NZDCAD

The pair traded within a channel in the past months, overall pursuing a downtrend as the Canadian dollar gathers strength from the perking up in oil prices. On the NZD side, the bank has implemented aggressive rate cuts in recent weeks. According to the central bank’s assistant governor, such aggressive moves decreased the need for unconventional monetary policy to prop up inflation. The bank has cut rates by a bigger-than-expected 50 basis points to a record low 1% this month. The governor also opened the doors for the possibility of using negative rates in the future. On the Canadian side, many economists are already coming to predict that the Bank of Canada will need to cut rates this year. A rate cut in September also appears to be really possible. The Canadian economy has also showed signals that a rate cut might be needed in the future. Global demand has weakened, and the trade tensions persist.

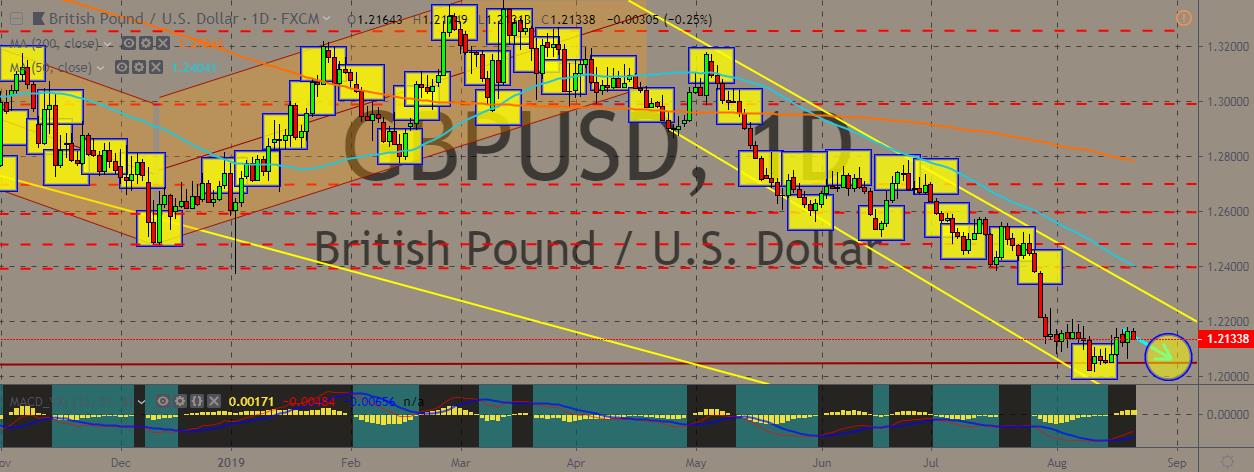

GBPUSD

The British pound continues to weaken against the dollar as persisting political and economic problems continue to bog down the United Kingdom. The US dollar, on the other hand, retains its safe haven appeal even as the US-China trade war continues to dampen risk sentiment in the markets. On the GBP side, the royal currency slid after European Council President Donald Tusk rejected a request from the UK Prime Minister Boris Johnson to drop the “unviable” and “anti-democratic” backstop. Boris claimed that it would undermine the Good Friday peace agreement. Tusk said that the backstop was an insurance to prevent a hard border from happening unless a better alternative has been found. On the USD side, the looming trade war fears limited market risk appetite, feeding into demand for the USD despite the Huawei, a Chinese telecoms giant, additional reprieve from US sanctions.

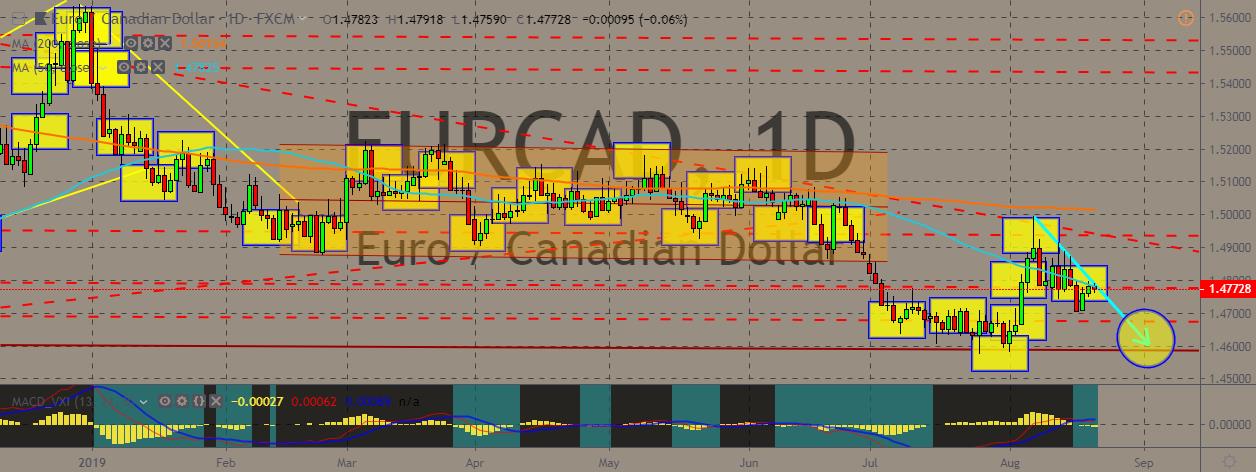

EURCAD

The pair recently whipsawed, climbing from record lows to above a solid support, converging with the 50-day moving average on the daily charts. Short-term sessions remain bearish as the 200-day moving average trades far above the 50-day counterpart. In Europe, Italy fell into crisis as Prime Minister Giuseppe resigned on Tuesday, effectively collapsing the country’s government. Conte blamed Matteo Salvini, his deputy prime minister, for the collapse. He accused Salvini of putting his own interests above Italy’s. Salvini leads the far-right, anti-immigrant Lega party and he has been calling for snap elections. Salvini has been benefitting from his popularity, which is in turn propped up by his anti-immigrant approach and policies. Italian President Sergio Mattarella will be in charge of the country’s next steps. Among his choices could be early elections or try to form a new coalition government.

NZDJPY

The NZD weakened against the safe haven appeal of the Japanese yen, with the pair trading on the lower portion of the daily charts and recording lows for the NZD. In Japan, negative-yielding bonds managed to benefit from the collapse of global interest rates last July. According to data, foreign investor more than doubled their purchases of said bonds. Global fund also purchased super-long bonds with maturities in 20 years or more amid fears of a worsening outlook for global economic growth, which could compel the Bank of Japan to ease policy. If they do, the move would favor bonds with longer maturities. Meanwhile, the global economy still is reeling from the effects of the US-China trade war, which showed a bit of a progress nonetheless after a rough schedule of future negotiations between the top two economic powerhouses has been reportedly released by the US government.

COMMENTS