Here are the latest market charts and analysis for today. Check them out and know what’s happening to the market today.

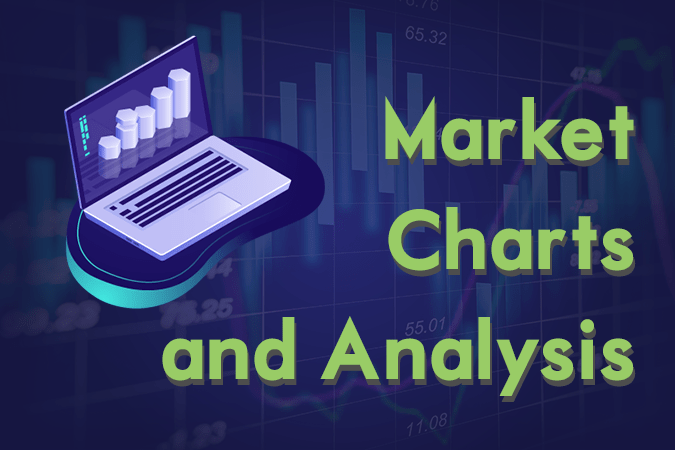

CADJPY

The pair was seen to fail to break out from 50 MA, sending the pair lower to the nearest support line. As Canada struggles with its relationship with China following it arrest of the Chinese telecommunication giant Huawei’s Global Chief Finance Officer as part of its extradition treaty with the United States, Japan had advised the country to shift its focus to its economy. Japan heads the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) on which Canada was also a member and was abandoned by the United States following the election of Donald Trump. Aside from economy, Japanese Prime Minister Shinzo Abe calls Canada for help in patrolling in the international waters together with other powers like the United States, Japan, Australia, the United Kingdom, France, and Germany, to counter China’s aggression in the South China Sea. Histogram and EMAs 13 and 21 will fail to crossover.

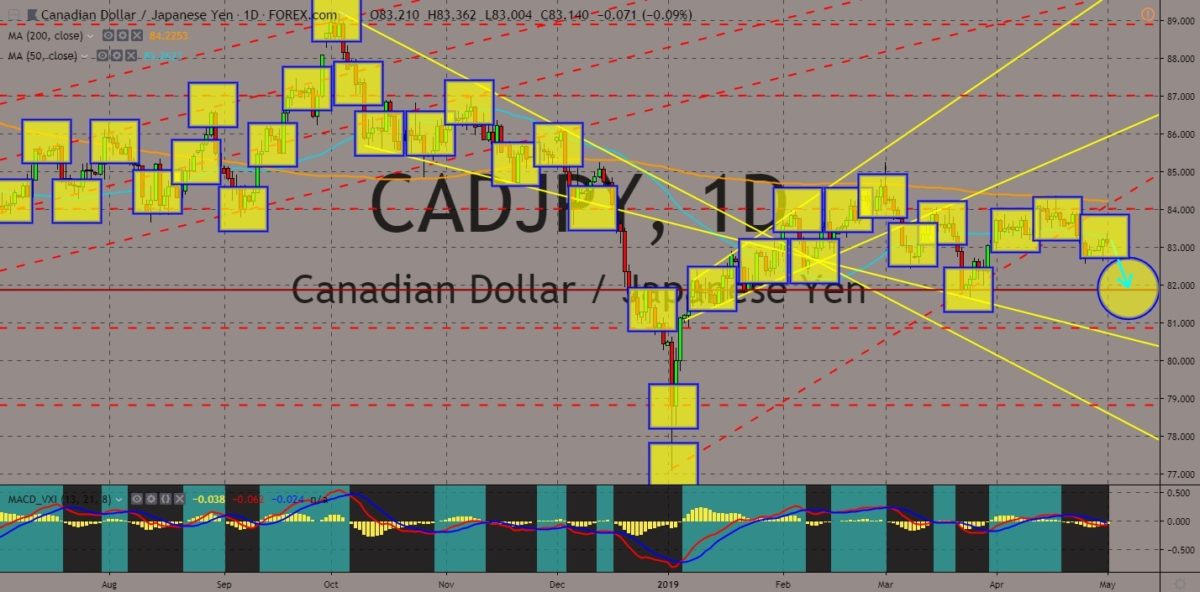

GBPCHF

The pair was expected to continue going up in the following days after finding a strong support line from 50 MA. The extension and uncertainty surrounding the Brexit is putting Switzerland’s future in dim. This was after the country signed a post-Brexit trading agreement with the United Kingdom, while rejecting a framework deal with the European Union, which incorporates the EU-Switzerland 20 main bilateral deals and 100 subsequent deals. Switzerland is neither a member of the EU’s Single Market nor the EU’s Customs Union, but its relationship with the European Union was built on a series of bilateral agreements. The United Kingdom’s withdrawal from the 27-nation bloc was extended until October 31. The post-Brexit agreement signed by the two (2) parties will also depend on the deal that will be approve both by the British Parliament and the European Parliament. Histogram and EMAs 13 and 21 will continue to go up.

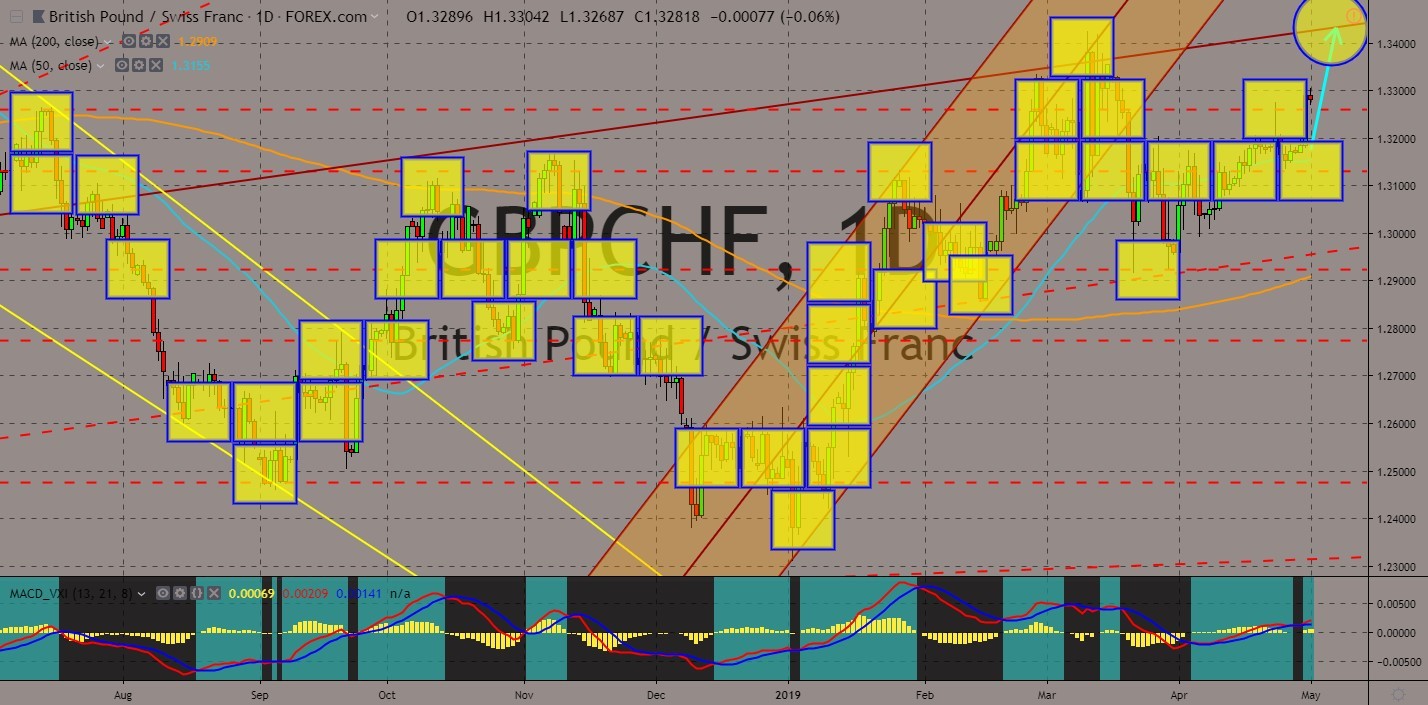

EURAUD

The pair broke out from the “Pendant Pattern”, sending the pair higher towards a major resistance line. The European Union increased its tariffs and quotas on Australian agricultural exports after Australia signed a post-Brexit trading agreement with the United Kingdom, giving the country an unfair advantage from other allies of the 28-nation bloc. The European Union was also supporting Australia’s regional rival in the Asia Pacific, Japan, through its ratification of the EU-Japan Free Trade Deal, which became the largest trading zone in the world. Australia’s economy was also expected to further weaken after the Brexit extension and the uncertainty surrounding the Brexit deal puts its trading relation with the United Kingdom in dim. The country recently entered a recession (base of GDP per capita), the first time in 27 years. Histogram and EMAs 13 and 21 was seen to further go up in the following days.

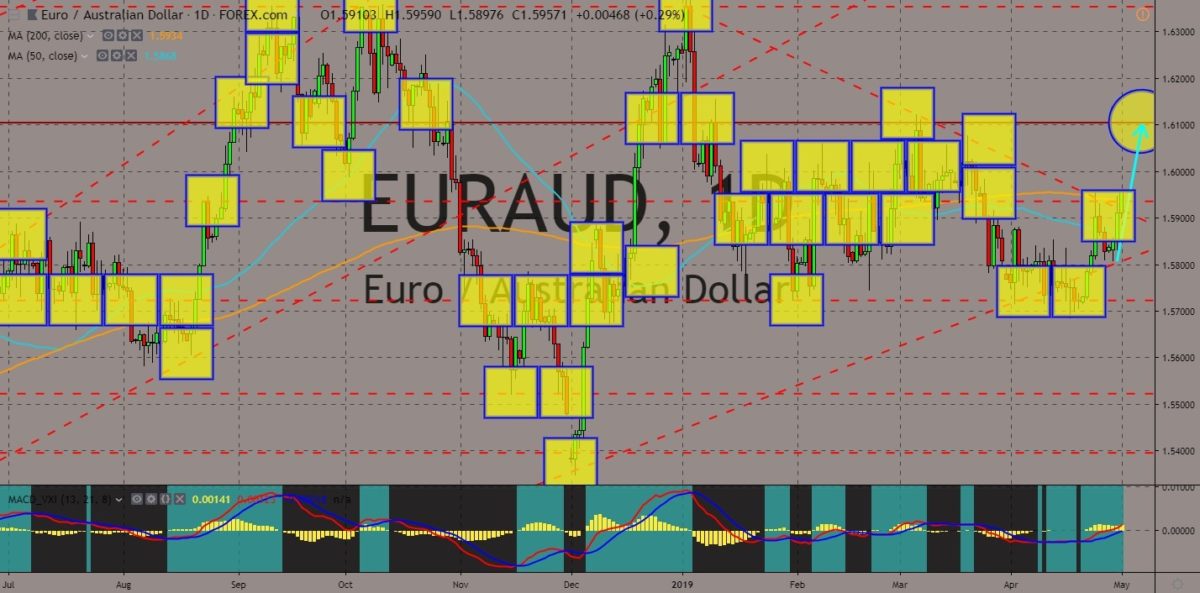

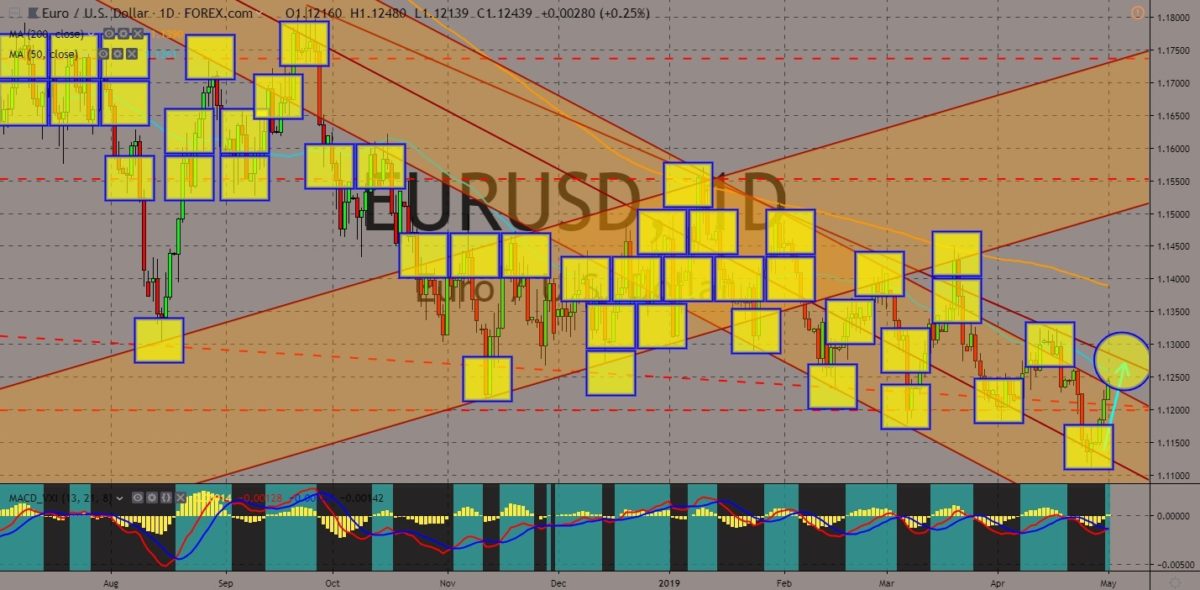

EURUSD

The pair was expected to break out from the “Falling Wedge” resistance line, sending the pair higher towards the nearest resistance line. The United States and the European Union agreed to start their trade talks following US President Donald Trump’s trade war on its enemies and allies as part of his “America First” policy. However, the optimism was immediately killed after the United States threatened to impose an $11 Billion tariff to EU’s Airbus after the bloc banned US’ Boeing after the 737 Max’s scandal. The Germano-Franco Alliance of the EU had also created the “Alliance for Multilateralism” as its response to President Trump’s withdrawal and isolation of America from the rest of the world. Japan and Canada had already joined the alliance, leaving the US behind, just like the ratification of the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership. Histogram and EMAs 13 and 21 will crossover in the following days.

COMMENTS