| General Information | |

|---|---|

| Broker Name: | Opticapital |

| Broker Type: | Forex & CFDs |

| Country: | England |

| Operating since year: | 2022 |

| Regulation: | FCA |

| Address: | 7 Westferry Circus, London E14 4HD, United Kingdom. |

| Broker status: | Active |

| Customer Service | |

| Phone: | +442039961423 |

| Email: | N/A (There is a Contact Form) |

| Languages: | English, French, German. |

| Availability: | 24/5 |

| Trading | |

| The Trading platforms: | MetaTrader |

| Trading platform Time zone: | (GMT+1) |

| Demo account: | No |

| Mobile trading: | Yes |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | #colsapn# |

| Minimum deposit: | $250 |

| Maximal leverage: | 1:500 |

| Spread: | Floating From 0.0 Pips |

| Scalping allowed: | Yes |

First Impressions

Opticapital.com offers financial trading services and manages more than a thousand trading accounts. The broker has quickly risen to the top ranks of financial brokers by establishing significant relationships and providing a broad selection of tradeable assets.

We were pleased to find that many countries, such as, St. Vincent & the Grenadines, the UK, and the UAE govern this broker. As a result, Opticapital is regarded as being extremely secure. This broker starts at 0.0 pips with decent leverage up to 1:500. This is good for a wide range of traders.

We discovered numerous appealing aspects of Opticapital while conducting our evaluation, and we’ll go over each one in more detail below.

The safety and security of its clients’ money is a top priority for Opticapital. The fact that this broker is governed by the best financial authorities in the world is the first sign. Opticapital is listed in Saint Vincent and the Grenadines as a legitimate corporate concern.

In addition, a lot of laws establish the standards for the Opticapital code of behavior. The rigorous guidelines guarantee that traders’ money is safe. Opticapital regulatory organizations consists of Financial Conduct Authority (FCA) (United Kingdom)

Opticapital Review: Protection of money

While researching for this Opticapital review, we were pleased to find that the platform implements extra safety measures like negative balance protection, fund segregation, and a trader’s insurance program.

With negative balance protection, if a user trades on margin and the trade goes against them, their equity will never drop below zero, and they won’t owe the broker money because the market will close on its own.

Because the trader’s money is maintained in separate bank accounts from the broker’s account and off the balance sheet, it cannot be utilized to settle debts. This is thanks to opticapital.com Broker. This keeps traders at Opticapital secure in the event that the broker declares bankruptcy.

Also, opticapital.com takes part in a civil liability insurance program with a maximum coverage of €5 million, which protects the creditors and traders in the event that the broker defaults and files for bankruptcy. This insurance program shields the traders from any dishonest, careless, or improper behavior on the part of the broker.

Trading Instruments

According to our Opticapital review, the broker provides one of the broadest selections of tradeable items across 7 markets. More than 3,138 different assets are available for trading in the following markets: forex, commodities, bonds, indices, ETFs, CFDs, stocks, and physical stocks.

Every trader wants to have access to a wide range of tradable assets, and Opticapital broker has options for all traders regardless of their preferences or level of experience. The lack of real or coin CFDs on Opticapital platforms is a drawback if you’re interested in trading digital currency.

In addition to this enormous offering, the spread and permitted leverage fluctuate between different markets, which we will go into detail about in the sections that follow.

Major and minor currency pairings are available for trading on Opticapital. Regrettably, you won’t find any exotic ones with this broker, and to be quite honest, most traders stay away from trading exotics due to their large spreads and limited liquidity. As a result, for you, this might not be a deal-breaker.

On the plus side, the broker provides a variety of accounts to accommodate different sorts of traders’ demands and offers narrow spreads. Depending on your nation of residence, you can use leverage for forex trading of up to 500:1. The FCA’s stringent rules, for instance, will result in a 30:1 leverage for British clients. Also, this broker’s modest average spread on the EUR/USD exchange rate is 1.3 pip.

Adding commodities to the watch list can expand the trading portfolio. You can find many commodities on the Opticapital website.

According to our Opticapital review, tight spreads on precious metals like gold, silver, platinum, palladium, and copper are available, with copper starting at 0.008. Each commodity has a different maximum allowable leverage. Palladium futures trading, silver trading, and gold trading can all be done with leverage up to 20:1, 100:1, and 200:1, respectively, against the USD or EUR.

Furthermore, spot or futures contracts can be used to trade Brent oil and crude oil. The spread fluctuates according to the state of the market, and the lowest amount it may be for UK Brent oil is 0.07 pip. Also, the leverage provided varies, being 50:1 for crude oil and 66:1 for Brent oil.

Commodities used in agriculture can also be traded. Products including cocoa, coffee, cotton, and sugar are among those offered by Opticapital Broker. These agricultural commodities feature narrow spreads, with sugars starting at 0.06, and floating leverage up to 1:66.

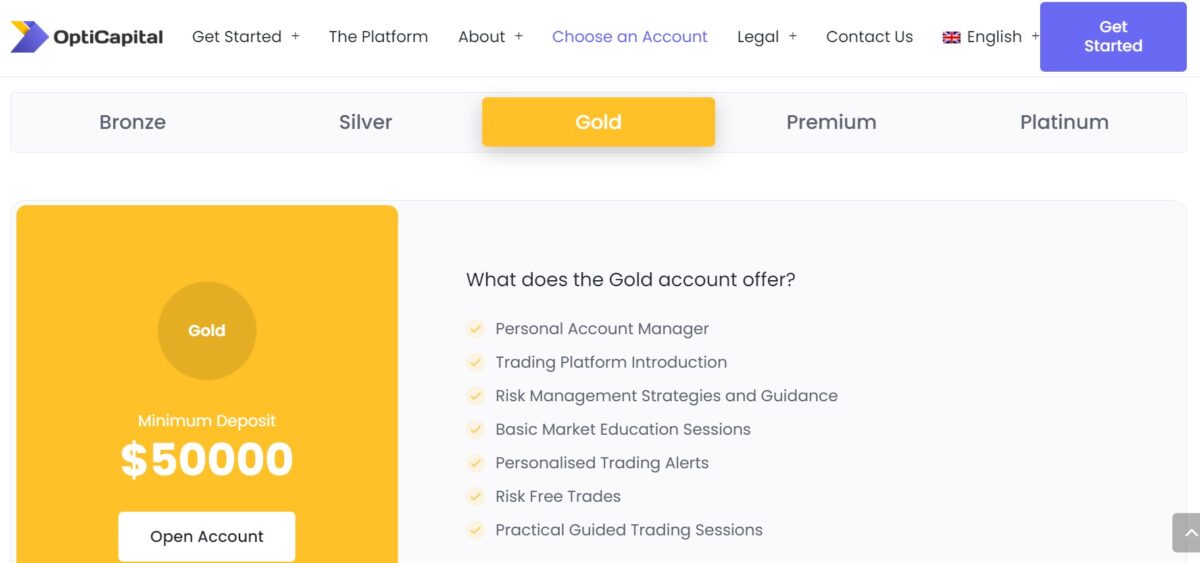

Opticapital Review: Account Types

There are five various kinds of trading accounts available. Because of this, Opticapital is a terrific place for a wide variety of traders. The minimum deposit and maximum leverage are varied for each trading account.

The state of the market determines variable spreads and commissions, the kind of account, and broker markups. Spread-free accounts or accounts that guarantee spreads starting at 0 pips give you market prices on spreads, but they also charge you a commission for financial services.

According to our opticapital.com review, if you are a high-frequency, aggressive trader, you might opt to pay more in commissions while paying less in spreads. Position traders typically prefer commission-free account types. Let’s go over each type that is provided in more detail.

This sort of Opticapital trading account is intended for traders who are just starting on the Forex market. A trader can place market orders using the Micro account, which has a lower minimum deposit requirement and a minimum contract size starting at 0.01 lots.

All financial products are fully accessible to traders with Bronze accounts, and they can use any trading platform the broker offers. 500:1 is the maximum leverage available for this account type. There is no commission associated with spreads, which begin at 1 pip. The minimum deposit required to start a Micro account is $5, or its equivalent in each of the four account base currencies: EUR, USD, NGN, and JPY. The recommended option for high-frequency and algorithmic trading is silver accounts. For short-term trading, a fee structure is more advantageous.

This account, as its name suggests, enables you to trade with a raw spread of 0 pip without any price markup. The maximum leverage available is 500:1. A $200 minimum deposit is required to open an Opticapital Silver account and begin trading. On the other hand, you will be paid variable commissions of $8 for USD minors and $6 for USD major pairings every round-turn lot.

A Gold account type is available from Opticapital Station Broker, in which a lot of investors contribute money to a pool that an account manager utilizes to invest in various markets. The Premium account type is intended for seasoned investors who prefer to plan their trades more thoroughly and place fewer orders than many intraday traders. The account must be opened with a minimum initial deposit of $100 or its equivalent in the base currency of your account (EUR, USD, NGN, JPY).

No commission is assessed for trading. Nonetheless, the broker will charge a 1 pip spread markup fee to traders. The Premium account gives you access to all of opticapital.com available assets. Additionally, there is also a VIP club for traders who want their experience to be more curated and custom. It comes with quite a few perks and promotional initiatives as well.

Final Verdict

We looked at every product and service offered during the course of our Opticapital review, and we discovered a definite uniformity in the offers and a definite statement of the services. Authorities oversee Opticapital, which adheres to highly tight rules that include segregated bank accounts, negative balance protection, and a global insurance program.

The enormous variety of trading assets that are offered is what distinguishes Opticapital from its rivals. Currently, many brokers offer CFDs on stocks, indices, commodities, and forex, but only a few can also add genuine stocks as a bonus. You can trade more than 3138 instruments with Opticapital, 2,170 of which are actual stocks. It’s important to note that the broker does not provide cryptocurrency.

Good support and brokers

They have good customer service and brokers who are highly skilled in forex trading. Also offers a great range of products to trade as well.

Did you find this review helpful? Yes No

Good company

This is a good company for investments. There are so many opportunities to earn money. Both services and results are good.

Did you find this review helpful? Yes No

Good broker

Good broker. I am gaining decent profit so far.

Did you find this review helpful? Yes No

Great signals

Signals are good and withdrawal is quick. I enjoy the service and I love the profit that I’m getting from the signals.

Did you find this review helpful? Yes No

Amazing brokers

Their customer service is truly amazing. They are helpful and attentive most of the time.

Did you find this review helpful? Yes No