Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

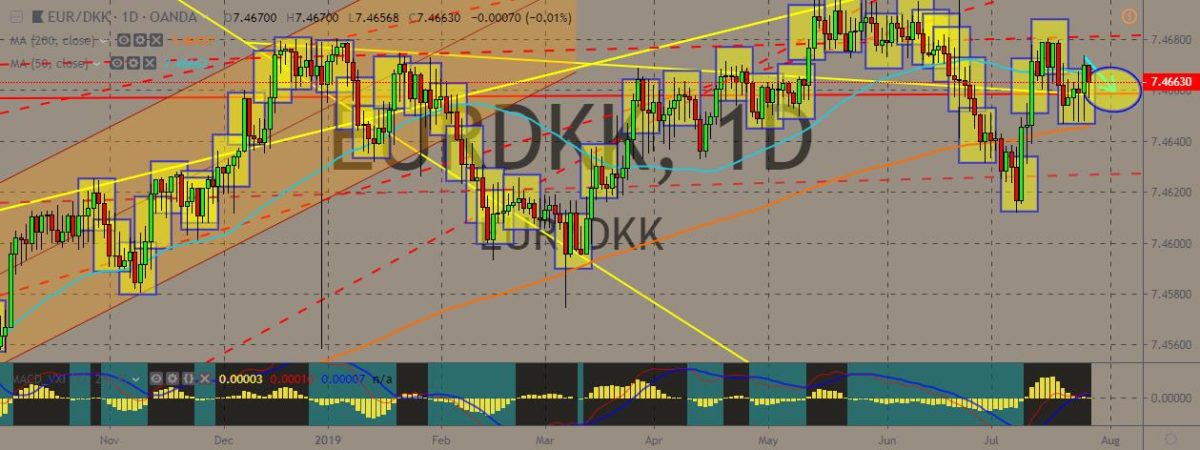

EURDKK

The pair suffered a pullback in the last trading session, nearly paring all of its gains during the last trading session. The pair recently traded above the 50-day moving average but failed to break a solid resistance line. The 50-day and 200-day moving averages indicate an impending bearish trend in the future. As expected, the European Central Bank signaled more easing measures and prepared the markets for them on Thursday during a speech. The central bank said that it expects the key interest rate to remain “at their present or lower levels” at least through the first half of 2020. The change in the monetary policy comes amid the uncertainty in and out the European Union, with growing fears over US-led protectionism, weakness in emerging markets and geopolitical risks. These factors have all continued to dampen economic mood. And then there’s also the looming trouble as Boris Johnson was elected as the UK prime minister.

EURTRY

The pair traded in an overall downtrend since May, with the 50- and 200-day MAs confirming the golden cross mid-May and now appears to be threatening a death cross. The pair currently trades in tight ranges, with the euro weakening against the Turkish lira. Turkey’s central bank recently delivered a massive interest rate cut on Thursday in an attempt to revive the country’s economy hit by recession. Policymakers, along with the newly appointed central bank chief Murat Uysal, cut the country’s key interest rate from 24% to 19.75%, coming in much bigger than most analysts had expected. The cut also marks a drastic change in emergency monetary policy stance implemented during 2018’s currency crisis, during which the Turkish lira collapsed and pushed inflation above 25%, compelling authorities to adopt aggressive rate hikes. Inflation has already dropped below 16%.

GBPAUD

The pair perked up during the previous sessions, although it still traverses an overall downward trajectory. The 50- and 200-day MAs on the daily chart recently confirmed the death cross, indicating the pair will probably suffer bearishness in the near future. Even so, the British pound flexed as it extended its rally. Boris John officially took over from Theresa May as the United Kingdom’s Prime Minister. Markets are awaiting fresh information over Johnson’s intended Brexit policy before dragging an already discounted currency any lower. Meanwhile, Reserve Bank of Australia Governor Philip Lowe said that the Australian central bank was ready to provide additional policy stimulus if they needed it. Traditionally, the RBA is reluctant to long-term guidance on policy. That means Lowe’s reference to an “extended period” was considered as a dovish concession to markets.

GBPCAD

The pair has plummeted greatly since May, with the 200-day MA crossing above the 50-day MA (death cross) indicating the pair might be staying longer in the lower levels. The British pound has suffered a lot of volatility and weakness, even when it stood strong recently to other majors. The Canadian dollar, on the other hand, performed mixed on the forex markets, as it was weaker against the dollar but stronger against the British pound. The Bank of Canada has made it clear that it doesn’t intend to cut interest rates. However, the recent strength in the Canadian dollar could ruin the bank’s approach, which is sitting out the global rate cuts by global peers. The loonie has already lost some steam after it was pressured by weaker-than-expected retail sales and wholesale trade data for May. Canadian government bond prices were higher across the yield curve.

COMMENTS