Ongoing demonstrations in Hong Kong once more underlined that security is deteriorating in the city. In this situation, it makes sense that investors are cautious when it comes to investing in Hong Kong. This situation is also harmful to the stock markets.

It is worth mentioning that Hong Kong is one of the most important financial hubs in the world.

There is a chance that Hong Kong’s economy may decrease by 1.3% in 2019. It means that the economy is suffering, and the first annual recession since 2009 would undermine the stability of Hong Kong’s economy.

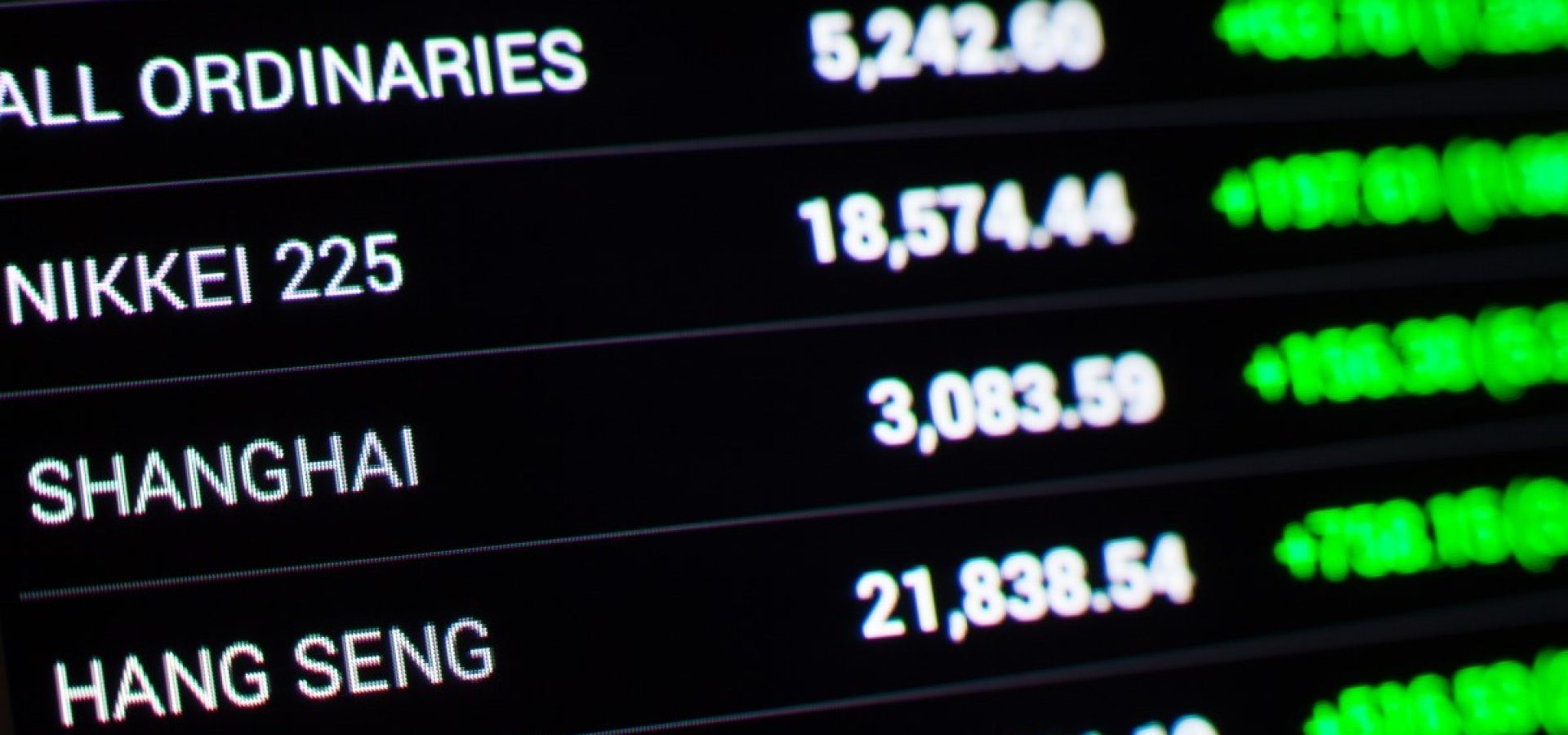

During the last week, Hong Kong’s Hang Seng index declined by 4.8%. It was the biggest weekly drop since August.

On Monday, the Hang Seng Index increased by 1.4%, the best daily gain in two weeks.

The shares of Tencent increased by 3.1%. According to information from last week, Tencent was interested in acquiring a minority stake in Universal Music Group (UMG).

On November 18, the Shanghai Composite Index rose 0.5%.

In Japan, Nikkei’s 225 index, increased by 0.5%. South Korea’s Kospi index declined by nearly 0.1%.

-

-

- Interested in Trading Hang Seng Index or Nikkei 225? Read WiBestBroker’s comprehensive review on FXCM.

-

Stock markets on Monday

The Dow Jones Industrial Average rose by 33.4 points or 0.12% to 28,038.29. The Nasdaq Composite added 15.72 points or 0.18% to 8,556.55.

The S&P 500 added 3.26 points or 0.10% to 3,123.72.

The good news which helped to boost the market sentiment in the U.S. relates to tech companies. U.S. authorities approved an extension for U.S. companies.

In May, the U.S. added the Chinese tech giant Huawei to a blacklist. This decision affected U.S. tech companies.

This extension will allow U.S. companies to do business with the Chinese tech giant Huawei. Another good news comes from China, the news regarding the “constructive” trade talks improved the market sentiment. However, it is hard to say when the U.S. and China will sign a “phase one” deal. Otherwise, it will be impossible to end the speculations about the future of trade war.

COMMENTS