Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

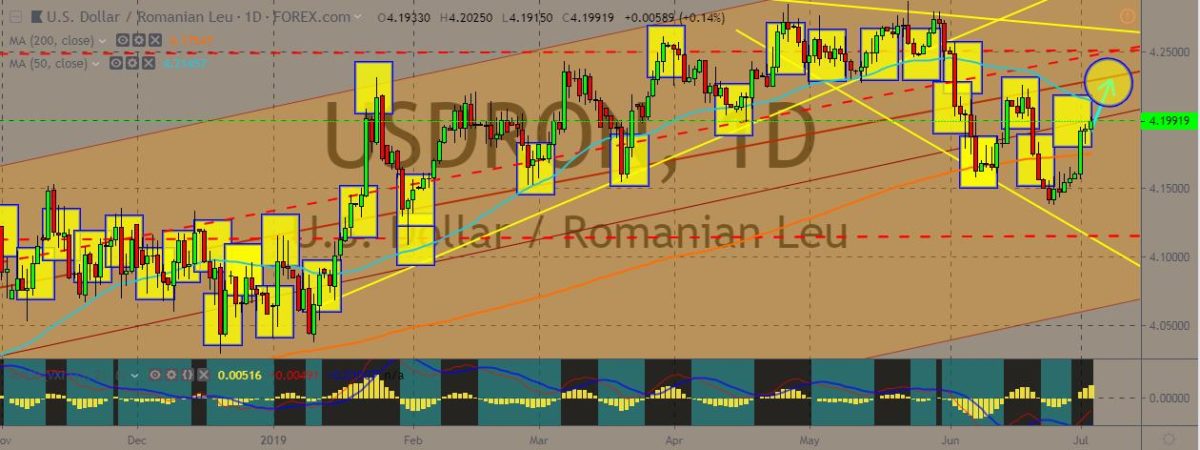

USDRON

The pair is appears to be tracing back its upward trend, with the current movement appearing to be at the upside. The prices range between the 50-day moving average (higher) and the 200-day moving average (lower). Romanian labor sector is now fearing that around 600,000 jobs in the country will be affected by the digital transformation that is being generated by new technologies. Around 275,000 are at risk of losing their jobs unless they manage to improve their skills, based on PwC’s Workforce Disruption Index that was published on July 2, 2019. These workers will have to improve their digital skills with the advent of automation and introduction of artificial intelligence. Meanwhile, Romanian President Klaus Iohannis and Prime Minister Viorica Dancila met the new Prime Minister of Moldova, Maia Sandu. The US dollar, on the other hand, managed to perk up in spite of a broader weakness in the market.

EURNOK

The pair has been moving in tight ranges on the daily chart after plummeting last month, going back and forth to recover and jump to the 9.8000 levels. However, the pair needs to top a solid resistance level near the 50-day moving average, while hovers at the 200-day moving average line. News broke out today in Norway, with the country’s radiation authority saying that Moscow had informed it there had been a gas explosion onboard a Russian sub. Meanwhile, the euro appears to be strengthening on the broader market, although it was still capped. Reports suggested that the European Central Bank wasn’t in a rush to cut interest rates at its upcoming meeting this month. The upside on the currency, on the other hand, appeared to be short-lived after trade war fears resurfaced, with the US threatening to impose tariffs on $4 billion worth of European goods.

EURHUF

The pair is converging along the 50-day moving average line, moving in tight ranges as the spair tries to perk back to the 326.000 levels, although that appears a long shot for now. On the flipside, it may be going for a retracement downward, after the pair started rising in late March to June. On the Hungarian side, the country’s Finance Minister Mihaly Varga held talks with Guenther Schoenleitner, who is an executive director at the Board of the World Bank Group. The two discussed ways in which the World Bank can help Hungarian companies kick off an expansion onto the international market. Hungarian companies have been involved in almost 40 projects started by the bank in recent years. Varga said that the World Bank’s development goals in countries affected by migration and poverty were in line with Hungary’s policy of tackling problems locally.

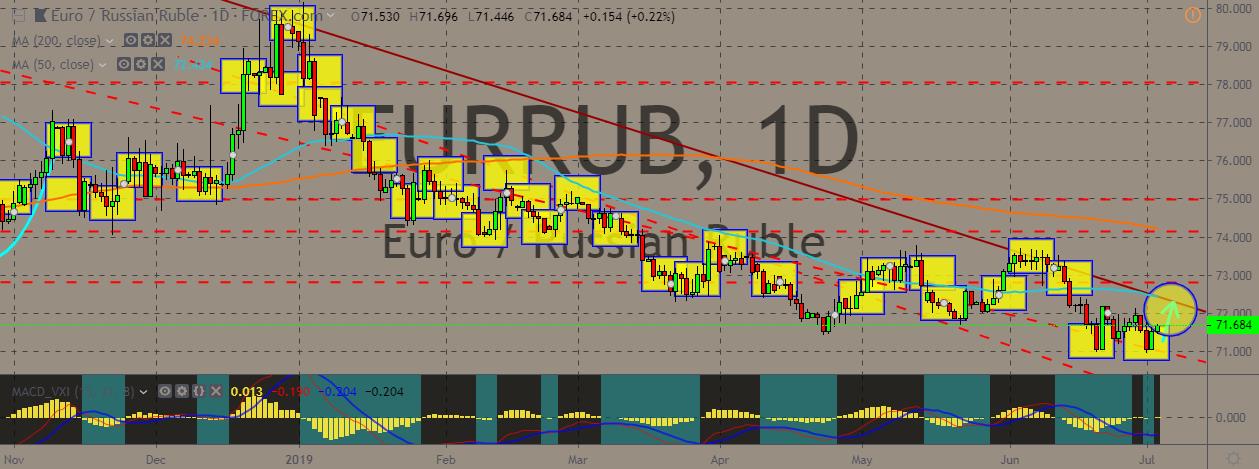

EURRUB

The pair is continuing a downtrend, with the euro still trying to perk up towards key resistance line above the 72.000 handle where the 50-day moving average on the daily chart is. On the Russian side, the country’s central bank is planning to cut down key interest rate in small steps while considering the government’s spending plans that may strengthen the ruble, according to Governor Elvira Nabiullina. Last month, the central bank kicked off a monetary easing cycle, decreasing the cost of lending amid a sluggish economic growth and abating inflation risks. Nabiullina said that the central bank is aiming at a 4% inflation target and is planning to complete the monetary easing cycle by the middle part of 2020. The Russian economy has also been weighed down by the trade war between the United States and China, which had been fueling global concerns even for emerging market currencies.

COMMENTS