Oil prices rose around the world after Trump announced that he expected the end of the dispute between Saudi Arabia and Russia. The announcement pushed prices to their lowest levels in 18 years.

The US president tweeted that he expected and hoped the two parties would reach an agreement to cut supplies by 10 million barrels of oil, and perhaps even more.

His comment came after Saudi Arabia called an emergency meeting of oil producers. The Russian Energy Minister, in turn, said his country might resume talks.

In response to falling demand, a deal to cut production had failed due to the spread of the Coronavirus last month.

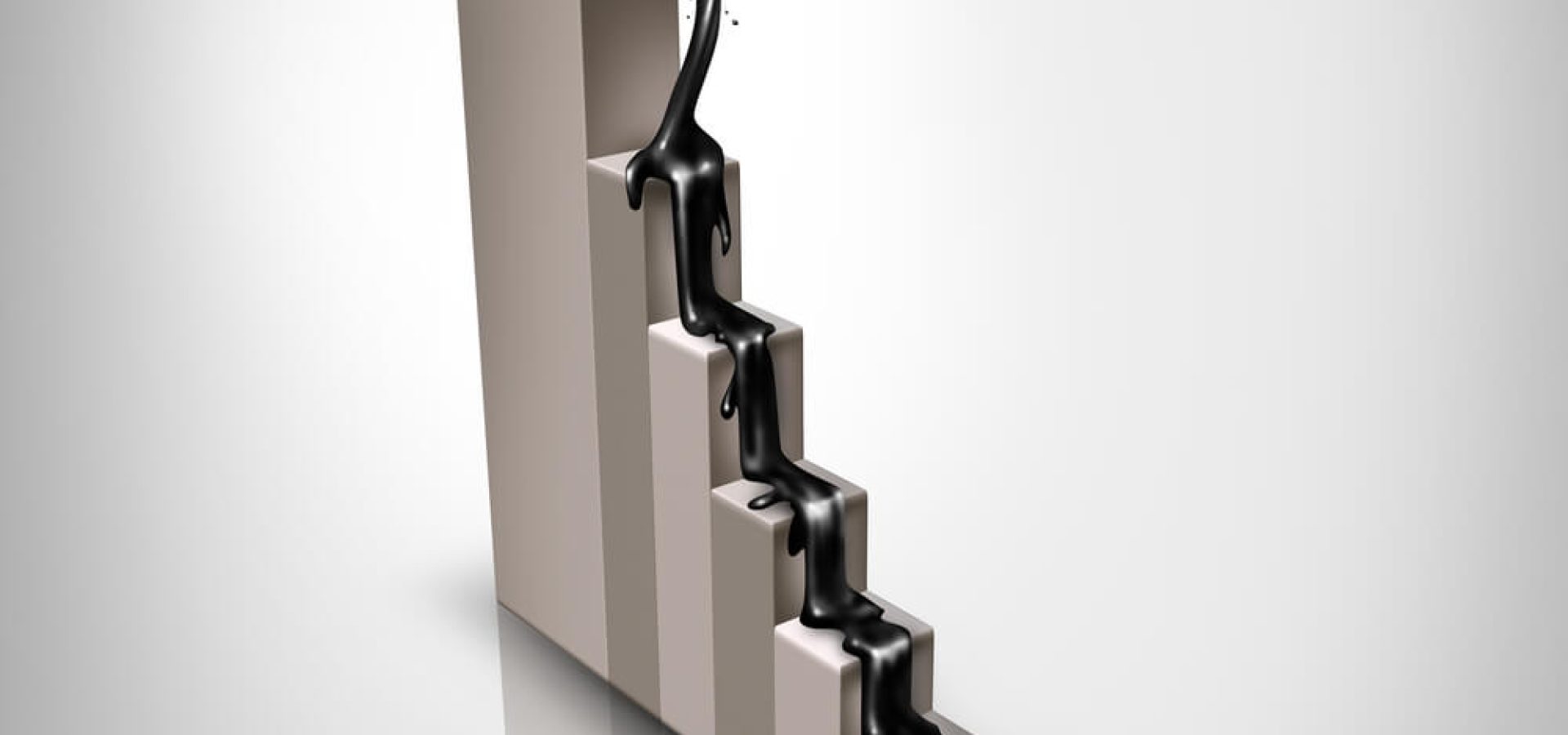

Since the outbreak of the epidemic, crude oil prices have reached low levels not seen in nearly two decades. This is after Russia and Saudi Arabia reduced costs and increased production, in a struggle for their market shares.

The US energy sector is sinking

The confrontation reflected negatively on US oil, marking the worst quarter ever. Prices dropped by two thirds in the first three months of this year, causing a shock in the energy sector.

These damages prompted American officials to try to mediate between the two parties, to complete a new deal.

Prices have jumped more than 30%, as hopes for a deal have risen. The price of Brent crude was $32.78 a barrel. And the price of a barrel of WTI was $26.93.

That put Brent crude price back on track to make the most significant gains in a single day.

Before the Saudi-Russian conflict flared up, Trump declared at a press conference at the White House that the situation was awful for both Russia and SA. He considered that both sides would strike a deal.

Russian Energy Minister Alexander Novak said that they agreed to stay in constant contact to find common measures. It would help facilitate the stability of the market shortly.

As Trump described, the US oil industry is devastated. Whiting Petroleum, the largest oil producer in Dakota, went bankrupt. The company said that it has worked to reduce its costs and will continue to work under the restructuring plan.

According to Reystad Energy, the research company, last year, it was expected that the global demand for crude oil would decrease by about 23 percent this month.

Meanwhile, Trump met the leaders of the first energy companies at the White House on Friday. This included Exxon Mobil and Chevron chiefs.

The meeting discussed options that included imposing tariffs on oil imports from Saudi Arabia.

COMMENTS