| General Information |

|

|---|---|

| Broker Name: | GigaFinancing |

| Broker Type: | Forex & CFDs |

| Country: | US |

| Operating since year: | N/A |

| Regulation: | N/A |

| Address: | 212 Prospect Ave, Brooklyn, New York United States |

| Broker status: | Active |

| Customer Service |

|

| Phone: | N/A |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/5 |

| Trading |

|

| The Trading platforms: | Web |

| Trading platform Time zone: | N/A |

| Demo account: | No |

| Mobile trading: | No |

| Web-based trading: | Yes |

| Bonuses: | No |

| Other trading instruments: | Yes |

| Account |

|

| Minimum deposit: | $250 |

| Maximal leverage: | 1:500 |

| Spread: | Floating From 1 Pip |

| Scalping allowed: | Yes |

GIGAFINANCING REVIEW CONTENT

- General Information & First Impressions

- Fund and Account Security

- Account info at gigafinancing.com

- GigaFinancing’s Trading Platform

- Conclusion

- FAQ

GigaFinancing is a brokerage that has attracted a ton of attention from traders and the general web. It offers an intuitive, streamlined trading service on numerous assets at a low cost. As such, it’s widely available and able to satisfy traders no matter what their preferences are.

What our GigaFinancing review will try to figure out is whether those conditions and it as a broker suit you.

GigaFinancing is a CFDs broker, meaning it has a wide array of assets in its selection. However, due to some common misconceptions regarding CFDs, some traders may interpret that the wrong way.

Before we carry on, we should clear the air, so you know exactly what you’re getting into.

What are CFDs exactly?

CFDs are different than standard assets in that they don’t provide their users with underlying asset ownership. Some scams use them since they’re easier to fake than spot trading tangible assets. However, when in the right hands, they’re much more beneficial to users than standard trading.

CFDs allow brokers to create wider asset libraries, as well as lowering costs for all but the top-intensity traders. Furthermore, they dodge liquidity issues and offer a much more transparent and realistic trading experience.

And since we don’t need to worry that the broker is a scam, as we’ll discuss later in our GigaFinancing review, it’s all upsides.

What is the broker’s website like?

The Giga-financing.com website also operates fantastically, with smooth transitions and quick loading times. It’s transparent and information-rich, so users can always find what they’re looking for.

Altogether, the customer experience is fantastic and shows the broker clearly put effort into the service. With that, gigafinancing.com has made us eager to explore the company further and check out its features. So, let’s take a look at the giga-financing.com review and get the most of it, shall we?

Fund and Account Security

We spoiled the safety section slightly in the previous part of our gigafinancing.com review, but that doesn’t devalue it. It’s important to understand why it’s so important that you choose a safe broker over a scam company.

First, we can’t overstate how easy it is to get caught in a scam if you’re not alert at all times. While regulation and online safety has improved, the finance world is still hazardous. That danger mostly comes from a combination of two factors.

What should you be aware of?

The first, of course, are the scammers themselves. Scams run for a short period and aim to maximize the money they steal within that limited window. As such, it’s natural that they gravitate towards spaces with lots of money, aka finance.

Second, there’s a circle of financial gurus that propagate the idea that anyone can get rich quickly. That attracts inexperienced and ignorant users who are the prime target for scammers. Again, that draws in even more bad actors towards the finance world.

However, if you take a methodical approach and do your research, you’re fairly safe. Sadly, the way to explore a broker isn’t always immediately obvious.

Luckily, we’re here, and we’ve devoted this part of our GigaFinancing review to making sure it’s entirely secure.

No maliciousness of the brand

Besides the fact that this broker offers a wide combination of digital currencies and CFDs, we should also mention that the brand doesn’t show the slightest sign of maliciousness. It’s laid out in a way that maximizes user power and knowledge, which simply isn’t how scams function.

On top of that, the broker is also located in the US. That means it works from the world’s most strictly regulated financial market and, thus, needs to abide by its rules.

Altogether we find it extremely unlikely that you’ll see any safety issues with gigainvesting.com if you are into online trading seriously.

Account Info at gigafinancing.com

Creating an account structure is tricky for most brokers. The difficult part is that they need to find a middle ground between budget and luxury users. Often, they tilt too hard to either side.

If they focus on budget users, that ends up dragging down those that are used to more high-end investing. They can simply get more bang for their buck elsewhere, and that’s where they’ll take their business.

From luxury traders to fund-limited ones

However, if the broker caters almost exclusively to luxury traders, that cuts off access to newer and more fund-limited traders. That can create difficulties for brokers since a lot of their profits come from the users that trade incrementally instead of the top-end.

As we said earlier in our GigaInvesting review, the broker is versatile and accepts everyone. That also means its account structure managed to split the service satisfactorily for everyone. It achieves that by having more or less a hard split between budget and luxury users.

The baseline account has all key features available and requires a small deposit. That means users that want to start small can still have a full experience.

GigaInvesting even includes some features that brokers usually reserve for more expensive accounts, such as the personal manager.

What can luxury users expect?

And for luxury users, the broker unlocks a ton of extra features. If you’re a high-end trader, you’ll feel at home at gigafinance.com. Its various assistance, analysis, and trading features make sure of that.

Here’s what you can expect from the gigainvesting.com accounts:

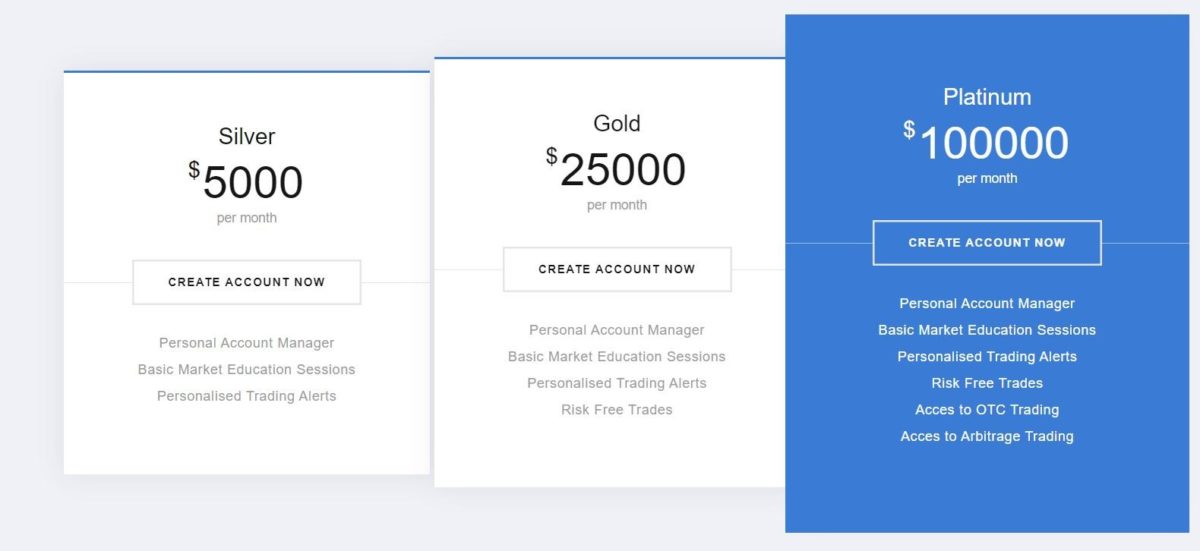

Silver

- Min. Deposit: $250

- Personal Account Manager

- Basic Market Education Sessions

- Personalized Trading Alerts

Gold

- Min. Deposit: $25,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

- Risk Free Trades

Platinum

- Min. Deposit: $100,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

- Risk Free Trades

GigaFinancing’s Trading Platform

GigaFinancing’s platform ties together its service with excellent software to back up the fantastic service. It’s intuitive and lets users adapt to it gradually.

If you’ve ever used a platform before, you’ll feel right at home, but even if not, you’ll learn it quickly.

The platform offers numerous analytical features that will make exploring market and predicting where they’ll go much simpler.

The software supports numerous visual indicators and their simultaneous use. That means you can track multiple assets or different metrics for one trading material.

A degree of automation with stop lossesis present

It also has a degree of automation with stop losses and take wins. Going with that, there’s slight personalization, both in terms of visuals and function. That lets you smooth out the platform according to your own preferences, improving user experience in the process.

Lastly, we should note that it’s a native web trading platform. In other words, it was developed with browser use as its first concern. That makes it much more technically advanced than other similar platforms that are just ports of other versions.

We’re quite satisfied with the platform at gigainvesting.com, as it does well to empower the already highly-functional and pleasant service.

GigaFinancing Review: Conclusion

GigaFinancing’s platform is straightforward and powerful, and we can’t ask for more from a broker. It does the things it does well and ensures its customers feel valued and safe at all times.

And with the features the broker provides exceeding the price range, customer satisfaction is a near guarantee.

We believe the broker is one of the strongest finance companies on the market currently. Our GigaFinancing review finishes on a great note, and we recommend trying the broker for yourself. For additional information you can always visit the official gigafinancing.com review!

FAQ

-

Where is GigaFinancing based?

GigaFinancing operates from the US, the world’s largest financial hotspot.

-

Is GigaFinancing a regulated broker?

GigaFinancing works from the US and follows all local legislation and regulation.

-

Is GigaFinancing trustworthy?

Yes, GigaFinancing earned high safety grades for our review, which cements it as entirely trustworthy.

-

What type of broker is GigaFinancing?

GigaFinancing is a CFDs broker, allowing it to offer various asset types to customers.

-

Can you trade with GigaFinancing in the USA?

Broker is a global broker and accepts customers from the USA and many other countries.

-

What is GigaFinancing’s leverage?

GigaFinancing offers margins of up to 1:500.

-

What platform does GigaFinancing use?

It uses a proprietary web platform.

-

How to trade CFD on GigaFinancing?

To trade, you need to sign up and deposit the minimum amount to activate your account.

-

Is GigaFinancing good for beginners?

Yes, GigaFinancing has a number of beginner-friendly features.

-

What is the minimum deposit to open a GigaFinancing account?

Opening an account is free, but to activate your account, you need to deposit $250.

Good broker

I had fun trading with this broker. I get good trading returns and I am dealing with skilled brokers.

Did you find this review helpful? Yes No