Here are the most relevant and most recent market charts and analysis for today. Check them out!

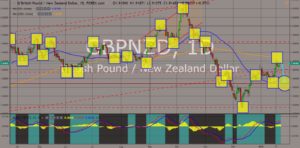

GBPNZD

The pair was seen to reverse back after it failed to break out of the 200 MA. The pair was in a contrary relationship with GBP/AUD pair as Australia will face an impending election, which will dim the country’s future leadership. Just like Australia, New Zealand is the first country to express its willingness to make trading relations with the United Kingdom once it officially withdraw from the European Union. Aside from this, the United Kingdom and New Zealand also conducted a joint statement on climate change and resilience in Asia Pacific. This move will further draw the line between Australia and New Zealand, whereas New Zealand had always been seen as Australia’s shadow. With the departure of the United Kingdom from the European Union, calls for the integration of CANZUK (Canada-Australia-New Zealand-United Kingdom) was also increasing, and with the growing distance between Australia and New Zealand, NZ can become a superpower country just like the United Kingdom, Australia, and Canada. Histogram shows weakness, while EMAs 13 and 21 signals an impending reversal.

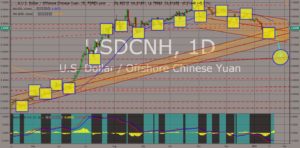

USDCNH

The pair will further go lower in the following days with the continued short term downtrend channel and breaking out of the long term uptrend’s support line, followed by an impending “Death Cross”. The pair was currently in a 90-day truce with the trade war between the United States and China. However, the trade war had been replaced by Intellectual Property theft, which saw the Five Eyes Intelligence Alliance’s, except Canada, banning of Chinese technology company Huawei amid security concern of its Fifth Generation (5G) network equipment. Recent data shows that both countries have been affected by the trade war, with China’s economic growth hitting the lowest in 28 years. While the United States experienced drought in Chinese investment, which greatly affects US companies trying to penetrate the Chinese market. Apple Inc. was the most visible US company affected by the trade war, which saw its market value lost $55 Billion on January 02 after its president Tim Cook warned slowing sales growth in China and blaming the trade war for the disappointing result. Histogram and EMAs 13 and 21 was expected to reverse in the following days.

USDTRY

The pair was moving slowly as it approached to break out of the “Falling Triangle” pattern and support the “Death Cross”. The relationship between the United States and Turkey were strained with Trump’s support for Saudi Arabia’s de facto leader and Crown Prince Mohammed bin Salman over the killing of Jamal Khashoggi on Saudi consulate. This was despite the Turkish government releasing a US Pastor accused of espionage. Turkey was an important geopolitical ally for counties trying to control the East and the West. Turkey is a Muslim majority country, and the gateway to Europe and Asia. It was trying to dominate the Middle East to reintegrate the Ottoman Empire. The United States had already lost its influence in Turkey after it Pivot to Russia to help Turkey in its fight with the separatist Kurdish militants who wants to establish an independent Turkish state. Histogram and EMAs 13 and 21 was expected to fall lower.

EURNZD

The pair is expected to continue its rally after bouncing back from MA 50. The World Economic Forum, also known as the Davos Summit”, will begin today, January 22, until January 25. The theme of the summit surrounds around the Fourth Industrial Revolution, and the struggles that the governments and companies need to overcome to keep up with the “Internet of Things”. US President Donald Trump canceled the US delegation’s trip to the annual summit, as the government was still facing the longest shutdown in the US history. Without Trump in the summit, the European Union will try to stir the attraction to show that the bloc was still intact and committed in protecting globalization amid the rising nationalism among countries, particularly with EU’s member states. However, Brazilian President Jair Bolsonaro was expected to match the European Union’s effort by replacing Trump during the summit. President Bolsonaro was dubbed as South American’s Trump. Though New Zealand was on the rise, the summit of the rich, Davos, was still out of hand from New Zealand’s control. Histogram and EMAs 13 and 21 already crossed over.

COMMENTS