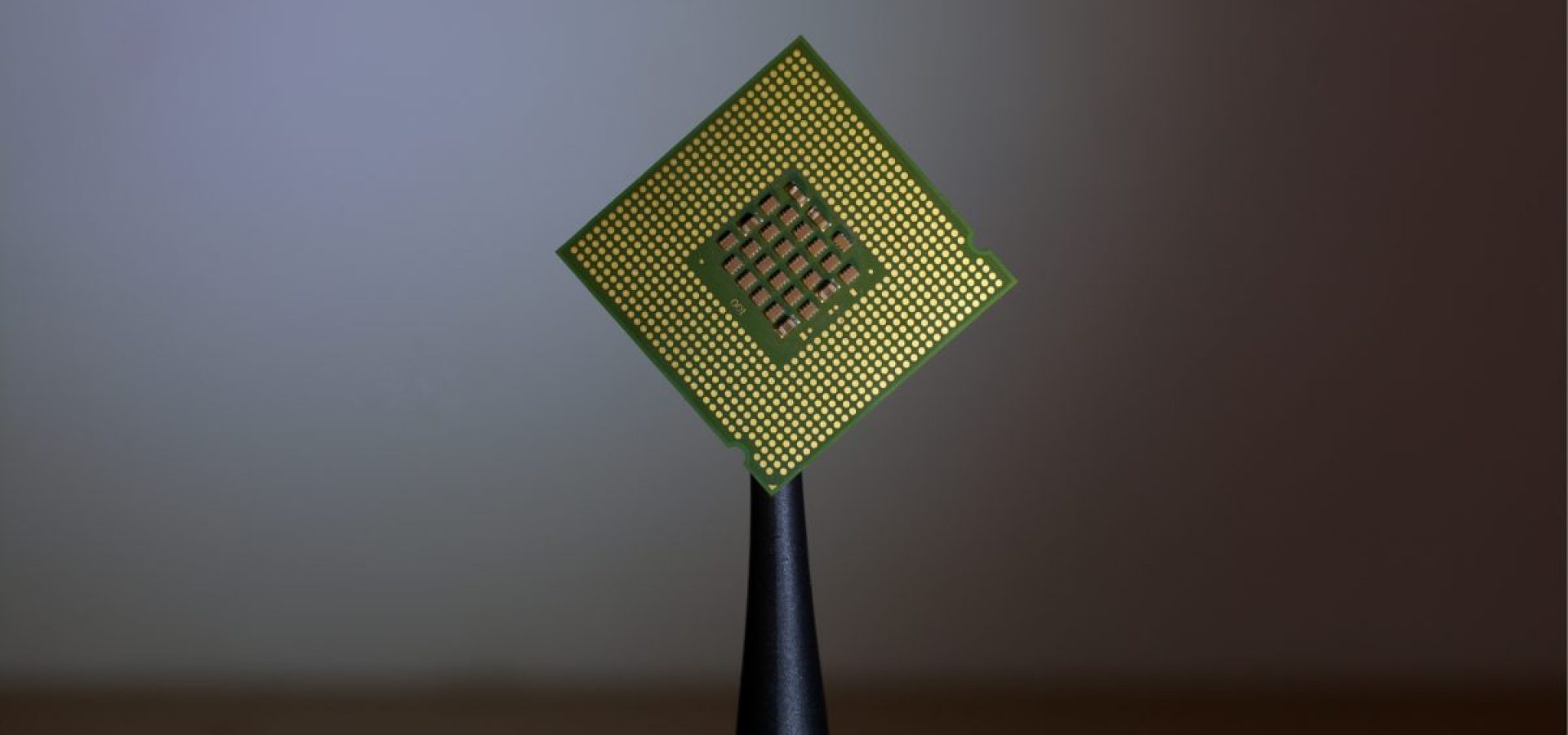

Europe is planning to lead the industry of chips.

The European Union aims to be a major player in the global semiconductor market. It has a clear strategy to become a top player globally. This is a big challenge for a region with a population of 500 million.

European Union lawmakers presented their ambitious plans to increase the production of semiconductors and become a global leader in the industry.

To do that, it will need help from Asia and the U.S. to invest heavily in the continent. Analysts say the EU lacks technology in critical areas like manufacturing.

On Tuesday, the European Commission launched the European Chips Act. It is a multi-billion euro attempt to secure its supply chains. It aims to prevent shortages of semiconductors and promote investment in the industry. This plan still requires permission from EU lawmakers to pass.

Chips are critical to our lives, from their role in everything from cars to smartphones to refrigerators. But the global chip crunch is causing production standstills and shortages of products, with ripple effects through industries from tech to manufacturing to food. The shortage results from a slowdown in the traditional electronics industry, specifically in producing conventional chips used in smartphones and computers, which a trade war with China has exacerbated. The situation has become so severe that the Semiconductor Industry Association (SIA), which represents the world’s largest chip makers, declared the industry in “a state of critical importance.”

Manufacturing challenge of chips

The EU Chips Act plans to put 44 billion euros of investment into the semiconductor industry. It will help the section become an “industrial leader” in the future.

Specifically, the EU aims to boost its market share of chip production to 25% by 2030, from 8% currently. It also plans to produce the “most sophisticated and energy-efficient semiconductors.

Unprofessional

Very unprofessional brokers. They do not meet schedules callbacks and did not meet commitments.

Did you find this review helpful? Yes No

Delayed withdrawals

Delayed withdrawals. They do not process withdrawals promptly. Even if I comply with all of the requirements, I still have great delays on withdrawals.

Did you find this review helpful? Yes No

Bad services

Bad broker services. They process deposit swiftly but they do not let anyone withdraw money.

Did you find this review helpful? Yes No

Slow withdrawals

The worst customer service among the brokers I have traded with. Withdrawal is also very slow.

Did you find this review helpful? Yes No

Poor services

Poor broker and customer service. I will not recommend this to anyone and I will not keep the services.

Did you find this review helpful? Yes No