Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

AUDNZD

The pair managed a pullback from the its lows since April, although the overall trend line on the daily chart appears to be descending one. The 50-day and 200-day moving averages are starting to break away, after creeping very closer in mid-June. The Aussie was boosted on Tuesday after the Reserve Bank of Australia decided to cut interest rates again for the second consecutive month. RBA Governor Philip Lowe, who is scheduled to speak in the northern Australian city of Darwin, said that one rate cut wasn’t sufficient to boost the economy. Traders are now shifting attention towards Lowe’s speech. The New Zealand dollar, meanwhile, weakened against its Australian counterpart after the RBA reiterated its view on inflation for the year 2020. The RBA also added that there were slight signs of improvement in the country’s housing market. The kiwi, on the other hand, managed to stand its ground against the US dollar.

EURBRL

The EURBRL pair is slightly higher on the day but still lower than its levels just two days ago. The pair is currently near to converging with the 200-day moving average on the daily chart, which is still below the 50-day moving average. Brazil’s trade surplus diminished to $5.02 billion last June, with rising imports and declining exports, according to the country’s Economy Ministry. The diminishing year-to-date surplus suggests that the net trade is serving as a drag on overall economic growth. IHS Markit’s purchasing managers’ index (PMI) data for June showed indicated that the manufacturing growth sped up in June. However, the exports in the sector shrank at their fastest pace in two and a half years. In Europe, meanwhile, Italian deputy prime minister Matteo Salvini just announced that he was now going to be more involved with economic policy.

GBPBRL

The Brazilian real, meanwhile, strengthened slightly against the British pound. The pair is hovering near a key support level, indicating that any good news for the pound could probably lead to a quick increase for the currency’s value. On the British side, frontrunner for the UK prime minister post, Boris Johnson, said that he is considering a proposal to cut short the British Cabinet by combining or removing a few departments off the government if he takes the position. On top of that, the British pound is also weighed by the release of the Markit Manufacturing PMI data, which is estimated to be largely unchanged at 49.00 against the previous record of 49.1. Investors are also in search for clues on the future of monetary policy amid the uncertainty surrounding the Brexit. Traders will be looking forward to the Bank of England Governor’s speech.

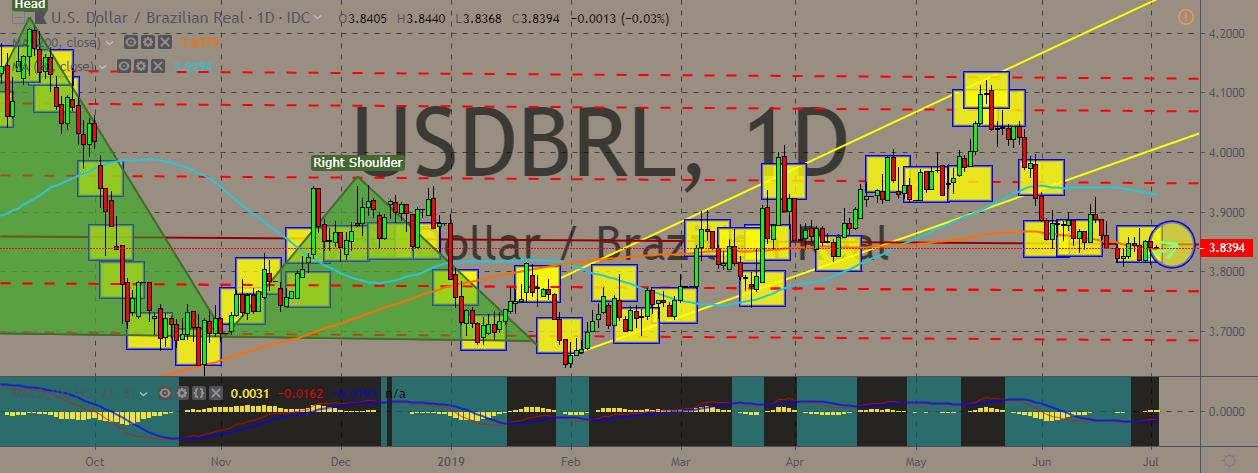

USDBRL

The pair is now trading on tight ranges up and below the key resistance level at the 3.8391 level, with the price still converging on the 200-day moving average line on the daily charts. The dollar was struggling on Tuesday, with economic data weighing it down while also erasing some of the optimism that traders felt when the US announced a trade truce with China. Economic data indicated a contraction in manufacturing activities in the country for the second month in a row. A gauge of world manufacturing showed that manufacturing worldwide slowed down for the first time since 2016. Traders quickly changed their focus, switching from the high stakes meeting at the G20 summit to the flurry of economic releases this week and month. Companies are also set to release their respective earnings reports this month, from which traders could get more hints as to where the economy is heading.

COMMENTS