Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDNOK

The pair is trading up in recent days, with the daily chart showing the pair approaching and testing the 50-day moving average. The pair has been apparently bullish in the recent week, with the USD strengthening with a plethora of factors. The greenback regained its might power against various assets, particularly gold, as investors start reining in for pricing in big rate cuts on the horizon. Meanwhile, on the Norwegian side, Oslo’s statistics bureau indicated higher three-month growth in Norwegian mainland economy, according to a local news outlet. The report said that Norway’s mainland gross domestic product (GDP) saw an increase of 0.3% from April to May and 0.7% from March to May. Specifically, the economy was supported by growth in fisheries and aquaculture, while there were some headwinds in the areas of service industries, building and construction, commodity, and electricity production.

USDPLN

The USDPLN pair is down in the previous trading session, but still for the week as the US dollar proved to be a favorite among currencies and as European currencies face pressure. The buck’s traders appear to be resilient in the dollar’s strength, as expectations of aggressive rate cuts by the US Federal Reserve start to fade. However, the markets are still pricing in at least one interest rate cut. On the broader markets, though, especially in Asia, the dollar is trading cautiously as the markets await the details of Fed Chairman Jerome Powell’s speech in Congress. On the Polish side, the country is facing the question of letting go of Huawei, which has faced numerous criticisms from the US government. Huawei has been scrutinized for possible espionage tactics in collusion with the Chinese government. Poland has to choose between receiving roughly $793 million in investment from the company and banning it from the country.

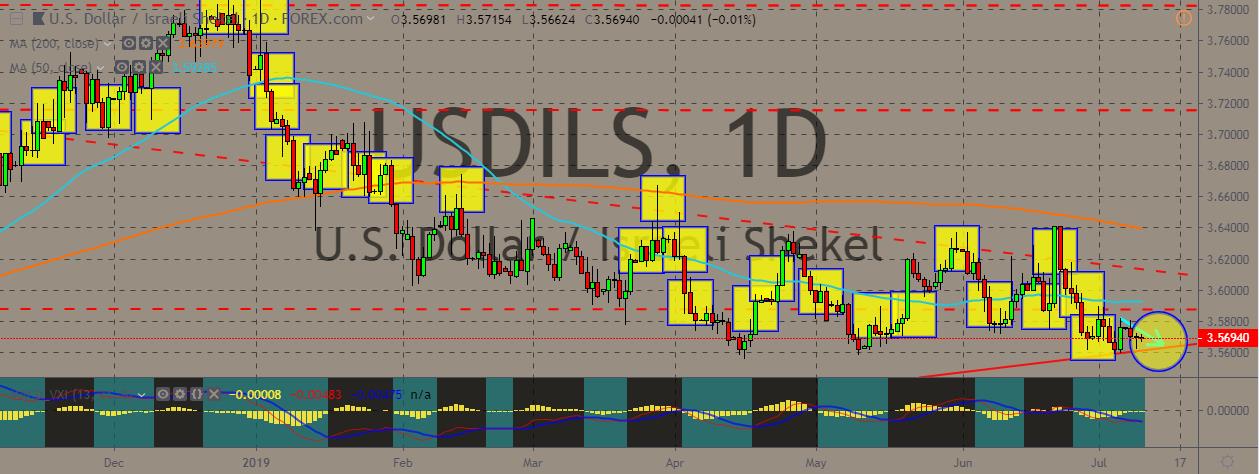

USDILS

The pair is still trading in tight ranges, although the broader trend is going downward. On the Israel side, the central bank decided to keep base interest rate unchanged at 0.25%. According to the bank, the interest rates weren’t changed because of three main reasons, namely the possibility of interest rate cuts in the United States, the unchanged interest rates in Europe, and the signs of global economic slowdown. The decision was made even though the inflation rate in the country stabilized within the government target of 1% to 3%. The last time the interest rate in Israel was changed was last November, and has stayed the same since then. Until that time, the rate wasn’t also changed for seven and a half years. Additionally, the Bank of Israel also expects one rate increase at the end of the 2019 third quarter to 0.5% and two increases next year to 1%. Inflation in the country has reached 1.5% for the first time since 2013.

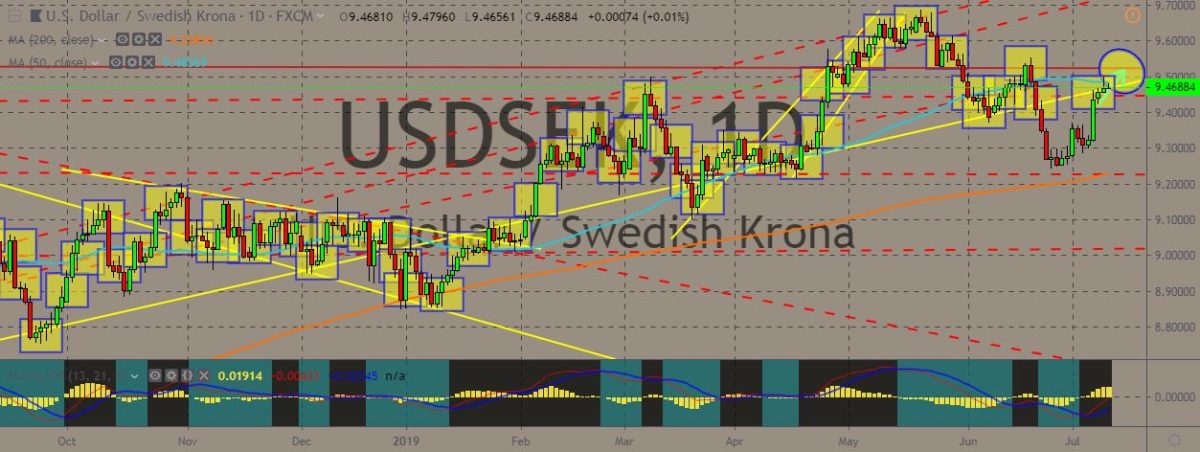

USDSEK

The pair is creeping up the daily charts, with the price meeting the 50-day moving average and above the 200-day moving average, indicating a bullish trend. The pair will probably meet a resistance above the 50-day MA, but should it break above that, it will trigger an extended rally. On the other hand, there is also a support line just near the 50-day MA, plus a trend line tracing the same. Meanwhile, Swedish Central Bank’s Head Stefan Ingves said that interest rates could probably go as low as -1.5% and said that Swedes likely wouldn’t even bat an eye. Overall, the Riksbank leadership is adapting a likely optimistic view of things in the longer term, hoping to increase rates to 1% by the year 2021. This comes even on the backdrop of a worrisome economic climate. Yields on 10-year government bonds in Sweden dipped below zero on the same day that he made the remarks.

COMMENTS