Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

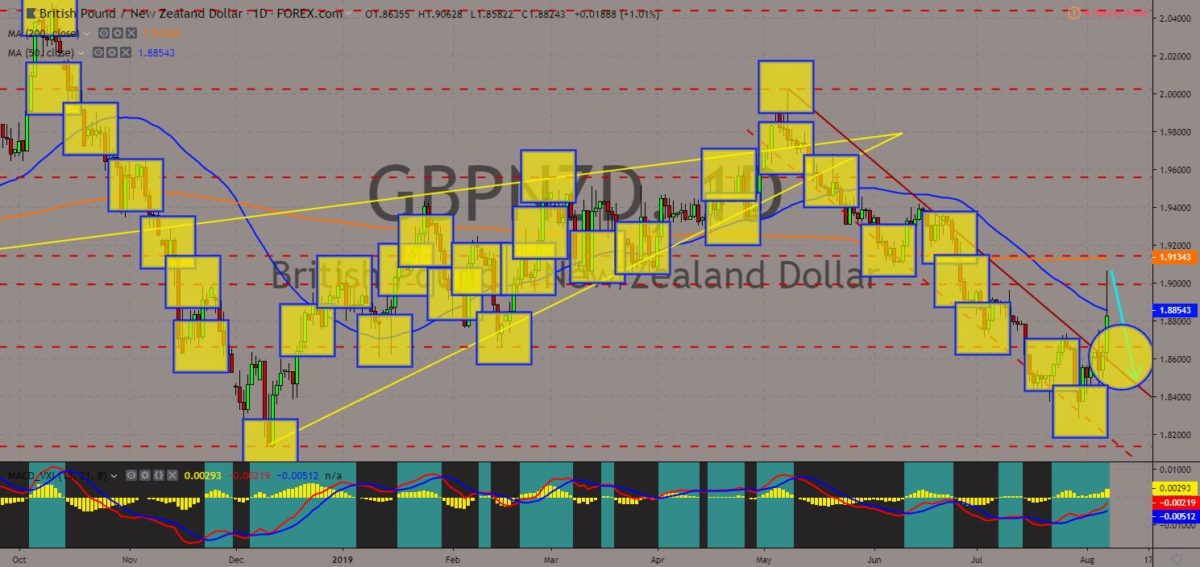

GBPNZD

The pair failed to breakout from 200 MA after it broke out from 50, which will send the pair lower towards a downtrend channel resistance line. New Zealand’s central bank, the Royal Bank of New Zealand (RBNZ), made a surprise move to cut its benchmark interest rate to dodge the escalating trade war between the United States and China. In July 31, Fed Chair Jerome Powell cut the U.S. interest rate by 25-basis point. A day after that, U.S. President Donald Trump tweeted his disappointment over the failure by the Federal Reserves to meet his expectations and had imposed tariffs of 10% on $300 billion worth of Chinese goods. China retaliated by devaluing its currency, the Chinese Yuan. Despite the weaker New Zealand Dollar, it will be helpful for the country once it negotiates with the United Kingdom regarding the post-Brexit trade agreement. Histogram and EMAs 13 and 21 was expected to reverse back.

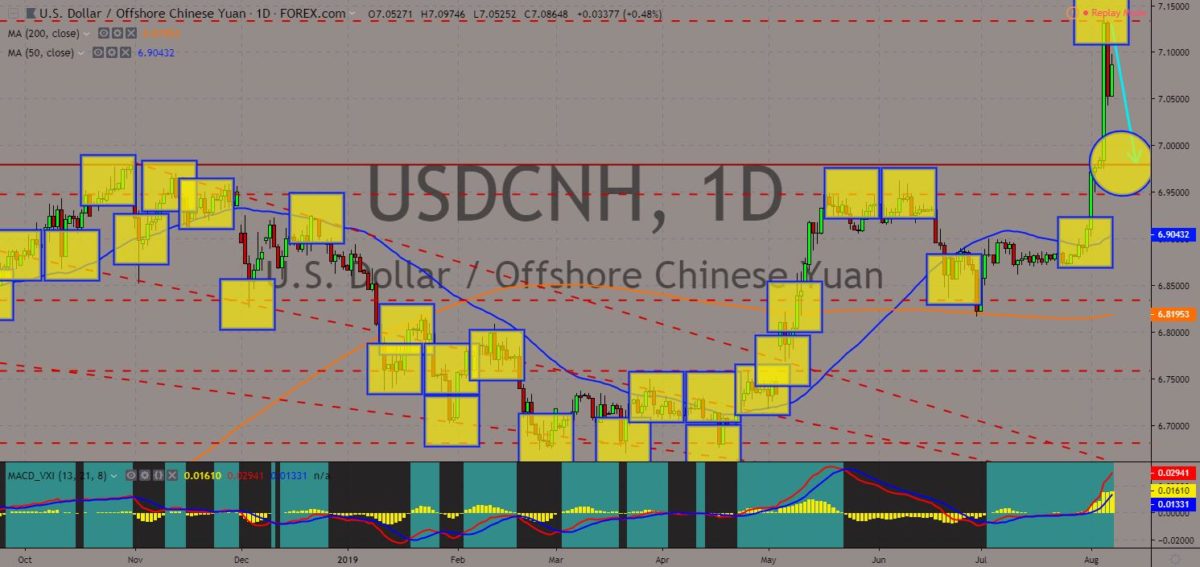

USDCNH

The pair failed to breakout from a major resistance line, which will send the pair lower towards a major support line. The escalating trade war between the two (2) largest economies in the world, the United States and China, had turned from economic war to political war and now has extended to a currency war. In July 31, the U.S. central bank, the Federal Reserves, cut the country’s benchmark interest rate by 25-basis points, from 2.5% to 2.25% amid the uncertainty in global economy. U.S. President Donald Trump was disappointed by this move as he was expecting more cuts from Fed Chief Jerome Powell. He had since then imposed 10% tariffs on $300 billion worth of goods, which further escalates the tension. To offset the new tariffs, China devalued its currency to make its export to the U.S. more competitive. Histogram and EMAs 13 and 21 is seen to reverse back in the following days.

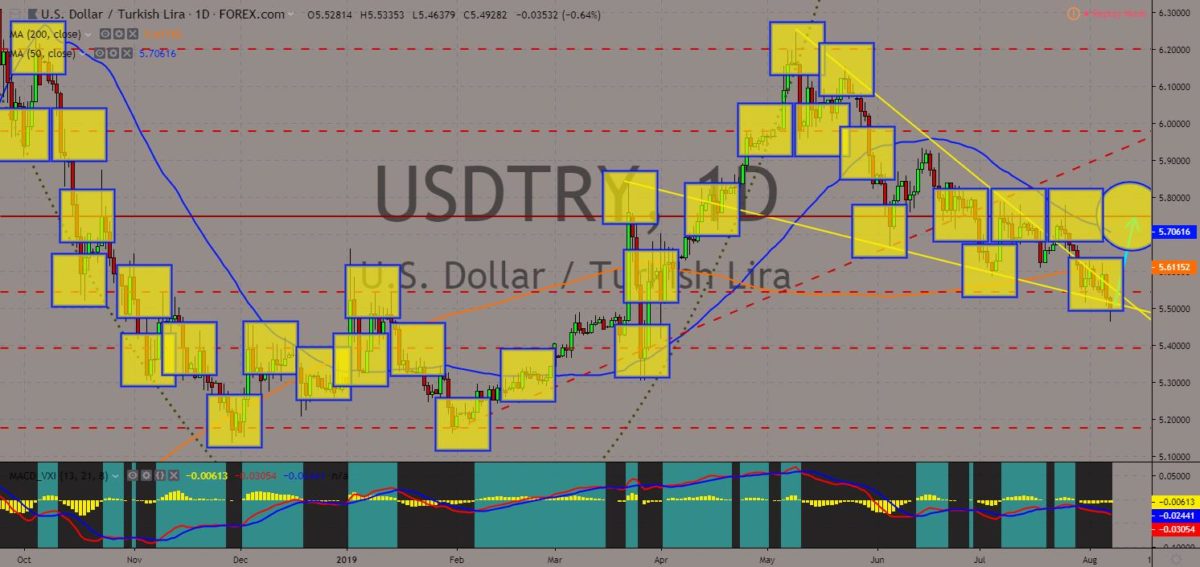

USDTRY

The pair is expected to breakout from the “Falling Wedge” pattern resistance line, sending the pair higher. The U.S.-Turkey’s relationship was at its lowest following the delivery of Russia’s S-400 missile defense system, which analysts see will compromise the U.S.-led NATO (North Atlantic Treaty Organization) Alliance defense sharing agreement. Turkey is also a member of the U.S. F-35 fighter jet program, which was the main purpose for the creation of the S-400. Aside from this, Turkey had been sliding back from the West in general after it warned the European Union that the country will no longer accept immigrants as part of the accession talks between Turkey and the EU. Turkey is a major geopolitical ally of the U.S. as it connects the West and the East. It was also the gate from the Black Sea, which can be use by Russia to send its navy overseas. Histogram and EMAs 13 and 21 was expected to go up.

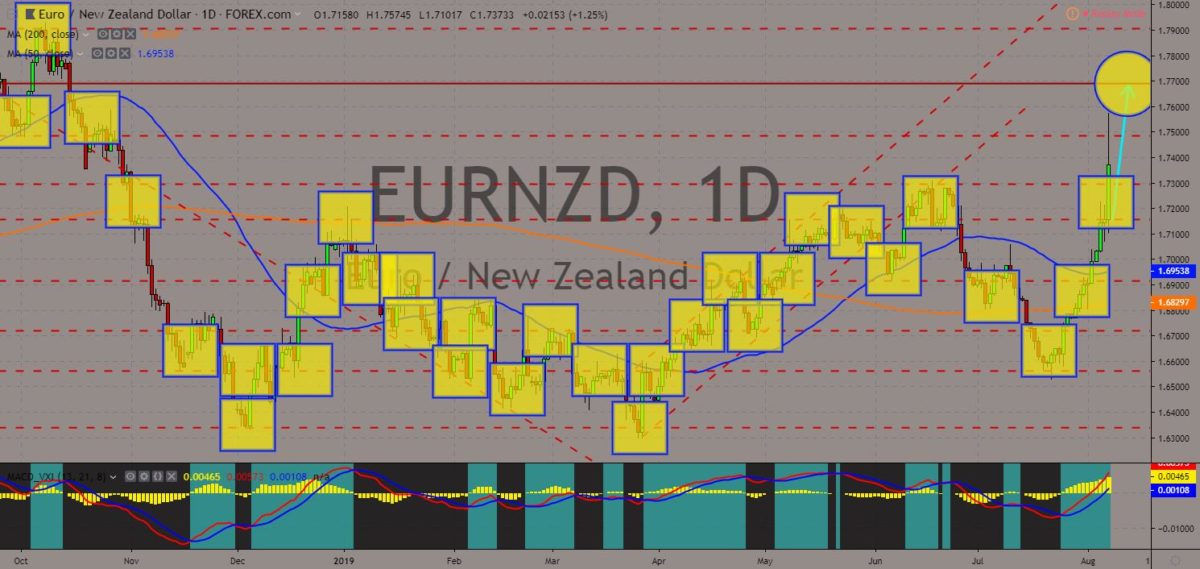

EURNZD

The pair was in a rally and is expected to further go up in the following days to reach its 10-month high. Following the escalating trade war between the United States and China, the Royal Bank of New Zealand (RBNZ) decided to cut its benchmark interest rate and had expressed its willingness to make an unconventional move on putting its interest rate into the negative territory. This means that the central bank will pay banks to borrow money from them and in turn the banks will encourage consumers and businesses to borrow money from them to propel the country’s economic growth. This will be beneficial in the long run for New Zealand in terms of its exports to other countries, particularly in Europe. Even European Central Bank (ECB) Chief Mario Draghi admit that the largest trading bloc in the world will need to cut its benchmark interest rate. Histogram and EMAs 13 and 21 will continue to go up in the following days.

COMMENTS