Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

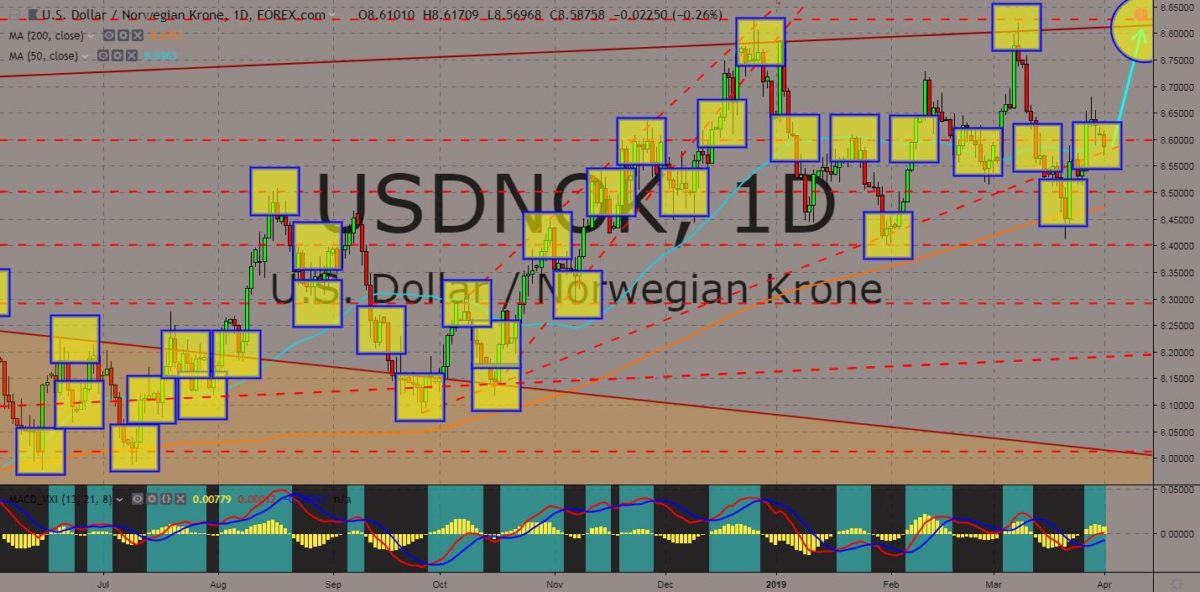

USDNOK

The pair was set for a rally as it sits on three (3) support lines – an uptrend support line, a major support line, and the 50 MA. The United States Air Force has deployed six B-52H bombers to Europe to conduct exercises that take them close to Russia. The exercise appears to be a tit-for-tat gesture for recent Russian bomber flights in the Arctic near the US state of Alaska. Norway invited the United States to double its military personnel deployed over the country as threat of Russian aggression in the region was escalating. Norway is dependent on the US led NATO (North Atlantic Treaty Organization) Alliance as it was not a member of the European Union, who recently announced its plan to establish an EU military with the renewed vow from German Chancellor Angela Merkel and French President Emmanuel Macron, two (2) de facto leaders of the EU, with the Aachen Treaty. Histogram and EMAs 13 and 21 will continue to go up.

USDCZK

The pair found a strong support line after being sold down as part of a healthy pullback and was expected to retest its 5-month high. The United States had successfully lobbied the Eastern and Nationalist bloc, the Visegrad Group (Hungary-Poland-Czech Republic-Slovak Republic) to continuously defy the European Union and to derail the plan led by the two (2) de facto leaders of the EU, German Chancellor Angela Merkel and French President Emmanuel Macron, to militarize the EU to cut the bloc’s dependence of the US led NATO (North Atlantic Treaty Organization) Alliance. This March, Czech Prime Minister Andrej Babis met with US President Donald Trump, which signals a strengthening relationship between the two (2) countries. However, the Czech Republic needs to comply with the US policies in order to continuously get the US support. Histogram and EMAs 13 and 21 will continue to go up in the following days.

EURCZK

The pair was seen failing to breakout of a downtrend resistance line sending the pair lower to the uptrend support line. The European Union was facing a rebellion inside the bloc with the Visegrad Group aligning themselves to the United States agenda for the region amid concerns of immigration led by German Chancellor Angela Merkel’s policies and the inability of the bloc to protect itself from Russian aggression, an issue to which the EU’s de facto leader and French President Emmanuel Macron was trying to address by planning to militarize the EU and to halt EU’s dependence from the US Led NATO (North Atlantic Treaty Organization) Alliance. The European Parliamentary election was being closely watch by experts and investors to have a glimpse of the future of the 27-nation bloc following the departure of the United Kingdom. Histogram and EMAs 13 and 21 was seen to be reversing back in the following days.

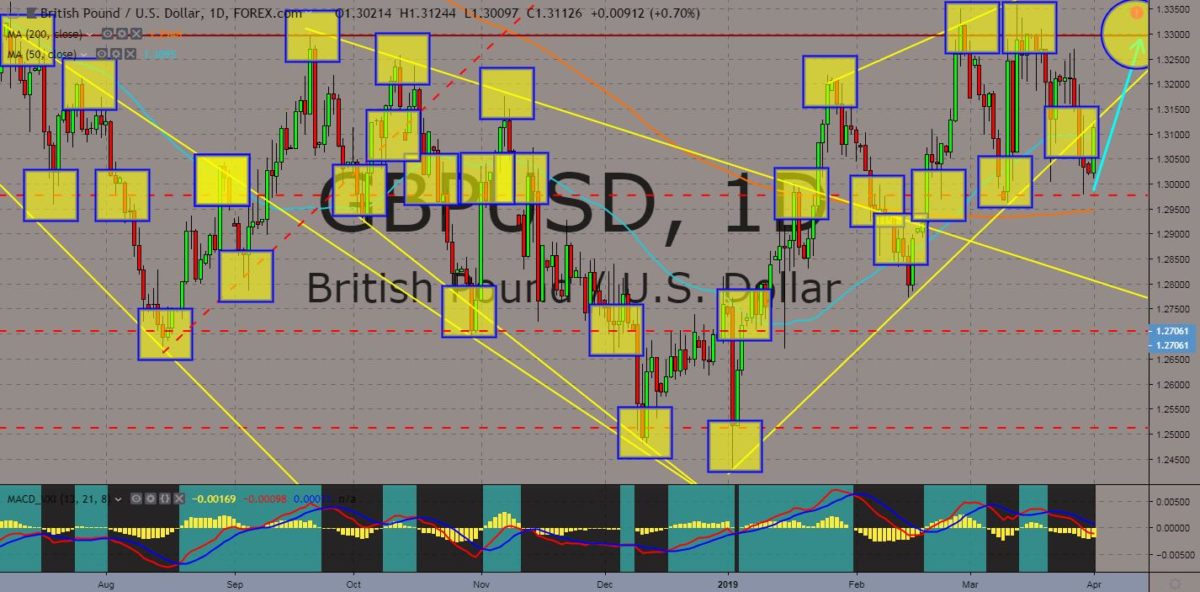

GBPUSD

The pair found a strong support line, which will further send the pair higher in the following days. UK Prime Minister Theresa May was being pushed in seven (7) different directions amid deadlock. This was after she suffered her third humiliating defeat after the UK Parliament turned down her deal. On the bright side, PM May and the European Union agreed a week before the UK’s date of departure to extend Brexit should her deal be rejected to prevent the United Kingdom from crashing out from the EU without a deal, which will hurt both economies. On the other hand, US National Security Advisor John Bolton retaliate that the United States was at the top of the queue for post-Brexit trade agreement. The deal will further boost US’ presence in Europe as it successfully lobbied the Eastern and Nationalist bloc, the Visegrad Group. Histogram and EMAs 13 and 21 started to reverse back after hitting the indicator’s previous low.

COMMENTS