Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

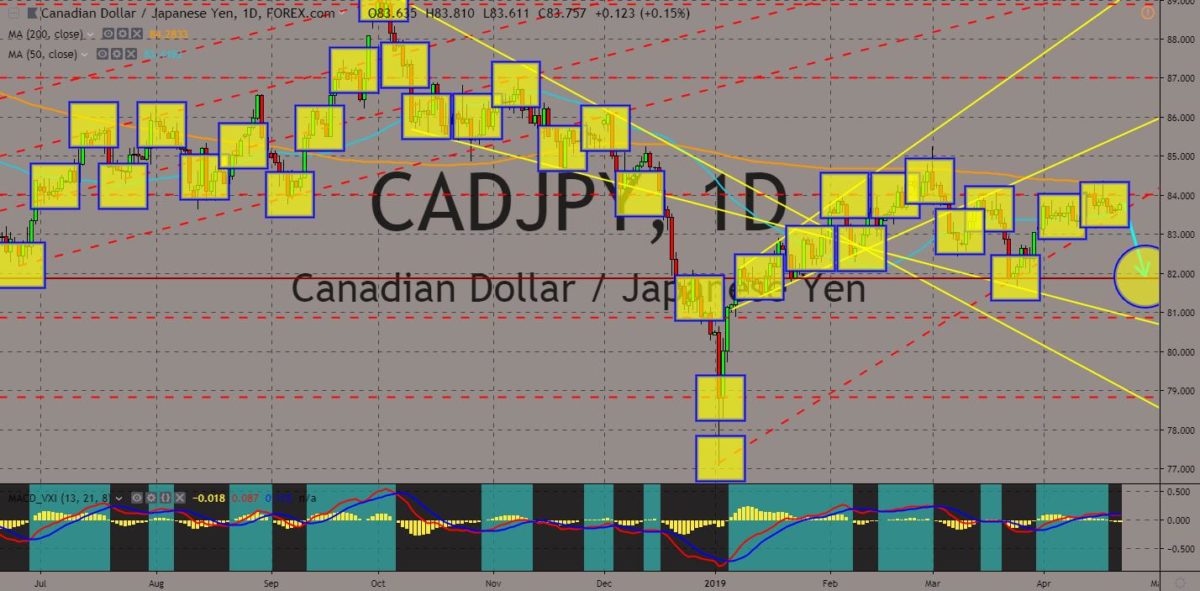

CADJPY

The pair will fail to break out of the “Ascending Triangle” formation following the possibility of crossover between MAs 50 and 200. Japanese Prime Minister Shinzo Abe was set to visit Europe, the United States, and Canada this weekend following Japan’s chairmanship of the Group of 20 Summit or G20. Its visit to North America was seen to benefit Canada whom it recently advised to shift its focus from China to its economy. In February, Japan ratified the EU-Japan Free Trade Deal which became the largest trading zone in the world, while Canada joined the Germano-Franco Alliance, together with Japan, on the German led “alliance of multilateralism”. The Germano-Franco Alliance holds the majority in the control of the European Union. Histogram and EMAs 13 and 21 will continue its fall.

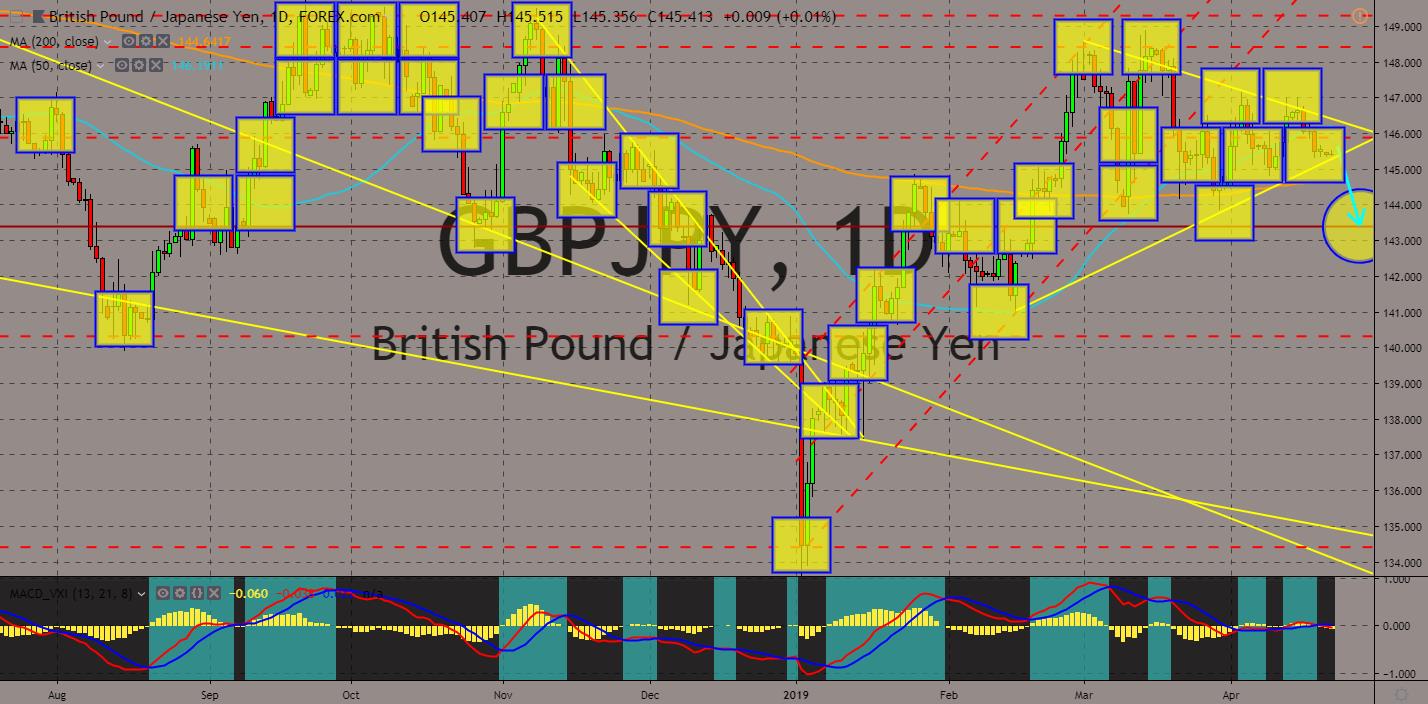

GBPJPY

The pair was expected to break down of the “Pendant Pattern”, sending the pair lower towards the pair’s nearest resistance line. Japan and the United Kingdom was still at odds after the UK said that it will never sign a post-Brexit trade agreement with Japan until the country officially leaves the European Union. On the other hand, Japan had ratified the EU-Japan Free Trade Deal with the European Union, while Australia signed a post-Brexit trade agreement with the United Kingdom. The EU-backed Japan and UK-backed Australia both headed the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Japan had also joined the German-led “alliance of multilateralism”, which aimed to prevent the destruction of the world order following US President Donald Trump’s withdrawal of America from the rest of the world. Histogram and EMAs 13 and 21 was expected to go lower in the following days.

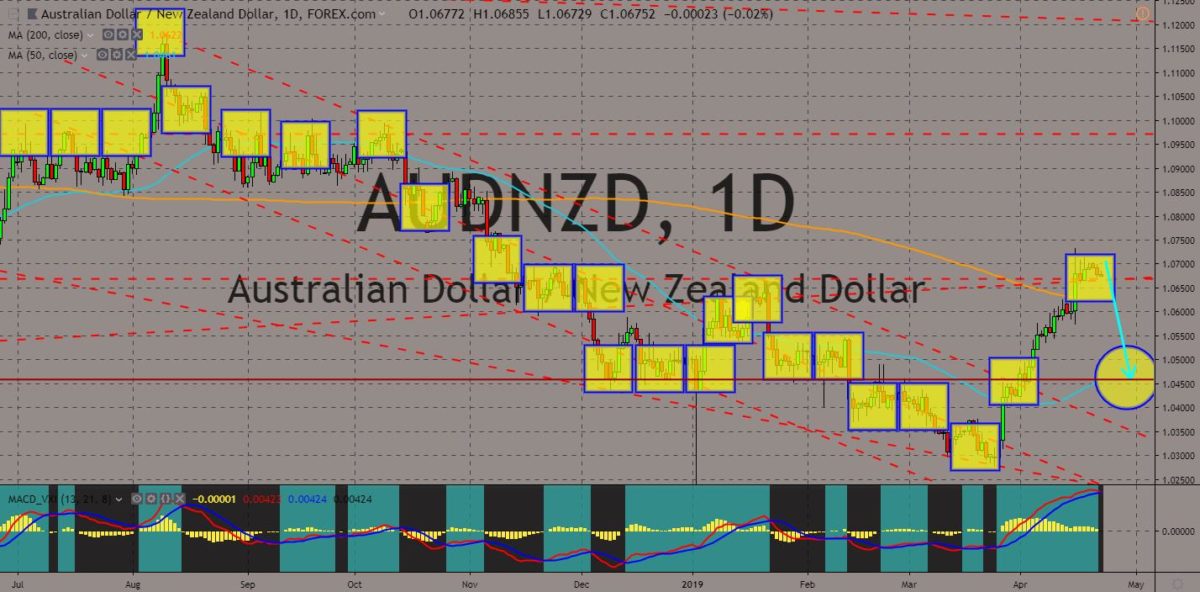

AUDNZD

The pair failed to sustain its strength after it broke out of a major resistance line, sending the pair back to its nearest support line. In the past few months, the relationship between Australia and New Zealand diverged with Australia remaining royal to the United States leadership, while New Zealand is taking a more neutral stance towards global issues. The rift between the two (2) countries further escalated after an Australian senator blamed New Zealand’s poor immigration policy, which resulted to the Christchurch mosque bombing. On the other hand, New Zealand Prime Minister Jacinda Ardern was captured hugging a victim’s family, which escalated online and was shown on the tallest building in the world as a way for the Muslim community in supporting the PM. Australia was also reported to be deporting Australian nationals with roots from New Zealand. Histogram and EMAs 13 and 31 will crossover in the following days.

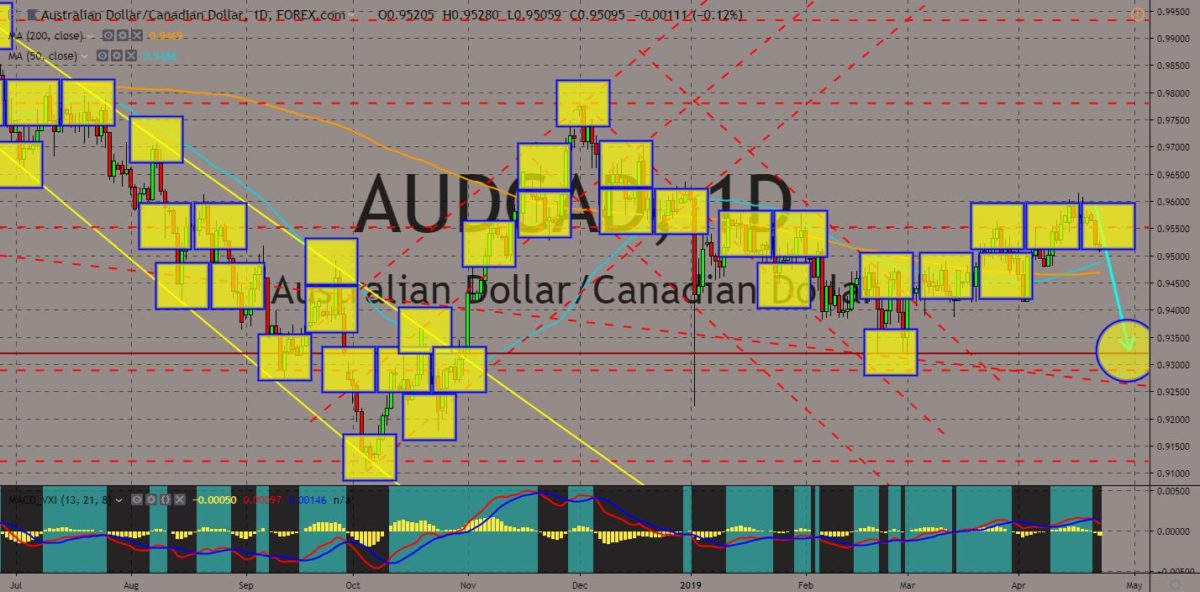

AUDCAD

The pair broke down from a major support line, which sends the pair lower to the nearest support line. With Australia entering a recession for the first time in three (3) decades, the European Union was in a better position to negotiate with Canada to kill any possibility for the United Kingdom on striking a post-Brexit trade agreement before the EU had ratified its free trade agreement with Canada. It was also reported that the grandson and granddaughter-in-law of Queen Elizabeth II, Duke and Duchess of Sussex Prince William and Meghan Markel, of the UK, might be offered the position of Governor-General of either Australia or New Zealand. The CANZUK (Canada-Australia-New Zealand-United Kingdom) and other former British colonies considered Queen Elizabeth as their Head of State. Having Canada to choose the European Union will offset this possibility. Histogram and EMAs 13 and 12 will go down.

COMMENTS