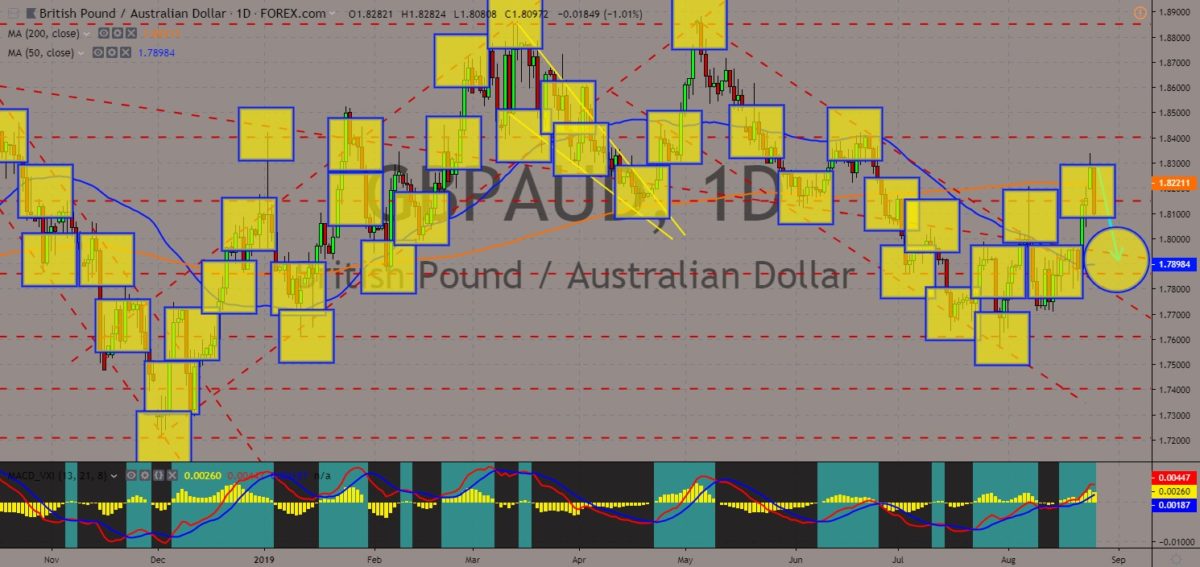

GBPAUD

The pair failed to sustain its strength after it broke out from 200 MA, which will send the pair lower towards MA 50. Increasing global headwinds, threats to security, and sharpening trade tensions will shape the G7 (Group of Seven) leaders’ meeting in France where Prime Minister Scott Morrison represents Australia as a special invited guest. However, this invitation was primarily rooted on the U.S. led mission on the Strait of Hormuz where Australia has been invited both by the U.S. and the U.K to participate. Australian Prime Minister Marise Payne has denied that the country is dragged in a broader conflict against Iran by U.S. President Donald Trump. Australia announced that the country will commit a warship and a surveillance plane. PM Morrison said the move was of a national interest as the country’s crude and refined oil travelled through the region. Histogram and EMAs 13 and 21 is poised to go lower.

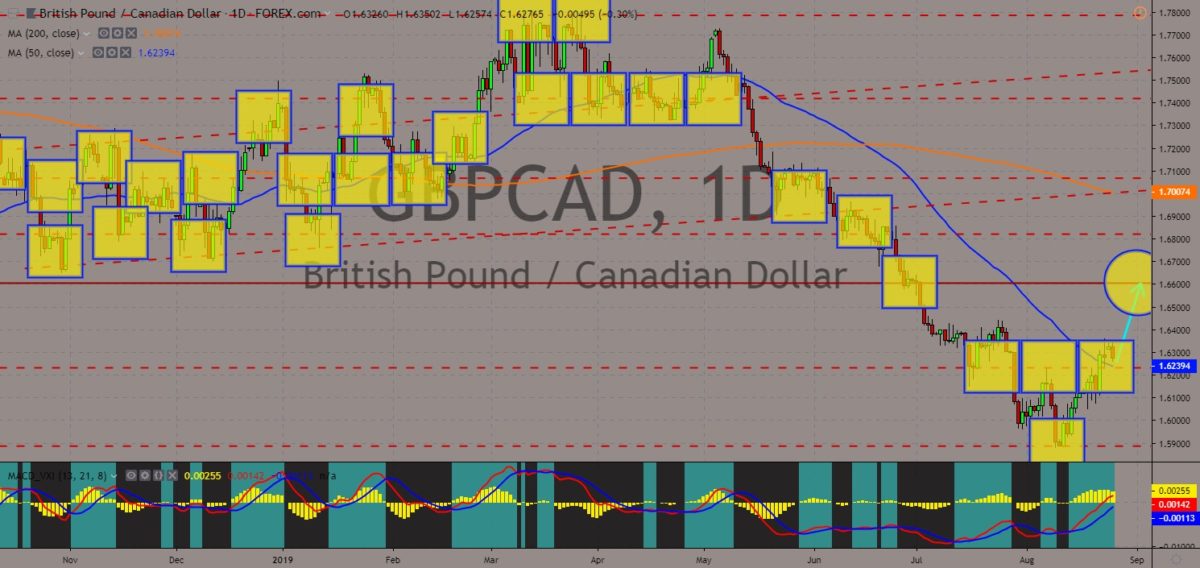

GBPCAD

The pair is seen to continue going up in the following days after it broke out from 50 MA, which will send the pair higher towards a key resistance line. Canada has been increasing its exposure in the previous days following the looming Group of Seven Leaders Meeting. Its increased participation is also tied with the impending federal election in Canada by October with Canadian Prime Minister Justine Trudeau once again running and hoping to be re-elected on one (1) of the country’s highest positions. This year has not been easy for PM Trudeau after he was involved in a scandal where he was accused of bribing his attorney general to interfere with the SNC-Lavalin case for political reasons. Canada slammed the United Kingdom for stripping an ISIS Jihadist of British citizenship, accusing its former colonial master of shrinking its responsibilities in counterterrorism.

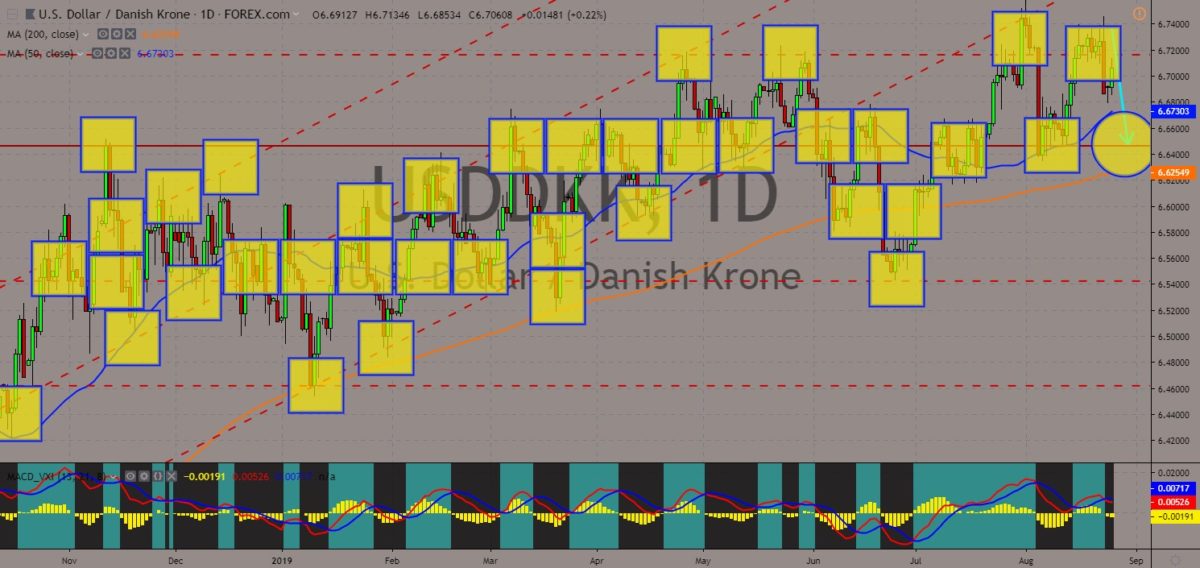

USDDKK

The pair is expected to move lower in the following days after it failed to breakout from a major resistance line. U.S. President Donald Trump was supposed to visit Denmark to talk about the two (2) countries increased cooperation amid economic and political uncertainty towards the Western world. However, President Trump abruptly cancelled his plans following the refusal of Danish Prime Minister Mette Frederiksen to discuss the sale of Greenland, which is part of the Danish Realms. Denmark was heavily reliant on U.S. protection of Greenland. Despite this, this spat between the two (2) countries could cost the U.S. more than Denmark. Denmark is one of the U.S. allies active in participating U.S. led missions, particularly in the Middle East. Queen Margarethe of Denmark was reportedly surprised by President Trump’s action and were lost of words. Histogram and EMAs 13 and 21 recently crossed over.

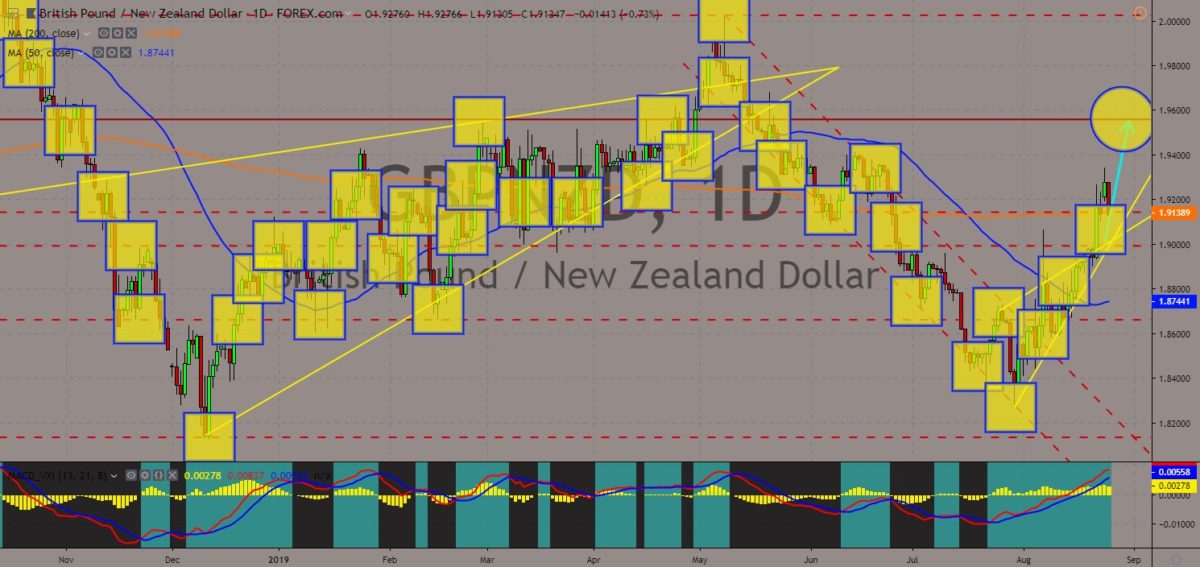

GBPNZD

The pair found a strong support from a major support line, sending the pair higher towards a major resistance line. The British Pound is in a rally after the Royal Bank of New Zealand (RBNZ) surprisingly cut its benchmark interest rate and expressed its willingness to try an unconventional method of negative interest rate, which means that the bank will pay banks to borrow money from the central bank. Despite a weaker New Zealand Dollar, it will be helpful for the country’s exports. Aside from that, New Zealand was the first country to reopen a British consulate on its country, the first country to sign a post-Brexit trade agreement, and the first country to express its willingness to talk to the new British Prime Minister. This will help the country to dodge the escalating trade war between the United States and China. Histogram and EMAs 13 and 21 will continue to move higher in the following days.

COMMENTS