Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

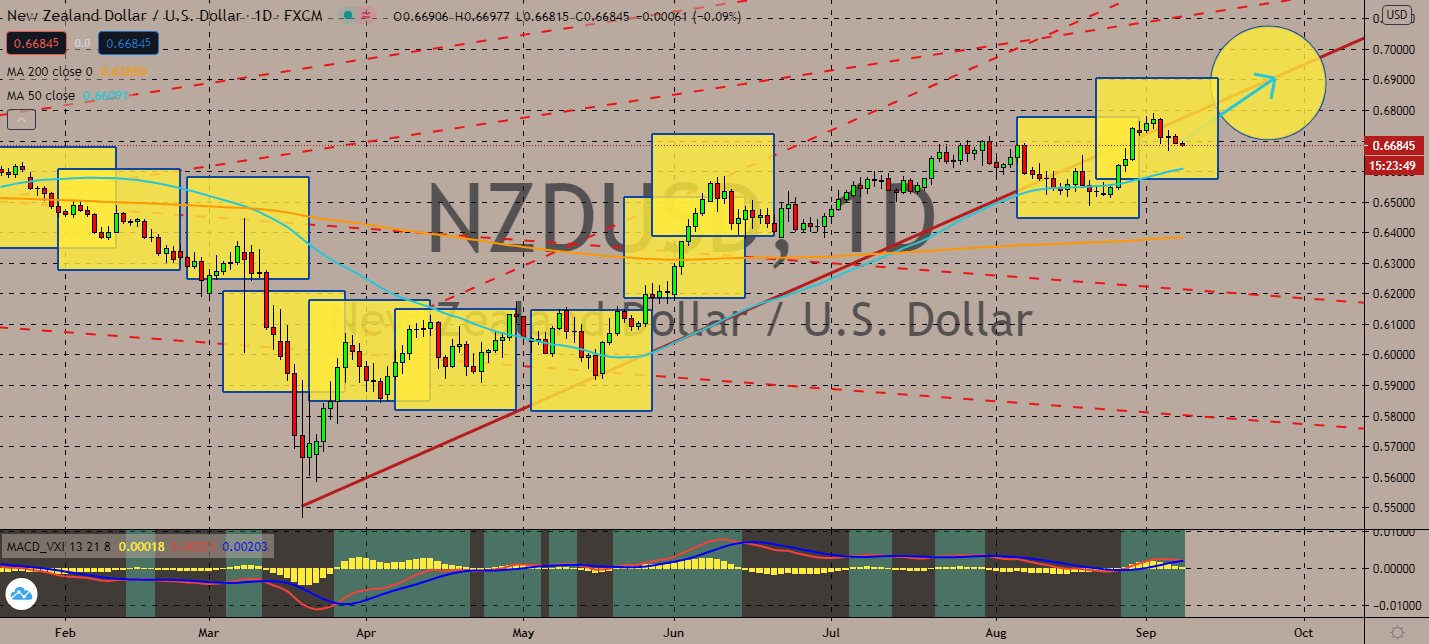

NZDUSD

The national US election is approaching, and its current president is bringing back his 2016 campaign with a prospect of permanently dropping the US’ trade relationship between the two countries before November. The US Chamber of Commerce warned against more tariffs against China because it could trigger another wave of suffering American businesses and consumers. The news decreased appeal for the greenback as bullish traders dominate the AUDUSD pair with an increase for its 50-day moving average, which was already climbing above its 200-day moving average. Investors are also taking advantage of the recent figure in Australia that claimed businesses are more confident in growing revenues within the month, coming in at -8 in August contrary to July -14. Although the confidence level is still in negative territory, the news was much better than the market’s forecast of a decline to -22.

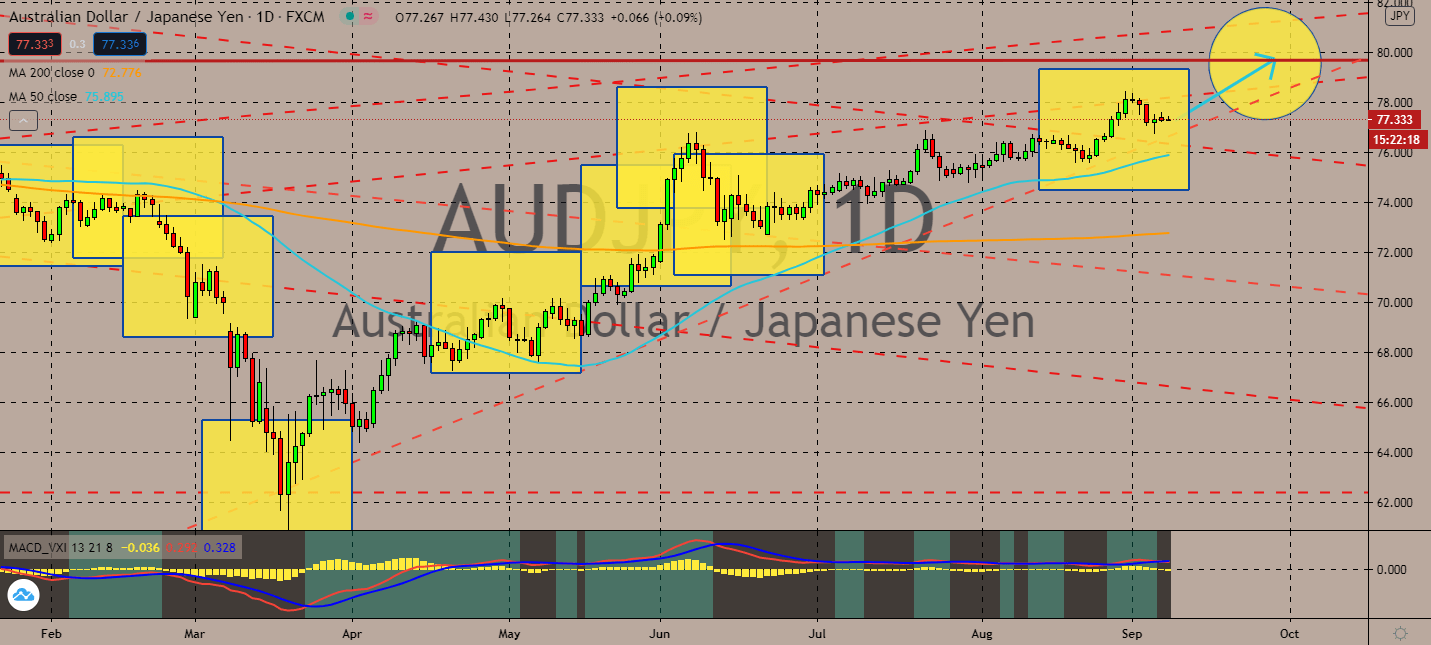

AUDJPY

Japan is still on questionable ground after the official resignation of Shinzo Abe as its prime minister. Despite his claim that he retired over health concerns, investors were worried about its timing – it turns out that its economy fell by 28.1% during the second quarter of this year, and his Abenomics initiative had fallen short to help the economy float through the pandemic. It looks like the Japanese yen’s track will remain bearish until the tables could turn as soon as September 14, when a new prime minister will be elected to take over the legacy Abe had left behind. The AUDJPY’s 50-day moving average is still climbing above its 200-day moving average equivalent, a sign that the bulls have no plans to bring the currency pair back to the bearish market. Australia’s increasing business confidence is also assisting its lift alongside its overall strength, although it’s questionable due to a possible stock market decrease in the region brought by US-China conflicts.

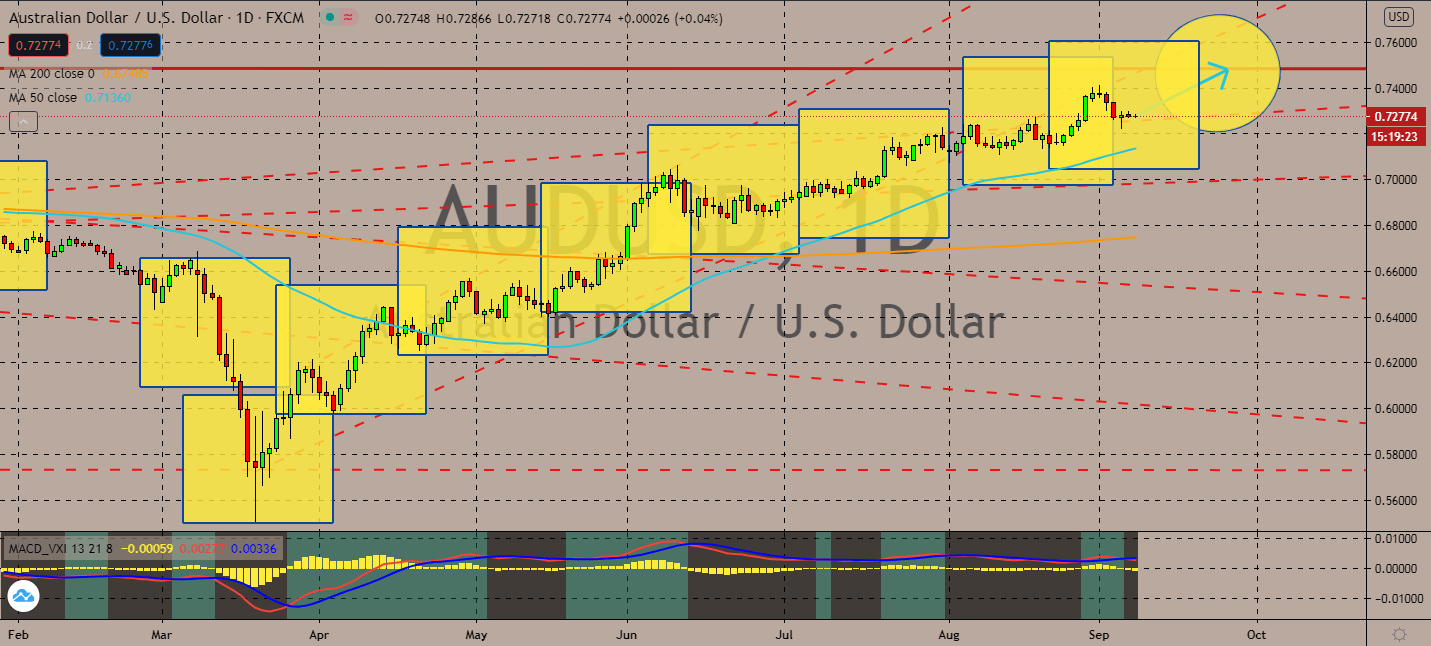

AUDUSD

Down under, it looks like China is still propping Australia’s currency up. China is projected to recover quicker than most as its export figures beat market expectations in August, which lifted surrounding economies such as Australia. China’s exports jumped by 9.5%, the highest increase year-to-date and above the 7.5% expected prior. The report alarmed the Trump administration, and the president brought up the prospect of eliminating its trade relationship with China once again on labor day, no less. But his claim quickly backfired, because economists believe that the move could damage American businesses and consumers’ ability to purchase. The claim locked in another increase for the pair’s 50-day moving average, which was already rising above its 200-day moving average since the beginning of July. Rising business sentiment in Australia and falling payroll figures in the US are expected to increase the Aussie price.

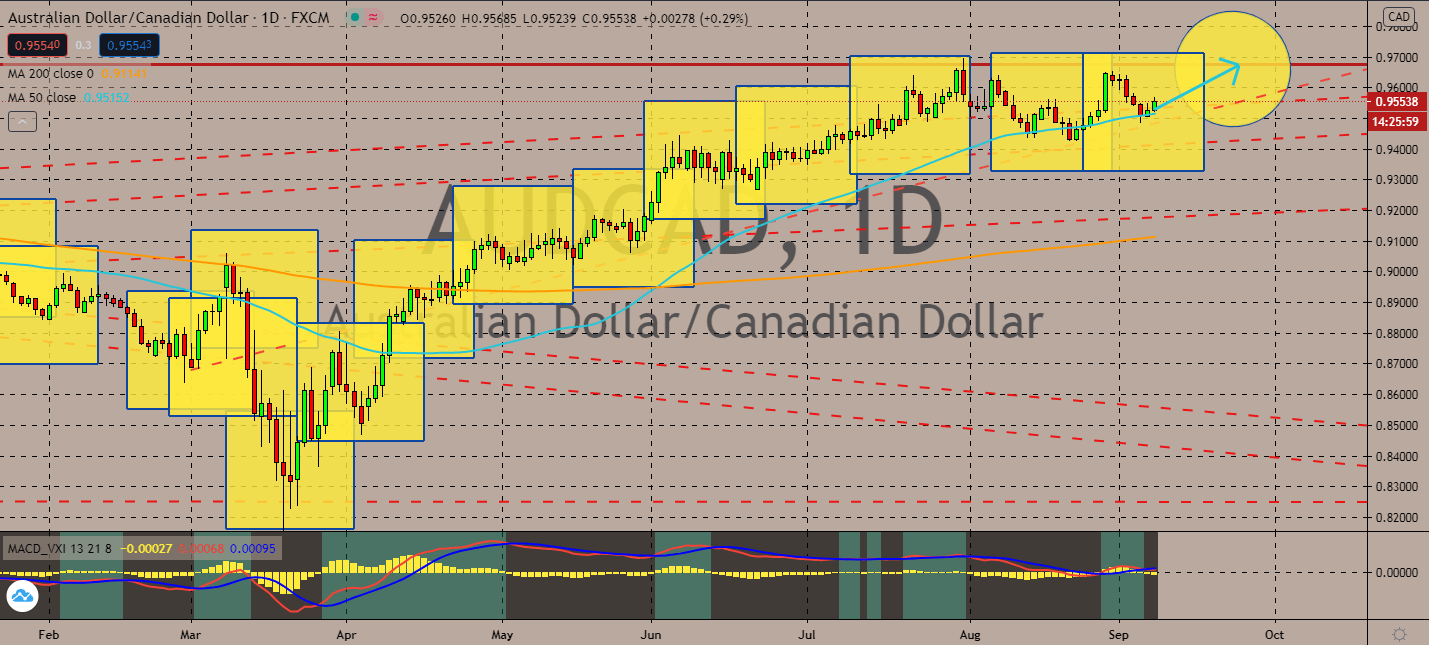

AUDCAD

Economists have always kept a close eye on Canada’s immigration figures as a major basis for its economic growth. Obviously, the figure would suffer from travel restrictions amid a pandemic. In fact, Canada saw 85% fewer new permanent residents compared to the same month in 2019. Now, the current rate sits at 170,000 fewer permanent residents in 2020 than originally planned. Immigration figures have been the country’s biggest advantage, but now that the figure is stuttering, markets are getting more hesitant to trade for its currency. On the other hand, Australia’s business sector is closely tied to its economy. Although business confidence in Australia is still in negative territory for August, it had climbed to -8 from -14 seen in July. The pair’s 50-day MA is projected to move further upwards from its stagnant 200-day MA.

COMMENTS