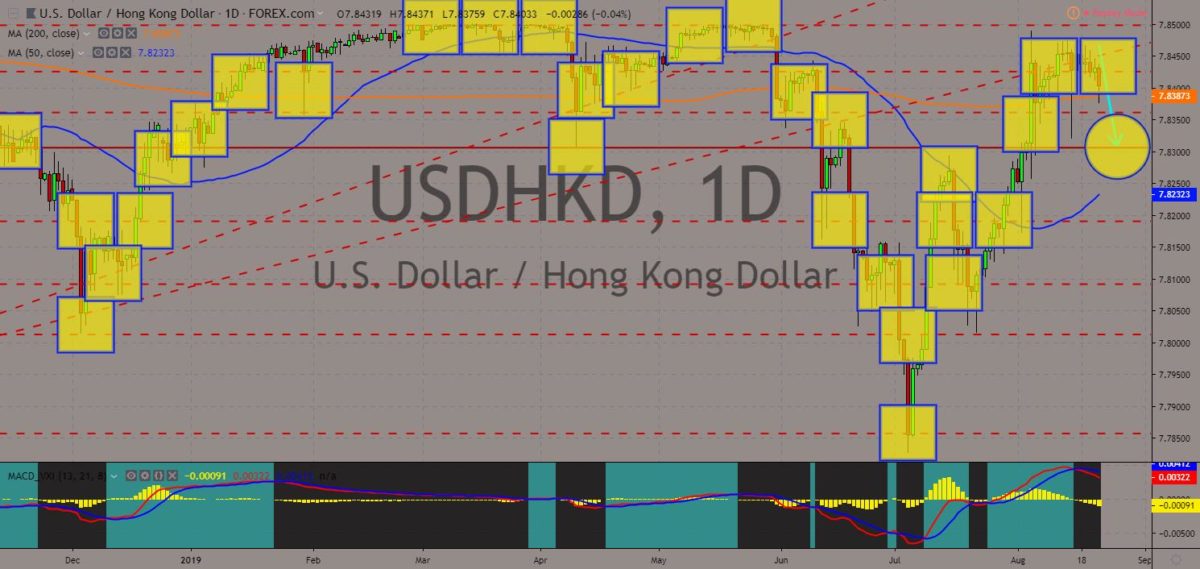

USDHKD

The pair is expected to break down from 200 MA, which will send the pair lower towards a major support line. U.S. President Donald Trump made his most extensive comment suggesting that Hong Kong’s protest movement fate be tied to a trade deal between the United States and China. This was after China accused the United States of orchestrating the protest, including U.S. lawmaker Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell. This statement by President Trump further complicates the negotiation between the two (2) largest economies in the world. After putting tariffs of 10% to $325 billion worth of Chinese goods, President Trump threatened to impose another 15% on the same amount of good, which totals to 25% tariffs on all Chinese exports to the United States. The current status of Hong Kong was created after its handover to China in 1997. Histogram and EMAs 13 and 21 was poised to go down.

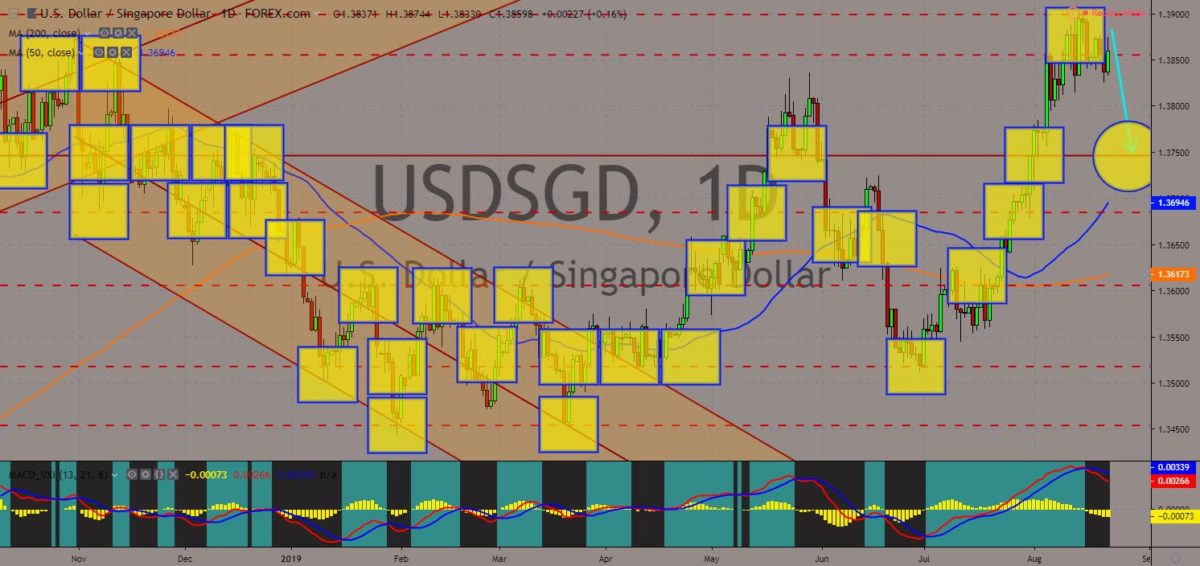

USDSGD

The pair failed to breakout from a major resistance line, sending the pair lower towards a major support line. Strong economic headwinds and the U.S.-China trade tensions have not stopped Singapore from attracting an unexpectedly large amount of investment commitments. In just six (6) months, Singapore has attracted $8.1 billion in investment commitments in manufacturing and services. This is higher than the $5.3 billion worth of investment commitments it had drawn from the same period last year. This was partly due to Singapore’s hosting of “Singapore Convention on Mediation”. The convention was signed by 46 countries including the United States and China. On the U.S.-China trade dispute, Singapore encouraged the two (2) largest economies in the world to settle their disputes. Histogram and EMAs 13 and 21 was expected to further move lower in the following days.

EURDKK

The pair is seen to continue moving lower in the following days after it broke down from a major support line. U.S. President Donald Trump is playing fire in the European Union. He was supposed to visit the new Danish Prime Minister Mette Frederiksen but abruptly cancelled his plan after the PM declined the possible talk on the acquisition of Greenland, which is part of the Kingdom of Denmark. Greenland was strategic for the United States as it can be converted to a military base and protect mainland U.S. against a possible Russia invasion. Denmark also lay claims to the Arctic Region with Greenland. The Arctic region is a possible disputed territory in the future if ice melts at a faster pace, paving way for a new formed territory. On the other hand, this can affect the European Union as it was relying on the U.S. led NATO (North Atlantic Treaty Organization) Alliance. Histogram and EMAs 13 and 21 will continue to move lower.

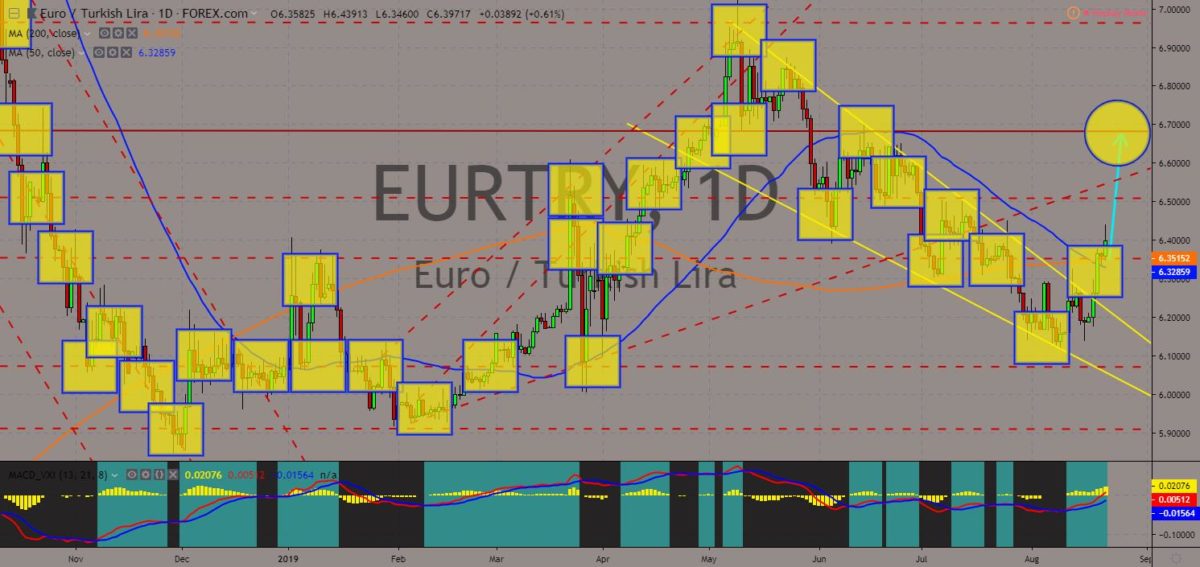

EURTRY

The pair is expected to further go up in the following days after the recent crossover between MAs 200 and 50 through which the pair broke out. Turkey is coming back to the European Union after Turkish Foreign Minister Mevlüt Çavuşoğlu tells Brussels that difficulties with Turkey’s accession to the 28-member state bloc should be remove in cooperation between the two (2) parties. This was after Turkey threatens to suspend EU migration deal due to lack of Visa-free travel to the European Union. Negotiation for Turkey’s accession in the European Union started in 2005 but was partially suspended in the recent years following Turkey’s decision to purchase Russia’s S-400 missile defense system that will compromise the NATO (North Atlantic Treaty Organization) Alliance defense agreement, which most EU-member states are also members. Histogram and EMAs 13 and 21 will continue to go up.

COMMENTS