Here are the most important and relevant market charts and analysis for today. Check them out!

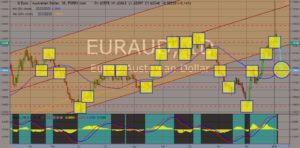

EURAUD

The pair was expected to further go lower in the following days, despite the impending “Golden Cross”. In the recent months, Australia was seen to re-established itself as a regional power in the Indo-Pacific after China tried to lure Pacific Island nations into its debt trap as part of expanding its power and influence. However, Australia and the United States were not visible during the United Nations Global Compact on Migration, which made investors doubt if the country can promote multilateralism and free movement of people. Despite this, Australia’s economy was seen to grow after the ratification of CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), which was expected to take effect on March 01, 2019. In 2030, one (1) European country and four (4) Asian countries will dominate the world’s five (5) largest economies. Histogram and EMAs 13 and 21 already crossed over.

EURCHF

The pair was seen to continue to slide down after it failed to break out of the down trend channel’s resistance line. The European Union and Switzerland’s negotiation on integrating Switzerland’s Six Swiss Exchange in the EU was given a new deadline until June 2019, after Switzerland defies the first deadline on the deal between the two countries. Switzerland is not a member state in the European Union, but was part of the Single Market. Switzerland considers the European Union as its largest trading partner, and failure to agree on the deal between the European Union and Switzerland will affect Switzerland’s economy. It was estimated that EU Investors in the Six Swiss Exchange account for 24.36% of the active participants. Histogram and EMAs 13 and 21 were stagnant, but price movement was seen to make the pair go lower in the following days.

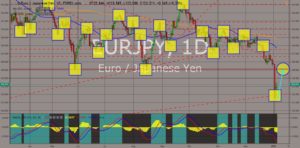

EURJPY

The pair was expected to bounce back in the following days after finding temporary relief in the support line, after investors bought safe haven asset Japanese Yen due to a dim outlook with the US economy triggered by Apple Inc.’s announcement of a lower forecasted revenue for the last quarter of 2018. Japan and the European Union are reaping the rewards of globalization after they closed a deal, which will begin on February 2019, that will account for 1/3 of global GDP. Three trading blocs composed the global GDP namely: Japan-EU Free Trade Agreement, European Union trading bloc, and the recently ratified CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Japan, together with Australia, was expected to lead the CPTPP. Histogram and EMAs 13 and 21 points to a future reversal.

GBPCHF

The pair was seen to go up as the candles and indicators show divergence. UK Prime Minister Theresa May was still struggling to pass the deal she negotiated with the European Union, after Members of the Parliaments doubt that the deal will deliver what the Britons voted during the Brexit referendum. European Commission president, Jean-Claude Juncker, said that there will no longer be any re-negotiation of the deal, while Labour Party leader, Jeremy Corbyn, said that he was against the idea of a second referendum to reassert whether the Britons still want the United Kingdom to leave the European Union. Despite the current struggle, the United Kingdom was expected to be Europe’s biggest economy in 2023 despite Brexit and secession talks with Scotland and Northern Ireland. The United Kingdom was already prepared for a post-Brexit trading agreement with countries from Europe, Asia and Africa. Histogram and EMAs 13 and 21 was expected to continue to go up.

COMMENTS