Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

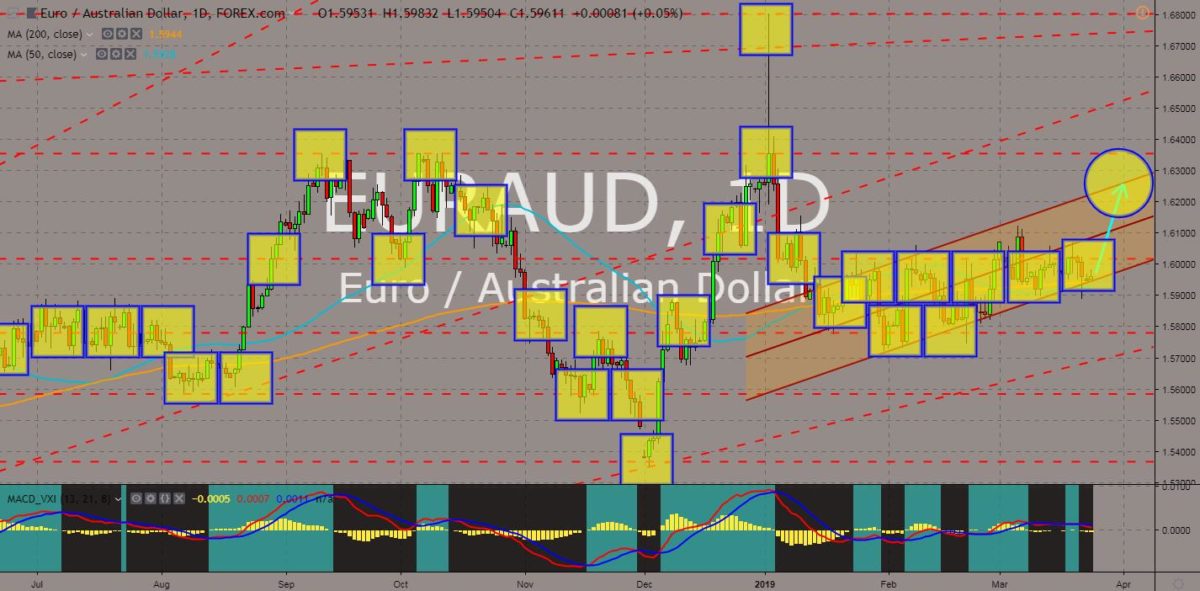

EURAUD

The pair was expected to bounce back from the uptrend channel support line to retest the pair’s previous highs. The European Union took back the control of the Brexit as the United Kingdom was set to depart from the bloc within five (5) days wit no clear plan after the second deal negotiated by UK Prime Minister Theresa May was declined by the UK Parliament increasing the likelihood that the UK might crash out of the EU without a deal. This lost of the UK was also Australia’s lost as among the former British colonies – Canada, Australia and New Zealand – the country was deeply exposed to the United Kingdom’s market. Australia also entered a recession for the first time in three (3) decades, which could lead to the start of the 21st Century Global Financial Crisis, with the UK expected to enter a recession in the scenario of a “No Deal Brexit”. Histogram and EMAs 13 and 21 was expected to reverse back.

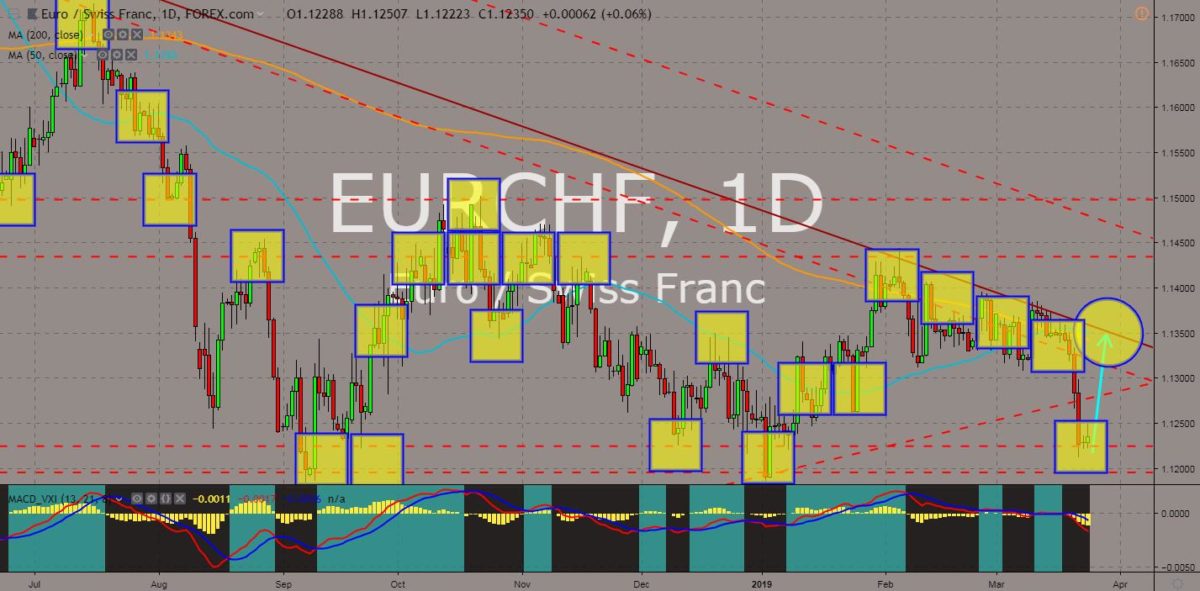

EURCHF

The pair was seen to retest a down trend resistance line after bouncing back from a major support line. The uncertainty surrounding the Brexit, with only five (5) days remaining before the United Kingdom was set to officially withdraw from the European Union, had been putting countries such as Australia and Switzerland at risk. These two (2) countries are signatories of the post-Brexit trade agreement who sided with the UK as the rift between the United Kingdom and the EU intensifies. A week before the UK will leave the European Union, the Swiss Parliament voted to officially invalidate its 1992 application to join the EU. Switzerland was the only country who has access to EU’s Single Market and Customs Union through a series of bilateral agreement, which the European Union hopes to incorporate into a single framework. Histogram begin to side on the buying pressure with EMAs 13 and 21 was seen to follow.

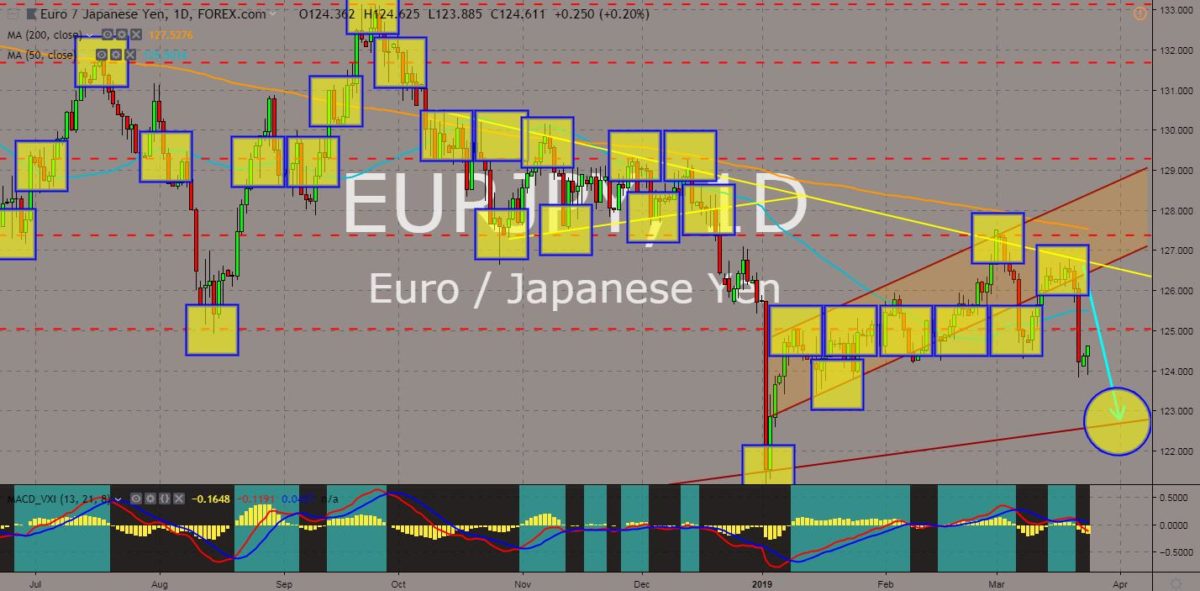

EURJPY

The pair was expected to continue its decline to the nearest support line following its failure to break out of the downtrend support line. The ratified EU-Japan Free Trade Deal created the largest trading zone in the world with Japan leading the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) with Australia, while the European Union was the largest trading bloc in the world. However, with the slowdown in global growth and the fear of recession taking place, the Japanese Yen elevated as the safe-haven as the United States bond market signaling a recession in the end of 2019 to mid-2020. This was backed by Warren Buffet and Bill Gates, but the Federal Reserves of the US says otherwise. The partnership between the two (2) countries was further strengthened by the EU taking control over the Brexit as the United Kingdom heads to the deadline without a deal. Histogram and EMAs 13 and 21 will continue to go down.

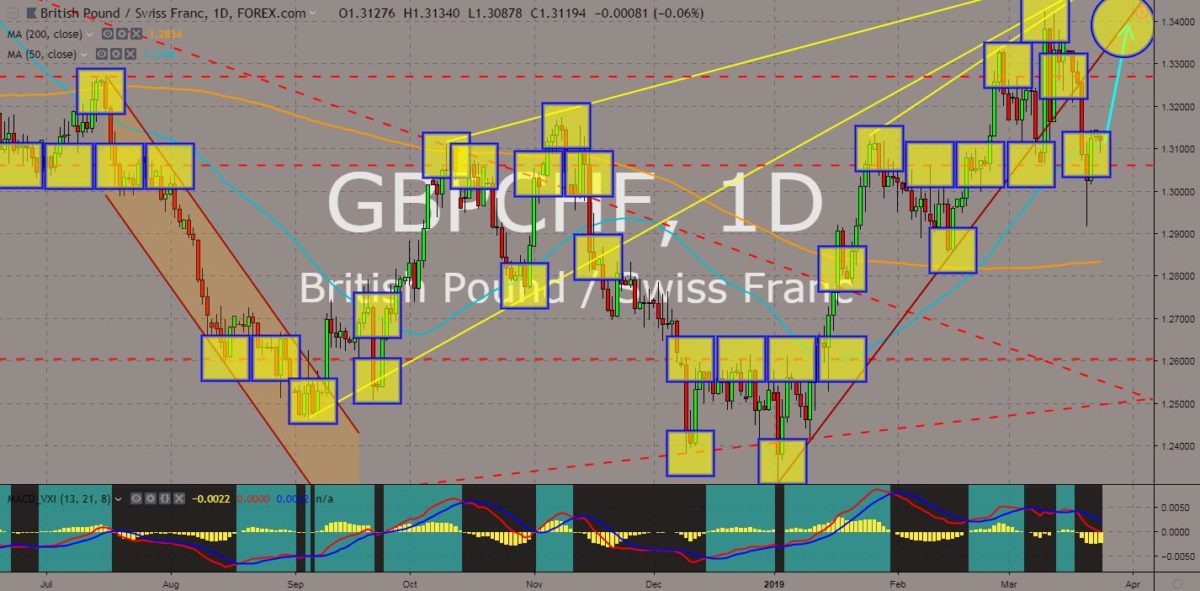

GBPCHF

The pair was seen to bounce back from a major support line, sending the pair to retest the uptrend channel support line. This March, the United Kingdom and Switzerland sign a post-Brexit trading agreement, which ensures the trading relationship between the two (2) countries, despite the UK leaving the European Union without a deal. However, things seemed to go way the other way around as UK was struggling with the pressure for UK Prime Minister Theresa May to prevent a No Deal Brexit, for the UK Parliament to ensure that the UK will benefit from the withdrawal, and for the British people to demand a second referendum on Brexit. Switzerland on the other hand, had voted to invalidate its 1992 application to become a member of the European Union, making the country more aligned with the United Kingdom. Histogram and EMAs 13 and 21 was seen to reverse in the following days.

COMMENTS