Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

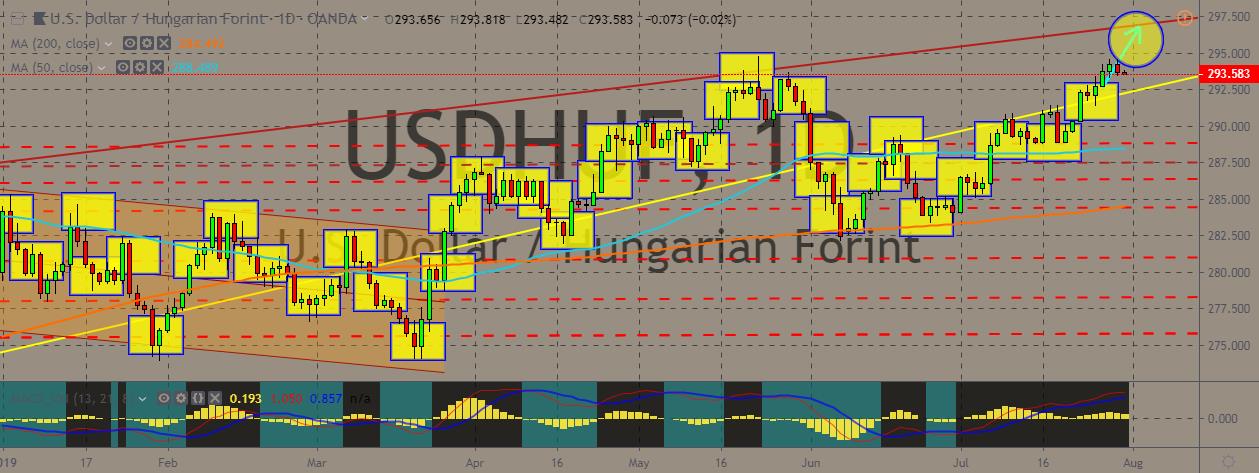

USDHUF

The pair is trading higher in recent weeks, although today it experienced a pullback that erased its previous gains in the previous trading session. It is trading above both the 50- and 200-day moving averages, though, and may continue to a solid uptrend in the medium term if no significant market mover disrupts the momentum. The US dollar will mainly be driven by the upcoming Federal Reserve interest rate decision to be released later in the day. The US central bank started its two-day meeting yesterday, with most investors speculating that the Fed will cut rates this week for the first time in more than a decade. Meanwhile, the Hungarian central bank recently chose to keep its key interest rate steady, and also confirmed inflation outlook. The decision was largely in line with the expectations among economists and analysts. Due to the increasing uncertainty in the global economy, banks have been cautious with their policies.

EURPLN

The euro gained a lot versus the Polish Zloty in recent weeks, with the pair spiking higher than the 200- and 50-day moving averages, having been below them two trading sessions ago. The euro has mainly been driven by the expectations that the European Central Bank will be cutting rates and increasing the monetary stimulus. Also, the European Union is continuing to consider its options when it comes to the UK’s departure from the bloc, insisting that eh Withdrawal Agreement will not be reopened. Meanwhile, in Poland, the Sentiment Indicator in the Polish Economy reached 102.2 points in July 2019 against 103.0 points in June, as per the European Commission’s Directorate-General for Economic and Financial Affairs (DG EcFin). According to it, the business climate index in the Polish industry clocked in at negative 9.7 points, against the negative 8.9 points recorded in June.

USDSEK

The pair traded higher on the daily chart as it managed to break above the 50-day MA and another resistance line that now may act as its support. On the fundamentals side, Sweden’s economy shrank unexpectedly during the second quarter. This triggered doubts on the Riksbank’s plans to continue increasing interest rates. Gross domestic product contracted 0.1% during the second quarter from the first, based on the initial figures from Statistics Sweden on Tuesday. Economists had expected an expansion of 0.3%. Annual growth was at 1.4%, against economists’ and Riksbank’s expectations of 1.9% and 1.8%, respectively. Statistics Sweden says that the shrinking was mainly because of gross fixed capital formation, which sank by 1.1%. Exports and imports lost 0.3% and 0.5%, respectively. Household consumption expanded by 0.6%. The data was released early because of a mistake at the agency.

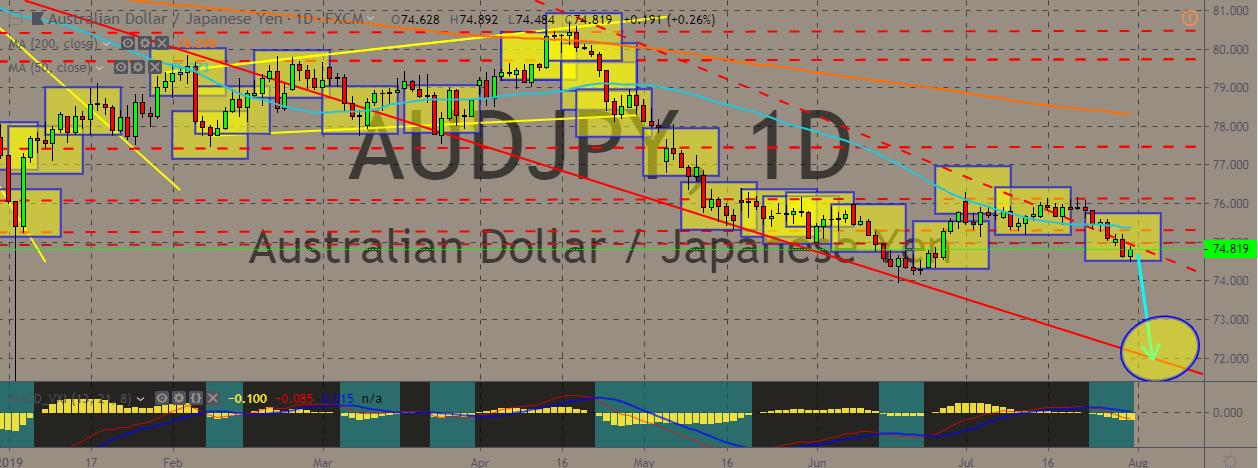

AUDJPY

The Australian dollar pared back some of its losses previously against the Japanese yen, although the recent overall trend is still going down. The Australian dollar has been weakening, and may even suffer from further weakness, as a plethora of risk factors continue to loom over the currency. The second-quarter figures for inflation and the latest batch of Chinese economic data are expected to pose a threat to the currency. Markets generally expect the three months ended on June 30 to be recording below-target inflation figures that will do little to discourage the Reserve Bank of Australia (RBA) from slashing its interest rate for the third time later in the year. Forecasts come for the consumer price index to have risen from 1.3% to 1.6% in the recent quarter. The RBA has been trying to get inflation within the 2% to 3% target band and has already cut its rate twice in the year so far.

COMMENTS