Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

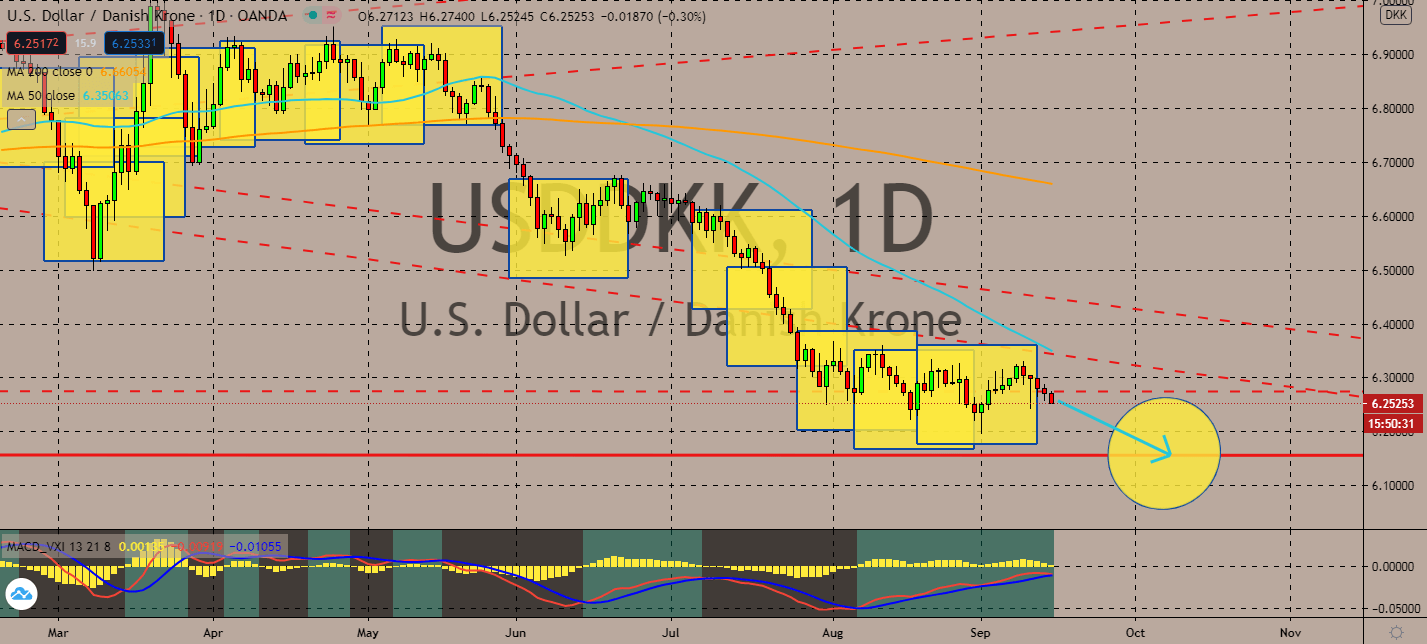

USDDKK

The Federal Reserve is preparing for its final monetary policy meeting before the next election. The important week will tackle how the American economy is faring in the pandemic despite President Donald Trump’s intention to prioritize the stock market. Fed Chair Jerome Powell confirmed the Bank’s shift to increasing inflation to its 2% target by the end of the year, contrary to the previous figures seen in negative territories. However, previous pessimistic reports claim that the Fed is less likely to provide hope for its currency. This could push the greenback lower than most of its currency counterparts, which includes the Danish krone. In fact, the pair’s 50-day moving average is still far below its 200-day moving average, showing that the bears are determined to keep the pair’s path down that road that it could continue to fall even in the medium term. This could change only if the Fed reports good news come Wednesday or Thursday.

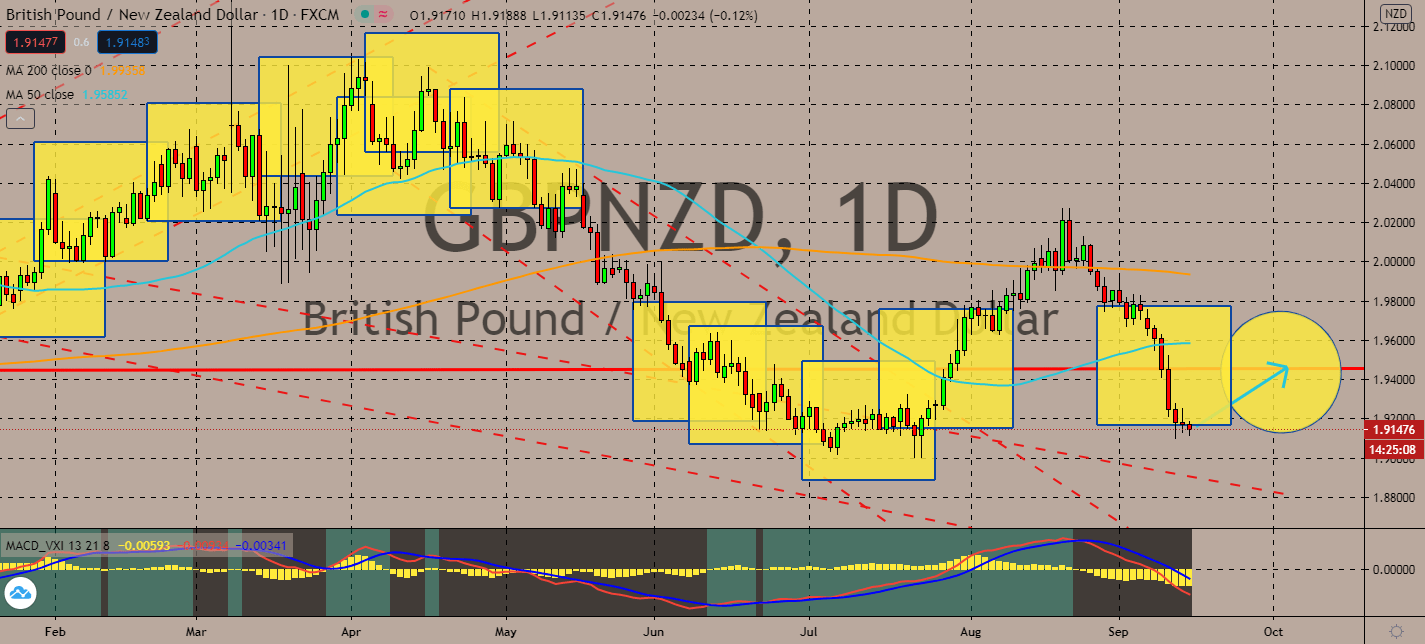

GBPNZD

Economic analysts believe that New Zealand will officially enter recession when it releases its second quarter economic contraction later this week. Forecasts claim that it could shrink as much as 12.8% in a quarterly manner for the three months ending June, which followed a modest 1.6% decline seen in the previous quarter. Moreover, GDP could decline by as much as 13.3% annually. Its economy used to be the only country to stay free of Covid-19 for more than 100 days, but it only managed to do so with a strict lockdown in April. Prime Minister Jacinda Arden is looking to make the same strategy, but it looks like it won’t be as effective now as it was before. Businesses are forced to shut down once again, the GBPNZD’s 50-day moving average went down from its 200-day moving average. Notably, investors are seeking the British pounds over news that it preordered Covid-19 vaccines enough for five doses per citizen.

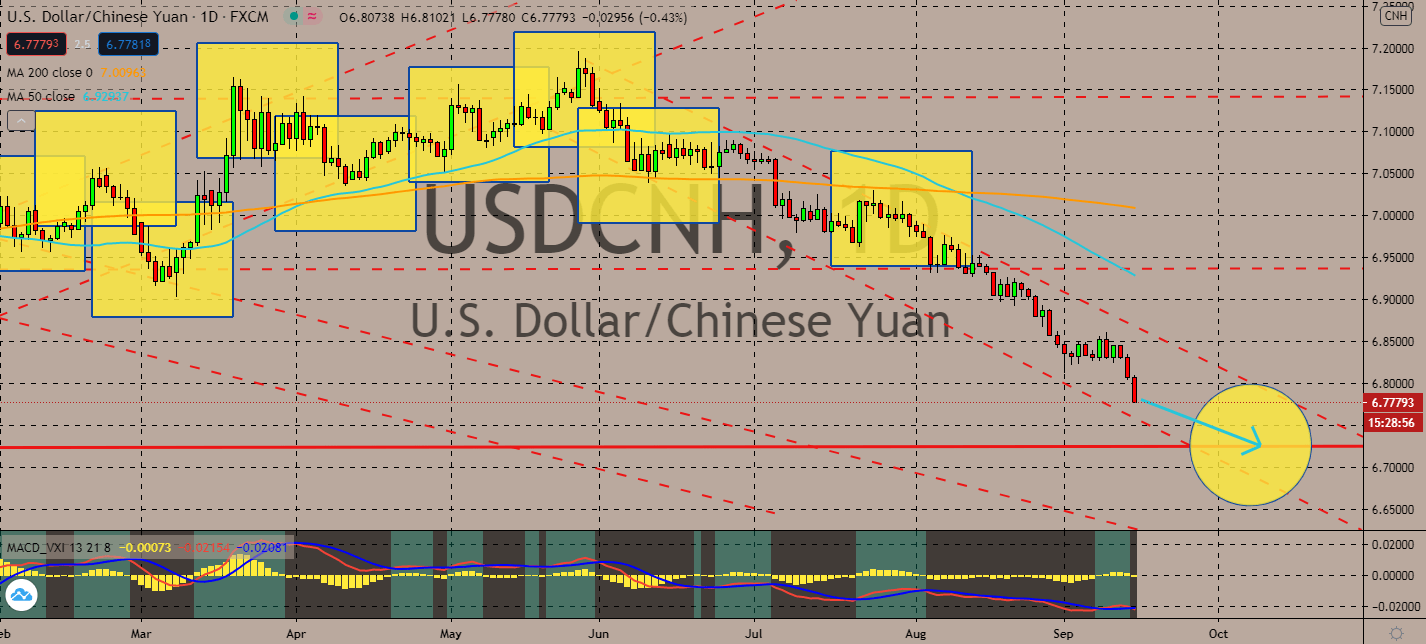

USDCNH

According to the new data released by the National Bureau of Statistics in China, all industry, retail, and investment showed improvements last month as part of the country’s economic recovery from the coronavirus. Retail sales grew by an annual 0.5%, which pleasantly surprised its investors. It was also way up from 1.1% seen in July and is the first increase the figure had seen year-to-date. Investors have been siding with its currency for the past months against the greenback, and it looks like the improving figure will continue this trend. The pair’s 50-day moving average declined below its 200-day moving average counterpart, which is a determiner that the market isn’t as optimistic about the greenback’s safety as much as it used to. The Federal Reserve is also expected to report how the United States is recovering from the economic effects of the coronavirus, which is undoubtedly not as well as China’s.

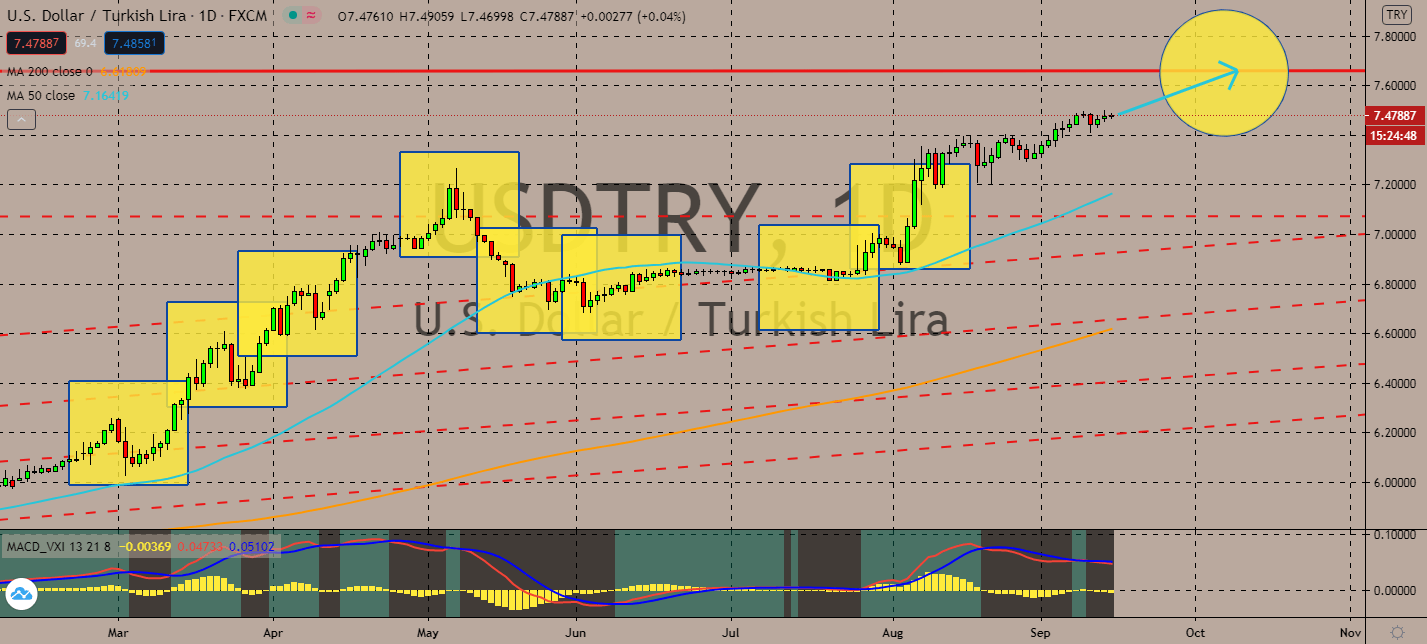

USDTRY

Moody’s Analytics downgraded the lira in recent trading from B2 to B1, pushing the currency to record lows. Its path is projected to continue against key currencies like the greenback after the firm warned that its country would experience a deeper economic contraction this year. The lira’s losses year-to-date is nearly 21%, and according to the pair’s 50-day moving average, it’s less likely that it will end soon, given that even its increasing 200-day moving average can’t catch up to its counterpart’s increase. Turkey’s sovereign rating went deeper into what Moody’s called “junk territory,” even while its fiscal buffers failed to keep its economy afloat from the coronavirus decline in the country. Investors are projected to keep the lira low even as the US economy waits for an update from the Federal Reserve later this week. Turkey’s external vulnerabilities will also make it one of the riskiest currencies in the industry.

COMMENTS