Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

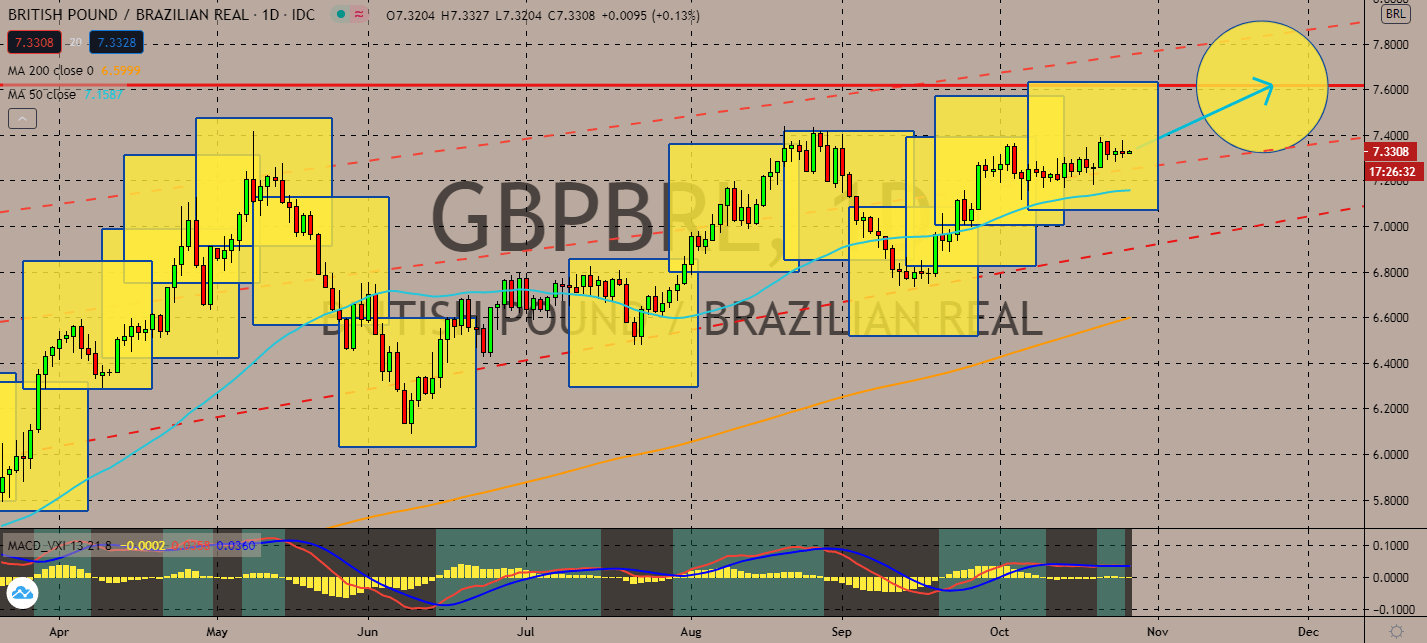

GBPBRL

The United Kingdom is being forced to compromise before Britain makes its full exit this year. As both parties involved are pressured to reach an agreement, the Pound will reach upward in the near-term. The pair’s 50-day moving average is still above its 200-day moving average, showing signs that bullish traders are still optimistic about the deal at hand. The pair will likely rise until an agreement is signed before the year ends. Meanwhile, Brazil is second to only the United States for having the most coronavirus cases nationwide. With more than 150 thousand fatalities, Brazil’s economic outlook has worsened over the past three months. In fact, economists now expect its end-year economy to contract by 5.8%, which will then grow to 2.8% by next year. Investors are also worried about Brazil’s soybean exports. Its role as the world’s leading producer and exporter of soybeans is now being challenged after it sold too many soybeans for exports.

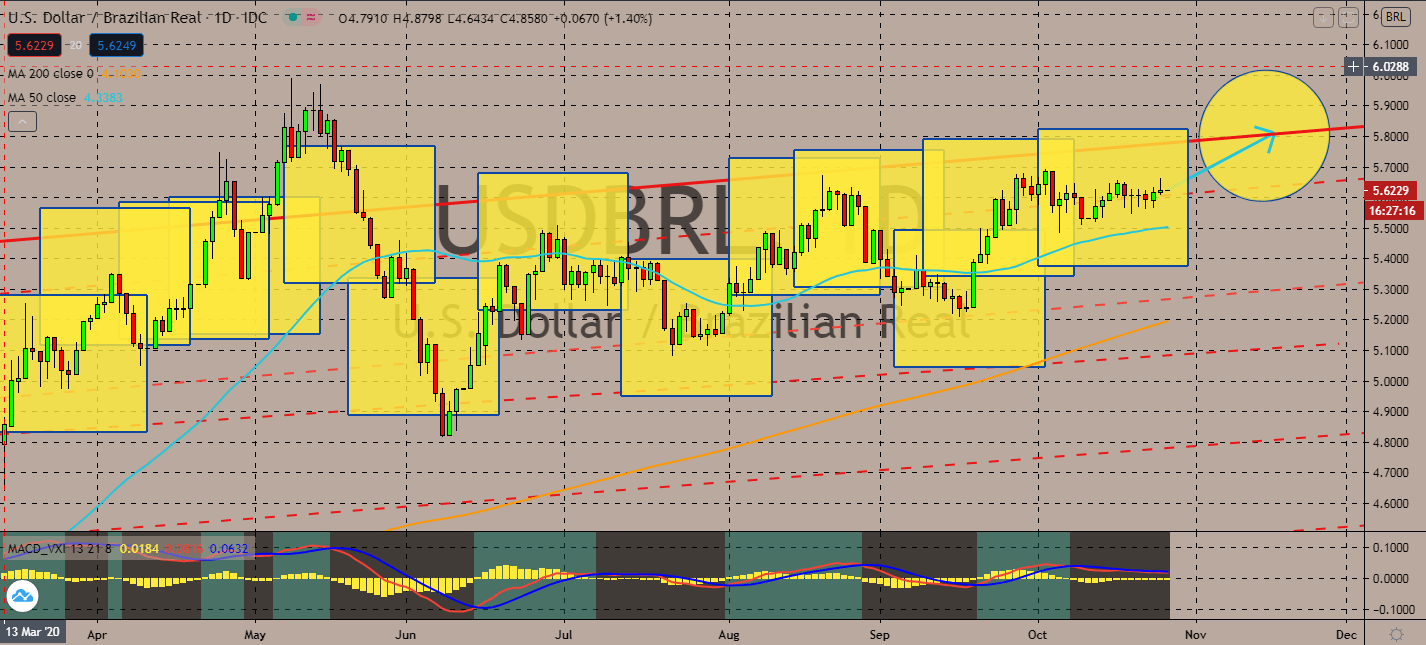

USDBRL

It’s a relatively busy day for the US dollar. The largest economy in the world is projected to report CB Consumer Confidence for October, which could rise from 101.8 to 102.0, while Core Durable Goods Orders could fall from 0.6% to 0.4% in September. But it looks like talks for the upcoming stimulus package will likely be the driver of the pair in the near-term. House Speaker Nancy Pelosi has been in talks with the White House to implement coronavirus relief before the presidential election in November. Although there’s no certain sign of a package soon, economists are looking forward to any results seen from slow talks after new infections in the US hit record highs recently. Moreover, the pair’s 50-day moving average is still above its 200-day moving average. Recent reports that claim Brazil’s gross domestic product could decline by 5.8% by the end of the year, which will then grow timidly by 2.8%. The news will pull investors away from the real.

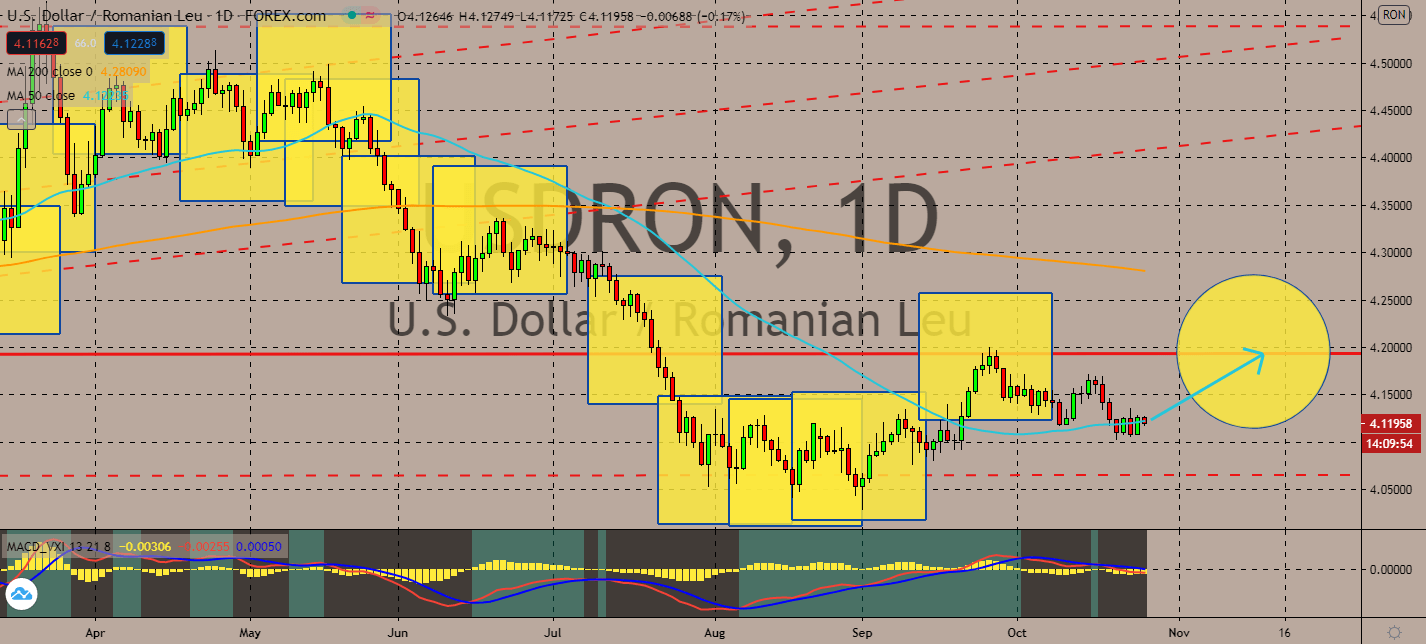

USDRON

Romania recently confirmed a new high in new daily coronavirus cases, effectively pushing its total to 200,000. This led to a blanketed pessimism towards its economic outlook for the rest of the year. Surveys claim that 70% of Romanians believe that the country is in a bad economic situation. Even as the pair’s 50-day moving average remains lower than its 200-day moving average, it looks like the pair could only go up thanks to hopes from the White House that a deadline for another stimulus package is due for a launch. Whether House Speaker Pelosi manages to pump out one final package before the November elections or not, it looks like the trillion-dollar aid will still happen by the end of the year nonetheless. The market is projected to trade for safer assets against the Romanian leu, including the US dollar, in its place as the world attempts to recover from what could be another unforeseeable coronavirus wave.

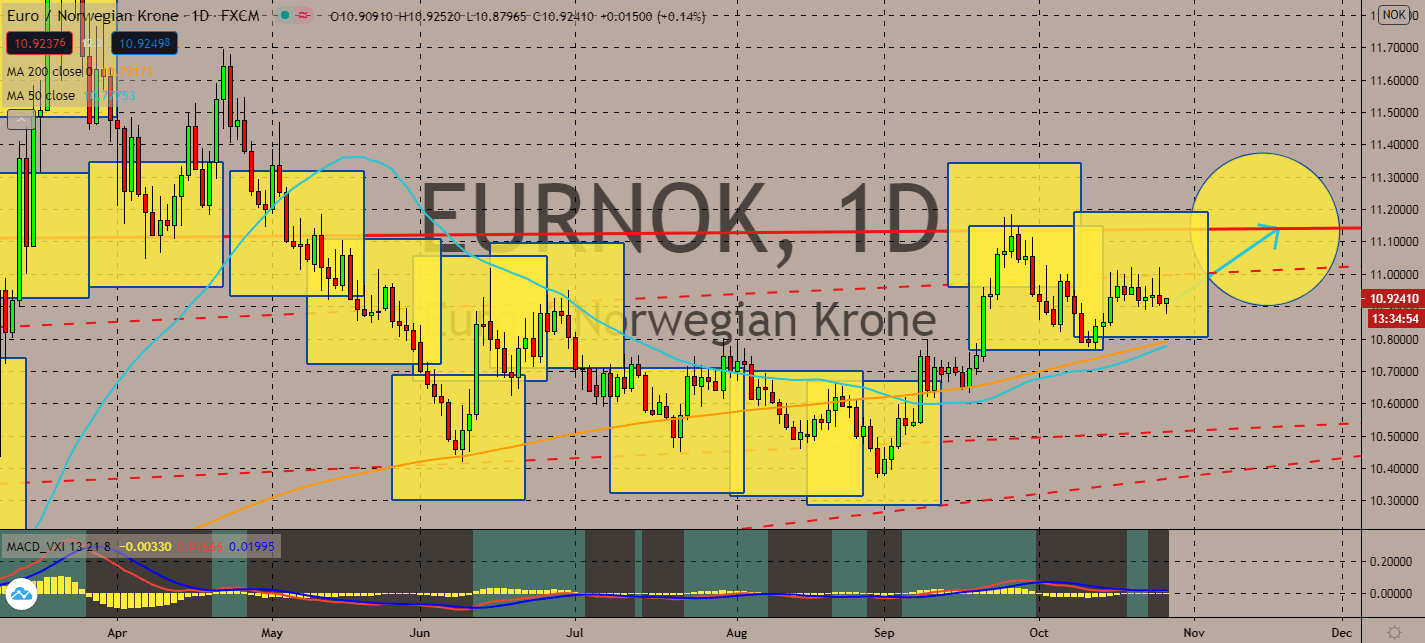

EURNOK

Despite having one of the lowest coronavirus infection rates in Europe, Norway’s economy might be in danger after Norway implemented stricter lockdown measures across the country. Economists and investors are both on red alert soon after hospitalizations exceeded its May levels, a sign that could mean that its next lockdown could affect more of its economy more than initially anticipated. Although the pair’s 50-day moving average is still below its 200-day moving average, bullish traders are projected to take advantage of the resurgence in the near-term. Meanwhile, despite having an uncertain quarter, the euro currency is likely to rise over risk aversion and the possibility that it could reach a definite agreement with the United Kingdom for Brexit by the end of the year. Pressure pushed by economists and negotiators on both sides should help boost negotiations, and therefore the single currency along with it.

COMMENTS