Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

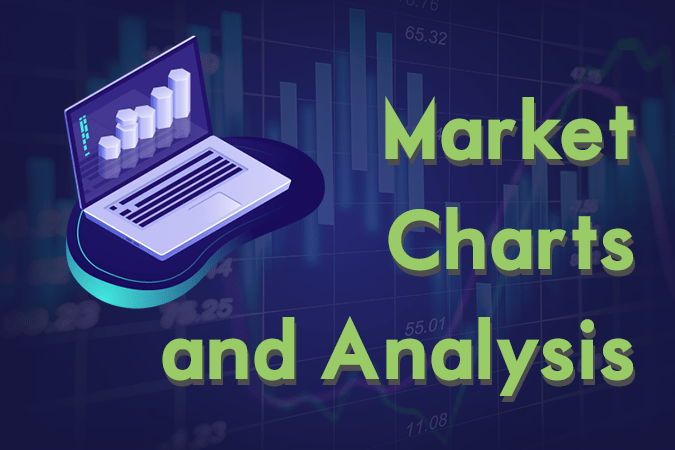

USDMXN

The pair found a strong uptrend support line, which will send the pair higher towards a major resistance line. The NAFTA (North American Free Trade Agreement) came into force on January 01, 1994 as a trilateral trade bloc between the United States, Canada, and Mexico, which became one of the largest trading blocs in the world by GDP. However, following the election of U.S. President Donald Trump in 2016, he sought to replace the NAFTA after calling its “the worst trade deal in history”. Trump had since declared trade war against its enemies and allies. A major ally affected by the trade war is Mexico after Trump imposed 5% tariffs on all Mexican goods. Despite this, the election of Mexican President renewed the relationship between the two (2) countries. AMLO had also sought to solve the increasing immigrants to the U.S. supporting Trump. Histogram and EMAs 13 and 21 was expected to continue moving up.

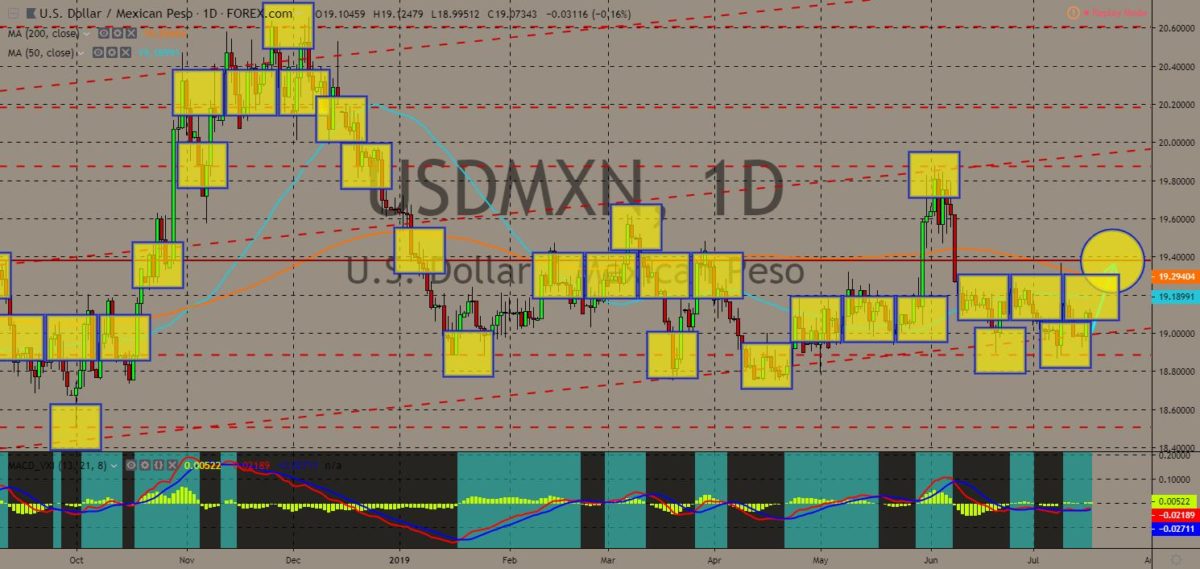

USDNOK

The pair will continue to go up and to break out from its resistance line amid the looming crossover between MAs 200 and 50. Norway is divided between the United States and the European Union. Norway is pushing for a closer tie with the EU following the recent data showing that Boris Johnson might be the next leader of the Conservative Party and in extension, the new British Prime Minister. Johnson had reiterated that he will make the U.K leave the bloc until October 31 and to have a “no-deal Brexit” if necessary. This will end the dream of the European Free Trade Agreement, which is composed of non-EU European countries, to add the UK on its members. On the other hand, Norway was reliant on the U.S. led NATO (North Atlantic Treaty Organization) Alliance for protection against Russian aggression. Histogram and EMAs 13 and 21 will continue to go up.

USDPLN

The pair was expected to bounce back from a major support line, which will send the pair higher towards the uptrend support line. The relationship between the United States and Poland was given further boost following the announcement by Turkey that Russia had delivered its first order of the S-400 missile defense system. This prompted some U.S. lawmakers to pass a policy to halt its deliver of F-35 fighter jets to Turkey. Instead, the lawmakers were looking to the Eastern and Nationalist bloc, the Visegard Group, to further boost its presence in Europe. The tension between the West and the East increased following Russian annexation of Crimea and candidate for accession in the European Union and the U.S. led NATO (North Atlantic Treaty Organization) Alliance. Histogram was consolidating, which suggest that the indicator might be up for upward movement, while EMAs 13 and 21 is expected to fail to crossover.

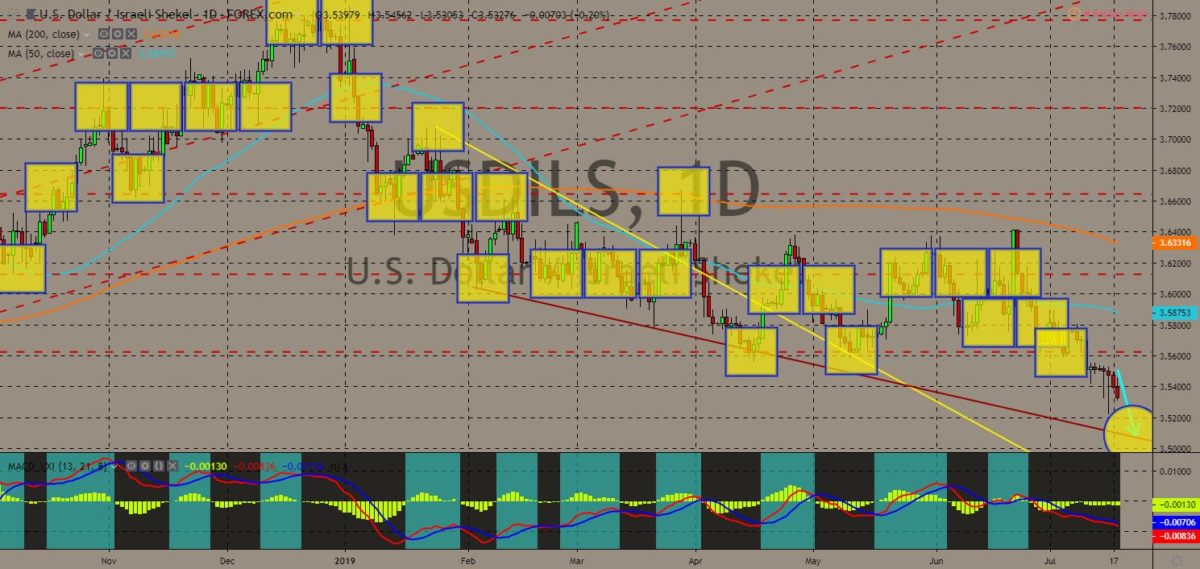

USDILS

The pair was seen to continue its steep decline and to further go lower towards a “Falling Wedge” pattern support line. The relationship between the United States and Israel might enter to a new high. Despite decades of de facto alliance, the U.S. does not have a formal collective defense treaty that would legally require it to come to the defense of Israel. Those decades might already end as Israeli Prime Minister Benjamin Netanyahu said the two (2) countries are already examining a potential U.S.-Israel defense alliance. The two (2) countries are also key to the win of their current leaders. U.S. President Donald Trump acknowledged Golan Heights, Gaza Strip, and West Bank, as Israeli territory. On the other hand, Jared Kushner, a Jewish and Trump’s son-in-law and Senior White House Adviser, had orchestrated major deals for President Trump. Histogram and EMAs 13 and 21 was poised to further go lower in the following days.

COMMENTS