Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

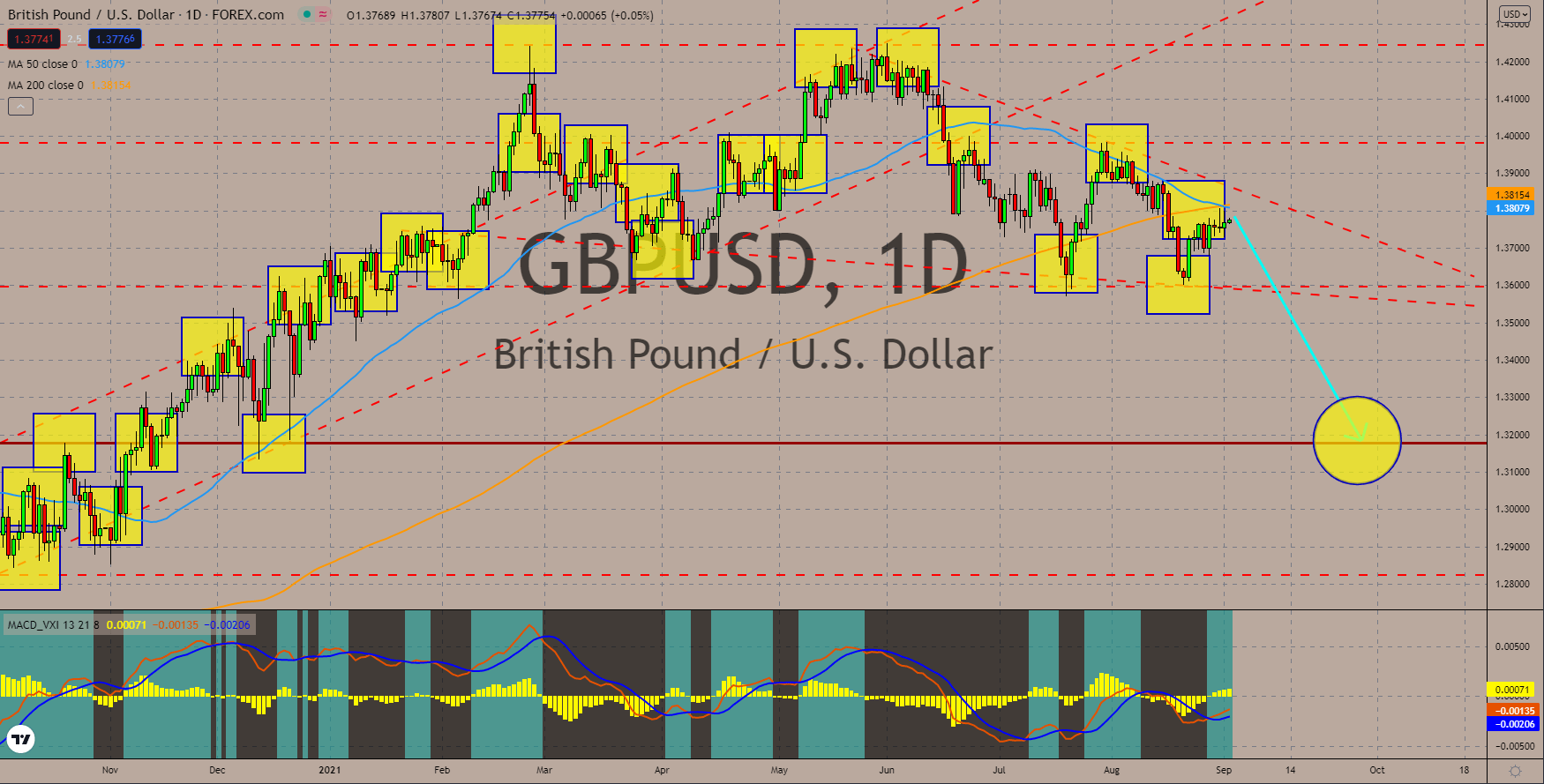

GBPUSD

The British Manufacturing PMI inched lower at 60.3 points compared to July’s 60.4 points result. Nevertheless, the reported figure defied expectations of 60.1 points for August. The Nationwide HPI published on September 01 also advanced 11.0% YoY. Analysts anticipate the August result to slow down to 6.8%. The report jumped 2.1% on a monthly basis, up from a -0.6% decline prior. However, the tighter lending activity will weigh down on the pound. The latest BOE Consumer Credit report showed a decline of -0.042 billion, which is in contrast to the expected increase of 0.441 billion. Mortgage lending and approvals also fell with -1.37 billion and 75,150 approved loans. The net lending per Britons shrinks -1.4 billion. The 50-bar and 200-bar moving averages open the month of September with a “bearish crossover.” This signals a further decline in the pair. Also, the MACD indicator continues to trade below zero, suggesting a downtrend movement.

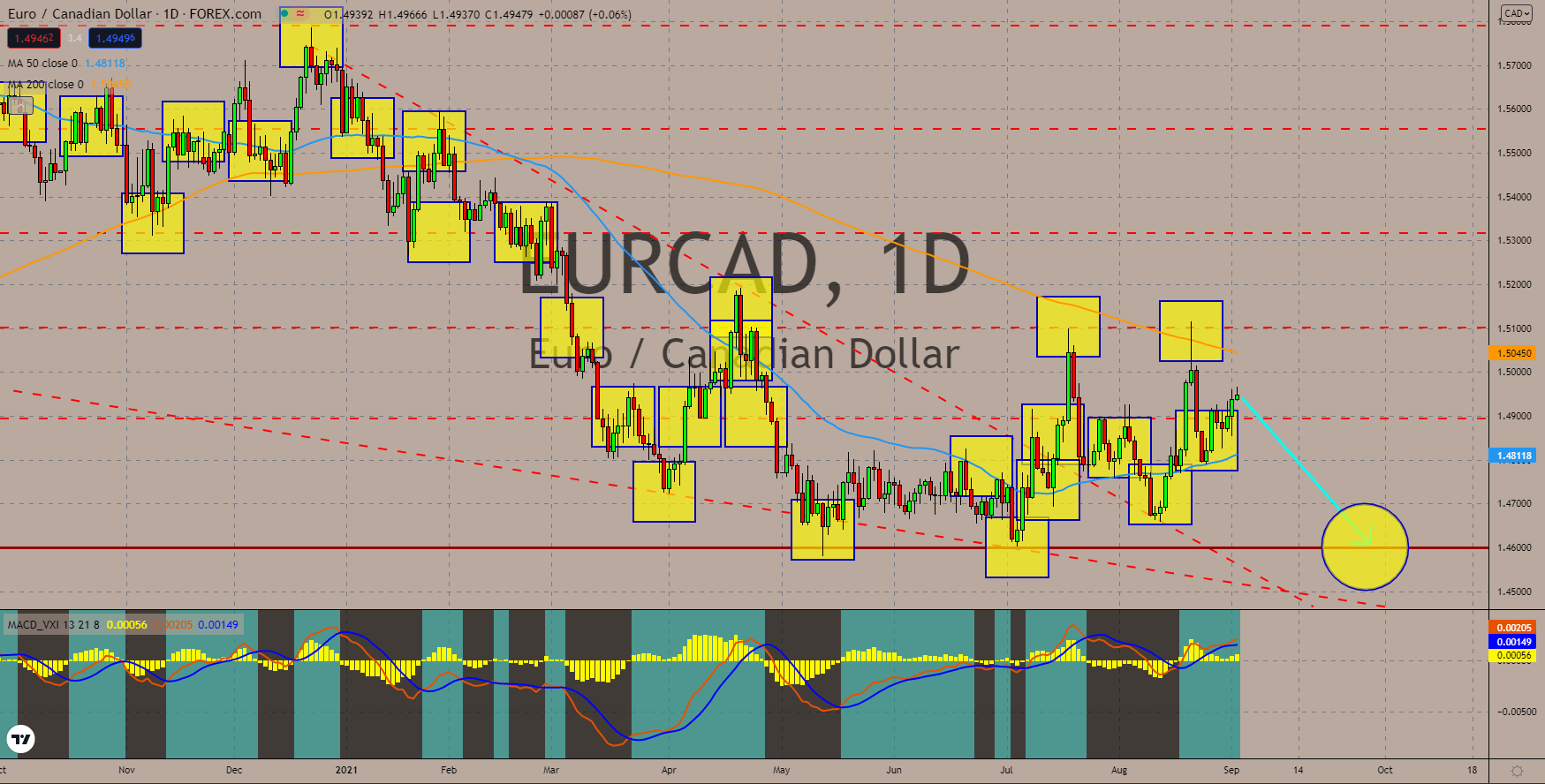

EURCAD

Canada’s second-quarter GDP dropped -0.3% against the first-quarter result. This is as the country extended its border restrictions with the United States. Prime Minister Justin Trudeau approved a cross border for fully vaccinated Americans starting September 07. Year on year, the annualized QoQ data also contracted with -1.1%. While the past performances disappoint investors, the 0.7% uptick in June’s GDP increases investor’s optimism for the upcoming results. In addition, Canada’s Manufacturing PMI jumped 1.00-point to 57.2 points. On the other hand, the Eurozone, along with Germany and France, posted a decline for the same report. The EU recorded 61.4 points, down by 1.4 points from July. Europe’s economic powerhouses, Germany and France, also fell with August results of 62.6 points and 57.5 points. On the chart, prices failed to move past the 200-moving average of around 1.50712. EURCAD will extend its fall towards a 2-month low at 1.46000.

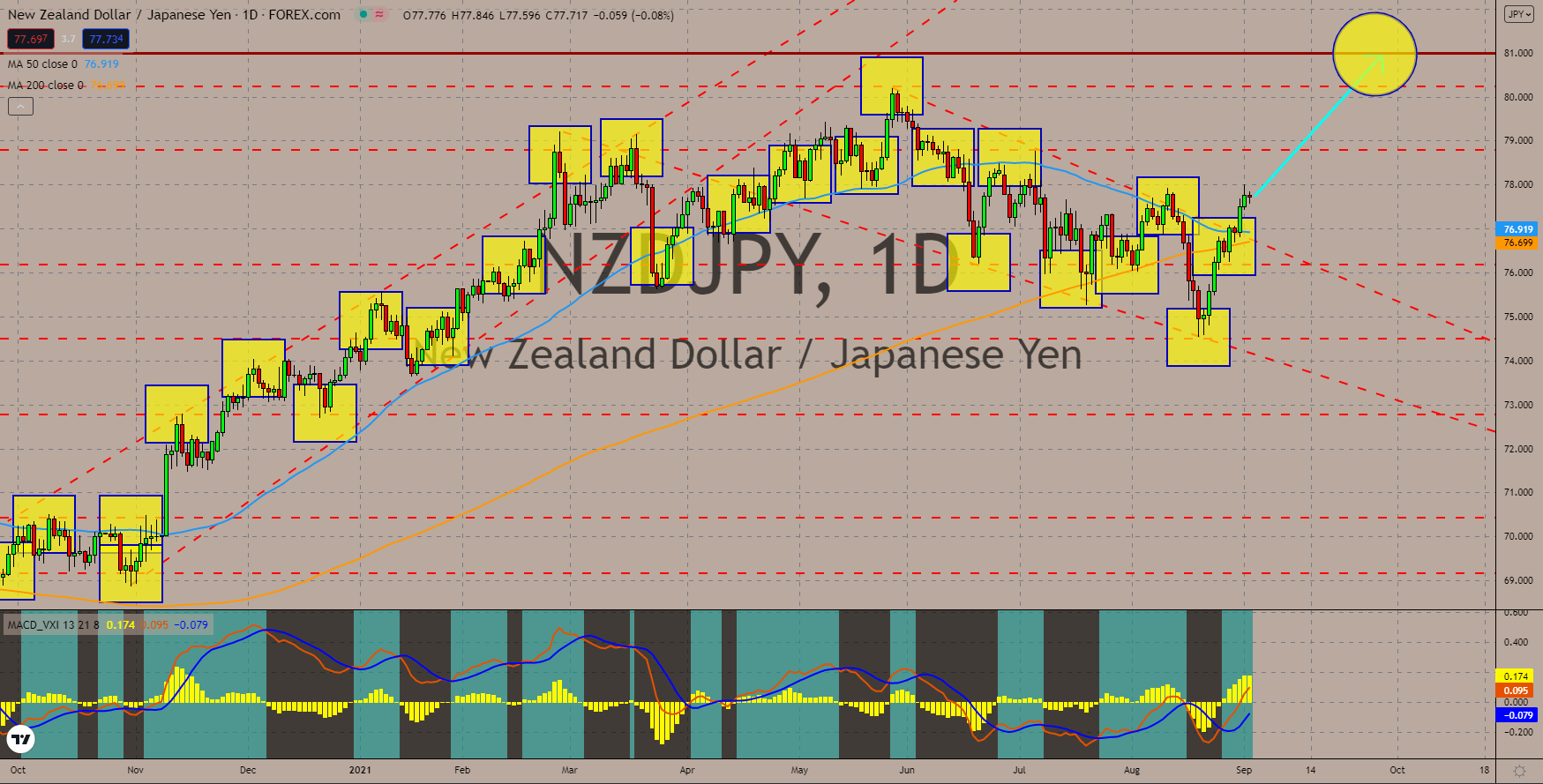

NZDJPY

Analysts see weaker demand for the Japanese yen in sessions. Foreign investments in local stocks jumped by 25.3 billion in the last week of August. The published weekly result is a recovery from a revised 550.2 billion in the prior week. Meanwhile, the smart money in bonds fell in the week. The -545.5 billion is the steepest decline in two weeks, extending last week’s -182.5 billion record. The upbeat capital spending in Q2 2021 and increase in August’s Manufacturing PMI set the bullish movement for stocks. The results are a 5.3% increment and 0.3 points addition, respectively. As for New Zealand, the central bank reaffirmed its hawkish tone for the interest rate. The Reserve Bank of New Zealand postponed its rate hike last week. This is as Prime Minister Jacinda Ardern put the country under lockdown. The 50 and 200 moving averages at 76.919 and 76.699 will fail to crossover. Meanwhile, MACD will continue to move to the positive this week.

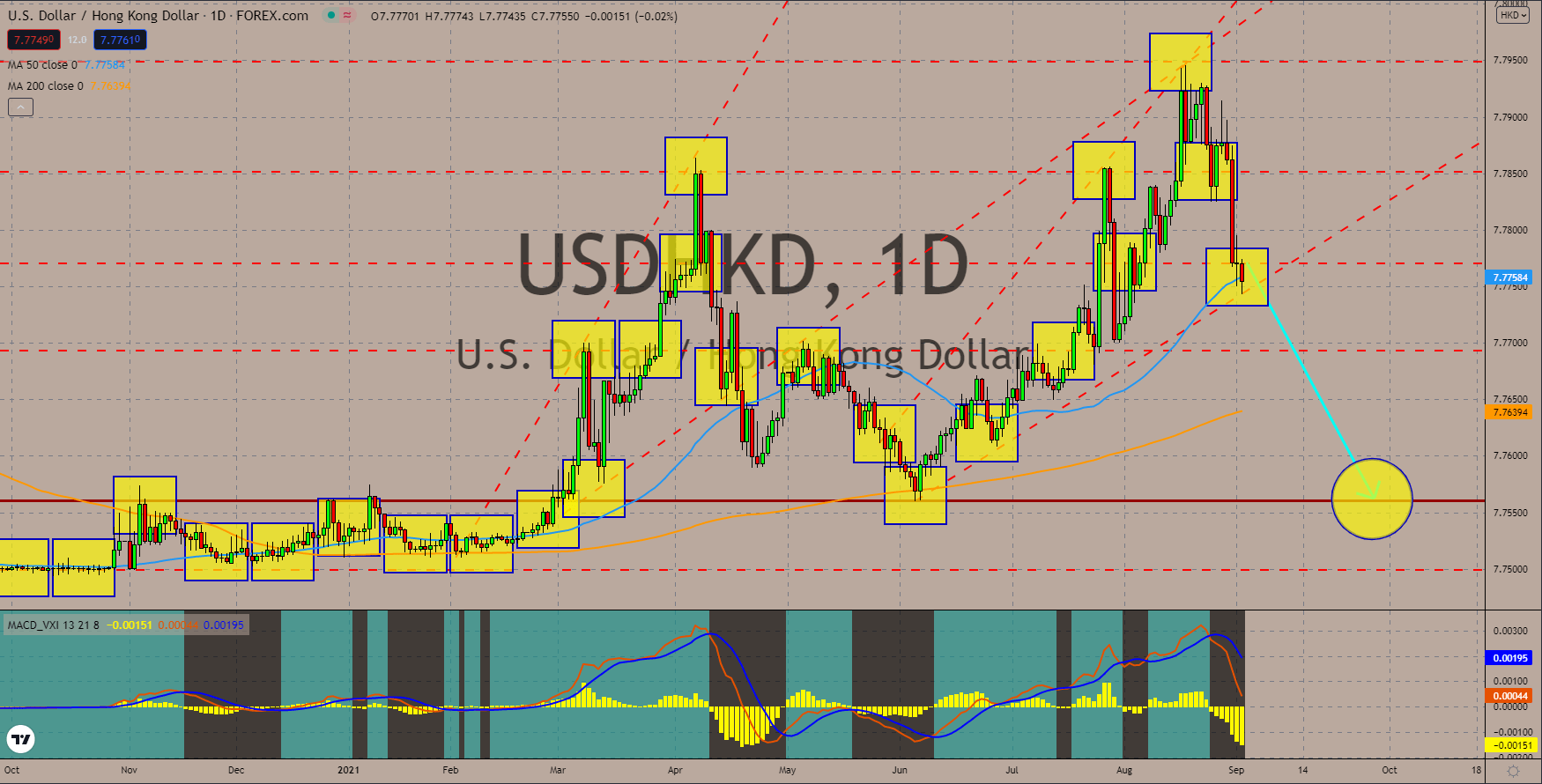

USDHKD

The US dollar will continue to underperform against its Hong Kong counterpart this week. The bearish outlook for the greenback is due to two reasons. First, crude oil scarcity limits economic activities. New York and New Jersey joined Louisiana and Mississippi in implementing a state of emergency. The Gulf Coast states are crucial for America’s energy security. As a result, the results from the American Petroleum Institute and the Energy Information Administration showed deficits of -4.045 million and -7.169 million barrels per day. The second reason is the weak ADP figure. The Nonfarm Employment Change tallied by the ADP showed 374,000 jobs addition, which is two times lower than the 613,000 estimates. On September 03, the US will release the monthly NFP. Analysts are pessimistic following the ADP result. Meanwhile, the initial jobless claims are anticipated to add fewer claimants of 345,000. The pair will fall below the 50-day MA at 7.77584.

COMMENTS