Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

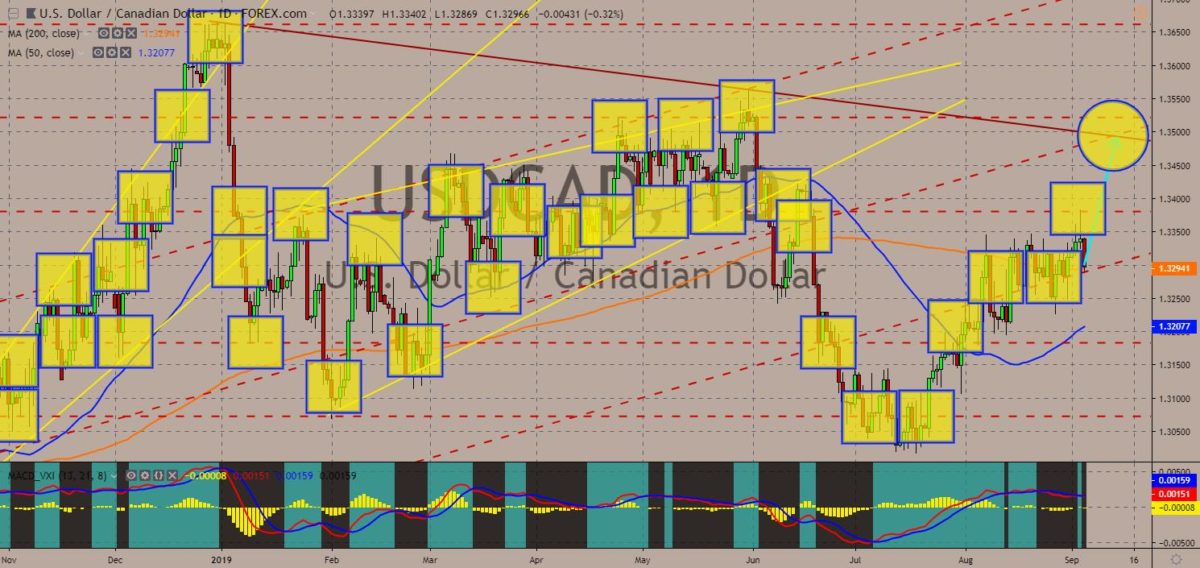

USDCAD

The pair is expected to continue its upward movement in the following days and to retest a downtrend resistance line. It’s a critical month for Canadian Prime Minister Justine Trudeau as he seeks to be reelected on his position for the second time once the federal election is held in October. However, this election is not particularly easy for him after being involved in the SNC-Lavalin case where he was accused of pressuring the country’s Attorney General. On the other hand, U.S. Farmers are pushing for the passing of the USMCA (United States-Mexico-Canada), which could further push U.S. President Donald Trump to pressure the U.S. Congress to pass the NAFTA (North American Free Trade Agreement). The USMCA began after the election of President Trump wherein he accused the members of taking advantage of the U.S. and doing unfair trade practices. Histogram and EMAs 13 and 21 recently crossed over.

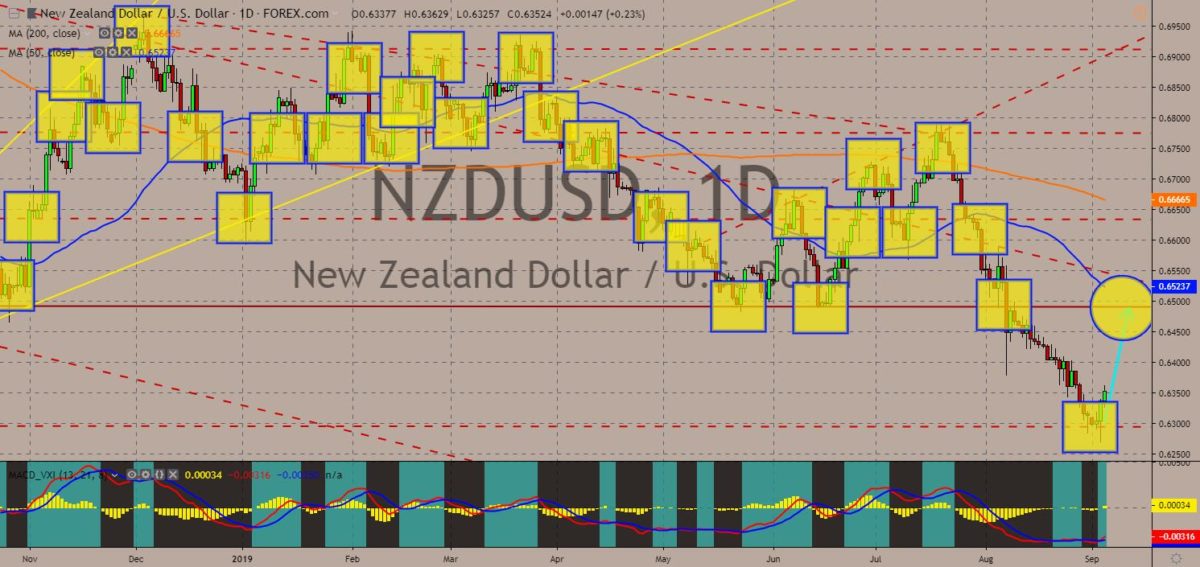

NZDUSD

The pair will continue to move higher in the following days after it found a strong support from its 36-month low. America’s top cyber diplomat says the U.S. will reassess how it shares information with New Zealand if Chinese company Huawei is allowed to upgrade its mobile networks to 5G. New Zealand is part of the intelligence-sharing group, Five Eyes, together with the U.S., U.K, Australia, and Canada. However, the group had been shaken by different opinions concerning China’s alleged cyber espionage through telecom giant Huawei. The proposed banning of Huawei was part of the escalating trade war between the U.S. and China. It ended up with only Australia and the U.S. reaffirming its commitment to ban the company. PM Jacinda Ardern said the country’s decision will not be influence neither by its former colonial master, the UK, and the United States. Histogram and EMAs 13 and 21 is poised to further go up.

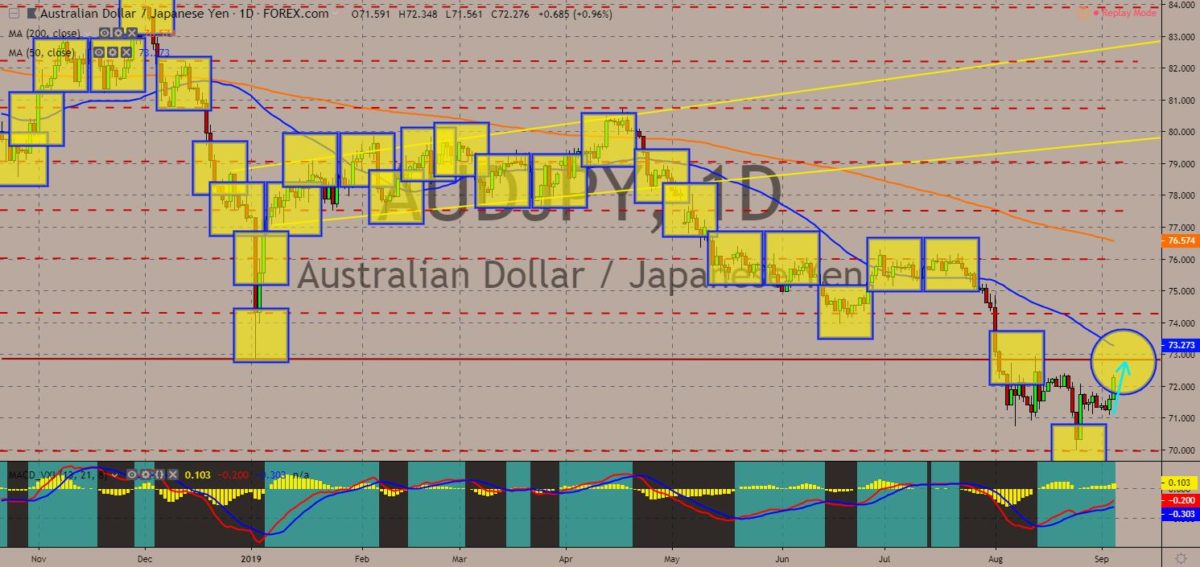

AUDJPY

The pair is seen to continue moving higher and retest 50 MA to breakout from the downtrend movement. Japan and Australia vowed to cooperate into their Indo-Pacific Vision. This was amid the rising military presence of China and Russia, which was expected to disrupt the world order following the weakening U.S. military. However, the two (2) countries are still at odds with how they share economic dominance in the region. The two (2) countries head the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Australia has secured its place as the top beef exporter to Japan, but with Tokyo hashing out bilateral trade deal with the United States, another beef powerhouse, Canberra is refusing to renegotiate the terms of the CPTPP. In another news, the Royal Bank of Australia (RBA) keeps its interest rate at hold amid central banks racing to negative interest rates. Histogram and EMAs 13 and 21 will continue to go up.

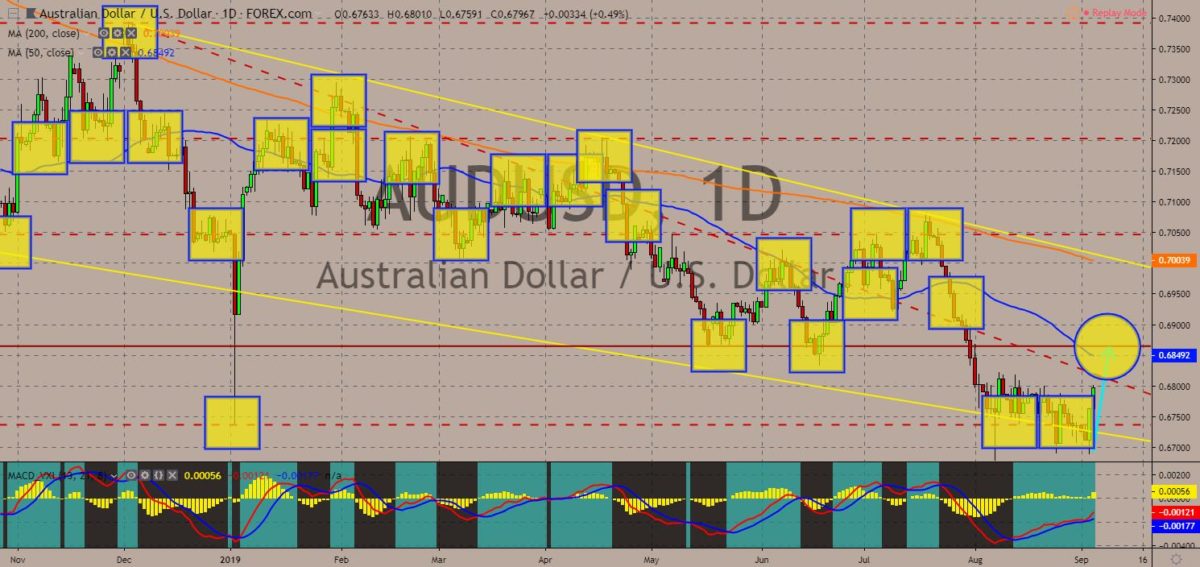

AUDUSD

The pair is expected to continue its upward movement after it found a strong support line, sending the pair higher towards a major resistance line. Australia is being pressured to take sides between the U.S. and China. The country considers U.S. as a military ally, while it considers China as its largest trading partner. In August, Secretary of State Mike Pompeo visited Australia where he described the U.S.-Australia relationship as “unbreakable alliance”. A month after the visit, Chinese Ambassador to Australia launch a scathing critique to President Trump’s tactics, labeling them as bullying. He said China does not want a trade war, but argues Beijing is not scared of retaliating tariffs to U.S. Aside from this, Australian PM Scott Morrison has accepted the invitation from the U.S. to join a coalition of countries protecting oil tankers from attacks by Iran in the Strait of Hormuz. Histogram and EMAs 13 and 21 will continue to go up.

COMMENTS