Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

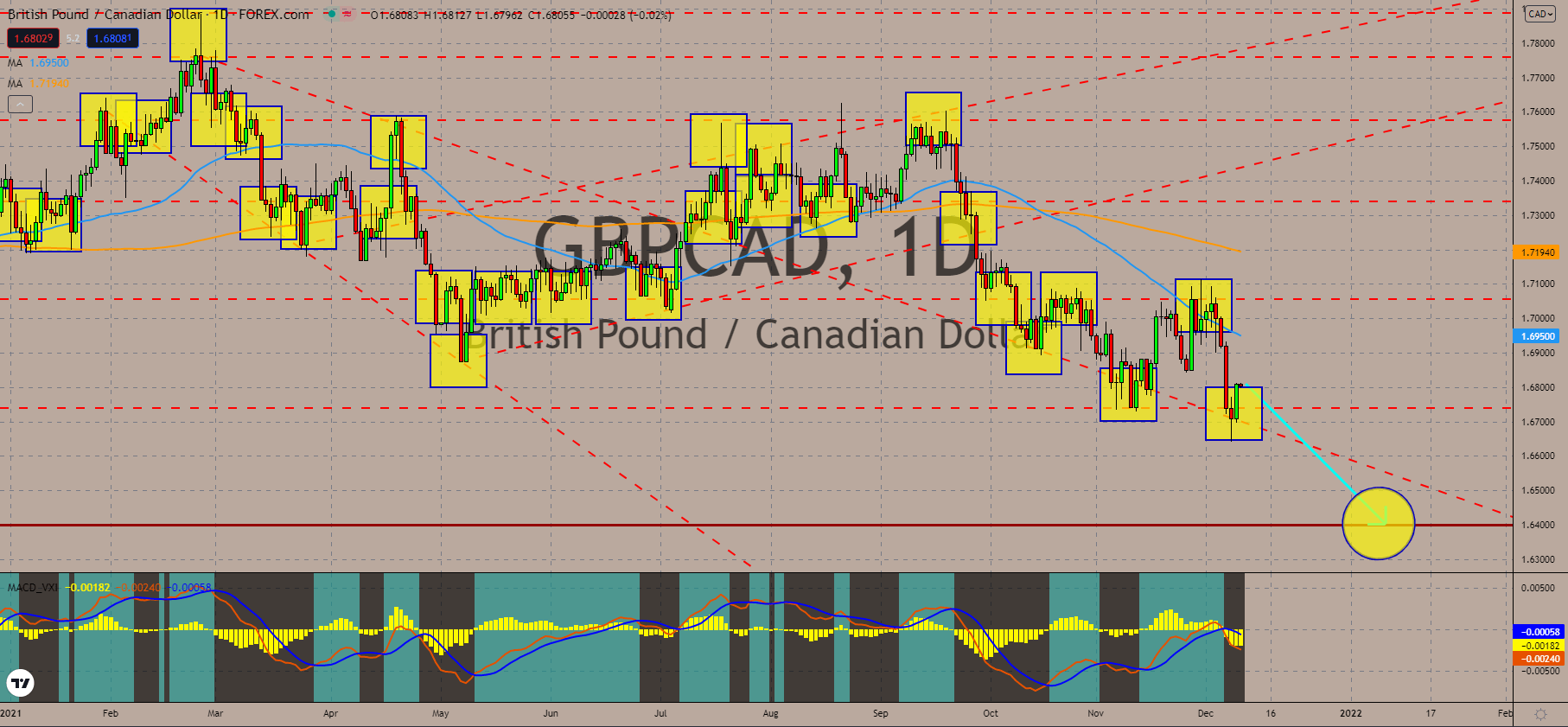

GBPCAD

Bank of Canada kept the interest rate at a record low of 0.25% on December 09. In addition, the central bank defied pressures despite forecasts of a continued rise in inflation throughout 2022. In October, Canada’s inflation rate advanced by 4.7%. It was the country’s highest monthly inflation increase in 18 years. The BOC sees the consumer price index easing at the end of 2022 near the median target of 2.1%. In relation to inflation, Canada’s trade activity increased and recorded a 2.09 billion surplus in October. The figure beat the consensus of flat 2.00 billion and a revised 1.42 billion data previously. The increase was driven by massive growth in exports, posting a result of 56.18 billion. On the other hand, imports also grew by 54.09 billion but with a lower net change. Exports jumped 6.40% compared with imports with a 5.25% monthly comparison. Another report released in the week is Ivey PMI, with not seasonally adjusted staying at 61.2 points in November.

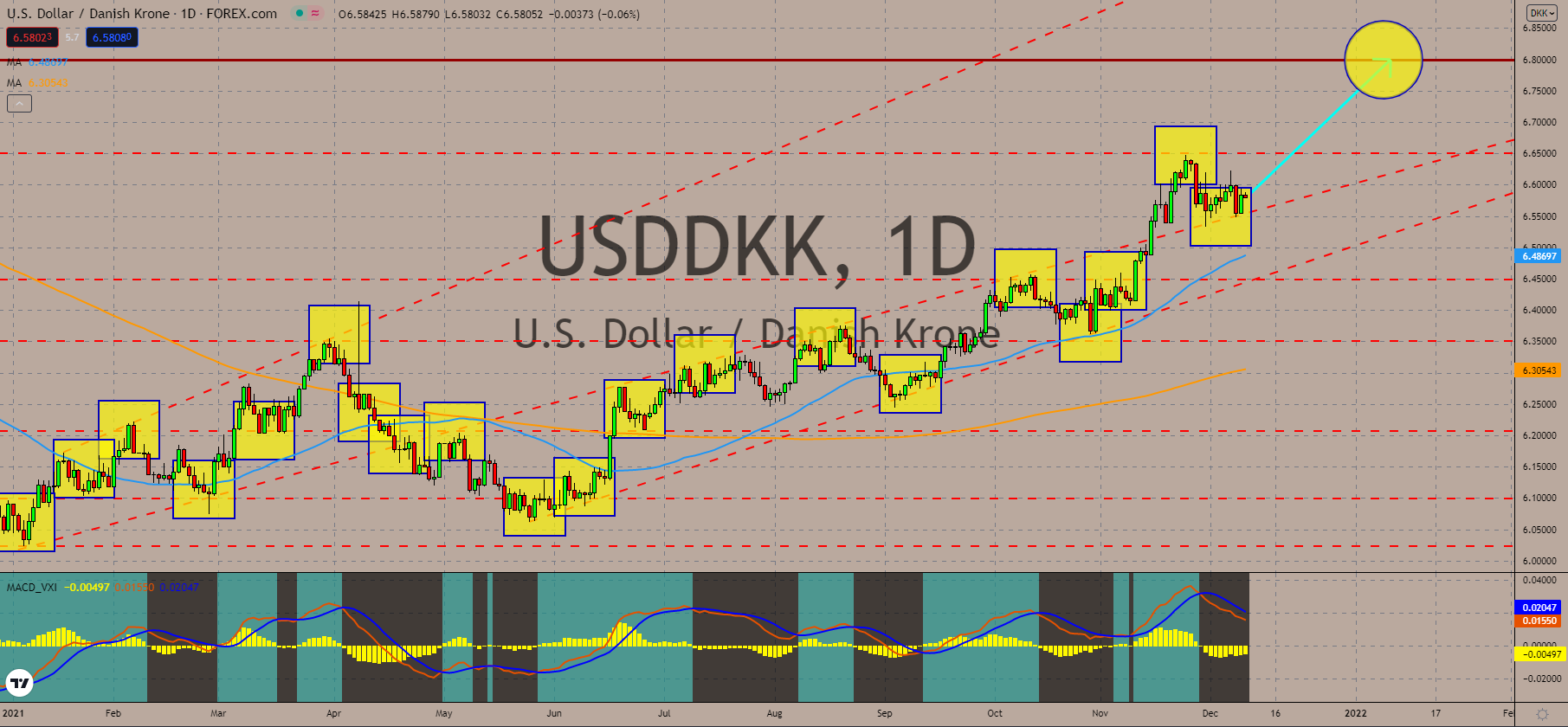

USDDKK

The US initial jobless claims on Thursday posted a 52-year low to 184,000. The recently reported data is below last week’s revised result of 227,000 and the 215,000 forecasts. In addition, it beat a previous low of 194,000 two weeks ago. Analysts interpreted the data as businesses refusing end employees contracts amid a labor shortage. On the contrary, the Continuing Jobless Claims ended higher to 1.992 million against estimates of 1.900 million. Meanwhile, job openings increased to 11.033 million in October. The number could swell amid a five-month record for revised data. The all-time high record from July of 11.098 million is a revision from the initial data of 10.934 million. On economic activity, the US trade balance eased in October with a deficit of 67.10 billion. It is a huge improvement from September’s record level of 81.40 billion. The latest data is at a 10-month low. The result is driven by high exports figure of 223.60 billion from September’s 206.80 billion.

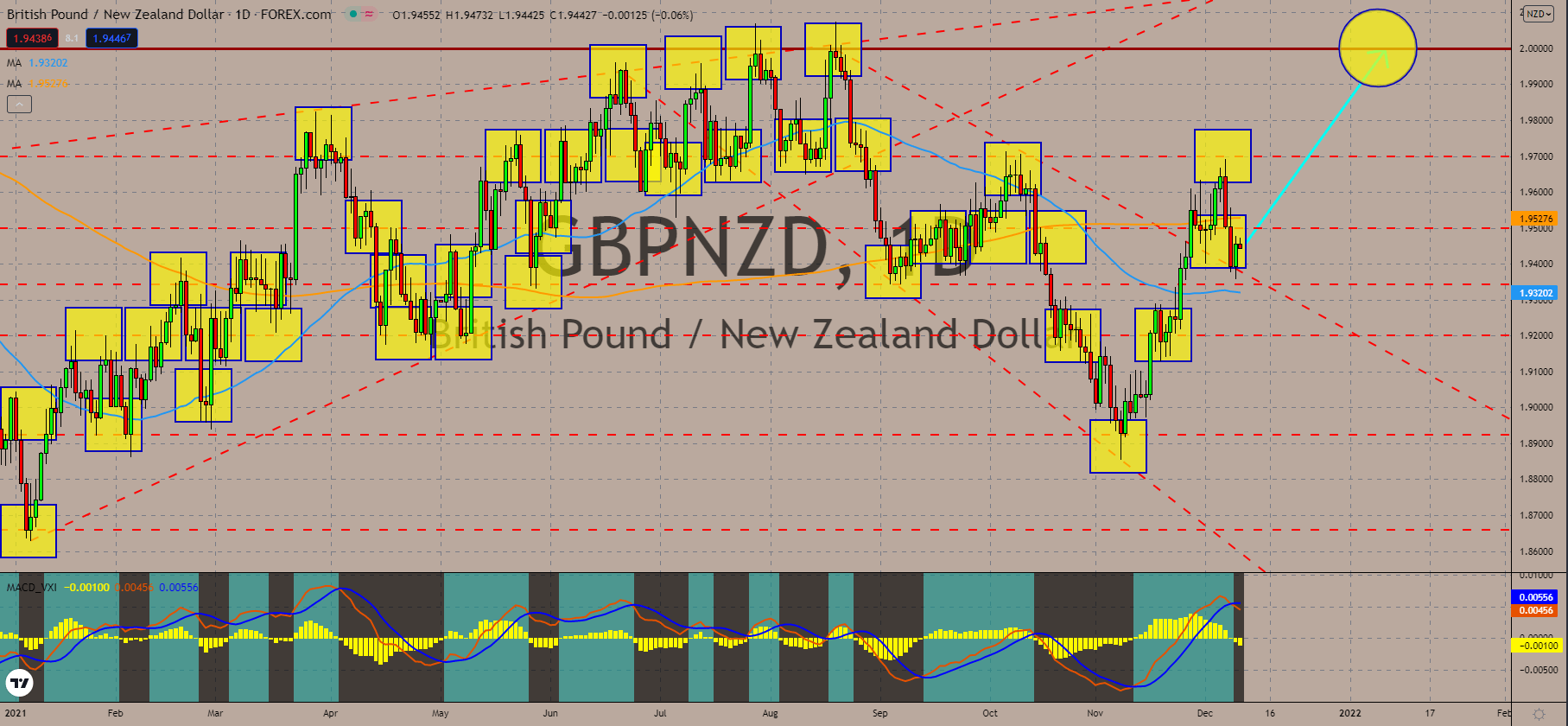

GBPNZD

The Bank of England could become the first major central bank to raise its interest rate. The BOE considers tightening monetary policy amid Omicron’s threat, which could pressure prices to soar. Currently, the UK inflation is at 3.4% based on October’s data. Meanwhile, the interest remains at a record low of 0.10%. The November consumer price index result on December 15 plays a critical role for the following day’s interest rate decision. Analysts expect the BOE to raise its benchmark next week or in February 2022. The mixed sentiment is amid muted data from this week’s reports. The Halifax House Price Index jumped 8.2% year-on-year, while the monthly data advanced 1.0%. Both figures are similar to October’s results. The same observation is seen with RICS House Price Balance which came at 71%. As for New Zealand, the November electronic card retail sales hiked 2.9% from the previous decline of 7.6%. The positive data is due to the lifting of covid restrictions.

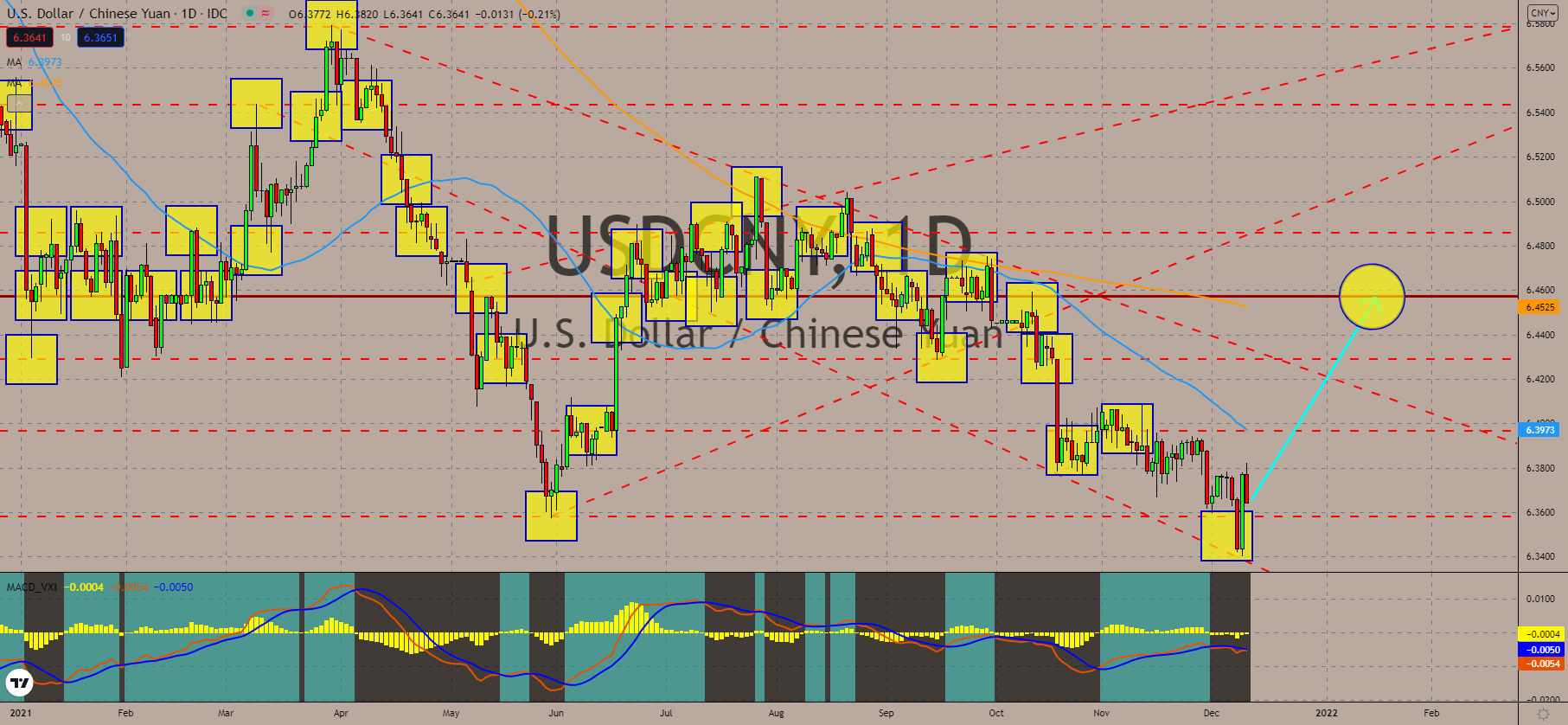

USDCNY

China posted a series of disappointing economic reports in the week. The country’s consumer price index hiked 2.3% to a 5-month high in November, a massive jump from the 1.5% result previously. Rising inflation pressures the People’s Bank of China to ease monetary policy. The Chinese central bank cut its reserve requirement ratio (RRR) earlier in the week, which freed 1.2 trillion yuan from the local banks. Moreover, the Producer Price Index advanced 12.9%. It is higher than the forecasts of 12.4% but retreat from an all-time high last October of 13.5%. On finances, the 1.270 trillion commercial loans are a miss from predictions of 1.555 trillion yuan. Moreover, the outstanding Chinese loans decelerated to 11.7%. The weak data suggests that fewer businesses are willing to take risks amid fears of spillover from China Evergrande. On geopolitics, the United States led the 2022 Beijing Winter Olympics boycott. China warned that the United States would “pay a price.”

Interested in penny stocks trading? Check the best broker for penny stocks trading.

COMMENTS