Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

USDPLN

The pair was expected to bounce back after hitting an uptrend support line, sending the pair higher to retest its previous highs. The United States was seen to fulfill its plan to contain Russia in Europe after Poland of the Visegrad Group backed the accession of Bosnia and Herzegovina in the European Union. This will be a major blockade to Russia who was seen trying to penetrate to the EU with its annexation of Ukraine territory, the Crimea. The United States had already deployed its military and the THAAD (Terminal High Altitude Area Defense) system in Romania and was planning to sell US F-35 fighter jets to the Visegrad Group. Poland was a former Warsaw Pact signatory who allied with the USSR (Union of Soviet Socialist Republics) against the US led NATO (North Atlantic Treaty Organization) Alliance. Histogram and EMAs 13 and 21 was expected to fall lower in the following days.

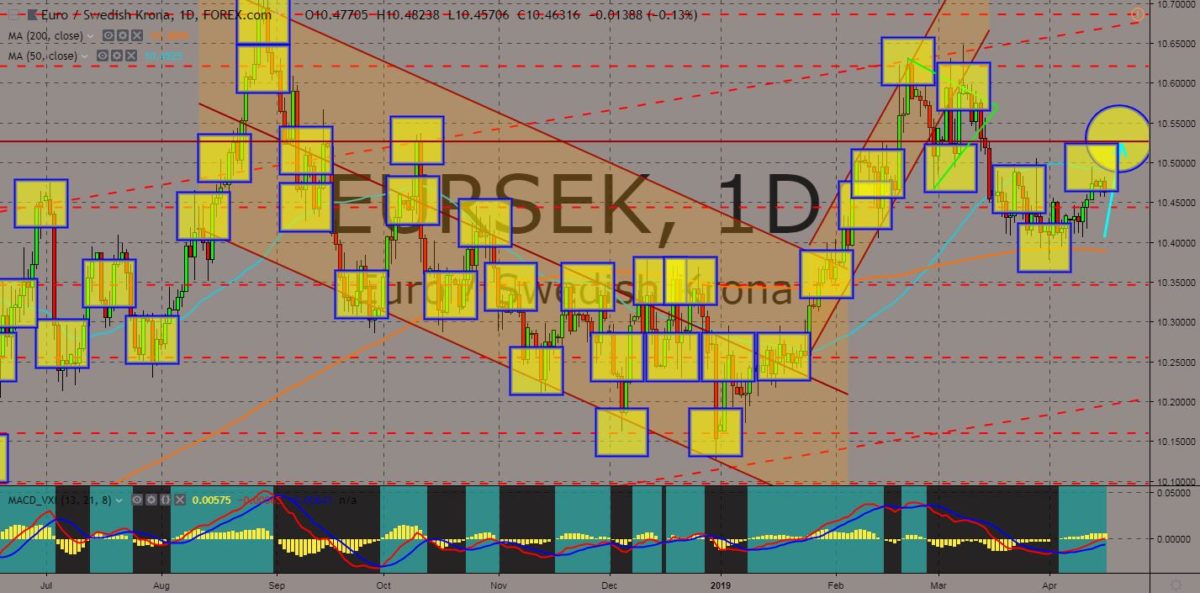

EURSEK

The pair was expected to continue going up in the following days and to retest a major resistance line. The European Council passed the European Copyright Directive, also known as the EU Article 13. It will take 2 (two) years for Article 13 to be fully adopted into an enforcible law by all EU member states. When enforced, EU Article 13 will make social media websites, including US tech giants, responsible for the copyrighted content which its users post online. This will further narrow the relationship between the United States and the European Union. However, a group of Swedish MEPs have revealed that they pressed the wrong button and have asked to have the record corrected. They have issued a statement saying they’d intended to open a debate on amendments to the Directive so they could help vote down Articles 13. Histogram and EMAs 13 and 21 was expected to continue going up in the following days.

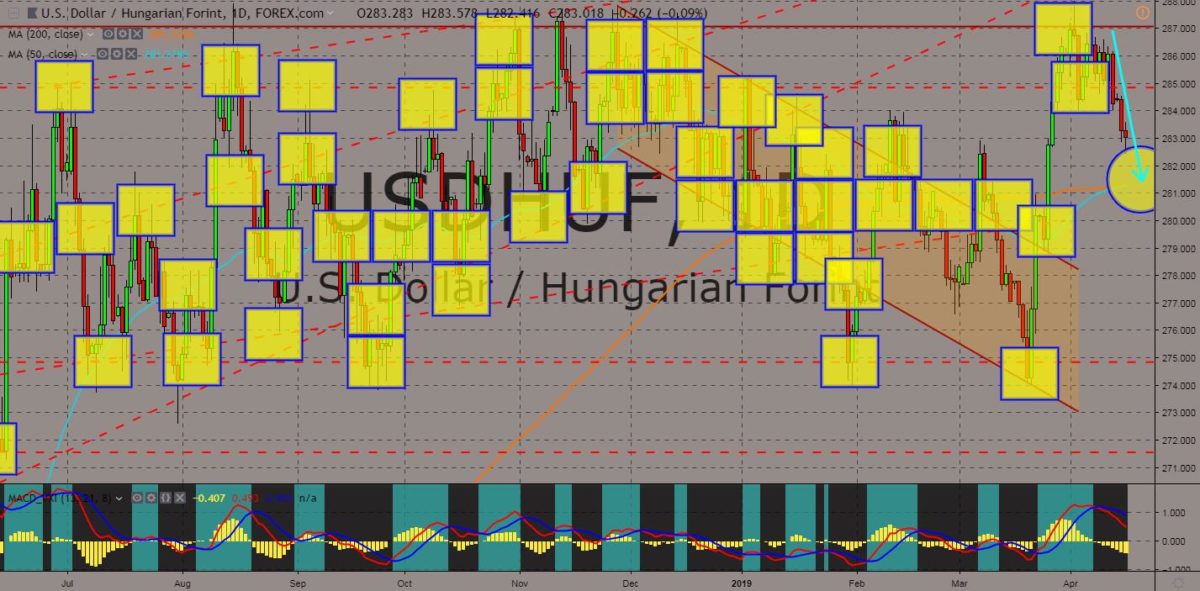

USDHUF

The pair will continue its steep decline following a potential cross over between MAs 200 and 50, which could further send the pair lower. The United States was seen increasing its effort to bolster its influence with the Visegrad Group. In the past few months, US Secretary of State Mike Pompeo visited the Visegrad Group to reaffirm US’ commitment with the group. The US had also signed a Defense Cooperation Agreement with Hungary on the day of the commemoration of the 70th founding anniversary of the NATO (North Atlantic Treaty Organization) Alliance. The uprising of Russia and its withdrawal, together with the United States, from a nuclear pact treaty, the INF (Intermediate-range Nuclear Forces), could also prompt the US to take a tougher stance on EU’s border with Russia. Histogram and EMAs 13 and 21 will continue to fall lower in the following days.

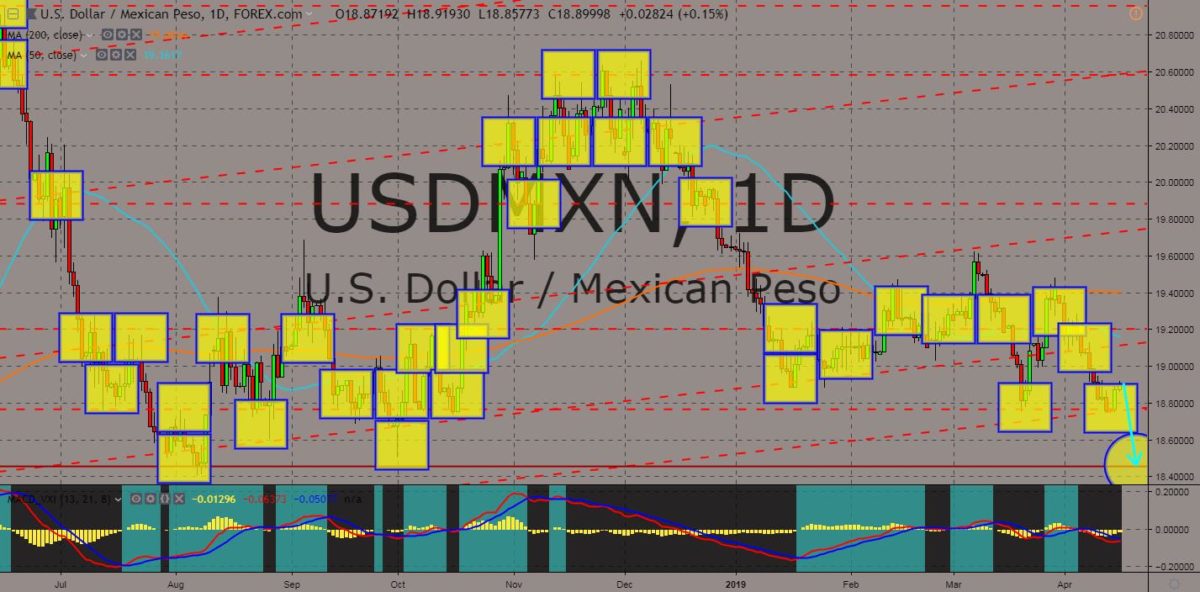

USDMXN

The pair was seen to break down from a major support line, continuing its steep decline towards the nearest support line. During the 2016 US Presidential Election, Donald Trump promised to make Mexico pay for a border wall. This had led to a series of threat by US President Donald Trump to shutting down his government for thirty-five (35) days, the longest government shutdown in US history, after the House of Representative, which is controlled by Democrats, denied Trump’s proposal to fund the border wall for $5 Billion. However, President Trump had already dismissed the option to shut down his government again. But now, Trump found a new way to threaten the US Congress to approve the funding budget by closing its southern border with Mexico. Trump will seek re-election in 2020 and his promised in 2016 to build the border wall will play a vital role in his bid. Histogram and EMAs 13 and 21 will fail to cross over.

COMMENTS