Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

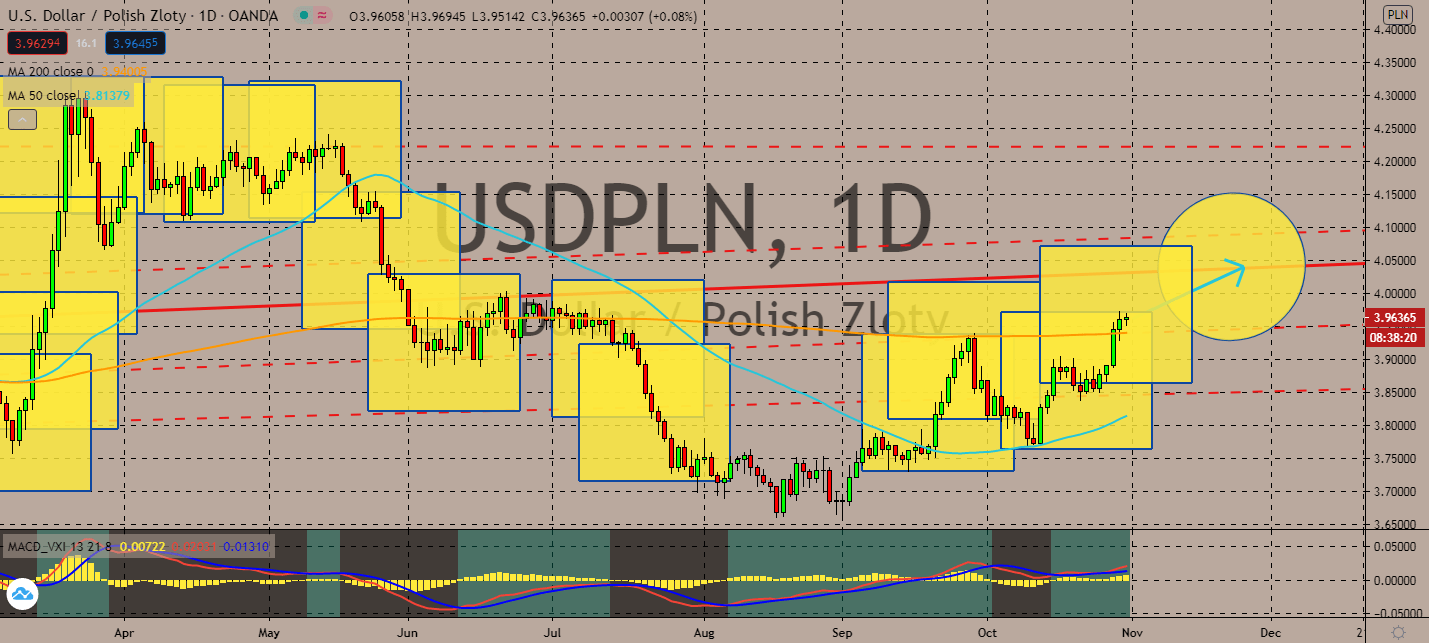

USDPLN

Coronavirus cases jumped to 300,000 in Poland on Thursday after it had seen 20,156 new cases, a record the country has never seen. However, the Polish government is insisting on keeping it open. The market is projected to keep worrying about its country after the total number of infections turned out to be thrice as much as its previous record in less than a month. Although the pair’s 50-day moving average is still below its 200-day moving average, the former is arching up to the latter. This shows that the bulls are fighting to push the pair up as the world descends into risk aversion for the near-term market once again. Investors are also expected to be optimistic towards the greenback from its leap in gross domestic product announced yesterday as a result of the government injecting more than 3 trillion US dollars-worth of pandemic relief that fueled consumer spending throughout the third quarter.

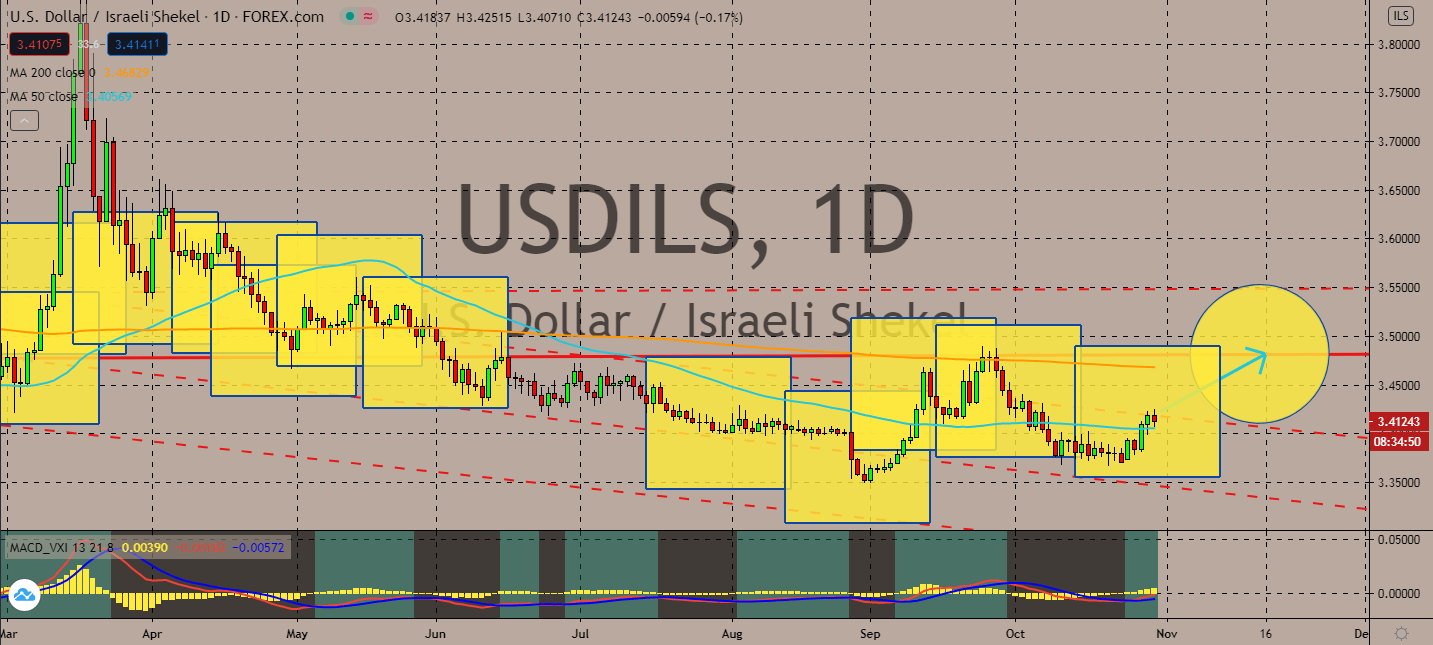

USDILS

Israel’s lockdown is costing its government about 2.3 billion NIS a week. The contraction in business activity, the drop in private consumption, and state revenues, as well as the overall effects of the coronavirus on global growth and trade, have tumbled into the Israeli economy. Investors are bracing themselves for the Finance Ministry’s end-month report regarding the economic costs of its current lockdowns. Economists now believe that the nation will experience a budget deficit of 13 percent of its GDP within the year, which is a far jump in comparison to the 4% deficit last year. The pair’s 50-day moving average had just met its current levels, which indicates that the pair might be preparing to rise again soon. This could be further proven by the United States’ gross domestic product recovery before the presidential elections in November, which props up more opportunities for new stimulus aid for the rest of the year.

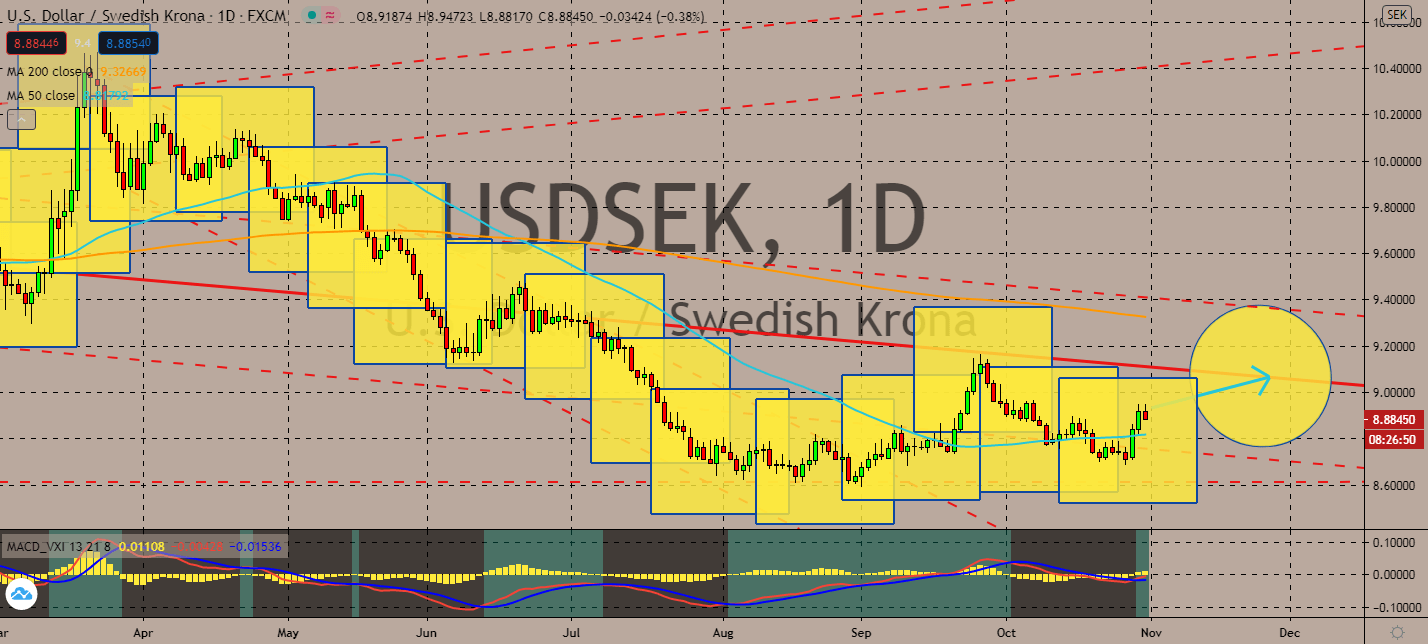

USDSEK

The Swedish government has heavily relied on its Public Health Agency, which had helped it make decisions on how it managed to continue its economy without implementing a full lockdown. Although its economy had done significantly worse than Finland, it had still been better than the UK and most countries in southern Europe and the US. However, economists claim that Sweden will soon face tradeoffs for the lives it had lost and endangered through its lax measures. Meanwhile, the US economy just experienced its largest jump in gross domestic product in history. The 33 percent annual growth is projected to be a safer bet against the Swedish krone in the near-term as the largest economy in the world prepares for its presidential elections next week. Economists had forecasted a 31 percent expansion in the months ending September 30, which could ignite a small bump up for the US dollar against the suffering krone.

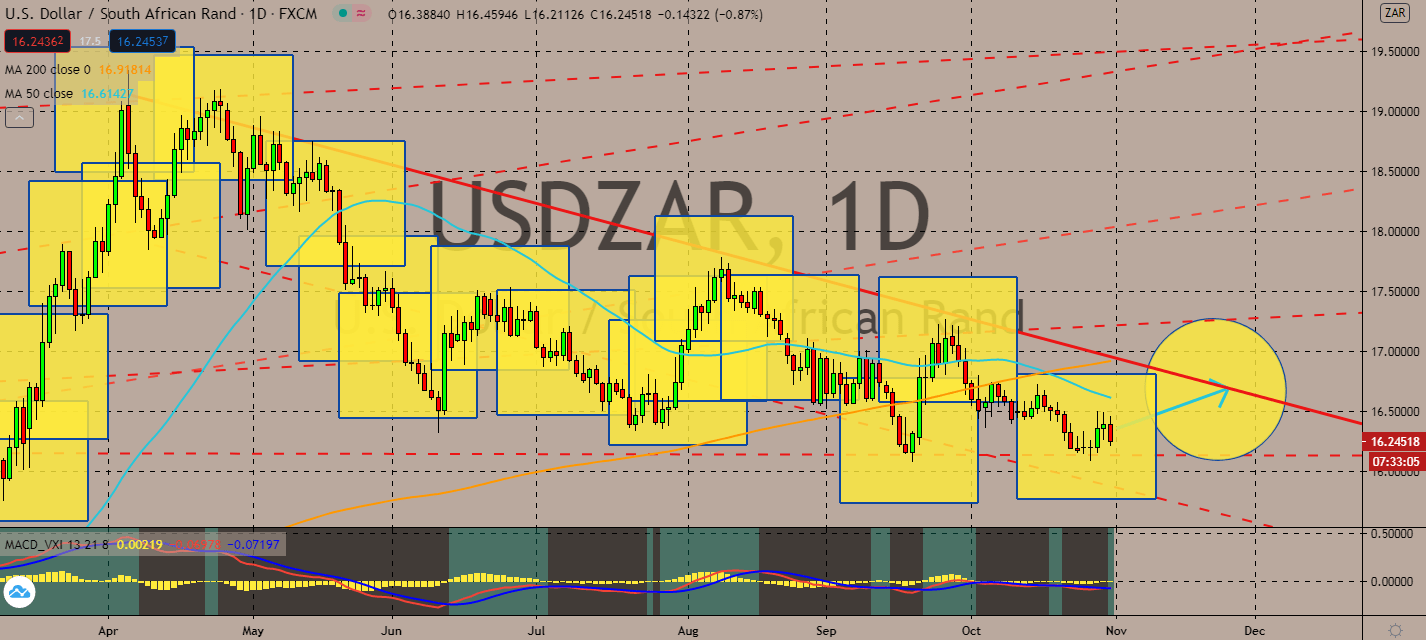

USDZAR

South Africa is using debt as a scapegoat, and it’s taking a toll on its economic outlook. According to the tax team at Mazars in South Africa, debt is spiraling out of control, now that it’s expected to breach 80% territory in the year. The crisis had long been rendering since it began at a reasonable 30% in 2010. Tax managers claim that the whole country is sinking into a debt trap, which could result in an irrevocable economic decline for the country, even in the long term. Although the pair’s 50-day moving average declined lower than its 200-day moving average, the pair is likely to go up soon out of fear of a new coronavirus wave taking over the rest of the world. After all, the US presidential election is drawing near. After the said elections, any movement made by the government would most likely ignite a need for greenback alternatives, especially if it initiates another massive stimulus package as they promised.

COMMENTS