Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

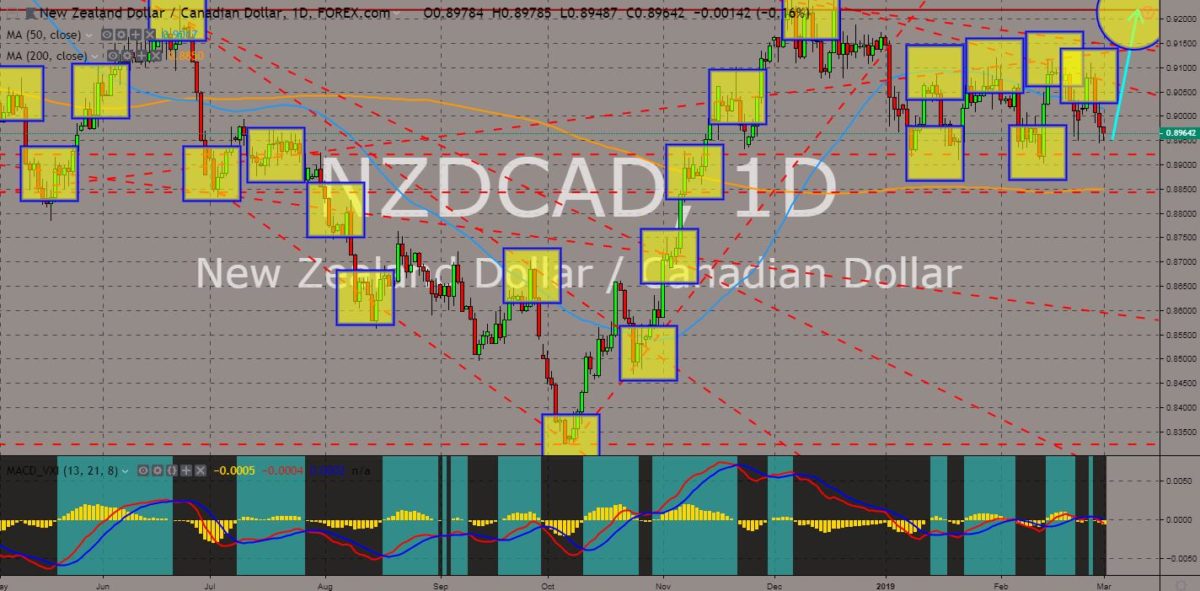

NZDCAD

The pair was expected to go higher in the following days as it was seen to bounce back from the support line and create an “Ascending Wedge” pattern. The trade war between the United States and China escalated from a widening trade gap to Intellectual Property theft on which US President Donald Trump pressured its allies to ban the Chinese technology company Huawei amid security concern. Canada is the only country among the Five Eyes Intelligence Alliance that didn’t ban the company. However, the United Kingdom and New Zealand changed their tone with the UK saying that their government’s spy agency can handle any threat that Huawei might possess, while New Zealand said that it never excluded Huawei from building its 5G (Fifth Generation) Network. Despite this, Canada still suffers from its broken relationship with China. Histogram and EMAs 13 and 21 was expected to reverse back.

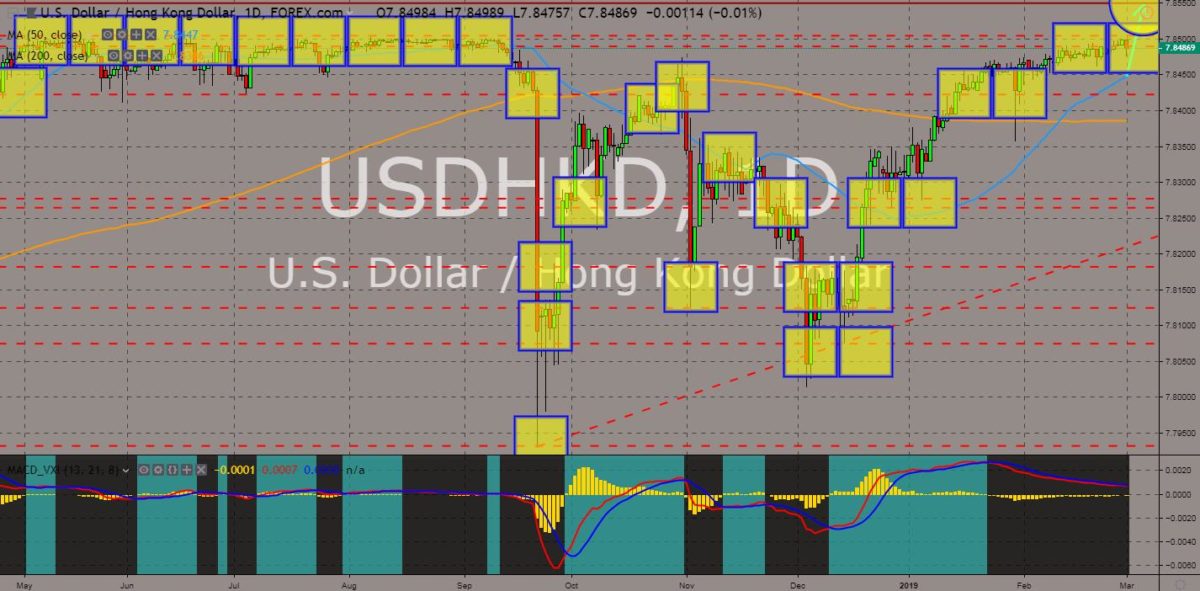

USDHKD

The pair was seen trading inside a major channel, which resistance might be challenge for the pair to reach an all time high. Hong Kong was sensible with the trade war between the United States and China, and regarding the ongoing tension with the disputes in the South China Sea. Today, March 01, is a crucial day for the 90-day truce between the US and China as the truce was set to expire. However, US President Donald Trump said that he is willing to extend the truce for another 60 days after a substantial progress was seen on the negotiation. Aside from that, US Secretary of States Mike Pompeo assured that the US will honor its defense treaty with the Philippines under the Article 04 of their Mutual Defense Treaty, which states any armed attack on any Philippine forces, aircraft, or public vessels in the South China Sea, the US will retaliate back. Histogram and EMAs 13 and 21 was expected to cross over.

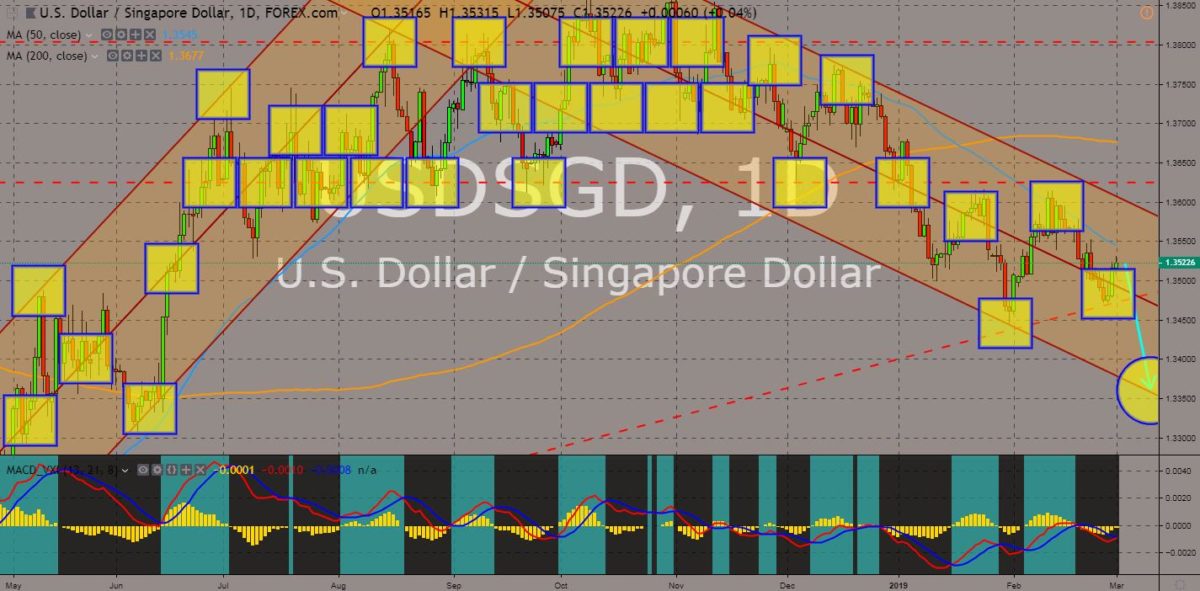

USDSGD

The pair was expected to fail to break out of 50 MA and another major support line, sending the pair to the down trend channel support line. Despite Singapore buying four (4) US F-35 Joint Strike Fighter, Singapore choose to maintain neutral when it comes to the rivalry between the United States and China. Singapore is the nearest passage way connecting the South China Sea to the Indian Ocean. China is in a 99-year lease with Sri Lanka’s biggest strategic port, and if it wanted to make use of it, it must be an ally to Singapore, which was dominated by Chinese nationals. This puts pressure to the United States who might lose control of the Chagos Islands in the Indian Ocean, with the United Nations International Court of Justice who ordered the United Kingdom to return the control of the islands to Mauritius. The United States is leasing those islands from UK. Histogram and EMAs 13 and 21 was expected to fail to crossover.

EURDKK

The pair was expected to bounce back from a support line and 200 MA, which will make the pair to continue its upward movement. Denmark was expected to take the United Kingdom’s role in the European Union once the UK officially withdraws from the bloc on March 29. Denmark was the United Kingdom’s closest friend inside the EU, which can be a key in striking a deal that will be approved both by the European and UK Parliament. Denmark was also open in delaying the Brexit to prevent the UK from crashing out of the European Union. Aside from theses, the Danish lawmakers already proposed a deal that would allow British citizens to stay in the country in case of a “No Deal Brexit”. Denmark has the highest approval rate from its citizens who want the country to stay in the European Union, ahead of the de facto leaders, Germany and France. Histogram and EMAs 13 and 21 will continue its upward movement.

COMMENTS