Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

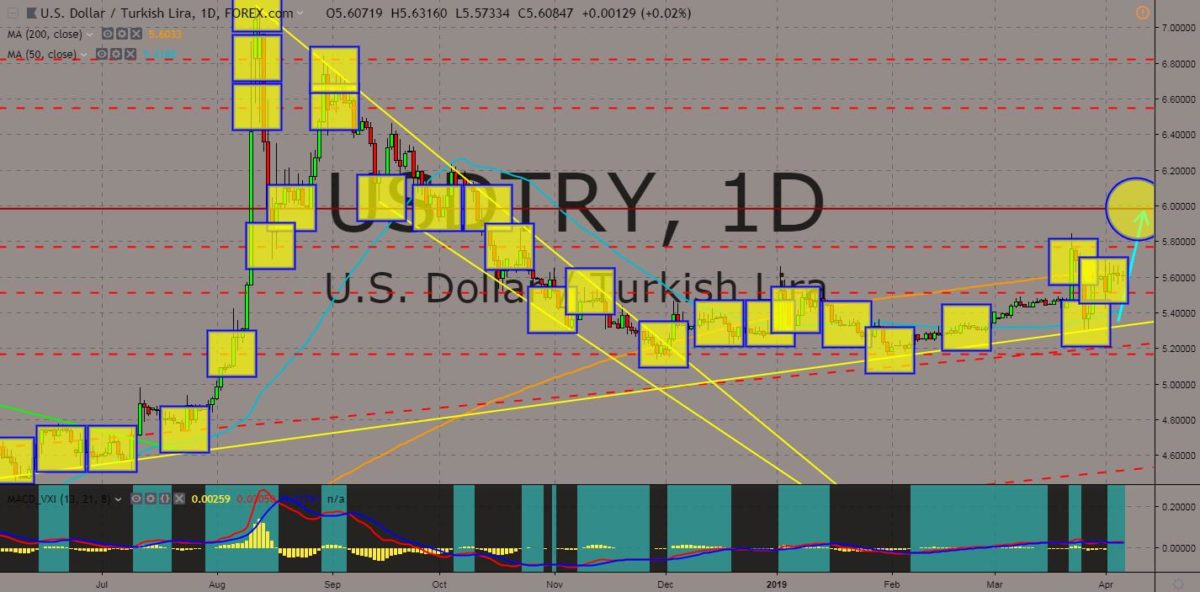

USDTRY

The pair was seen consolidating above 200 MA and was expected to go up in the following days to reach its 6-month high. Turkish President Recep Tayyip Erdogan says that his country will continue to pursue Russia’s S-400 ballistic missile defense system amid the United States pressure. Turkey is a member of the US led NATO (North Atlantic Treaty Organization) Alliance and was part of its defense sharing agreement. The US said that the purchase of Russian equipment will undermine America’s anti-ballistic missile defense system, the THAAD (Terminal High Altitude Area Defense) and the F-35 fighter jets. On the other news, President Erdogan’s AK Party suffered a major defeat in local Turkish election. Turkey will hold a general election on 2023, which could end President Erdogan’s rule of eleven (11) years as Prime Minister and as a president since 2014. Histogram and EMAs 13 and 21 was expected to go up.

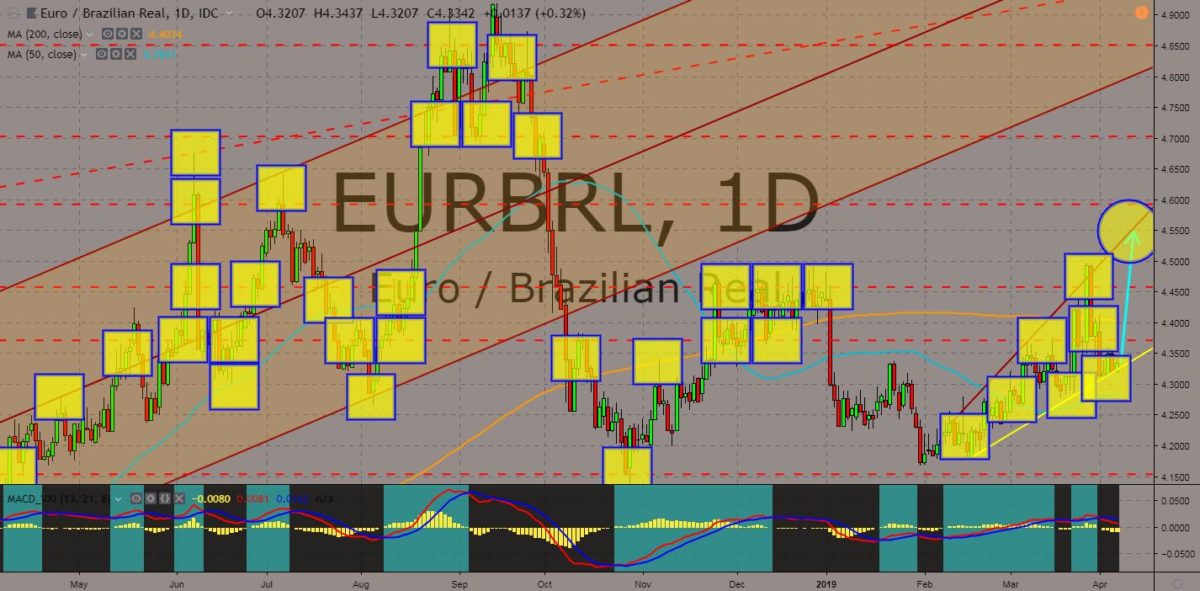

EURBRL

The pair was expected to bounce back after hitting the “Rising Widening Wedge” pattern support line. The European Union was trying to win South America after it successfully expanded its influence with Asia as the ratified EU-Japan Free Trade Deal, which became the largest trading zone in the world. On the other hand, the United States had pulled out from the TPP (Trans-Pacific Partnership), after the election of US President Donald Trump in 2016 prompted its withdrawal from the pact. It had since began to win the North and South America through the ratification of the NAFTA (North Atlantic Free Trade Agreement) and its partnership with Brazilian President Jair Bolsonaro with the US’ sixth military branch, the Space Force. However, President Bolsonaro’s approval rating plunged following his failure execute his promises during the election. Histogram and EMAs 13 and 21 was expected to fall in the following days.

USDBRL

The pair was expected to go higher in the following days after it found a strong support from a major support line and from 200 MA. The United States and Brazil signed an accord on space technology last week. This was after Brazilian President Jair Bolsonaro declared his intention of hosting US military bases in Brazil and following Trump’s creation of the sixth US military branch, the Space Force. Despite having a good relationship with the US, this could also potentially hurt Brazil as the end of the trade war between the United States and China could impact Brazil’s soybean export to China. During the trade war, Brazil accounted for 80% of China’s total soybean export. Aside from this, Brazil is also a member of the BRICS (Brazil-Russia-India-China-South Africa), which is an association of five major emerging national economies. Histogram and EMAs 13 and 21 was expected to reverse.

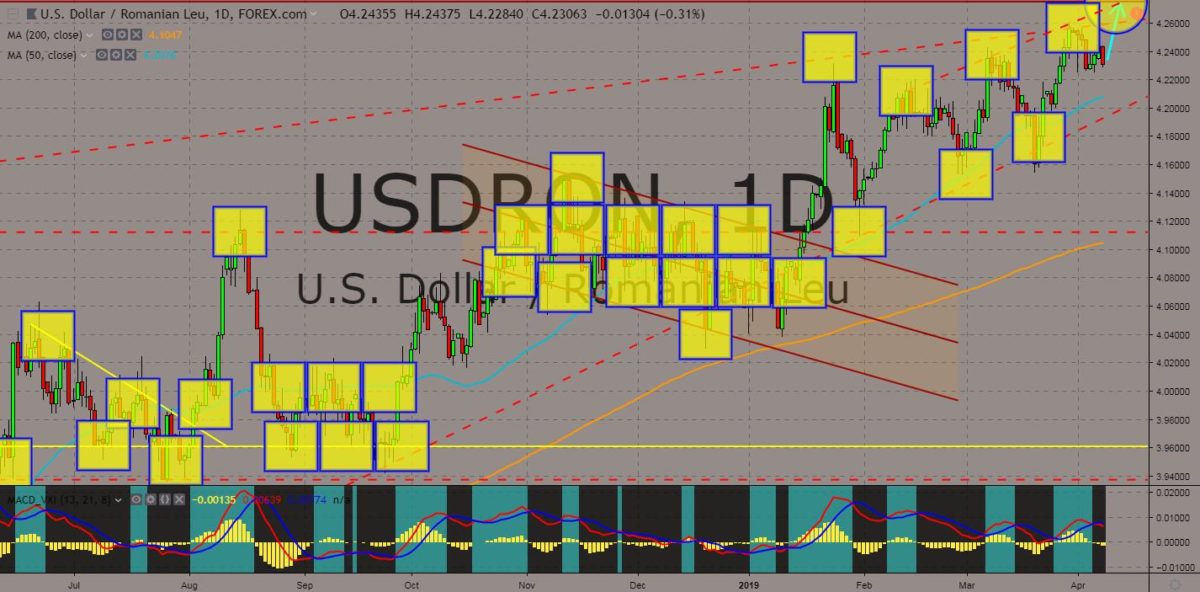

USDRON

The pair was seen to continue its upward movement and reach a 24-month high. The United States said in a statement that it was looking for a possibility to sell its F-35 fighter jets to Romania and Greece. This was after Turkey hold on to its commitment to purchase Russian S-400 ballistic missile defense system, which resulted to the US decision to no longer sell its fighter jets and defense system to Turkey despite being a member of the NATO (North Atlantic Treaty Organization) Alliance defense sharing agreement. The United States was seen positioning itself in Europe following its narrowing relationship with the European Union and the growing aggression of Russia. The US increased ties with Denmark and Poland (Baltic Sea), Romania and Greece (Black Sea) to prevent Russian naval ships of penetrating the North Atlantic Ocean. Histogram and EMAs 13 and 21 was expected to reverse.

COMMENTS