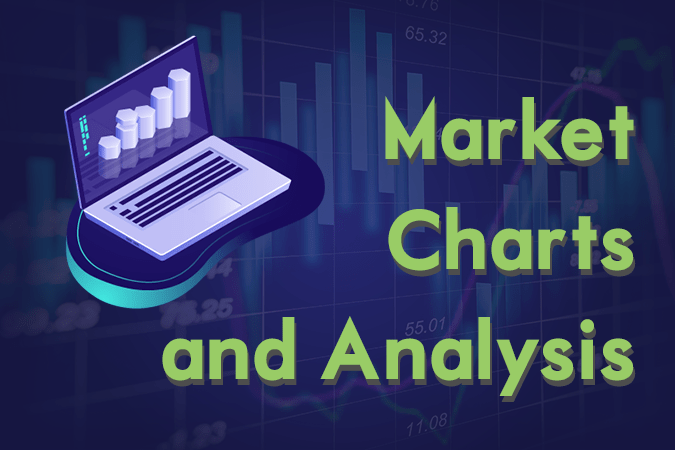

EURCZK

The pair failed to breakout from a major resistance line, sending the pair lower towards a key support line. The future relationship between the European Union and the Eastern and Nationalist bloc inside the EU, the Visegrad Group, was still uncertain. This was following the election of the new European Commission President Ursula von der Leyen who seeks a more unified European Union. This will put weigh on the Czech Republic who was seeking to increase its cooperation with the United States to counter Russia’s rising military aggression. Amid the better relationship between the EU and Czech Republic, Von der Leyen’s inability to solve Czech’s concern will further push the country towards the United States. The EU was planning to establish its own military, which will isolate the U.S. led NATO (North Atlantic Treaty Organization) Alliance. Histogram and EMAs 13 and 21 will move lower in the following days.

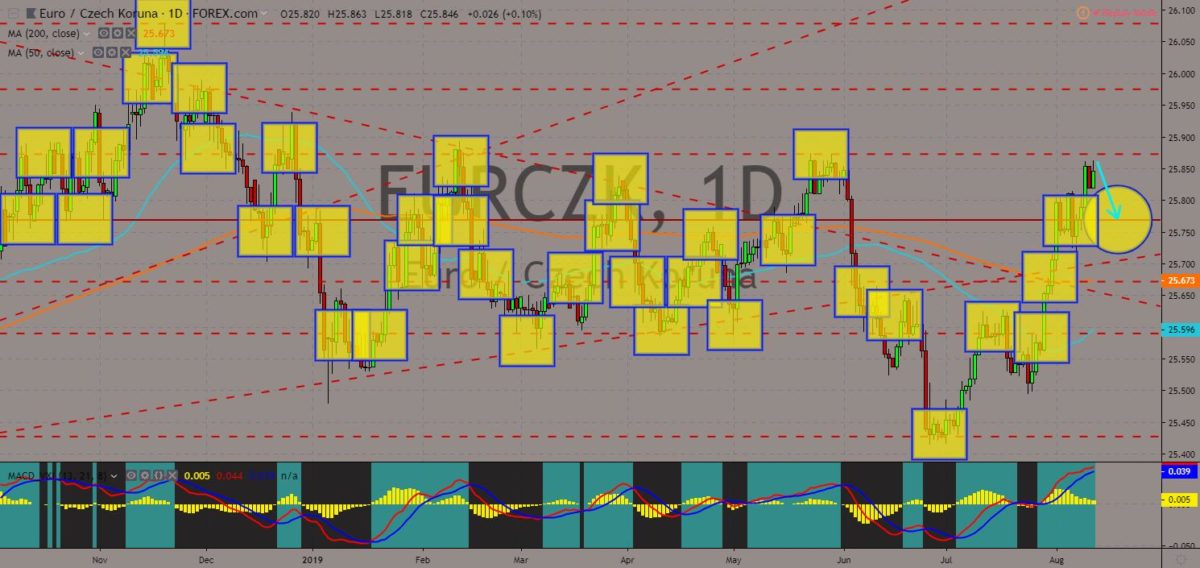

USDHUF

The pair is expected to bounce back from 50 MA, which will send the pair higher toward its previous high. Hungary is leading the EU enlargement on the Balkan as some citizens of the former Yugoslavia are ethnic Hungarians. This will boost Hungary’s influence not just in the European Union, but also around the globe. Yugoslavia broke up from 1989 to 1992 into 7 independent countries, which includes the UN administered Kosovo. In turn, this will increase the United States’ influence in Europe. Currently, the United States had already talk to leaders of the Visegrad Group and was in talks with Denmark and the United Kingdom. This was expected to pressure the European Union, with the European Commission President Ursula von der Leyen recently visiting the Visegrad Group members as she tries to unite the EU and establish a “United States of Europe”. Histogram and EMAs 13 and 21 will go up in the following days.

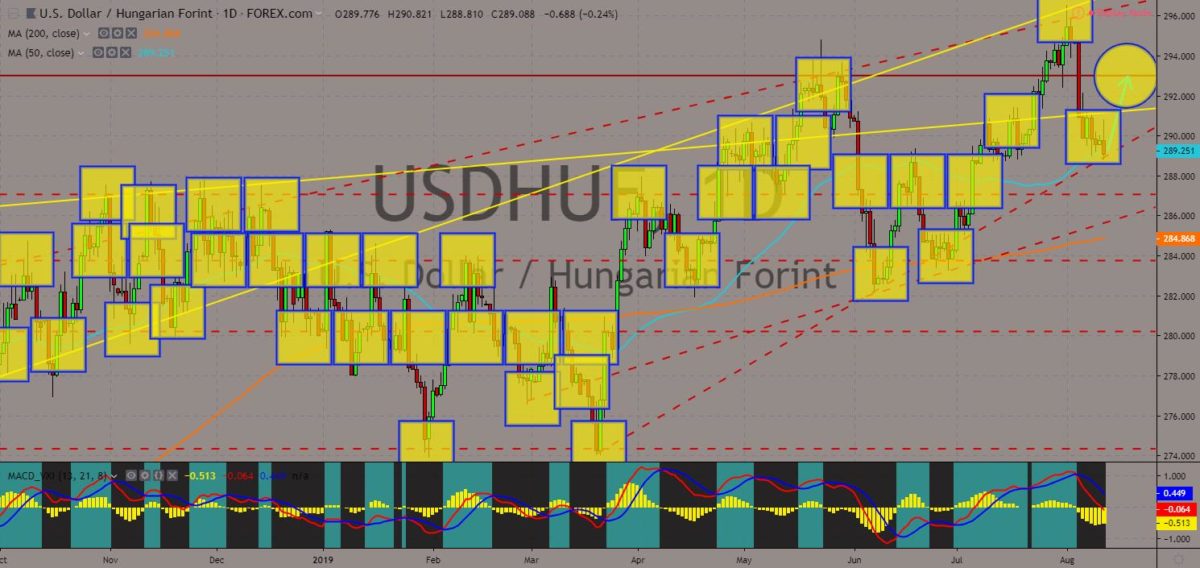

USDMXN

The pair was expected to break out from major resistance line, sending the pair higher toward the pair’s 9-month high. Mexican President Anders Manuel Lopez Obrador said he expected the United States to ratify a new trade pact to replace the NAFTA (North America Free Trade Agreement). This move was after Mexico became the largest U.S. trading partner, beating Canada and China. This will also pressure U.S. President Donald Trump who had pioneered the ratification of the NAFTA as the new deal was not enough to hinder the growing trade deficit between the country and Mexico. President Trump had already imposed 5% tariffs on all Mexican goods after Mexico became its largest trading partner. Aside from this, President Trump is facing pressure from the U.S. Congress who was partly controlled by the Democrats. Histogram and EMAs 13 and 21 was poised to further go up in the following days.

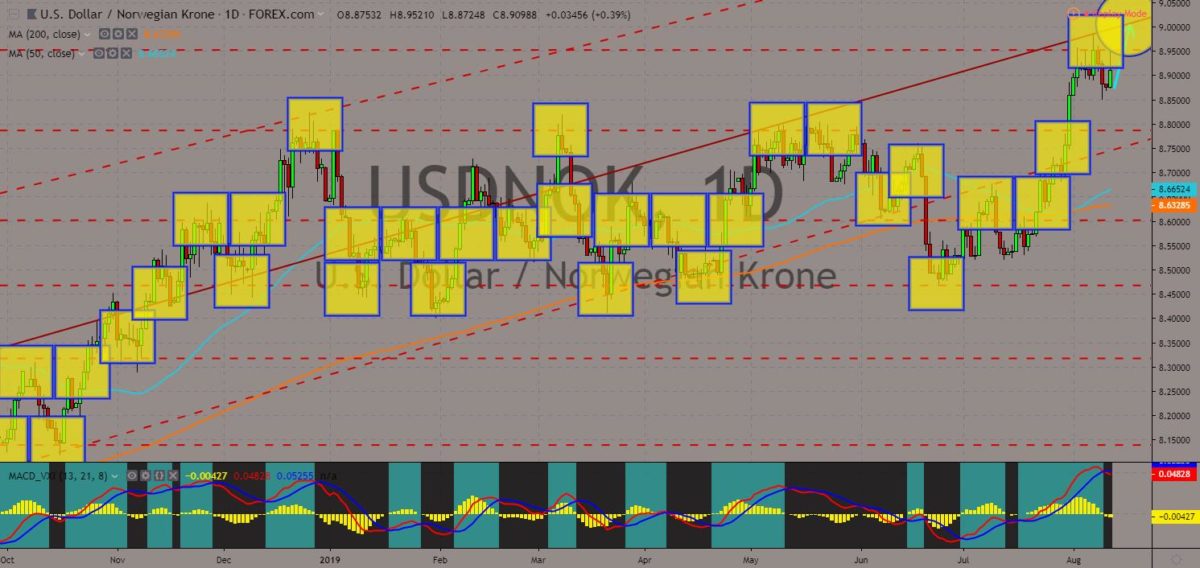

USDNOK

The pair was expected from its resistance line, which will send the pair higher toward its 32-month high. The United States and Norway was in a mutually beneficial relationship. Norway is currently acting as a mediator between the opposite parties in Venezuela. The country hosts the Russian backed Maduro government and the U.S. backed self-proclaimed interim president of Venezuela, Juan Guaido. Norway on the other hand, will need the backing of the United States after it discovered radioactive materials that was suspected to be part of the failed Russian nuclear test. The nuclear test was supposed to be a violation of the 1987 nuclear pact treaty on which the United States and Russia had withdrawn in February 2019. Aside from this, Norway will also need the U.S. to raise its claim on the potential disputed territory in the Arctic Ocean. Histogram and EMAs 13 and 21 was expected to continue its upward movement.

COMMENTS