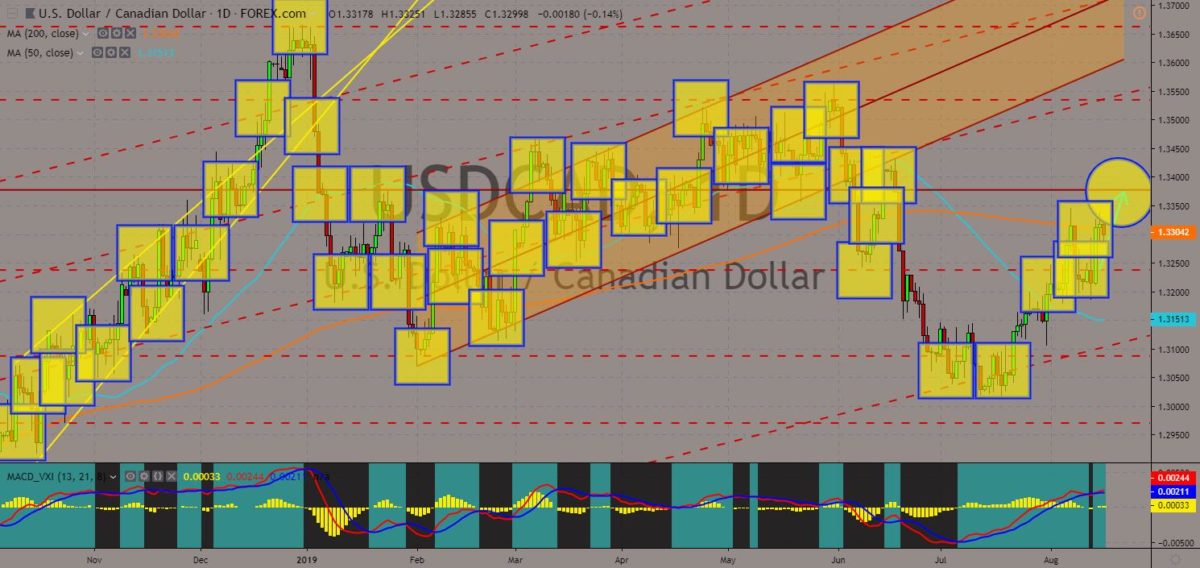

USDCAD

The pair is expected to breakout from 200 MA, which will send the pair higher towards the nearest resistance line. Canada’s ethics commissioner released a report that found Canadian Prime Minister Justine Trudeau violated ethics rules when he tries to pressure his former justice minister and attorney general to drop criminal charges against a Quebec-based company SNC-Lavalin. The report dropped just as Canada is preparing for federal elections in October, potentially complicating PM Trudeau’s reelection bid. This will also affect Canada’s leverage against the ratified NAFTA (North American Free Trade Agreement), which was seen to benefit the United States the most. Canada was currently increasing its participation on the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership) to decrease its exposure to the U.S. Histogram and EMAs 13 and 21 will continue to go up.

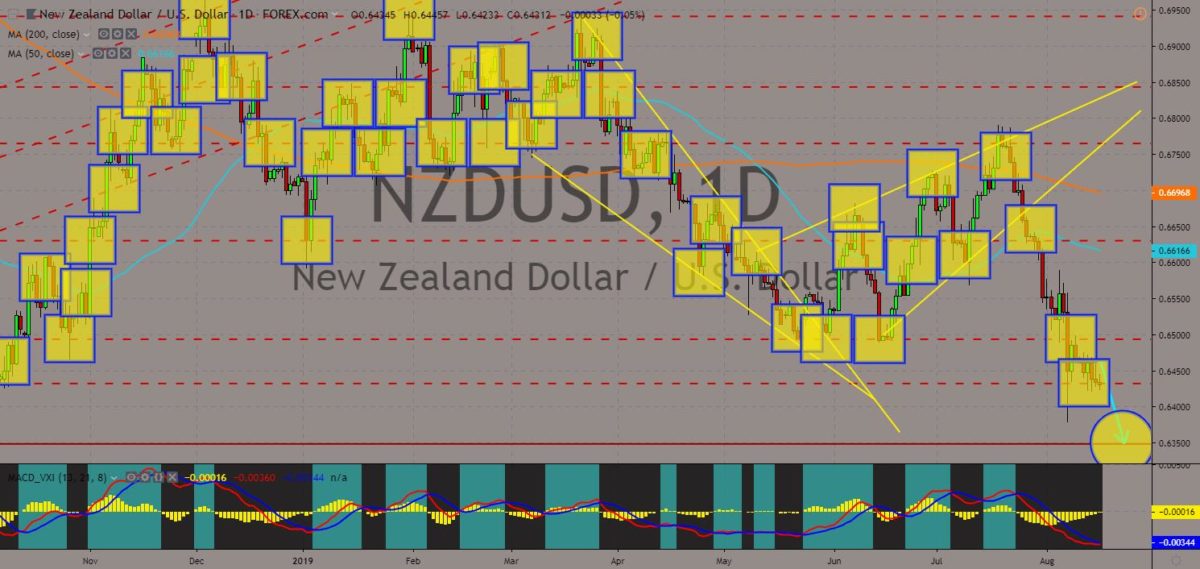

NZDUSD

The pair will fail to hold into its support line, which will send the pair lower toward its 59-month low. New Zealand Dollar is pressured from the escalating trade war between the United States and China. In the last day of July, U.S. central bank, the Federal Reserve, cut its benchmark interest rate by 25 basis points. This had triggered U.S. President Donald Trump to imposed 10% tariff on $300 billion worth of Chinese goods to compensate for what he said was a disappointing interest rate cut by Fed Chair Jerome Powell. Three (3) days after this, China devalued its currency to boost its export to the U.S. and counter the tariff imposed by President Trump. In a rare move, the RBNZ (Royal Bank of New Zealand) had also cut its benchmark interest rate. New Zealand was exposed to the U.S. Dollar, while it considers China its largest trading partner. Histogram and EMAs 13 and 21 will fail to crossover.

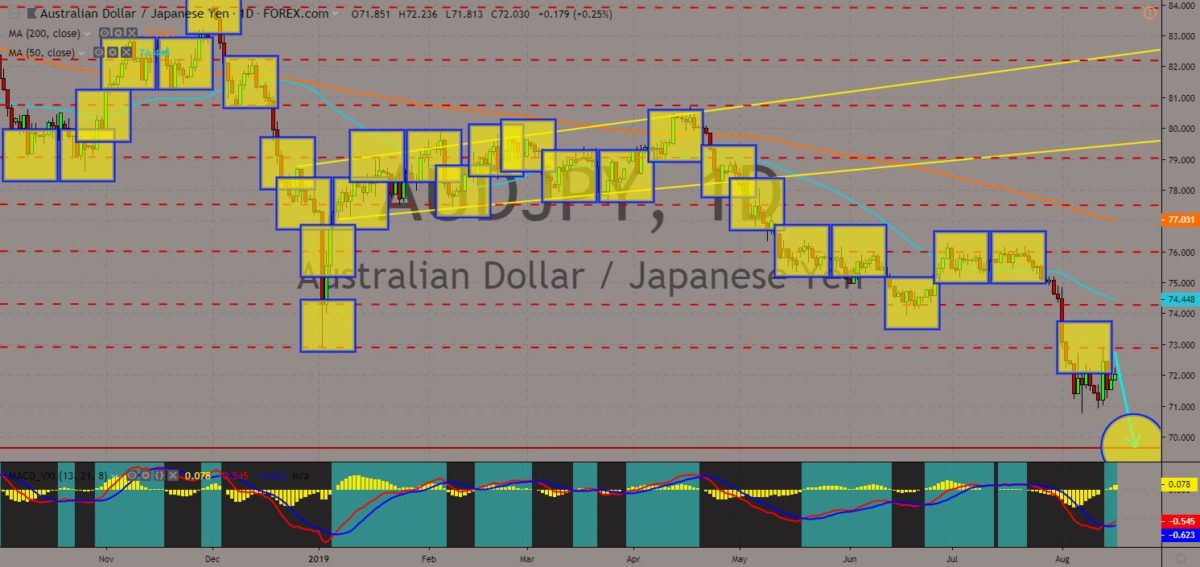

AUDJPY

The pair will continue to move lower in the following days to retest its 126-month low. Australia and Japan are two (2) regional powers in the Asia Pacific. The two (2) countries led the ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), after the withdrawal of the United States in 2017. Despite competing economically to dominate the pact, the two (2) countries were regional security partners. Though the two (2) countries doesn’t lay claim in the South China Sea, Australia and Japan teamed with the U.S. to protect international right of passage in the disputed sea. In 2007, Japan and Australia signed their Joint Declaration on Security Cooperation, a step away from a Security Treaty. Despite this, Japan was still leading against Australia in terms of economy and military. Histogram and EMAs 13 and 21 will reverse in the following days.

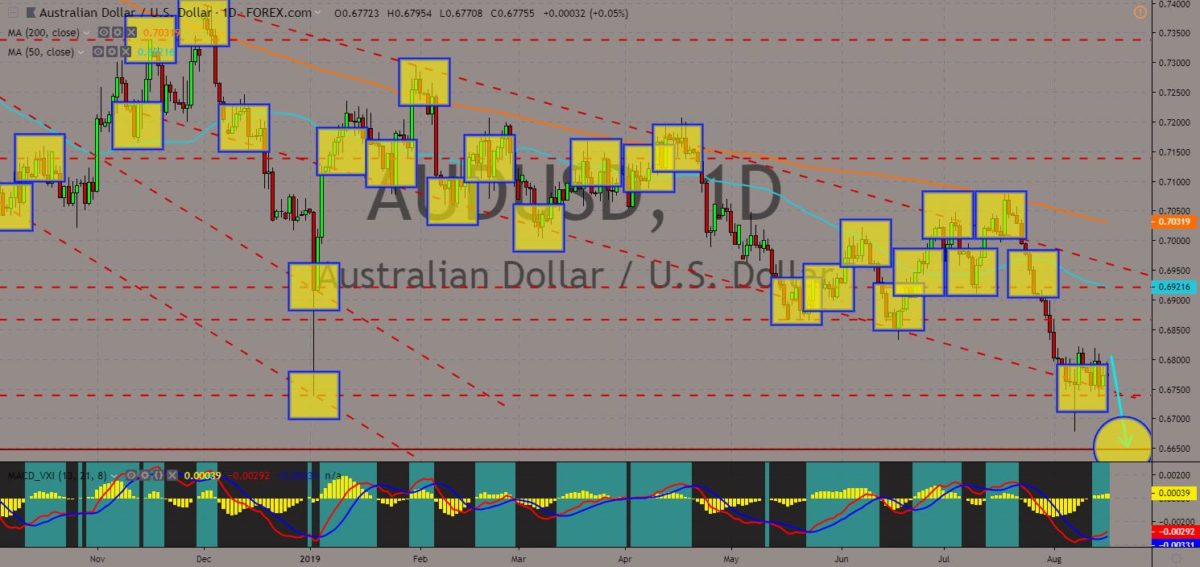

AUDUSD

The pair is seen to breakdown from a downtrend channel support line and from a major support line last seen in January 02, 2019. Australia is under pressure from the United States following a mystery $15 million Iran shipment that exposes an Australian-owned firm breaching a strict U.S. sanction. The shipment was loaded using a cargo ship being used by Quantum Fertiliser, a Hong Kong-based trading subsidiary of the ASX-listed multinational Incitec Pivot, a one-time contractor with the federal government and donor to the Labor party. This was after the U.S. requested cooperation from Australia to increase its role in the Strait of Hormuz, a major passageway controlled by Iran through which 80% of crude oil supply passes. The U.S. had also encouraged other western allies like the United Kingdom, Germany, and France. Histogram and EMAs 13 and 21 will reverse back in the following days.

COMMENTS