Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

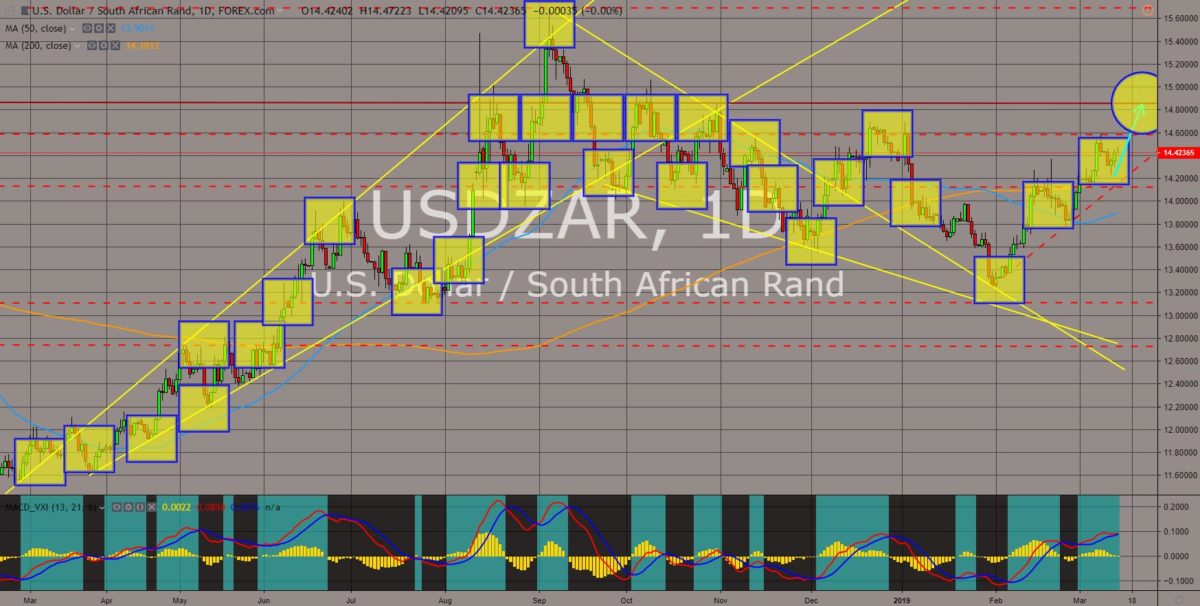

USDZAR

The pair will continue its upward movement following its bounce back from 200 MA and supported by uptrend support line. The United States and South Africa’s relationship continued a narrowing gap as Africa pivots to China in return for soft loans, grants and investments, as part of China’s Belt and Road Initiative. It also supported the Maduro government defying the United States support for the opposition leader and self-proclaimed interim president Juan Guaido. Brazil was the only country among the BRICS (Brazil-Russia-India-China-South Africa) that didn’t back Maduro as Brazil was seen to be more inclined with the United. South Africa headed the African Union, which was the largest bloc in the African continent. But its leadership was seen falling with different African nations struggling to keep up their economies. Histogram and EMAs 13 and 21 was expected to fail to crossover and continue its upward movement.

USDRUB

The pair broke down from a major support line after failing to break out from MAs 50 and 200, followed by the formation of the “Death Cross”. After the United States and Russia pulled out from the 1987 nuclear pact, the INF (Intermediate-range Nuclear Forces) Treaty, the two (2) countries had since then announced that they will be developing nuclear weapons that had been banned by the treaty. The treaty prevents the United and Russia to develop a new generation of weapons that can reach Europe, after the continent became the battleground of the proxy war during the Cold War. The NATO (North Atlantic Treaty Organization) Alliance, who won the Cold War against the USSR (Union of Soviet Socialist Republics), was falling with German Chancellor Angela Merkel and French President Emmanuel Macron planning to establish a European Army. Histogram and EMAs 13 and 21 recently crossed over.

USDNOK

The pair was expected to continue going up after it was seen on the uptrend support line, sending the pair higher to retest its previous high. The United States and Norway is currently conducting an observation flight over Russian territory this week as part of the Open Skies Treaty, which Russia is also a signatory. The move was made after Russia increased its build-up of its military weapons on its border with Norway. Norway is not part of the European Union but was a member of the NATO (North Atlantic Treaty Organization) Alliance. Russia was seen to be more aggressive following its departure from the INF (Intermediate-range Nuclear Forces) Treaty with the United States. In 2014, Russia annexed a Ukrainian territory, with Ukraine currently on process to apply for a membership in the European Union and the NATO Alliance. Histogram and EMAs 13 and 21 was expected to reverse back in the following days.

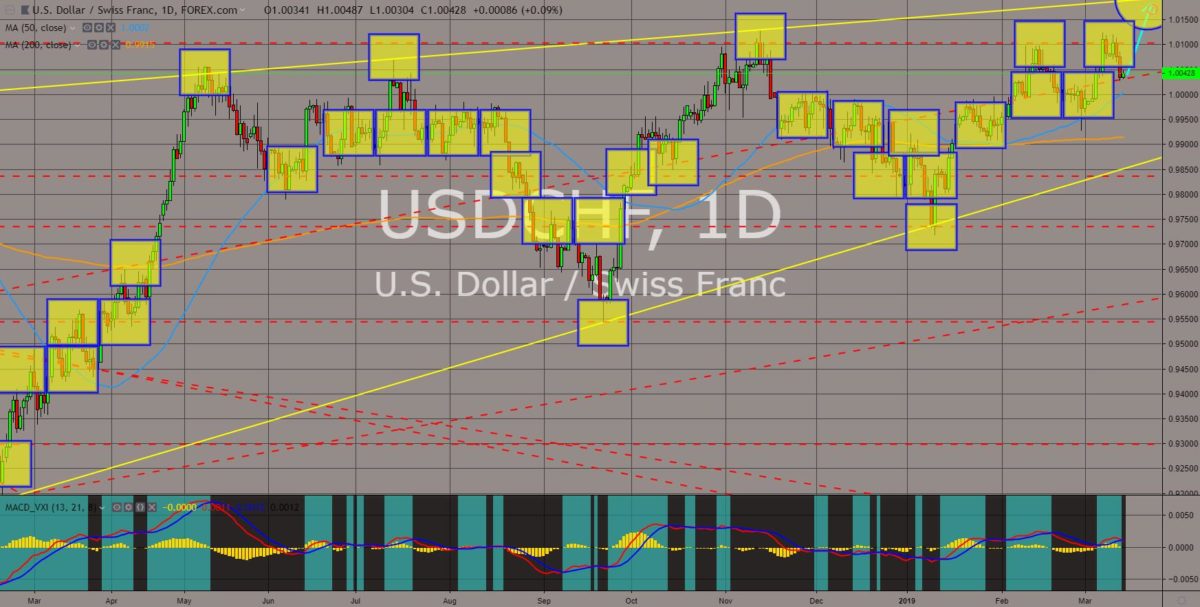

USDCHF

The pair was seen to further go up in the following days after it bounced back from a support line, followed by a failed crossover between MAs 50 and 200. After the defeat of the USSR (Union of Soviet Socialist Republics) during the Cold War, the United States became the sole superpower country in the world. It has then placed itself at the center of everything, especially in these three (3) areas – Military (patrolling the international waters), Economic (creation of the Bretton Woods Institutions: World Bank and the International Monetary Fund), and Politics (permanent seat in the United Nations). This was an enlargement of what is seen in Switzerland, which was considered as the most neutral country in the world, who is not a member of the European Union despite being surrounded by EU-members. Histogram will fail to enter the bear territory, while EMAs 13 and 21 was expected to reverse in the following days.

COMMENTS