Crypto assets, such as Bitcoin, Ethereum, and Ripple, are very volatile. Over the past few years, they hit both dizzying highs and extreme lows. However, Bitcoin is now trading around $60,000. It soared by approximately 1,000% in the last twelve months, and the cryptocurrency overall gained more than 11,000% in the previous five years. So, some investors may feel that they’vemissed out. One thing is clear, investors around the world flocked to the cryptocurrency market. According to the latest reports, one in four U.S. investors has exposure to digital assets.

However, many investors hesitate when it comes to cryptocurrency due to the lack of regulatory oversight. While blockchain is virtually impossible to break, there are other ways to gain money with crypto scams, and criminals do not hesitate to use them. One of the attractions of cryptos is that they are independent of the banks and governments. But that also has its own drawbacks.

Lots of countries have forbidden cryptos because they can’tcontrol them. Others seek to find ways to regulate them in such a way, which would be acceptable for all parties involved.

Regulators are trying to decide how they should classify crypto assets and which government actors can provide the best supervision. Meanwhile, many crypto owners and investors expressed fears that such control would undermine the decentralized ethos that attracted them in the first place.

The era of unregulated digital coins is nearing the end

Regulators pay more and more attention to the crypto markets. However, they seem to recognize the unique characteristics of digital assets, along with the need to balance investor protection and innovation.

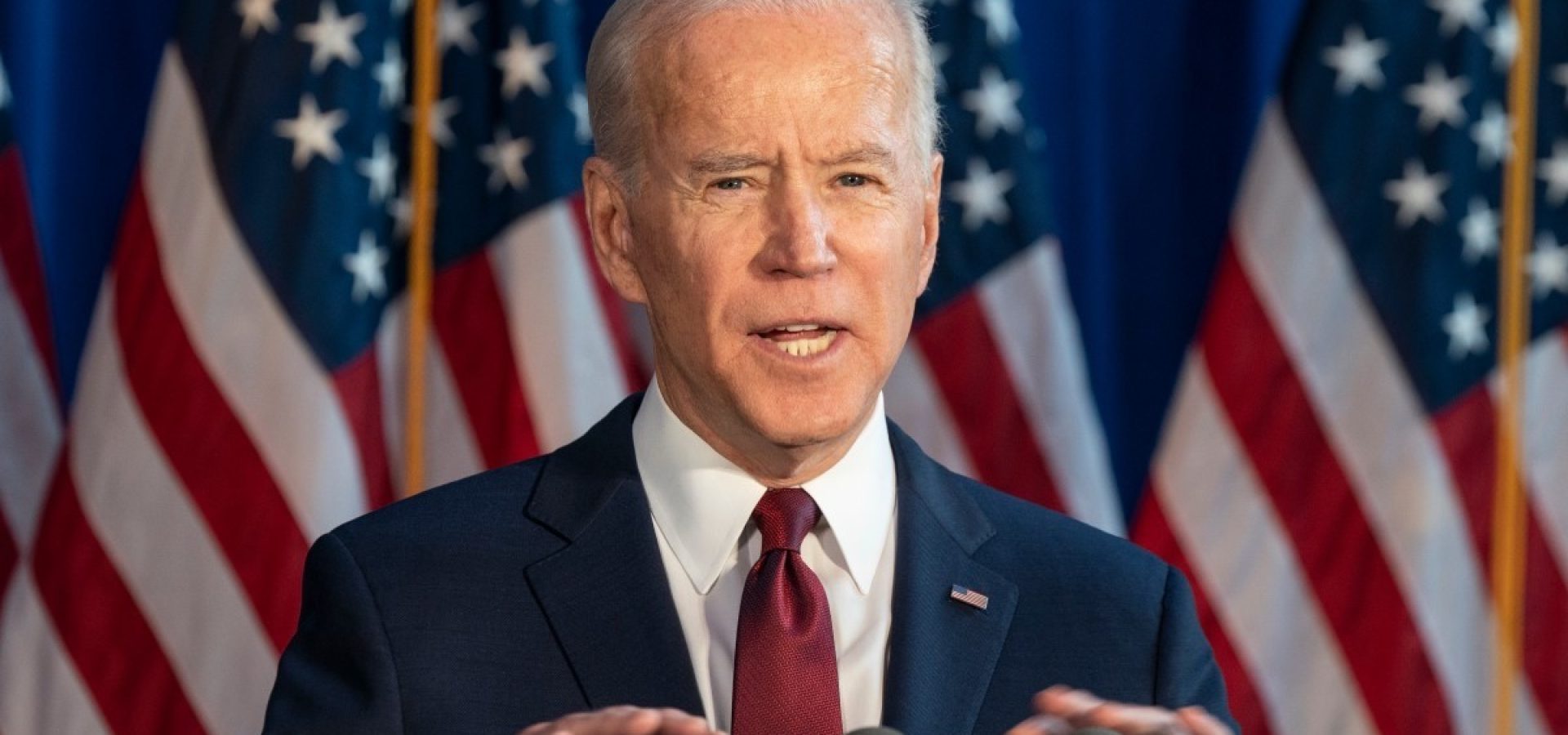

Gary Gensler, President Joe Biden’s nominee for SEC chair, is involved in the process. He already managed to reform the over-the-counter derivatives market without undermining its vitality during his previous term as chair of the Commodity Futures Trading Commission. Now he works to achieve a similar result in the more mature blockchain industry.

Meanwhile, other federal agencies are also attempting to protect investors from crypto scams or criminals. For instance, the CFTC has regulatory authority over some crypto assets, including Bitcoin and Ethereum. The agency has brought cryptocurrency enforcement actions under the Commodities Exchange Act.

Crypto owners and investors should regard such enforcement actions as positive steps. The agencies, such as the CFTC and the DOJ, aren’t attacking crypto itself. Instead, they are focusing on allegedly illegal actions that threaten crypto markets’ integrity.

Biden’s administration is paying cryptos especially more attention lately. The federal government continues to expand its crypto profile, which means that prosecutors and state regulators will need to sort out their place in the emerging paradigm.

COMMENTS