Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

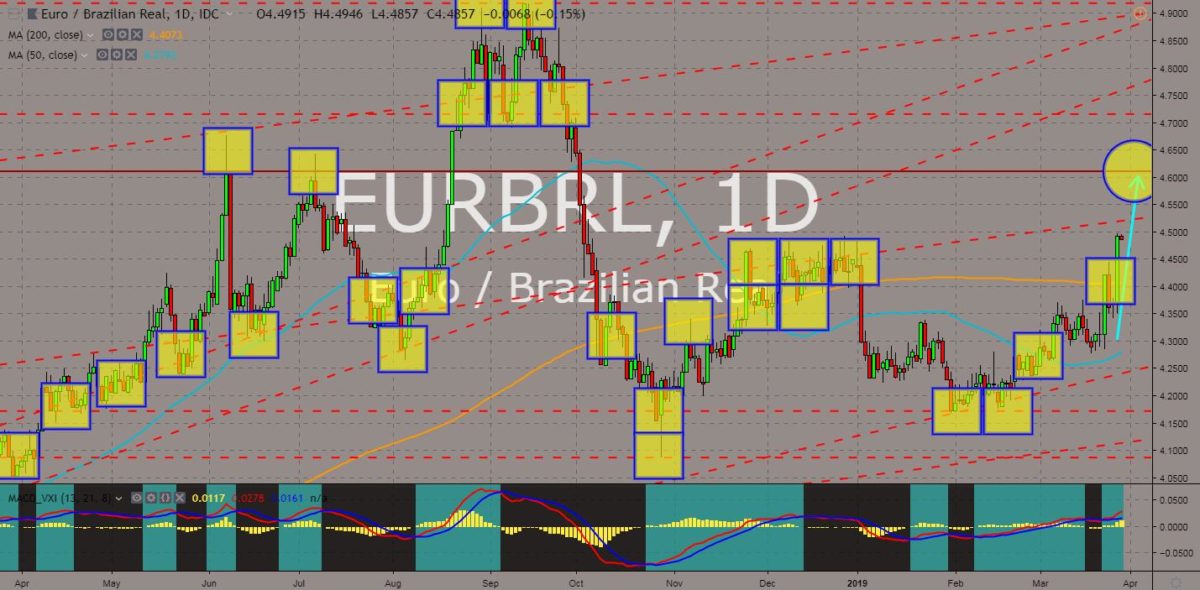

EURBRL

The pair found a strong support line from 50 MA that lead to the pair’s breakout from 200 MA and was expected to retest its 7-month high. After only eighty-seven (87) days, Brazilian President Jair Bolsonaro was already in trouble. President Bolsonaro’s approval rating suffer a 16-point drop since he assumed the office in January and currently stands at just over 50 percent. His promise to fix Brazil’s economy during the election failed to materialize, with Brazil’s lower house president, Rodrigo Maia, will no longer negotiate on behalf of the government’s pension reform in Congress, potentially dealing a major blow to President Bolsonaro’s legislative agenda. President Bolsonaro also expressed no interest of military intervention in Venezuela, despite Russia sending its military in Venezuela to protect Maduro’s interest. Brazil is backing the opposition leader Juan Guiado. Histogram and EMAs 13 and 21 will continue to go up.

USDBRL

The pair will continue its rally and breakout from the “Rising Widening Wedge” pattern resistance line and retest another major resistance line. With Brazilian President Jair Bolsonaro being dubbed as the “Trump of South America”, it would be likely that President Bolsonaro and US President Donald Trump will get along together and strike agreements that will benefit the two (2) countries. However, the slumped in President Bolsonaro’s trust rating could further derail its ambition to “Make Brazil Great Again” and might look toward President Trump’s assistance in his country, particularly in South America. President Bolsonaro already suggested for American troops to be deployed on its soil to help him protect the country, which can pave way for South American NATO (North Atlantic Treaty Organization) Alliance. Histogram will continue moving upwards, while EMAs 13 and 21 shows an extended upward movement.

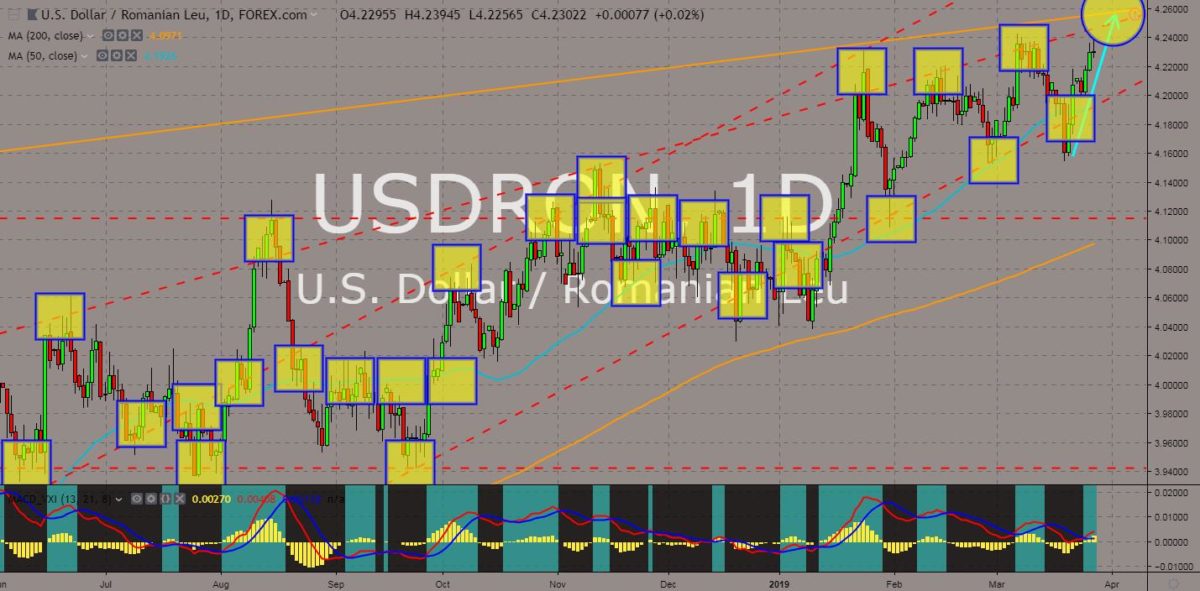

USDRON

The pair will retest a major resistance line after bouncing back from the uptrend support line, indicating a healthy uptrend movement. The United States was seen increasing its influence in Europe after it hinted a possibility of signing a post-Brexit agreement with the United Kingdom. It had also lobbied the Eastern and Nationalist bloc, the Visegrad Group (Hungary, Poland, Czech Republic, and the Slovak Republic. It has also close ties to Denmark, who will fill the UK’s role in the power balance together with Germany and France. The United States deployed its military in Romania following Russia’s annexation of Crimea, a territory of Ukraine. Ukraine is applying to become a member of the European Union and the US-led NATO (North Atlantic Treaty Organization) Alliance. US Vice President Mike Pence could also visit Romania in the coming months. Histogram and EMAs 13 and 21 will continue to go up.

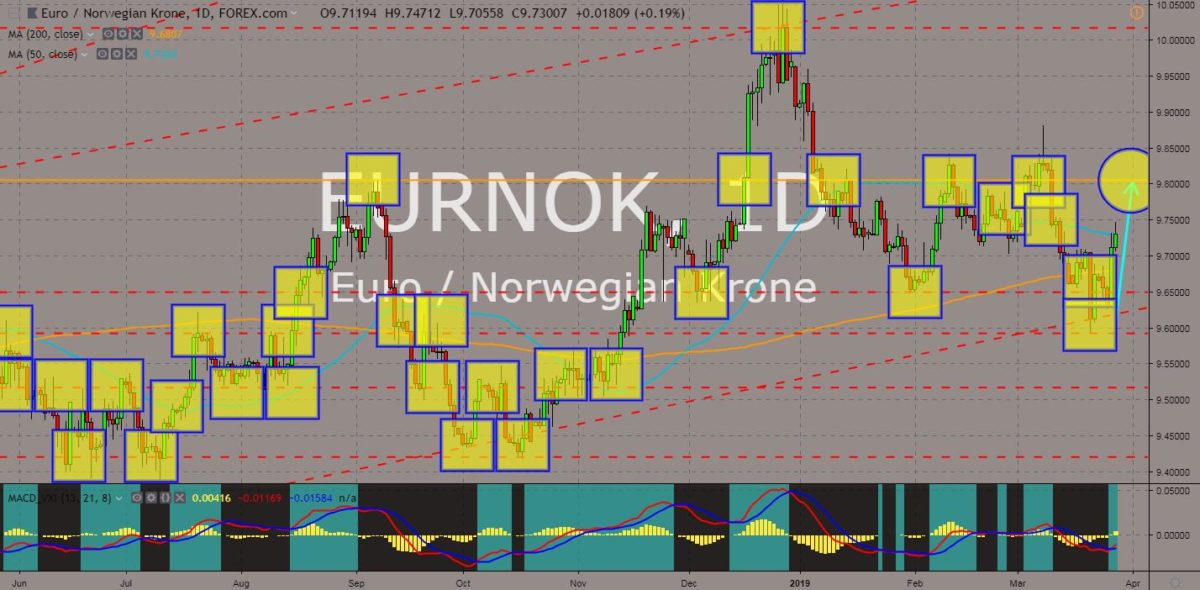

EURNOK

The pair was expected to retest its previous highs after bouncing back from four (4) support lines. The United Kingdom was set to officially withdraw from the European Union tomorrow, March 29. However, UK Prime Minister Theresa May was still struggling to pass a deal that will be approve by the UK Parliament after her previous deals were rejected by the MPs. PM May and the British Parliament also expressed their willingness to extend the Brexit. Norway’s model is one of the options that the UK was looking forward into. Norway is not a member of the European Union but can access the EU’s Customs Union through the EEA (European Economic Area). However, it was unwilling for the UK to join the EFTA (European Free Trade Agreement), which will give the UK an upper hand from the rest of non-EU countries.

COMMENTS