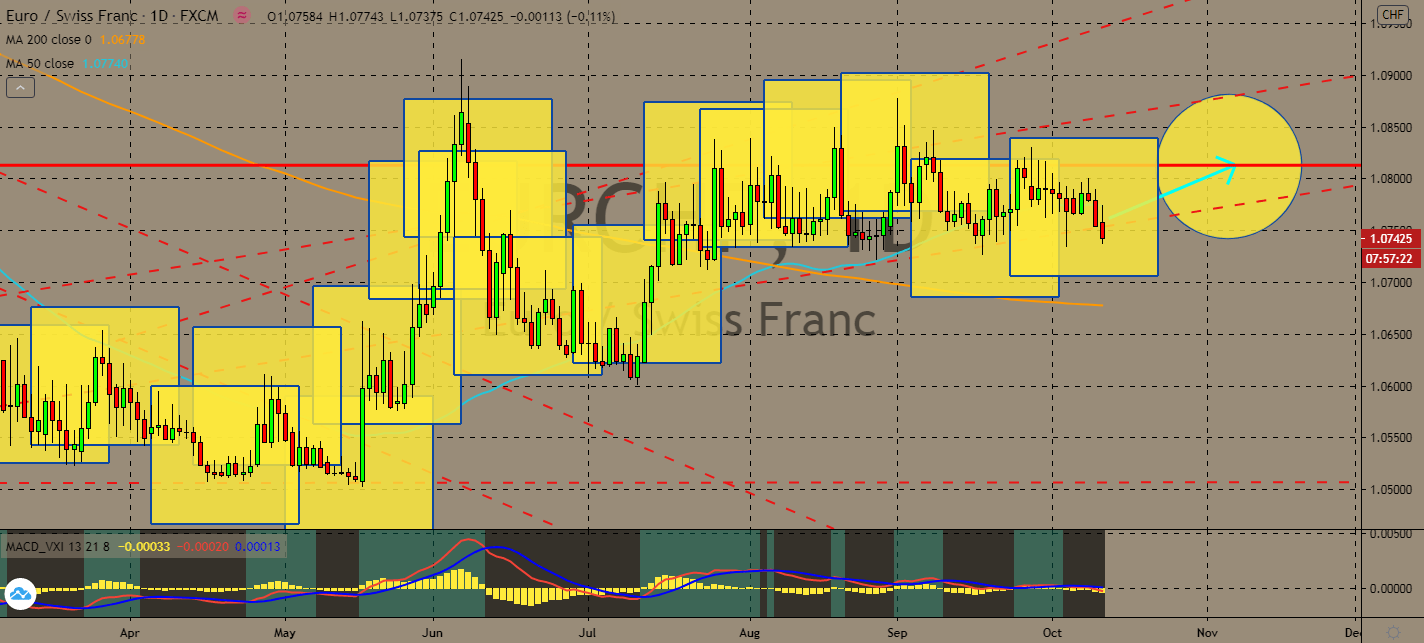

EURCHF

The euro will likely increase against multiple currency opposites as the market awaits the upcoming two-day EU summit later this week. The meeting to discuss better coordination of participating economies’ Covid-19 measures, as well as their approach to Brexit, will determine the euro’s longer-term track, but it looks like the market is more optimistic thanks to the possibility of a last-minute agreement between the European Union and the United Kingdom. The pair’s 50-day moving average is still up its 200-day moving average, which has been moving down since May. This shows that bullish traders might continue firming their grasp on the pair’s volatile upward trend near-term. Moreover, the Swiss economy is about to be tested – the country had recently faced its record spike in coronavirus cases, which brought its total to 60,300 including nearly 1,800 deaths in one of its largest cities, Geneva.

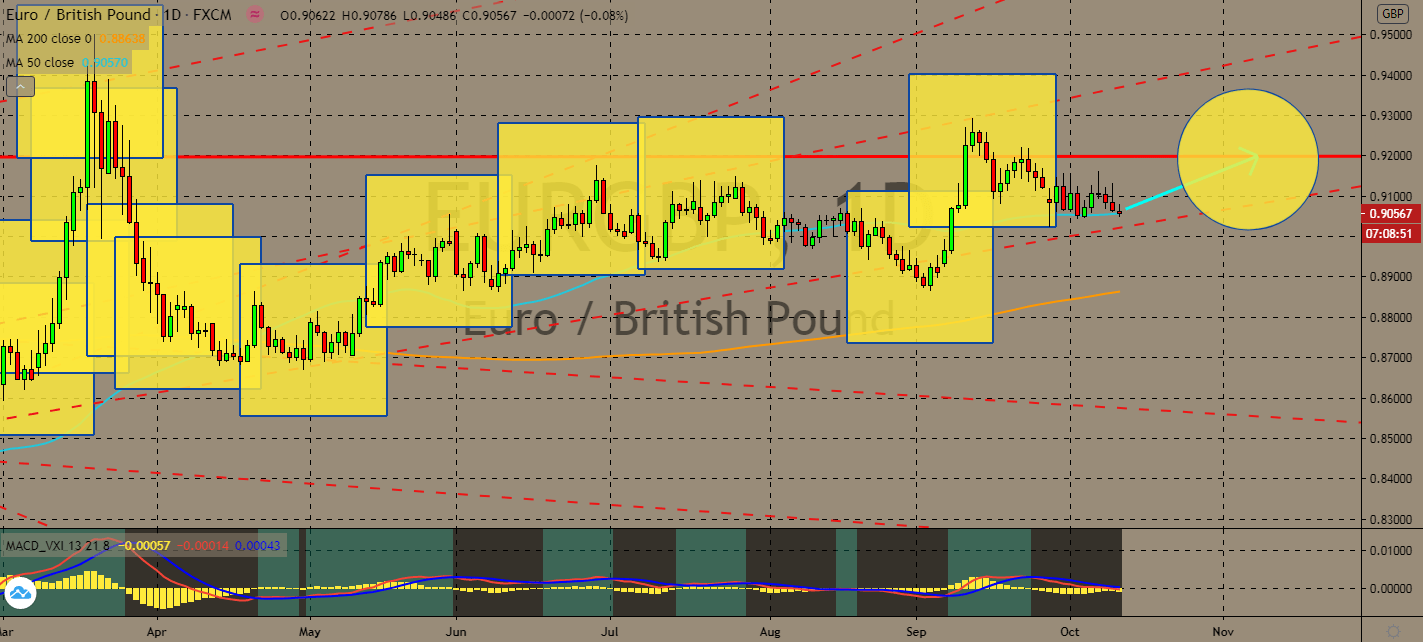

EURGBP

The British Pound has been declining against its euro counterpart after it reported a slower-than-expected economic recovery in August late last week. The estimated growth was about 4.6%, only to have fallen behind at 2.1%. The slowdown began amid the resurgence in coronavirus cases in mid-August. Unfortunately, economists believe that its decline wouldn’t stop there. Recent surveys claim that the slowing activity in September will bleed into the rest of the year as the possibility of another bond package program in the UK looms over its November meeting. The pair’s 50-day moving average has been moving way up its 200-day moving average, which means that optimism for the European Union’s recovery is more likely to prevail in upcoming sessions even with the expected last-minute agreement for Brexit, which European leaders are projected to discuss later this week during their two-day meeting on Thursday and Friday.

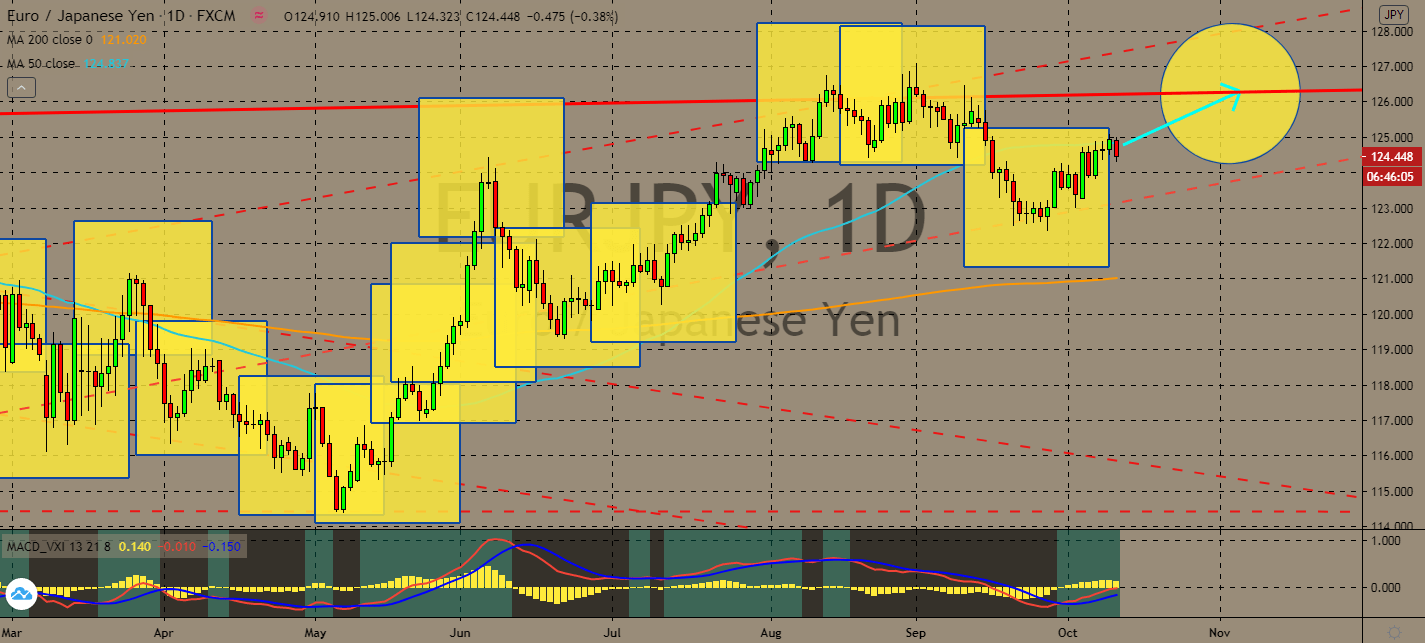

EURJPY

Inflation is at risk in Japan. Wholesale prices fell by 0.8% in September in comparison to the same month a year prior, which showed its seventh consecutive decline. But this year’s decrease has become more pressing than most with a more heightened risk of deflation. Global demand for Japanese machinery has declined in the month, pulling down both economic progress and its currency with it. The exchange’s 50-day moving average will continue its upwards track over its 200-day moving average with overall euro strength prior to the EU summit later this week, which will take place to discuss another collaborated stimulus deal across the eurozone, as well as a possible mid-point deal with the United Kingdom regarding their corresponding fishery territories. The likeliness of a last-minute October deal will help the euro lift against the typical safety of the Japanese yen in the near-term, or if Japan reports an improvement in economic data.

COMMENTS