| General Information | |

|---|---|

| Broker Name: | StormGain |

| Broker Type: | Crypto |

| Country: | Saint Vincent and the Grenadines |

| Operating since year: | 2014 |

| Regulation: | None |

| Address: | Hinds Building, Kingstown, St. Vincent and the Grenadines |

| Broker status: | Active |

| Customer Service | |

| Phone: | +248 467 19 57 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/5 |

| Trading | |

| Trading platforms: | Proprietary |

| The Trading platform Time zone: | / |

| Demo account: | YES |

| Mobile trading: | YES |

| Web-based trading: | YES |

| Bonuses: | YES |

| Other trading instruments: | YES |

| Account | |

| Minimum deposit ($): | $10 |

| Maximal leverage: | 1:200 |

| Spread: | Variable |

| Scalping allowed: | YES |

StormGain Review

GENERAL INFORMATION

StormGain is a broker with an exclusive focus on cryptocurrency, providing trading as well as some additional services. The firm started operating in 2020, meaning it’s still quite new to the market. The brokerage works from Saint Vincent and the Grenadines, a common offshore location. Its exact location is in the Hinds Building, Kingstown.

As you enter StormGain’s website, you’ll notice that the firm aimed to integrate some sort of high-tech design. That’s a common theme for crypto brokerages, but this one’s execution is above average. Another good thing about the website is that it runs smoothly, with webpages taking nearly no time to load. However, nice looks and smoothness seem to have been a priority for the broker, as other aspects fall short.

The information you can get, for example, is severely limited, with only the basic specifications readily available. That can make researching the broker a chore, as you need to consult third-party sources, which are often unreliable. The firm seems to be much more interested in littering their website with self-promotion rather than things traders would want to know. The entire ordeal makes the details of the broker’s service unclear, pushing away potential customers.

However, let’s put that aside for now and inspect some of the brokers’ primary draws:

SOLELY CRYPTO FOCUSED

Specialized brokers can often push away customers that enjoy diversity or consider it a necessity for success. However, they are usually invaluable for specialized traders, as they commonly provide a much better service in their area of expertise. As such, although many brokerages offer crypto trading services, many digital currency traders rush towards crypto-only firms.

ADDITIONAL CRYPTO SERVICES

Its focus on cryptocurrencies has allowed StormGain to introduce crypto features that go beyond regular trading. So, for example, the brokerage provides a fully functional crypto wallet, along with digital currency exchange services. Not only that, but you can earn interest on your deposits. Moreover, the website even teaches you how to mine crypto.

BONUSES AT STORMGAIN

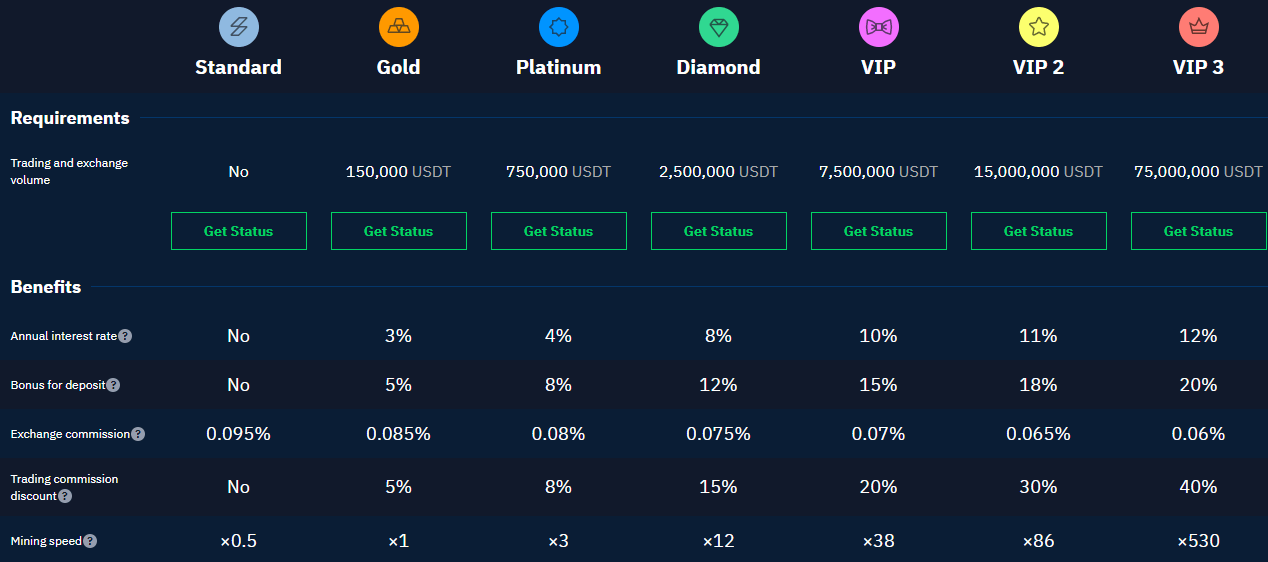

StormGain provides multiple bonus features that can serve to enhance your funds while you trade. The first of those is the classic referral bonus, but there’s also a loyalty program that doesn’t require you to involve others. The best thing is that the program works from trade volume, meaning you won’t need to go out of your way to get rewards. All you need to do is trade as usual, and you’ll gradually get certain reward features.

Funds Trading and Security

Security is an area where a lot of newer brokerages seem to lack tremendously. That’s unfortunate since the recent move of the online trading world into the mainstream has made safety more of a concern than ever. With the increase of new traders came an increase of malicious brokers trying to profit off them. As such, many advise against using brokerages with even a hint of uncertainty safety-wise.

StormGain is one of those new brokers that simply don’t do enough to ensure customer security. For what it’s worth, the firm doesn’t have a record of misbehavior, and there don’t seem to be many major user complaints online. However, the broker was founded only earlier this year, meaning that fact has little weight.

On the other hand, we can see that the broker’s headquarters is at a very popular scam destination. On top of that, there are no licensed authorities that control the broker’s actions or limit the damage it can do to customers. Besides a moral compass, which many online brokerages lack, nothing is stopping StormGain from disappearing with all their users’ money.

Trading Accountsat StormGain

StormGain ensured to set up a demo account option loaded with funds so potential users could try out the service. The feature is especially useful for newer traders or those thinking about trying their hand at the profession. A fleshed-out demo account is invaluable since it allows them to familiarize themselves with a process they’ve likely only been reading about. They’re still quite useful for experienced traders, too, since it’s nice to have the option of inspecting brokerages before investing. That’s particularly applicable to StormGain, since it boasts a custom platform, which many might not find enjoyable.

Once you move to the live account, sadly, there’s no variety. The least you need to invest is $10, and that nets you the right to trade and use the firm’s other services. The closest thing to account typing is the loyalty program we mentioned earlier in our StormGain review. It allows traders with a high trading volume to achieve certain benefits, such as a higher interest rate, deposit bonuses, and lower currency exchange commissions.

While the feature does somewhat cover for the lack of account typing, high investors might find the feature progression too slow. On the other hand, budget traders are quite limited until they reach higher loyalty levels. It seems like a workaround that doesn’t benefit anyone but the company.

The Trading Conditions

While the brokerage thus far seems to be so-so, with some above average specifications and some underwhelming ones, trading conditions are where it collapses. The leverage is 1:200, which is serviceable for some tactics but quite underwhelming for a crypto brokerage. The account typing is non-existent, so there is no way to customize your experience. The platform is proprietary, which is something many traders attempt to avoid. Additionally, for a crypto-only brokerage, their asset count is quite limited.

Moving on, the firm attaches fees to each trade, making customers play against an edge. The commissions do get lower as you progress through loyalty levels but are quite high even at the top tier. The additional charges don’t stop there, as the broker has both fixed and percentage-based withdrawal fees. The amount they ask for is quite greedy and makes it significantly more challenging to maintain a long-term profit.

Even past all of that, the secondary conditions are relatively poor. Most of the information is hidden, so you’d be going in half-blind if you sign up. The security is also concerning, as the location makes the firm near-impossible to prosecute.

Trading Platform

As we’ve mentioned multiple times in our StormGain review, it uses a custom platform. They advertise the software as simple to use, which we can confirm after a quick test. However, we can’t vouch for long-term functionality, security, or the number of glitches you’ll encounter. One more positive thing about the software is that both browser and mobile versions are enabled.

StormGain’s Trading Products

As you could’ve guessed, the brokerage provides digital currency trading exclusively. That includes trading on single coins, as well as cryptocurrency pair trading. However, the number of assets is quite underwhelming, with six singular coins and slightly over twenty pairs in the selection.

Customer Service

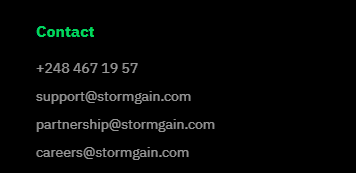

As far as the support options go, StormGain went with the regular trifecta of phone, email, and live chat methods. You can reach the team 24/5, so you shouldn’t have too much trouble on that front.

Phone: +248 467 19 57

Email: [email protected]

StormGain Review Conclusion

StormGain is a brokerage with some potential that seems to be going nowhere. Mixing crypto trading with other supporting services, such as mining and exchanging, is quite an interesting area to explore. However, when each of these sections is sub-par, it is not worth using them, even if they’re bundled up.

Currently, StormGain is severely underwhelming and not worth prioritizing over other digital currency brokerages. If it removed the fees, upped the overall trading conditions, and got some security, it might have some legs to stand on. However, it would need a drastic improvement in all those areas, which seems unlikely.

- Tags:

- News

- Fashion

- Politics

- Sport

LEAVE A COMMENT

CHOOSE YOUR BROKER

BROKER NEWS

New Investment Opportunities for deportees in Spain

BinckBank is a Dutch stock-brokerage. It offers an online trading platform to trade financial assets. The company was founded in 2000. The company was mostly dealing with the professional broker market and banks.

Oil Prices Recoup Losses after Massive Plunge

Oil Prices Perk Up on Russian Nod to Cut Output

Oil Prices Rally after US-China Summit, Qatar Leaves OPEC

BROKER NEWS

Plus500 Witnesses Growth in Q1 Revenue

In the first quarter, Plus500 reported a $215.6 million revenue, marking a 4% rise Y-o-Y and a 14% increase Q-o-Q. Customer income was $169.6 million, with $30.6 million coming from customer trading performance. The

3 thoughts on “StormGain Review”

Not bad not too good

Agree with previous comments. This is an average broker, not very good not very bad. You can try

Did you find this review helpful? Yes No (1)

Nothing special

I hoped for more. But this borker is just average. Not the best trading experience.

Did you find this review helpful? Yes (1) No (1)

Average

Average broker. Not useful for professionals.

Did you find this review helpful? Yes (2) No