Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

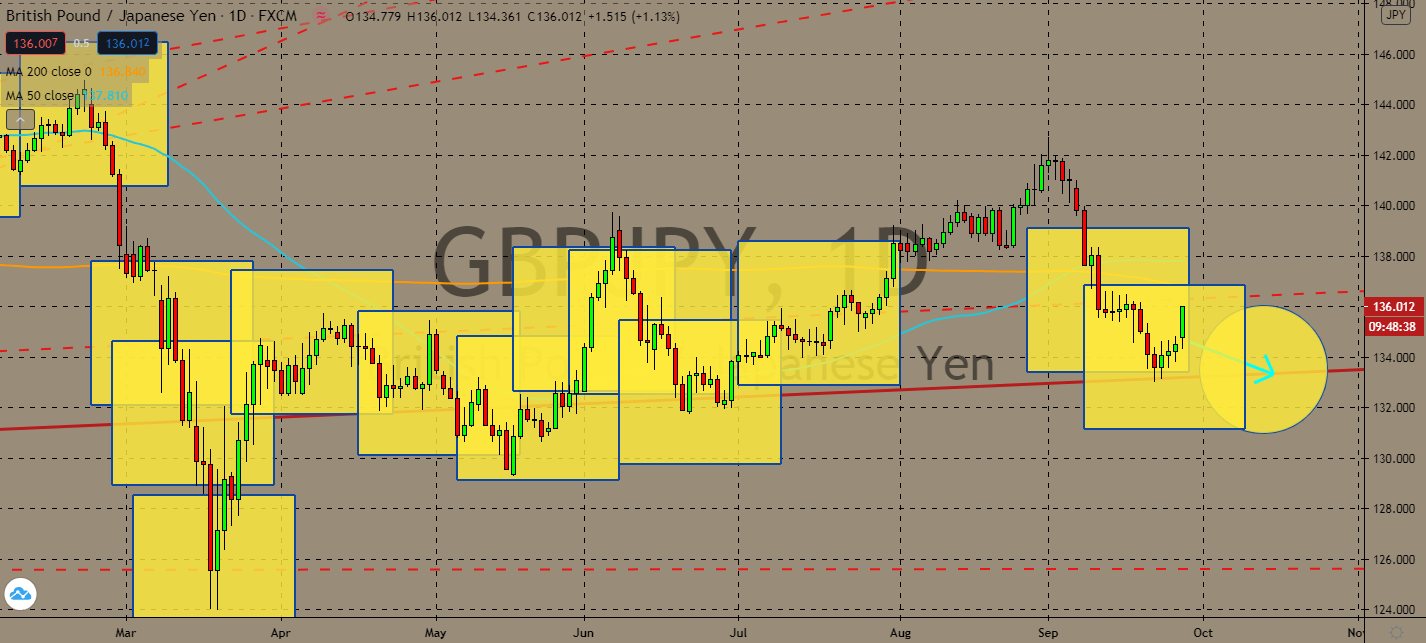

GBPJPY

Only days before its second-quarter gross domestic product announcement, economists warn that the UK economy has seen very little momentum since it locked down from an unforeseen surge in coronavirus cases a few weeks ago. After July showed an 11.7% shortfall, an improvement against a 25.6% decline seen in April, analysts believe that its decline could increase once again at 4.5% in August and 2.0% in September. The quarter would then be 5% below the same period from a year ago. The Japanese yen’s safe haven status is expected to boost its price with risk aversion as the pair’s 50-day moving average begins to gain momentum against its 200-day moving average, which has been trading below it since the indicators crossed in early September. Yoshihide Suga’s planned continuation for Abenomics is projected to benefit the Japanese yen, alongside the country’s pressing security-centered relationship with the United States.

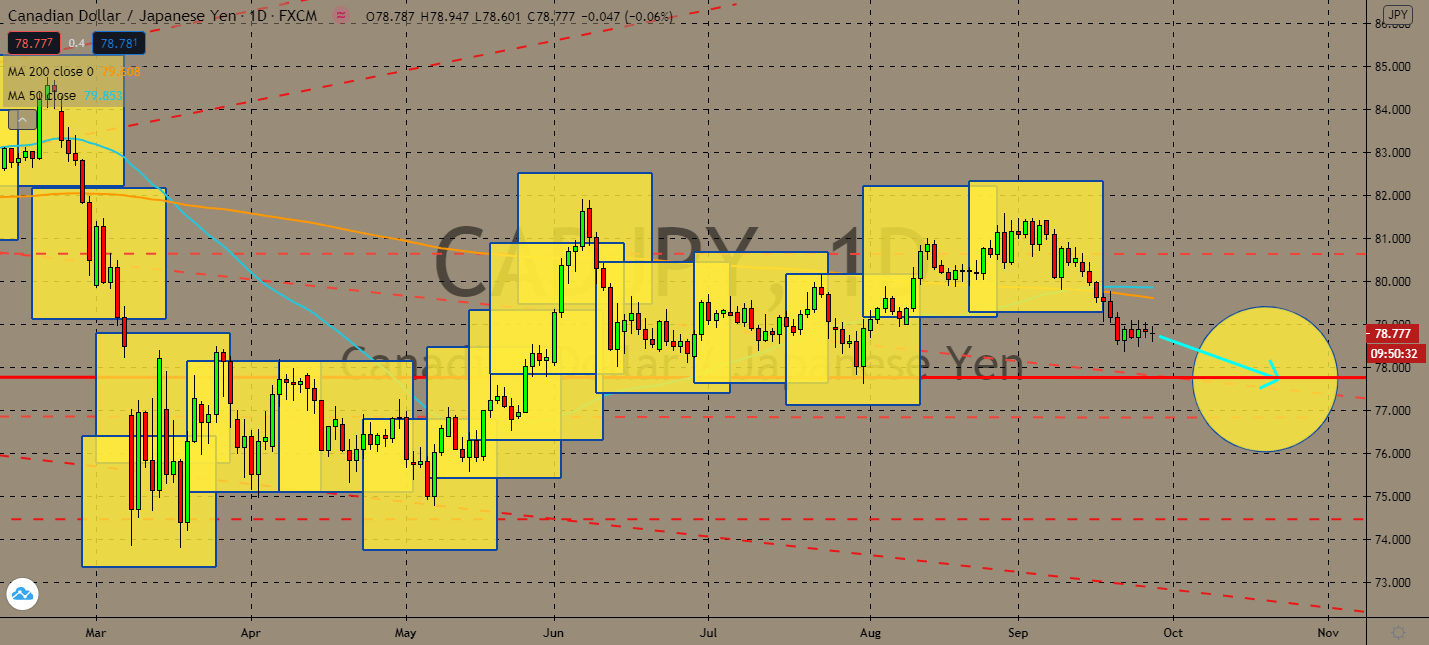

CADJPY

Canada is preparing for its second wave of coronavirus infections. The country suddenly reported more than 1,600 new cases in Quebec alone, which was the country’s highest rate of new daily coronavirus infections since May 8. The increasing worries about its economy, and a possible nationwide lockdown, will take a toll on its risk-oriented currency with falling prices for fossil fuels like oil. The pair’s 50-day moving average just intersected its 200-day moving average moving upwards, but it looks like the bears are fighting to keep the pair on its bearish track even after weeks of falling against the Japanese yen. Meanwhile, Japan’s currency is benefitting over China’s announcement that its economy accelerated in August, with all major activity indicators beating market projections. Prime Minister Yoshihide Suga’s continuation for his predecessor’s Abenomics is also bringing optimism in investors in the near-term.

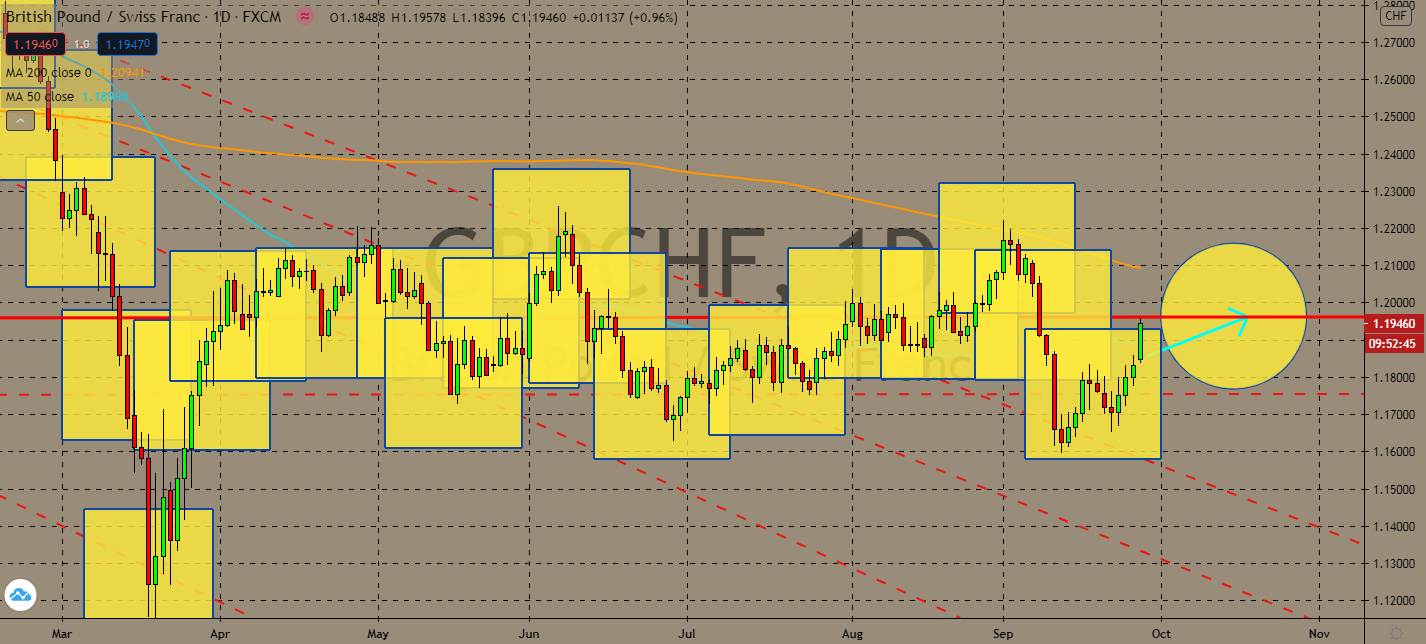

GBPCHF

The euro’s strength relative to the dollar is giving itself a safe haven advantage against most major currencies in the market. Even as several of its participating economies are going through lockdowns across the bloc, its strength is still projected to boost as investors await the European Central Bank’s leader Christine Lagarde’s speech later today. Its possibly last-minute trade deal with the United Kingdom could also ease the market’s worries about both economies’ futures. The pair’s 50-day moving average still remains below its 200-day moving average, but signs say the pair is about to test its current resistance level. Should the euro increase in the upcoming sessions, the pair could be looking into going back to optimistic levels last seen in early June. Notably, it will also remain volatile as Australia’s loosened lending standard and overall uncertainty received mixed reactions in the major currency market.

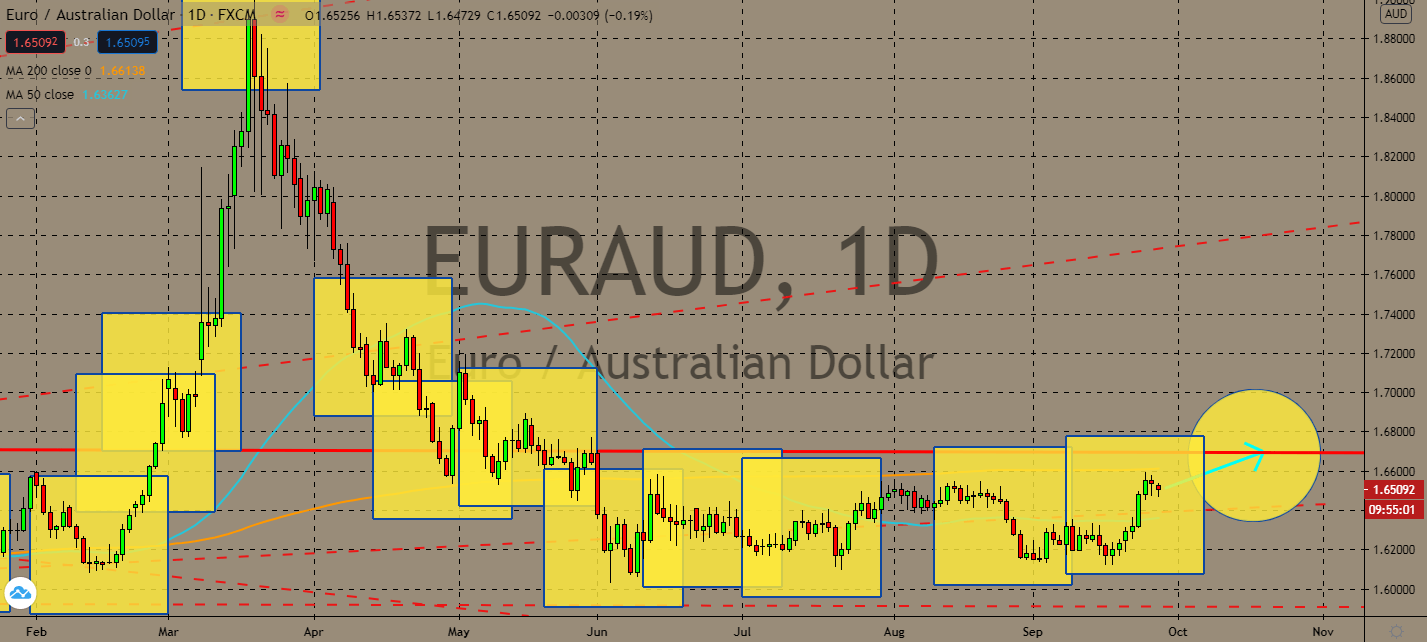

EURAUD

The euro’s strength relative to the dollar is giving itself a safe haven advantage against most major currencies in the market. Even as several of its participating economies are going through lockdowns across the bloc, its strength is still projected to boost as investors await the European Central Bank’s leader Christine Lagarde’s speech later today. Its possibly last-minute trade deal with the United Kingdom could also ease the market’s worries about the futures of both economies. The pair’s 50-day moving average still remains below its 200-day moving average, but signs say the pair is about to test its current resistance level. Should the euro increase in the upcoming sessions, the pair could be looking into going back to optimistic levels last seen in early June. Notably, it will also remain volatile as Australia’s loosened lending standard and overall uncertainty receives mixed reactions in the major currency market.

COMMENTS