Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

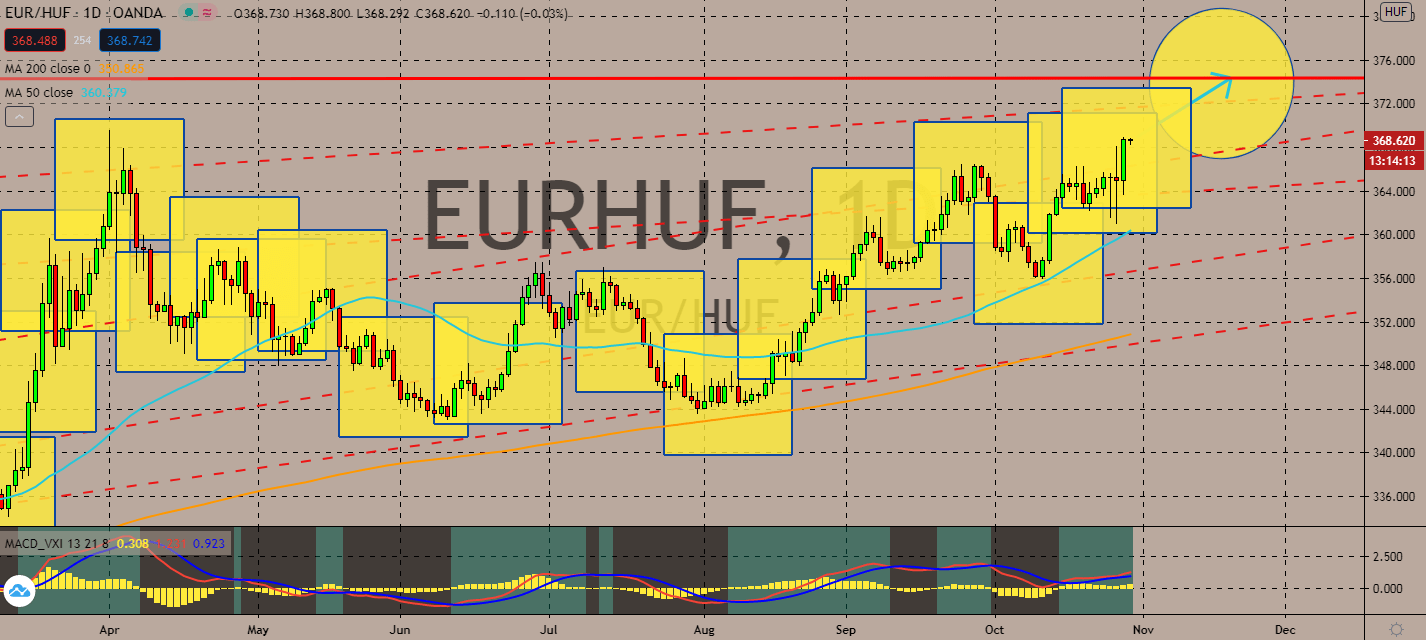

EURHUF

The eurozone’s economic calendar going to be busy today. October unemployment figures and prelim inflation figures are due for Spain and Germany. But the main catalyst for today’s trading will be the European Central Bank’s meeting later today. The scheduled monetary policy meeting is projected to show a pessimistic tone as lockdowns continue to suppress any prior progress towards its recovery from the coronavirus crisis. Although economists have yet to expect an addition to its stimulus, they’re now anticipating a hint for their change in policies for December. The pair’s 50-day moving average has been above its 200-day moving average as of late, prompting a promise for bullish traders to keep pushing the euro up in the near-term. The market is expected to keep searching for safer currencies, most especially against the Hungarian forint as markets get increasingly worried about the rising death toll from Covid-19 infections in Hungary.

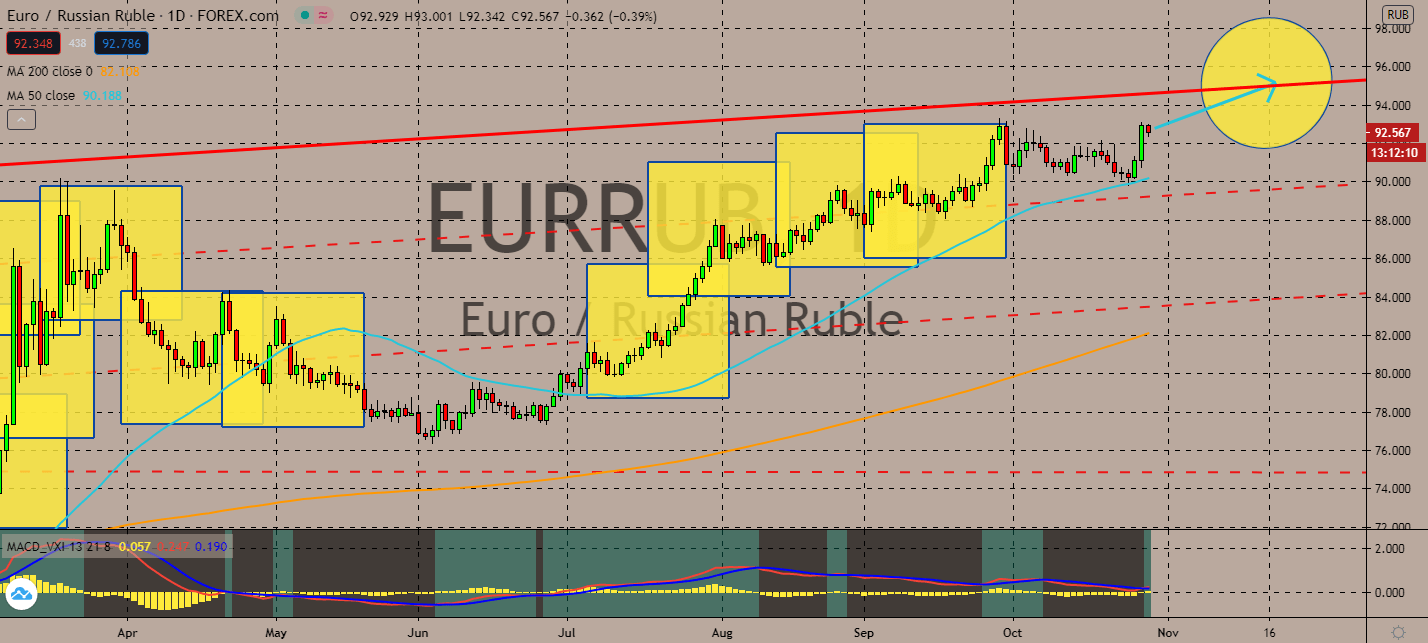

EURRUB

Geopolitics will get in the way of the ruble’s growth in the near-term. Investors are projected to lift the euro to counter their weariness amid growing tensions between Sweden and Russia. Sweden just announced that it plans to up its military budget between 2021 and 2025. Reports claim that Russia had been in discussion to use military means to achieve political goals, and Sweden had used this in retaliation. This will force a bearish market towards the Russian ruble, especially now that the EURRUB pair’s 50-day moving average has been moving far above its 200-day moving average. As the European Central Bank prepares to announce its stimulus plans for December, the pair is projected to rise near-term over the expectation that the upcoming stimulus would be as successful with helping its medium-term economic recovery, now that many economies have been suffering from lockdowns led by infection surges.

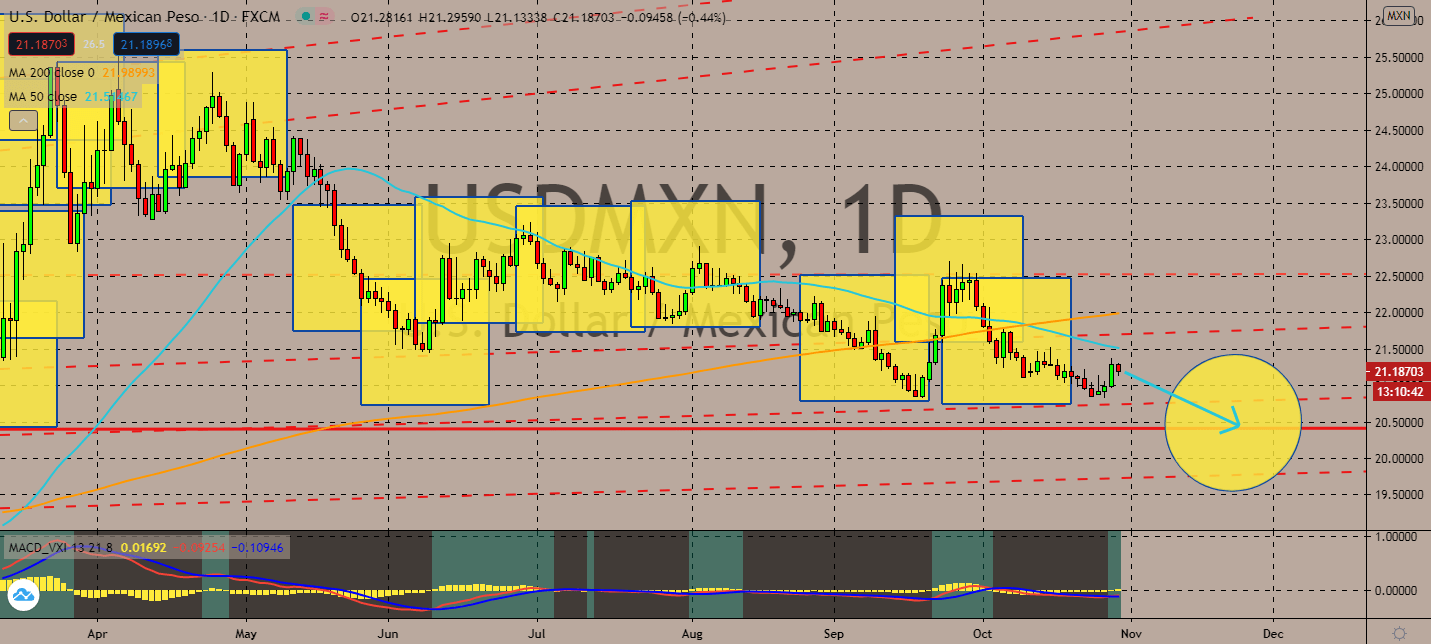

USDMXN

Mexico is in a complicated relationship with both presidential candidates in the United States. While the Mexican President Jair Bolsonaro follows Trump’s footsteps with most of his political decisions throughout Trump’s current term, Biden had promised to ease any anti-migration measures issued by Trump if he were elected president. As stimulus packages in the US remain elusive, investors are projected to count on Biden’s victory, which could stimulate more opportunities for the Mexican economy to improve over the next month. The pair’s 50-day moving average has been gaining momentum after it crossed down its 200-day moving average counterpart, indicating that bearish traders are insisting on pulling the pair down to support levels last seen in late September. It looks like the pair could continue this trend whether the US chooses to ignite its trillion-dollar coronavirus aid or not.

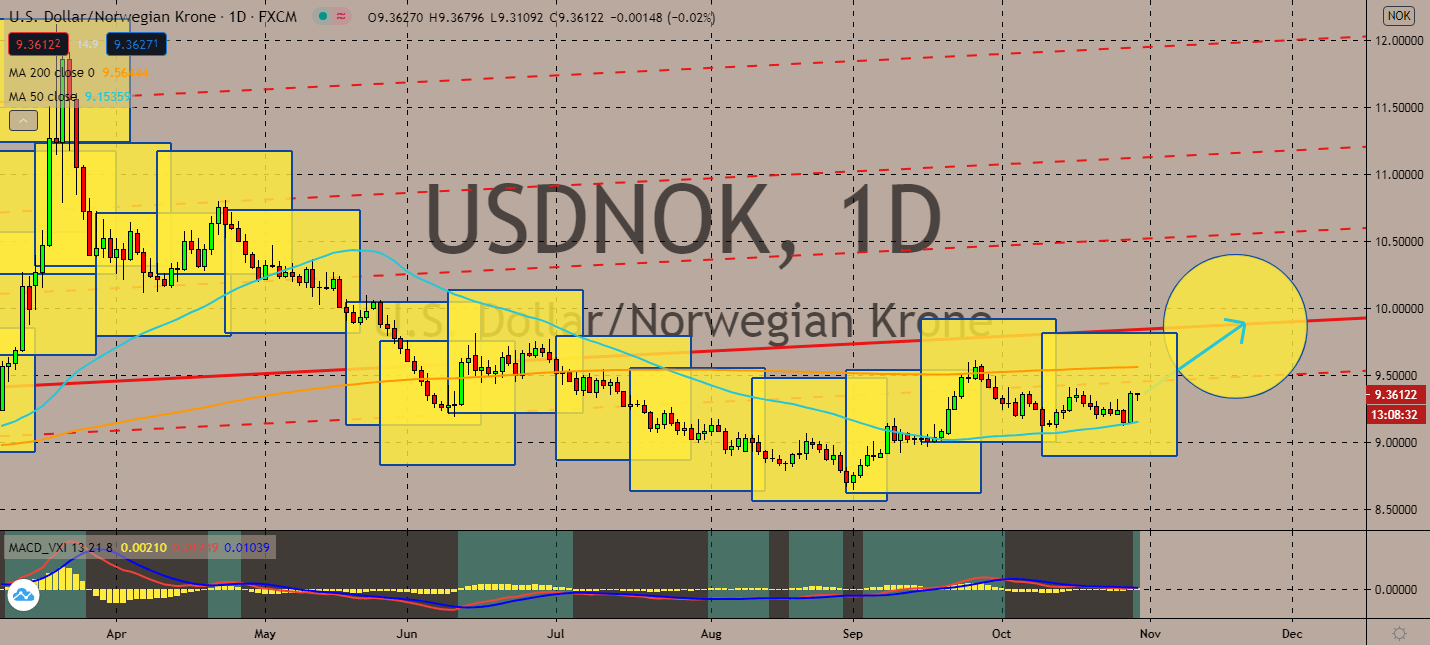

USDNOK

The presidential election will likely affect how the Norwegian krone will turn out over the next months. Now that investors are expecting a Biden victory, his planned trillion-dollar package could force the krone to suffer. The risk-sensitive krone will fall as political tensions rise in the US, as well. The krone is also projected to fall over uncertainties around oil consumption around the globe. In fact, oil prices have dropped by 5% worldwide to a three-week low after the pandemic forced another wave of lockdowns that plunged the need for the commodity. Norway has also been sensitive to the progress seen in the deal between the European Union and the United Kingdom, which has grown stagnant over the past week or two. Any pressure taken by the major economies will likely harm the Norwegian krone as they put additional weight on the already-struggling Norwegian economy and its reliance on oil reserves and output.

COMMENTS