Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

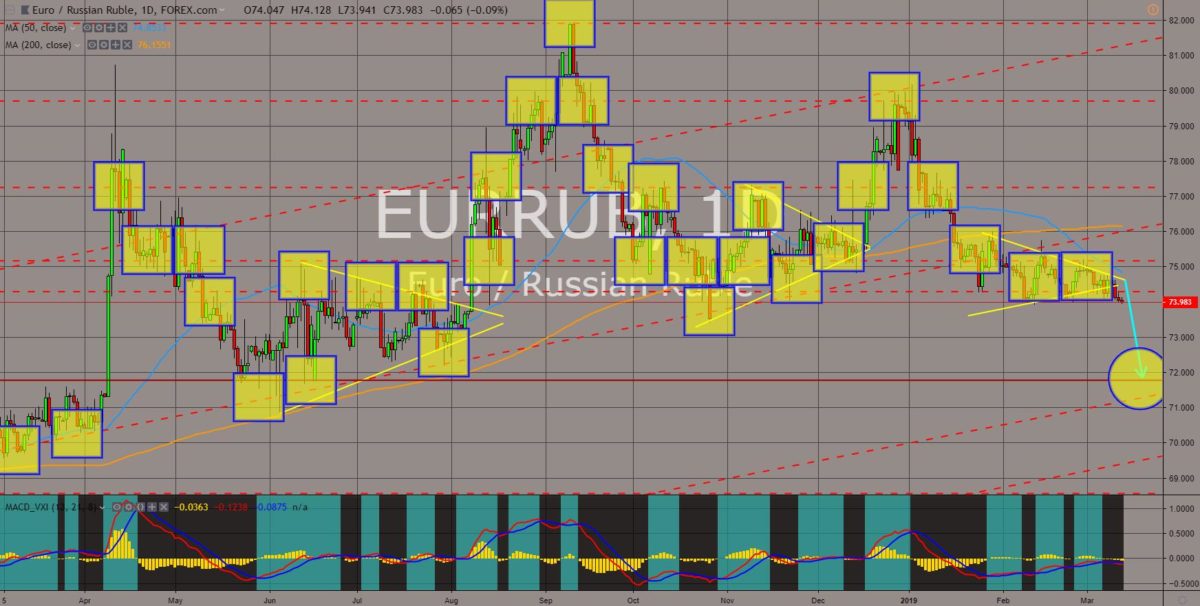

EURRUB

The pair broke down of the “Triangle Formation” sending the pair lower towards its nearest support line. The European Parliament had voted to approve a report stating that Russia “can no longer be considered a ‘strategic partner’” and that “the EU cannot envisage a gradual return to ‘business as usual’ until Russia fully implements the 2015 Minsk Agreement, which lays out a process for achieving peace in eastern Ukraine, and restores the territorial integrity of Ukraine,” following Russia’s annexation of Ukraine in 2014. The European Parliament also passes a resolution urging to halt Russia’s Nord Stream 2. Despite efforts by the European Union to shrug off Russia, it was reported that Russia will likely to meddle on the looming European Parliamentary Election, which will further weaken the European Union as it faced Russia’s continued aggression. Histogram and EMAs13 and 21 will continue to fall lower.

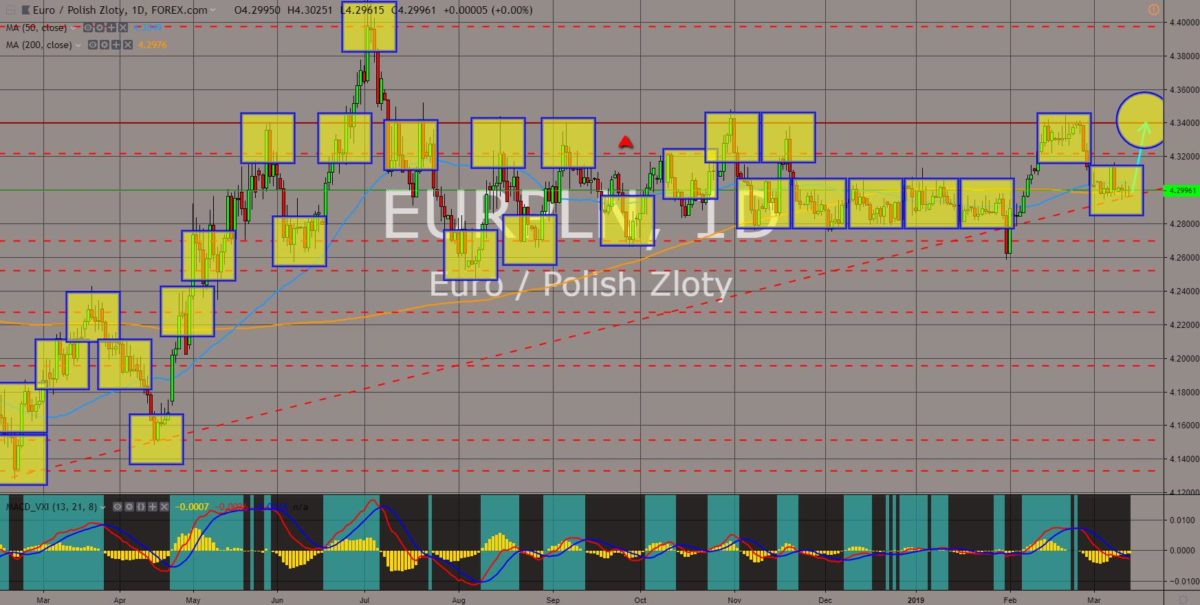

EURPLN

The pair was seen consolidating between MAs 50 and 200, and was supported by a major long-term support line, which signals a future rally for the pair. After the European Parliament ordered Hungary to return $13.22 Million of EU funds, it was now looking to retaliate with the rebellion of the Visegrad Group headed by Hungary and Poland. The European Commission found fault with Poland’s food safety documents, which could lessen Poland’s import inside the 27-nation bloc. Poland nationalists are also facing a major defeat ahead of Poland’s ruling party. This was after European Commission President Donald Tusk, who is a Polish national, called his countrymen to vote out nationalist candidates ahead of the European Parliamentary Election on May 23-26, 2019. Poland Nationalists urged other EU members to establish an anti-EU league. Histogram and EMAs 13 and 21 was expected to reverse in the following days.

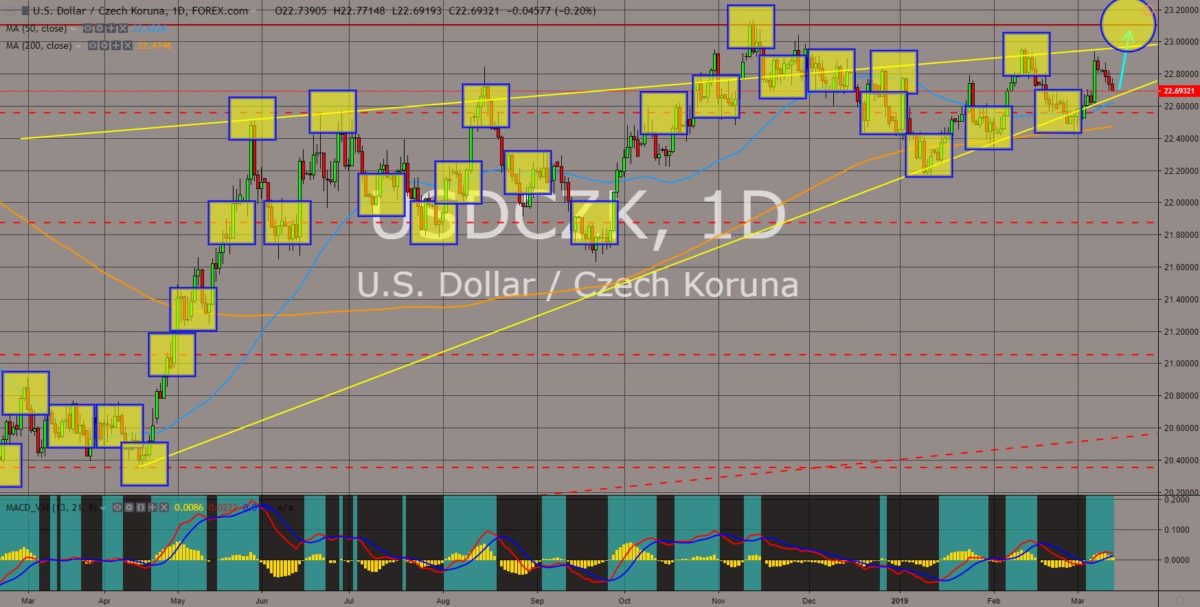

USDCZK

The pair was expected to bounce back from the “Rising Wedge” pattern support line and break out of the resistance line to retest its previous high. Chinese technology company Huawei used to be Czech Republic’s favorite telecommunication network, with Czech’s former Prime Minister striking a deal with China that resulted to billions of investments to the Czech Republic. However, as the United States backed the Visegrad Group, it is seen pressuring Hungary, Poland, the Czech Republic, and the Slovak Republic to bend on its will. Czech Prime Minister Andre Babis recently met with US President Donald Trump in the Oval office to discuss the strengthening relationship between the two (2) countries. The meeting also marked the 20th year of Czech Republic joining the NATO (North Atlantic Treaty Organization) Alliance. Histogram and EMAs 13 and 21 was expected to fail to reverse and to continue its upward movement.

EURSEK

The pair was seen to breakout o the stiff “Triangle Formation” to retest a major resistance line for the third time. A referendum calling for the departure of Sweden from the European Union was off the menu at election for the first time in 24 years. This was despite a survey showing 86% of European Union citizens felt that they are not attached to Brussels, which was the capital of the EU. If the European Parliamentary election on May 23-26 will go as planned, then German Chancellor Angela Merkel and French President Emmanuel Macron will be expected to dominate the EU. The two (2) leaders were considered as the former and incumbent de facto leader of the European Union. They also renewed their vows to lead the European Union and with President Macron dubbing it as a “Renaissance”. Histogram and EMAs 13 and 21 was expected to reverse in the following days to continue its upward movement.

COMMENTS